In the previous blog (which you should read first for a better understanding), we explored key aspects of the Bajaj Group, including its history, family tree, holding structure, and various group companies. The group has expanded to cover diverse industries such as automobiles, financial services, home appliances, and steel.

In this blog, we will delve into two fascinating companies within their financial sector: Bajaj Finance and Bajaj FinServ. Please note that this blog is intended to provide a deeper understanding of the companies and their businesses, not as investment advice or recommendations.

(Read similar posts on TVS group and Murugappa group)

Bajaj Finance Limited

About the Company

- Date of incorporation: 25 March 1987

- It is a 36 year old company a subsidiary of Bajaj Finserv Ltd.,

- The company one of India’s leading and most diversified financial services companies.

- It is a deposit taking Non-Banking Financial Company (NBFC-D) registered with the Reserve Bank of India (RBI) and is classified as an NBFC-Investment and Credit Company (NBFC-ICC).

- The company engages in lending and acceptance of deposits (Both public and corporate)

- It is a Non-Bank with strategy & structure of a bank

- Management: Sanjiv Bajaj, Chairman / Rajiv Bajaj, Director

How big it is?

- Distribution points: 190K

- Locations: 4092

- # Customers: 80 million

- # Finance products: 50

- # Employees: 43,147

Business Overview

- Started with a focus on 2 and 3-wheeler finance (Auto finance market).

- After nearly 10 years, the Company ventured into consumer, SME, commercial, rural, and deposits.

- The company is engaged in the business of lending and accepting deposits (Both public and corporate

- The company started accepting fixed deposits from 2014

- It has a diversified lending portfolio across retail, SMEs, and commercial customers with a significant presence in both urban and rural India.

Read about their full journey at https://www.aboutbajajfinserv.com/finance-about-us

Business Model

- The diversified business model enables optimal balance of risk and profitability to deliver a sustainable business.

- The model is focused on the acquisition of millions of customers and offering multiple loans and services on a cross-sell basis to meet their financial service needs.

- The Company’s strategy is to be an ‘omnipresent’ (Meaning: Present everywhere or every form) financial services company dominant across all vectors of consumer presence covering physical, app, web, social and virtual.

- The objective of the Omnichannel strategy is to be a customer-centric enterprise

- The Omnichannel strategy has six domains viz. (i) Geographic expansion, (ii) Bajaj Finserv app, (iii) Bajaj Finserv website, (iv) Payments, (v) Productivity apps, and (vi) Customer data platform (CDP). (The company does not have its own website)

