Are you a long term Investor? If ‘Yes’, this blog will introduce you to a little known but powerful tool – Auditor’s Report. (Featured image credits: Photo by Tumisu)

Auditor’s Report is a gold mine for investors. It provides a lot of information that aids in many investment-related decision points and financial statement analysis. However, the investing community has been giving it less importance than it deserves.

In this Blog…

We will explore the Auditor’s Report, its structure (including different sections), and how investors need to seek information and insights from it. Towards the end, we have provided a few examples of ideas discussed in this blog.

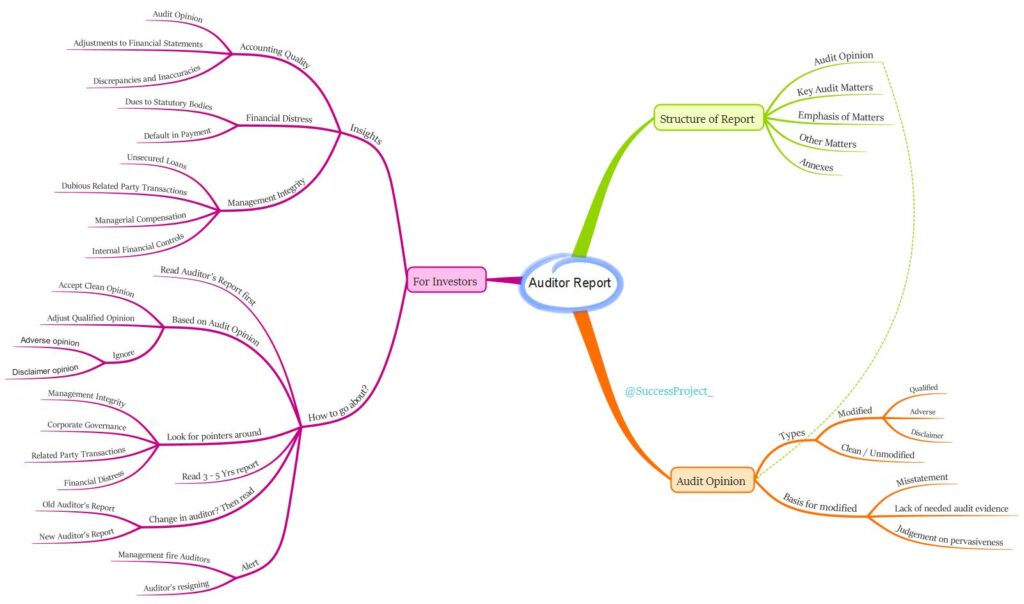

The mind map below presents the ideas discussed in this blog.

DISCLAIMER

The idea discussed in this blog is to show the investor how they can use Auditor’s Report. This may not align with academic content. Hence kindly do not use this blog content for academic purposes.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index for all my blogs.

Overview of Auditor’s Report

What is an Auditor’s Report?

- Every company publishes three main financial statements: (1) Balance sheet, (2) Statement of Profit & Loss, and (3) Cash flow statement.

- These financial statements must provide information as required by the law and various regulations, such as the Companies Act, Generally Accepted Accounting Principles, Indian Accounting Standards, etc., and in a prescribed format.

- The information in these statements is based on transactions recorded daily in the book of accounts.

- The statutory auditors of a company audit this information/statements and certify the correctness of the financial statements.

- At the end of the audit, the auditor creates the Auditor’s Report.

- Through this report, the auditor conveys their observations, views, and judgment on their audit of the financial statements.

- Importantly, this report is signed by the statutory auditor and not by the company management.

What does the report have?

The auditor shares his/her observations from the audits, mainly related to the following aspects:

- Compliance with accounting as required by the Companies Act.

- Whether the financial statements give a true and fair view aligned with the GAAP in India.

- Agreement of the financial statements with the book of accounts maintained by the company.

- Identification of any missed mandatory accounting standards by the company.

- Changes in accounting methods/policies compared to the previous year.

- Noting observations that materially impact the financials of the company.

- Detection of transactions that could be book entries and did not actually take place or were not in the interest of the company.

Where to find the auditor’s Report?

