Welcome to the second part of the blog on the Cooker industry. In this blog, we explore the fascinating world of cookers and delve into its industry structure, competition, and challenges. In the last blog, we took a closer look at the types of cookers available, and the manufacturing process. If you are an investor seeking potential opportunities, you are in the right place.

The blog in a nutshell.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

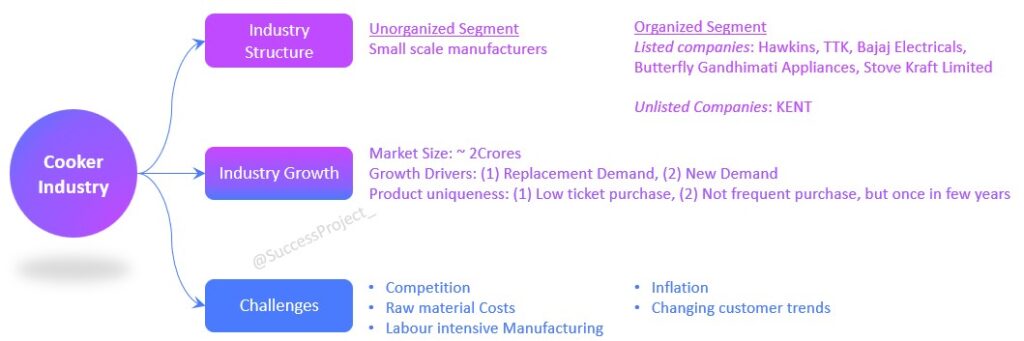

Industry Structure

The market for Pressure Cookers is shared amongst:

- Organized national branded players and regional players

- Unorganized players consisting of small-scale industries

Unorganized Segment

There is no entry barrier in this industry. In the previous blog, we discussed that there are a few parts needed to manufacture a cooker, a few machinery and skills. You could read this report where a manufacturing set-up is possible with even 50 Lakhs.

Manufacturing cookers may seem straightforward, but is not that seemingly easy. While manufacturing is easy, it is no child’s play. A pressure cooker cooks food at a pressure higher than that of ambient pressure, thus necessitating sufficient precaution required in designing, manufacturing and use of domestic pressure cookers to safeguard against accidents in the kitchen.

Organized Segment

This segment has manufacturers from both listed and non listed entities. Among the listed companies (Organized sector) there are 6 notable players:

- Hawkins Cookers Limited

- TTK India Limited

- Stove Kraft Limited

- Butterfly Gandhimati Appliances Ltd.

- Bajaj Electricals

- Borosil Limited (https://myborosil.com/collections/pressure-cookers)

Of these 5 companies, Hawkins is the only company that is predominantly into Pressure cooker manufacturing. The other companies are in diversified business extending to cookware and kitchen essentials.

In the organized segment, one non-listed manufacturer that comes in mind is KENT, (Visit https://www.kent.co.in/healthy-cookware/cooker/ for details of their products)

Who is ahead?

Over the years, the share of the unorganized players has been gradually coming down as there has been a shift in consumer preference to reliable branded products.

The organized segment has advantages of brand, perception in the minds of customer, low cost of manufacturing due to scale, distribution network and capacity to invest in research and innovation.

Industry Growth

This topic is of much importance and interest to equity investors. They would like to understand what the industry is expected to grow and potential opportunities where their investments can grow. We will discuss this in multiple dimensions,

- The overall market size

- The past/present industry growth

- Growth drivers

- Unique nature of product demand

Market Size

- In India we can expect to have 25 crores house holds, within this the pressure cookers can be seen at 2 Crores (Reference: 2022 Hawkins AGM Transcript)

- In this 40% of the market is with the unorganised sector and 60% of the market with organised sector

Inference for Investors

- There is a good migration opportunity from the Unorganized to the Organized sector

- It is already happening due to demonetisation, GST and the ISI Mark becoming mandatory

Note: The Government of India has made the ISI mark compulsory for all pressure cookers sold in India from February 2021.

- This ISI requirement improves the quality and safety levels of the cooker in the market. This Unorganized sector has a challenge to meet this requirement as it increases the cost of production and thus price gap with a branded product reduces.

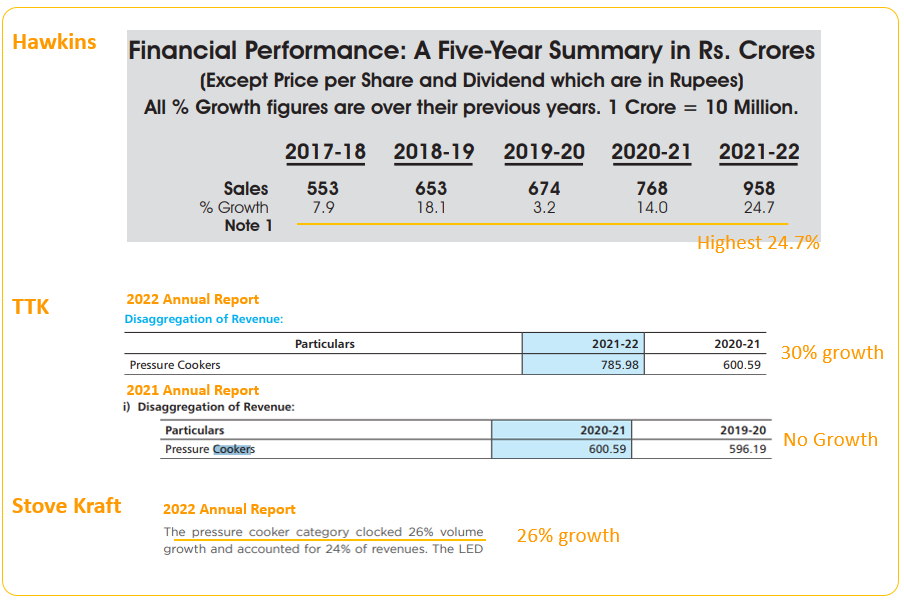

Growth of Listed Companies

The market growth has been between 6-8%. (Reference: Hawkins 2020 AGM Transcript)