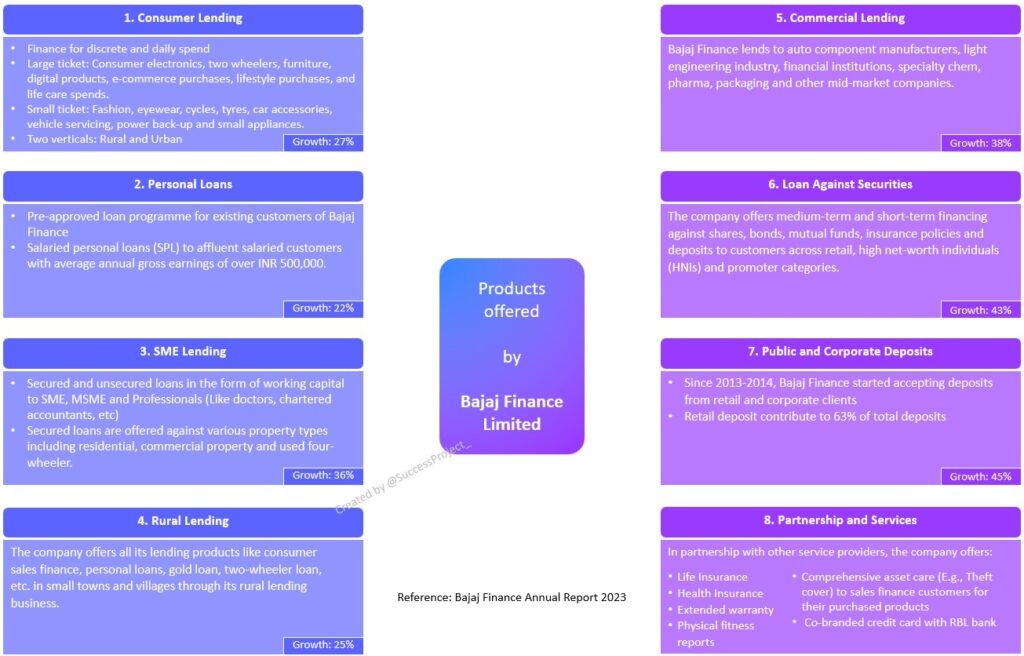

Products

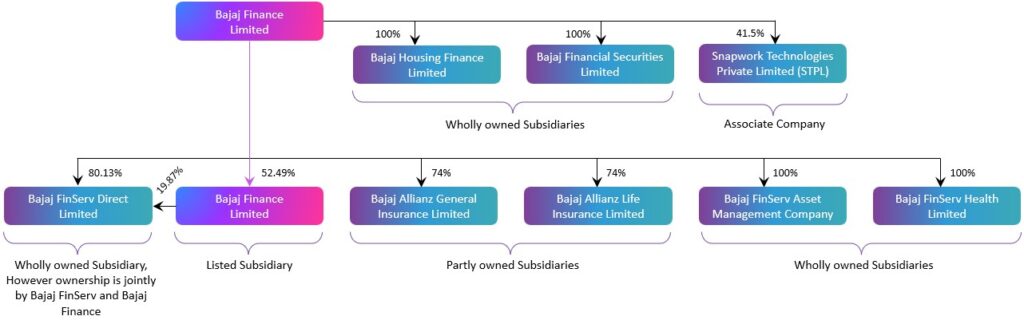

Subsidiary and Associate Companies

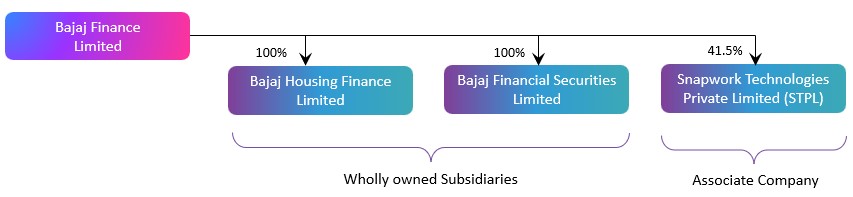

The company has two wholly-owned subsidiaries and one associate company.

Bajaj Housing Finance Limited

It is a housing finance company and does not accept deposits. Its operations started in July 2017.

Products

- Home loan: loans to mass affluent salaried, professional and self-employed customers for ready-to-move-in as well as under construction homes in 51 locations across India with an average loan value of INR 5 Million. Growth: 23%.

- Loans against property: The company offers loans to SMEs, MSMEs, self-employed individuals and professionals against mortgages of their residential and commercial properties. Growth: 5%.

- Lease rental discounting: Finance financing to high-net-worth individuals (HNIs) and developers for their lease rental discounting needs with loan amounts ranging from INR 10 crore to INR 550 crore. This involves financing against lease rental cashflows of commercial properties occupied by prominent lessees under a long-term lease contract. Growth: 64%.

- Developer financing: focuses on construction for small and mid-size developers with a strong track record of timely project delivery and loan repayments with an average loan value of INR 30 crore. Growth: 92%.

It also has a dedicated vertical offering home loans and loans against property to the rural sector and to MSME customers. This covers salaried and self-employed customers.

Product Mix

- BHFL is focused on building a low-risk portfolio.

- Individual housing loans contribute to about 62% of the overall portfolio.

- 95% of individual home loans pertain to even lesser-risk customers, viz. salaried customers and self-employed professionals.

- Going forward, BHFL intends to expand its housing loans business to self-employed and affordable housing segment with a calibrated risk strategy to cover full spectrum of housing loan market.

A piece of recent news is that the company could come out with an IPO for Bajaj Housing Finance Limited.

Bajaj Financial Securities Limited

It is a stock broker and depository participant. Operations started from August 2019. They are registered participant of CSDL and NSDL and also a member of BSE and NSE under equities and derivatives segment. The company has around 565,100 customers.

Products

- HNI Demat and broking

- Retail demat and broking

- Margin Trade Financing for both HNI and retail customers

Snapwork Technologies Private Limited (STPL)

It is an associate company. In the financial year ending March 2023, Bajaj Finance acquired 41.5% stakes in Snapwork Technologies Private Limited. STPL is engaged in the business of developing, consulting, providing, exporting, importing, marketing, dealing in and implementation of software technology and allied products for its clients and conducting research and development for the same.

Reference: Bajaj Finance 2023 Annual Report.

Bajaj FinServ

About the Company

- Date of incorporation: 30th April 2007

- Bajaj FinServ was formed in 2007 after demerger from Bajaj Auto Limited. The strategy to form a separate entity was to focus on the financial services business.