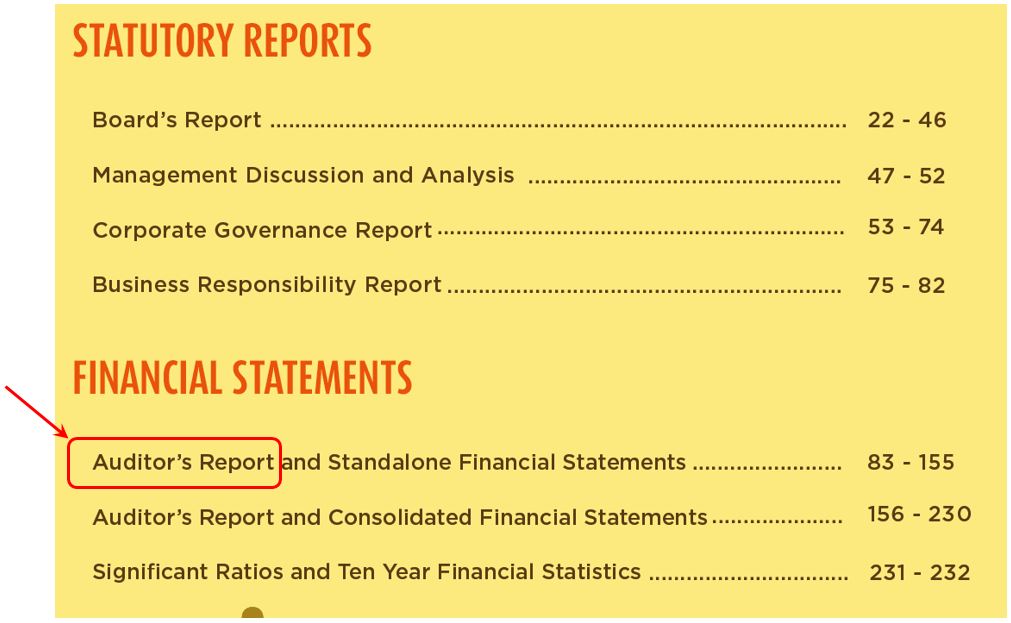

The company publishes the Auditor’s report in the Annual Reports. It constitutes the first part of the financial statements, appearing immediately after the director’s report. Following the Auditor’s report, there are annexures to the auditor’s report.

Below is a sample from the Annual Report’s Table of Contents.

Understanding the Auditor’s Report

Investors need to grasp the structure/contents of the report as this understanding is essential for relating the report’s contents to various investment decision points and financial statement analysis.

Below, I have covered a few important sections that are needed by an investor. However, I encourage investors to fully read the Auditor’s report and the annexures to gain maximum insights.

Sections/Details in an Auditor’s Report

The format of the report is fixed, and uniform as prescribed by the Standards on Auditing (SAs) issued by the Institute of Chartered Accountants of India. A few important sections are:

Audit Opinion

“This is the heart of the auditor’s report,” says GC Pipara in his book “Balance Sheet Decoded.” The auditor can provide different opinions based on their observations and judgment about the audit. More details regarding the various kinds of opinions are covered in the next section.

Remember, this is only an opinion – a personal opinion by an expert and not a guarantee or a certificate. This opinion is subjective, implying that two different auditors may report quite differently for the same company with the same set of facts and evidence.

Key Audit Matters

In the auditors’ professional judgment, these are the most significant ones in the audit of the financial statements. This section lists the observations and actions taken by the auditor.

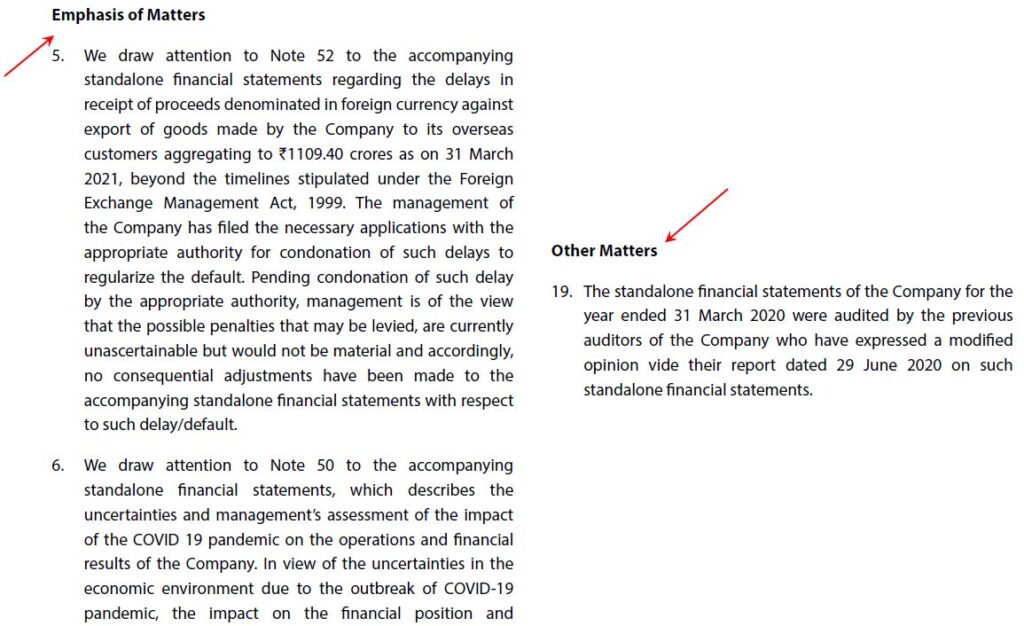

Emphasis of Matters

This is intended to draw the attention of stakeholders to matters presented/disclosed in the financial statements.