Below is the growth rate of few companies. Note that the numbers fo Hawkins reflects the growth of Cooker Industry closely, as nearly 80% of revenue comes from Pressure cookers. In case of TTK, the break up for Cookers is available. The same has been presented.

Drawing meaningful inferences from the available numbers is challenging due to their inconsistency. However, it is anticipated that organized players in the cooker industry will experience higher growth rates than the overall market growth rate of 6-8%, primarily driven by the strength of their brands. It’s important to note that such high growth may not happen year on year.

Growth Drivers

The growth in the cooker industry is driven by two types of product demand:

- Replacement Demand

- New demand

Replacement Demand

- Replace old cookers: A cooker typically needs replacement once in 10 – 12 years. This creates a consistent demand for new products in the market.

- Desire for better quality: In the past, a portion of the population may have used cookers from unorganized segments due to affordability. However, as disposable incomes rise and consumers become more conscious about product quality, there is a growing trend of replacing products from unorganized segments with branded, higher-quality cookers. This is a strong driver for the organized segment.

New Demand

- New / Bigger families: When individuals get married and start their lives, they require cookers for their households, contributing to new demand in the market.

- People Relocation: With the trend of people moving to new places for work or education, leaving their families behind, there is a need to set up new living arrangements. These individuals often need to purchase cookers.

Unique nature of Cooker Demand

- Low ticket size purchase within the overall annual consumer spend

- This purchase is also not frequent but happens once in a few years.

- The purchase is not on EMI and hence insulated from interest rate movements.

Due to the first two reasons, customer preference is inclined towards the best brand where quality and safety of the product are high.

Reference: Views from Basant Maheshwari

Challenges to Cooker Manufacturers

Below are the challenges faced by the Organized/Branded manufacturers. These challenges impact growth, and profitability.

Competition

In the initial part of the blog, we discussed that the market is heavily crowded with fierce competition from both Unorganized (small-scale) and organized sector (Branded) segments. However, the competition can be seen at two levels:

Low Price Point

This competition occurs among lower-priced products offered by small-scale manufacturers (Unorganized Segment). The competition by Chinese products also happens here.

High Price Point

This competition is between the branded products (Organized Segment).

So does it mean that there is no competition between the organized and unorganized players?

Not necessarily.

Consumers using the products at the lower price segment will move to branded products under certain circumstances, such as

- Increase in disposable income

- Decrease in the price gap between the branded cookers and those from small-scale manufacturers

- Improved awareness of product quality and safety

It is important to note that this movement is typically unidirectional, meaning consumers who switch to branded products (or already using branding products) seldom revert to using products from unorganized manufacturers.

Raw Material Cost

- Fluctuations in raw material prices, especially for metals like aluminium and stainless steel, can directly impact the profitability and manufacturing costs of cooker manufacturers.

- Manufacturers are left with two options: either increase the price of their cookers or accept reduced profitability in order to absorb the higher material costs.

- The approach of reducing product size or quantity, commonly seen in products like soap or biscuits, cannot be applied to pressure cookers. Unlike those items, pressure cookers cannot be shrunk while maintaining the same price point (Reference: Insights from Hawkins 2022 AGM Speech)

- This is B2C business, where a manufacturer cannot negotiate with consumers to take a higher price due to a rise in raw material costs.

Labour Intensive Manufacturing

The manufacturing process for cookers is labour intensive, which can lead to challenges such as labour disputes, demands for wage increases, or the need to ensure a safe and conducive working environment for employees. (This has happened in the past in case of Hawkins)

Inflation

The rise in inflation can impact consumer spending and purchasing power, potentially affecting demand for cookers. Where possible, consumers postpone their purchase or opt for lower-priced alternatives.

Changing Consumer Trends

Consumer trends are evolving and difficult to foresee.

- Customers using Pressure cookers may aspire for Electric or Induction cookers in future.

- With change in lifestyle people may move from Aluminium cookers or to Brass or Stainless steel cookers

- During COVID there was more of cooking at home, which increased the demand, but with times back to normal people are eating outside or ordering food from food aggregators

This brings in difficulty in demand forecasting, manufacturing and product marketing. Manufacturers must stay attuned to changing consumer preferences.

Conclusion

Investors interested in this industry should consider factors such as market structure, competition from both organized and unorganized players, and the evolving consumer trends. Despite challenges like raw material costs, labor-intensive manufacturing, and changing consumer preferences, the industry offers opportunities for growth driven by replacement demand and new market segments.

In the next blog, we will discuss the different listed companies.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.