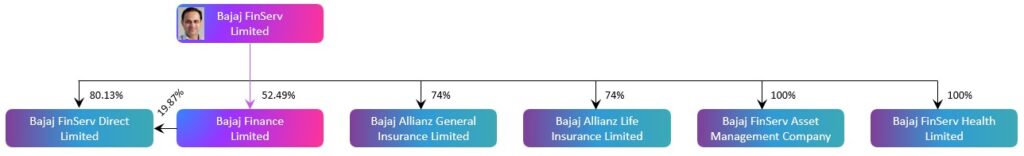

- It is an unregistered core investment company (CIC) under RBI regulations 2020 and the holding company for the various financial services businesses under the Bajaj group.

- As of March 2023, the company has 73,340 Employees (However, it is unclear if this number includes the employees of Bajaj Finance, one of its subsidiaries and a listed company.)

- Management: Sanjiv Bajaj, Chairman / Rajiv Bajaj, Director. Visit https://www.aboutbajajfinserv.com/people-and-committees-board-of-directors for the complete team.

- The company has the entire spectrum of financial products: Lending, Insurance, Investments, Securities and brokerage services etc. for its customers.

- These different products are handled by different subsidiaries i.e. Insurance by Bajaj Allianz General Insurace company

- Thus Bajaj FinServ has a structure similar to a Holding company where the company owns full or part of the stakes in various subsidiaries.

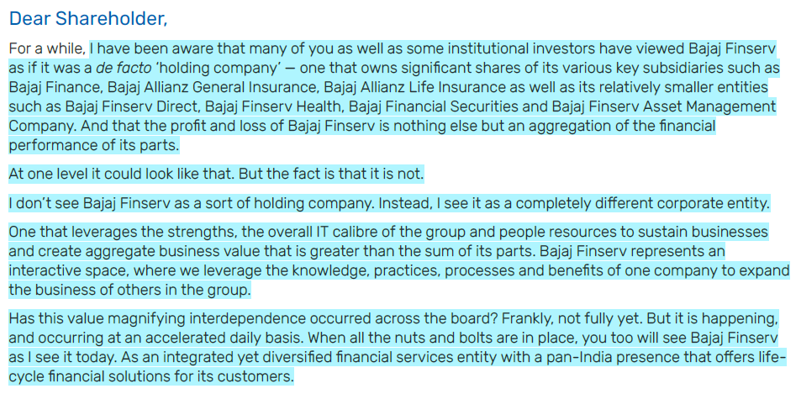

While it is a holding company, Mr. Sanjiv Bajaj, Chairman has a different view. Below are the highlights from 2023 Annual Reports.

Since the company does not have a core operation, but operating through subsidiaries, we will directly get to the discussion on the operations of different subsidiaries.

Subsidiary Companies

The below content is only intended to give a high-level overview of the operations of each subsidiary. To know more details about each subsidiary, please visit the page https://www.aboutbajajfinserv.com/