Other Matters

These refer to matters other than those presented/disclosed in the financial statements. In the auditor’s judgment, these are details that are relevant to the user’s understanding of the audit.

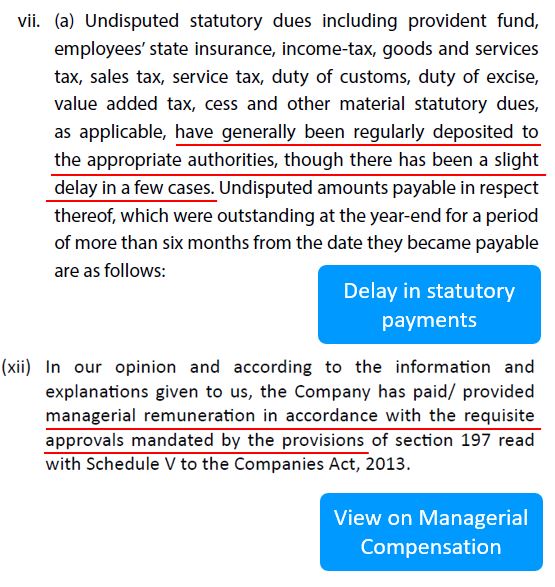

Annexures

The Auditor’s report has annexures. They provide information on:

- Payment (or dues) to statutory bodies like income tax, sales tax, provident fund etc.

- Details of payment default to its lenders

- View on managerial compensation

- Borrowings from the public

The above list is only indicative. The annexures have a lot of information useful to investors.

Type of Auditor’s Opinion

We observed that the Auditor’s opinion is the heart of this report. This opinion holds the key to judging many aspects of long-term investing, including the reliability of financial statements. There are two kinds of opinions.

Clean Opinion

This is also called an unqualified opinion. This opinion indicates that the financial statements:

- Have been prepared in alignment with GAAP (Generally Accepted Accounting Principles)

- Confirms to the book of accounts and accounting policies

- Meets the reporting requirements

- Free from the misinterpretation of facts.

Modified Opinion

An auditor can provide a modified opinion in two situations:

Situation 1: Financial statements are materially misstated.

Misstatement represents the difference between the financial statement and reporting framework. This difference could be in terms of amount, classification, presentation, and disclosure. Misstatements need not necessarily result from fraud; they could also arise due to human errors.

Situation 2: Insufficient audit evidence

The auditor is not able to obtain sufficient appropriate audit evidence. These could be due to:

- Circumstance beyond control – Account records seized by authorities

- Circumstance related to nature and timing of auditor work – financial information of an associate is not available.

- Limitation by management – Auditor not allowed to count inventory or verifications.

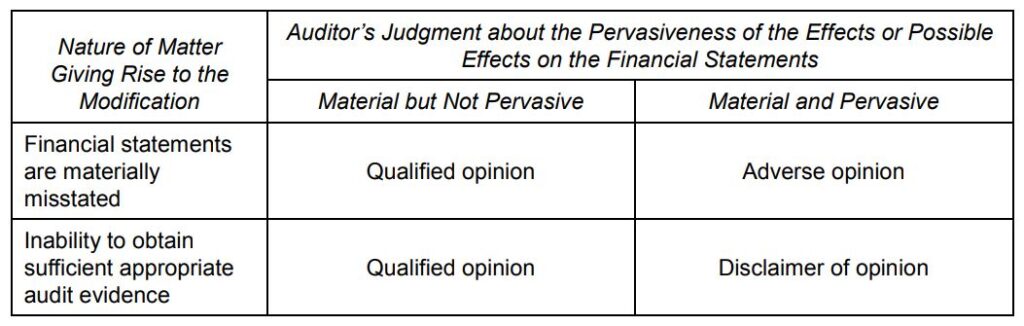

There could be three types of modified opinions based on: (1) These two situations and (2) Auditors’ judgement on the material and pervasive effects on the financial statements.

- Material: The errors or misstatement is expected to influence the decisions made by users of the financial statements.

- Pervasive: Meaning is widespread. The errors or misstatements would have a widespread effect on the financial statement. The effect or possible effect of misstatement is undetected. This decision depends on the judgement of the auditor.

Two pointed examples to explain the above:

- A cashier stealing cash is material, but not pervasive. It does not have a widespread effect.

- Management or promoter taking cash out of the company through related party transactions is both material and pervasive. It has a widespread effect.

The three kinds of opinions are shown in the below image.

Modified Opinion 1 - Qualified Opinion

(a) The auditor has the needed and sufficient audit evidence. The audit concludes that misstatements are material, but not pervasive, to the financial statements; or

(b) The auditor is unable to obtain sufficient appropriate audit evidence. The audit concludes that the possible effects on the financial statements of undetected misstatements could be material but not pervasive.

Modified Opinion 2 - Adverse Opinion

The auditor has the needed and sufficient audit evidence. The audit concludes that misstatements are both material and pervasive, in the financial statements.

Modified Opinion 3 - Disclaimer Opinion

These are extremely rare cases where there are multiple uncertainties in the financial statements. The auditor is unable to form an opinion due to the cumulative effects of the uncertainties.

The auditor concludes that the possible effects on the financial statements of undetected misstatements, if any, could be both material and pervasive. A disclaimer of opinion is not an opinion itself.

How should Investors use Auditor's Report

Importance of this report to an Investor

- The report is an opinion by the auditor – A professional, who has closely worked with the various stakeholders in the company.

- As part of the audit the auditor has verified several documents, related to various transactions, and discussed them with the different teams within the entity – This is something that investors can never do.

- An auditor performs the audit, certifies the financial statements and includes their observations about the auditor’s report – This is a kind of third-party verification and view

- The auditor’s report shares information that can provide a lot of insights into management integrity, corporate governance, and accounting quality (in terms of adherence to regulations, standards and accounting principles).

What information can investors get from Auditor’s report?

Auditor’s report is a gold mine for investors. It gives a lot of insights into management integrity, corporate governance, and accounting quality. However, they are not straightforwardly indicated. An investor needs to infer these insights from this report. A few important pieces of information that an investor gets are:

Accounting quality

- When assessing accounting quality, an audit opinion (Clean, qualified, adverse, or disclaimer) provides a judgment on whether the reported financial numbers can be trusted.

- In the case of a qualified opinion, the needed adjustments to financial statements, such as assets, liabilities, or profit/loss, are highlighted.

- Discrepancies and inaccuracies observed in various transactions, like lease contracts, trade receivables, inventories, etc., are also addressed.

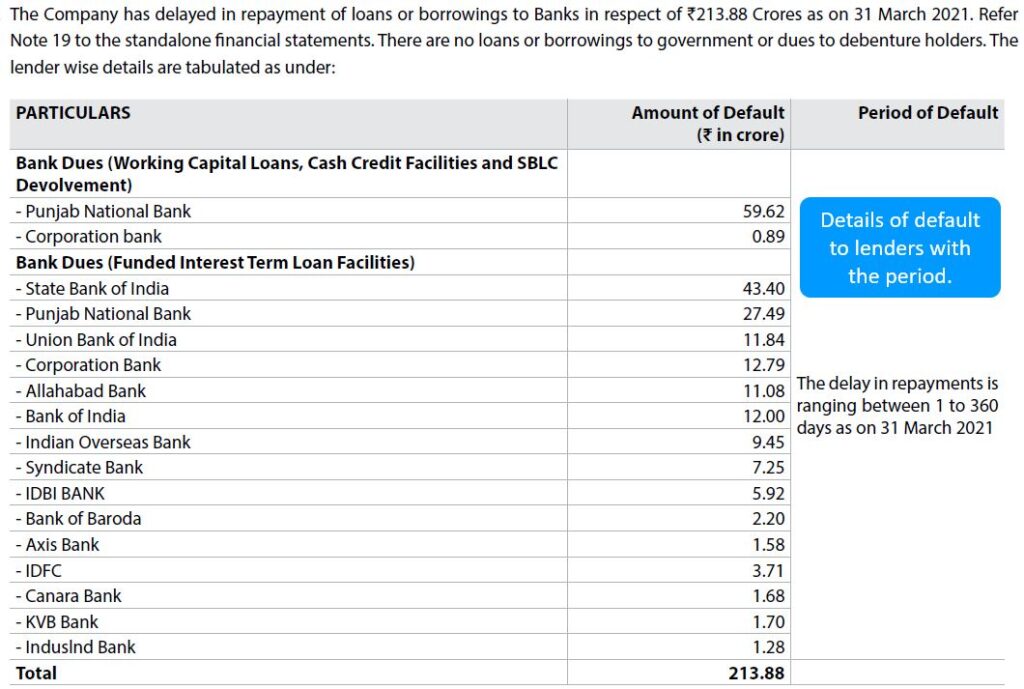

Financial Distress

- The auditor examines whether the company has been promptly paying dues to statutory bodies like income tax, provident fund, etc., or if there have been delays.