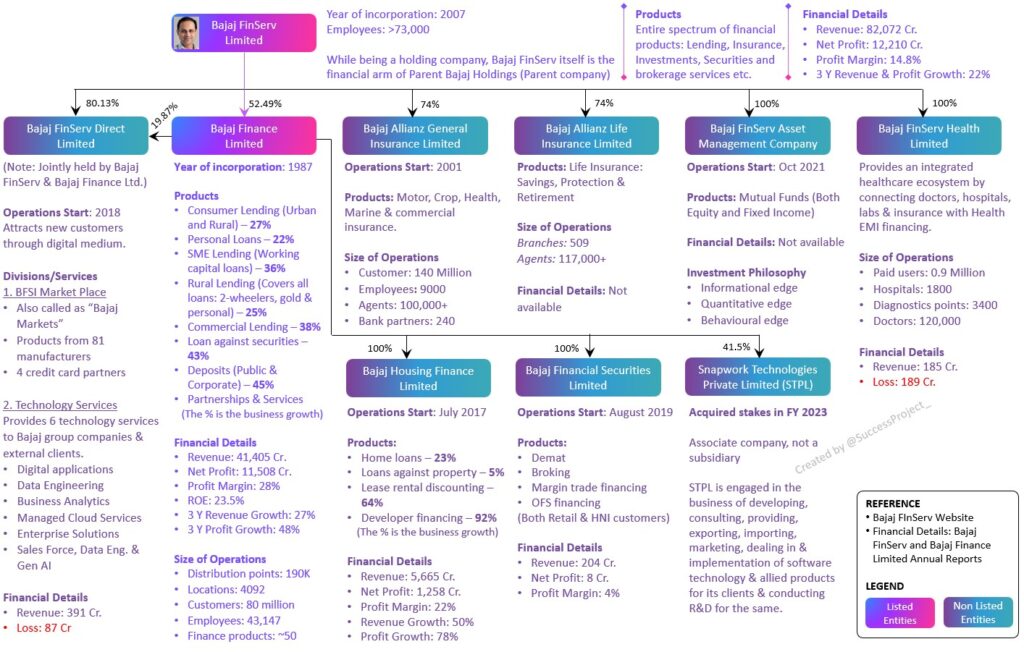

Bajaj FinServ has one listed subsidiary (Bajaj Finance Limited) and 4 other Wholly/Partly owned subsidiaries as in the below image.

Bajaj Finance Limited

We discussed about this in the first part of the blog. Bajaj Finance Limited is a listed Subsidiary of Bajaj FinServ and involved in lending and accepting deposits. Bajaj FinServ owns 52.49% of Bajaj Finance. Below is the bigger picture putting together the structure of Bajaj FinServ and Bajaj Finance.

Bajaj Allianz General Insurance Limited

It is a joint venture between Allianz SE and Bajaj FinServ. The operations started from 2001. It covers Motor, Crop, Health, Marine and various kinds of commercial insurance. In terms of numbers:

- Number of customers: 140 millions

- Employees: 9000

- Agents (Distribution network): 100,000

- Bank partners: 240

Reference: https://www.aboutbajajfinserv.com/allianz-about-us and 2023 Annual Report

Bajaj Allianz Life Insurance Limited

The company offers life insurance products covering savings, protection and retirement products. In terms of numbers:

- Branches: 509

- Agents (Distribution network): 117,700

Bajaj FinServ Asset Management Company

The company started operations in 2021. One of its products is Mutual Funds covering both Equities and Fixed income products.

Bajaj FinServ Health Limited

The company offers solutions beyond health insurance by providing an integrated healthcare ecosystem by connecting doctors, hospitals, labs and insurance with Health EMI financing. The comprehensive offering comes from two other susbdiaries, Health Inssurance coverage from Bajaj Allianz General Insurance and pre approved health EMI facility from Bajaj Finance. In terms of numbers:

- Paid users: 0.9 Million

- Hospitals: 2100

- Diagnostics Points: 5500

- Doctors: 120,000

Financial Details

- Revenue: 185 Cr.

- Loss: 189 Cr

Bajaj FinServ Direct Limited

Bajaj FInserv Direct Limited attracts new-to-Finserv customers by creating awareness and discovery of the Finserv brand through the digital medium. It started its journey in July 2018 and operates at the leading edge of finance and technology. This company is jointly held by Bajaj FinServ and Bajaj Finance Limited.

Divisions/Services

- BFSI Market Place

- Also called as “Bajaj Markets”

- Products from 81 manufacturers

- 4 credit card partners

- Technology Services

Provides 6 technology services to Bajaj group companies & external clients.

- Digital applications

- Data Engineering

- Business Analytics

- Managed Cloud Services

- Enterprise Solutions

- Sales Force, Data Eng. & Gen AI

Financial Details

- Revenue: 391 Cr.

- Loss: 87 Cr

Note: Detailed Financial and Operation metrics of these subsidiaries can be found in the recent investor presentation.

Bajaj FinServ and Bajaj Finance in One Frame

The image below serves as a high-level summary of our discussion, encompassing the products, financial details, and operations of Bajaj FinServ and Bajaj Finance.

Insights for Investors

Key Differences between Bajaj FinServ and Bajaj Finance

- Bajaj FinServ is a holding company offering a comprehensive spectrum of financial products, including investments, insurance, lending, and digital financial services.

- This diverse range is managed by various subsidiaries under Bajaj FinServ.

- Bajaj Finance, a listed subsidiary of Bajaj FinServ, focuses exclusively on lending and accepting deposits.

Which company is a better investment?

Please read this caution first, before reading further!

- I have shared the insights I gathered from my study.

- These are not any specific investment recommendations.

- Many of these insights are based on current business growth, my assumption on future growth and potential future developments that may or may not materialize.

- Please use these insights as a supplement information for your investment decisions, fully realizing that this is not a recommendation.

- If you choose to invest in any of these companies based solely on this blog and incur a loss, please recognize that it is due to a lack of adequate due diligence on your part, not because of this blog.

I want to emphasize that THIS BLOG IS NOT INTENDED TO BE AN INVESTMENT RECOMMENDATION.

Bajaj Finance Limited

- The company offers 50 products across 8 business lines.

- Furthermore, each of these business lines HAD IN THE PAST DELIVERED impressive growth of not less than 20%.

- Additionally, the financials of its subsidiary, Bajaj Housing Finance, are also impressive, with some products delivering growth rates of 64% and even 92%.

- Moreover, there is already news that Bajaj Finance is planning an IPO for its subsidiary, Bajaj Housing Finance.

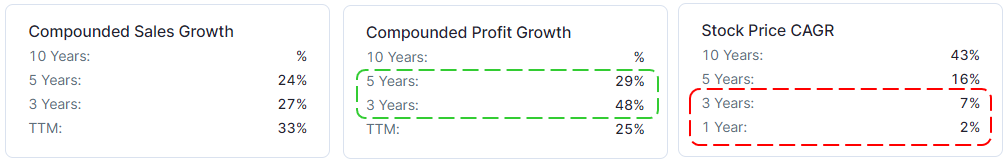

- In terms of growth metrics, the past years have been impressive.

- Will this growth continue?

- My perspective: Given the opportunity size and digital initiatives, this growth MAY continue for a few years

- However, despite this growth, the stock price return has been muted:

- This is surprising given the impressive past growth.

- My perspective is that it was overvalued in the past and has now corrected.

- Will it correct further? That is a call/judgement you need to make before any investment.

Refer image below from Screener.in for growth and valuation metrics.

(Note: “My Perspective”, carries the disclaimer that I could be wrong!)

Bajaj FinServ

This observation is quite intriguing:

- The market capitalization (M. Cap) of Bajaj FinServ is approximately 254,000 Crore, while Bajaj Finance’s M. Cap is about 454,000 Crore.

- Bajaj FinServ owns around 52% of Bajaj Finance, which translates to a value of 236,000 Crore (0.52 x 454,000 Crore).

- When comparing this 236,000 Crore to the M. Cap of Bajaj FinServ (254,000 Crore), there is a gap of 18,000 Crore.

- This suggests that the combined value of the other four subsidiaries (Insurance, AMC, etc.) is estimated at 18,000 Crore.

The above is what market is factoring in the Valuation of Bajaj FinServ. At first glance, Bajaj FinServ might seem undervalued or a potential value buy.

How to approach this situation further?

- Between the two entities, one is inefficiently priced. Either Bajaj Finance is overvalued or Bajaj FinServ is undervalued. However, given that Bajaj Finance’s return over the last three years has only been 7%, the argument that Bajaj Finance is overvalued is weak. Therefore, it appears that Bajaj FinServ is undervalued.

- If this assessment is correct and Bajaj FinServ is indeed undervalued, there is a potential trap. Bajaj FinServ is a holding company, which typically trades at a discount to the value of its underlying assets. This phenomenon is known as the “Holding Company Discount.” Even if Bajaj FinServ represents a value buy, this discount could persist for many years unless there is a catalyst to unlock this value.

- It is important to consider that the market may have already recognized this discrepancy. Thus, I might be overlooking factors that the market has already accounted for.

Undoubtedly, valuing Bajaj FinServ using the Sum of Parts method—assessing the value of all its subsidiaries—can be quite complex, complicating the investment decision.

Conclusion

Bajaj FinServ and Bajaj Finance exemplify the dynamic and multifaceted nature of the Bajaj Group’s financial services arm. Through their comprehensive range of products and strategic market positioning, these companies have not only fortified their presence in the financial sector but have also set benchmarks for innovation and customer-centric approaches. Furthermore, the intricate holding structures and cross-functional operations underscore their interdependence and collective strength. I hope and believe that this blog has provided deep insights into the operations of Bajaj FinServ and Bajaj Finance, thereby assisting you in making suitable investment decisions.

My next blog is on deep-dive analysis of Bajaj Holdings and Investment. Do not miss it.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.

Excellent narration of facts

Is there any scope of shareholders value creation in future of demerging Bajaj Finserv …your thoughts

Bajaj finance chart was difficult to understand.

good write up

Excellent work..

Bajaj Group is ethics group

excellent article. Please come up with study on bajaj holding too

Mujhe achcha khasa 2 sal ka financial experience hai aap mauka denge to main financial service mein kam karna chahta hun dhanyvad

मेरे पास आपकी नौकरी के लिए कोई टीम या कार्यालय नहीं है। शुभकामनाएँ।