- The auditor also investigates any default to lenders and the duration of such default.

- Additionally, deposits accepted from the public are scrutinized.

Management Integrity / Corporate governance

- The auditor assesses unsecured loans given by the company to related parties and other parties.

- Details of dubious related party transactions are disclosed, and the payment received by managerial personnel is examined to ensure compliance with statutory requirements.

- Any weaknesses in internal financial controls, which can make financial fraud easier, are also reported.

Investors must use this information and insights to: (1) Shape their view on softer parameters like Management integrity and (2) Adjust/discount harder parameters around published financial statements.

Link Auditor’s report to Financial Statement analysis

A significant part of investing judgment relies on the analysis of published financial statements. This analysis is complete and provides a real picture only when the numbers in the statements are related to the Auditor’s observations in the report.

The financial statements require suitable adjustments or interpretations based on the opinion and observations in the auditor’s report. The adjustment may be necessary for:

- Profits if the opinion is that profits are overstated (or loss is understated).

- Assets and liabilities if assets are overstated and liabilities are understated.

How should an investor approach Auditor’s report?

- When analyzing a company for investment, the first step is to read the auditor’s report.

- The audit opinion plays a crucial role in deciding the next steps

- Unmodified/Clean opinion is the sweet spot for investors.

- For a qualified opinion, adjust the financial statements suitably, i.e., if there are overstated profits or liabilities, or understated liabilities.

- Companies with adverse or disclaimer opinions should be ignored. In the case of a disclaimer, the auditor has not given an opinion on the audit and the statements. As an investor, you should avoid putting your money in such companies. If the auditor themselves cannot form an opinion, how can investors trust the financial statements?

- Identify pointers around management integrity, corporate governance, related party transactions, and financial distress (defaults in payments).

- Do not just read the current year’s report but also examine at least 3 to 5 years’ reports. Analyze how the opinion has changed over the years.

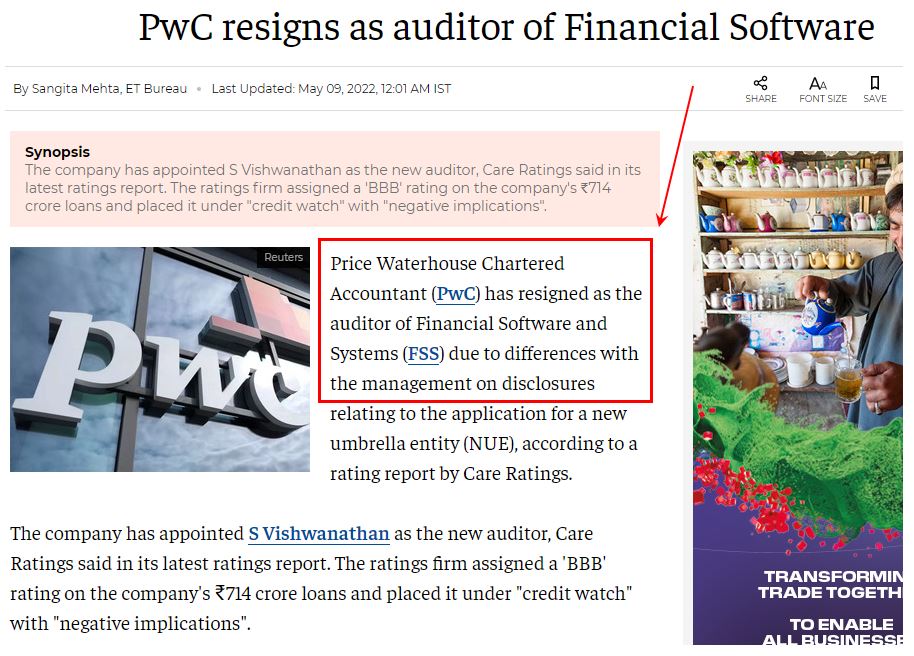

- Whenever there is a change in auditor, look for opinions from both the old and new auditor.

- Pay attention to moves like management firing auditors or auditors resigning. Such moves often result from disagreements between the management and auditors.

Drawbacks

Auditors being paid by the company has led to a lack of trust in the audit and the report. This lack of trust became a reality when the Satyam scam broke out in 2009.

However, the regulatory environment has changed over the years, and now auditors can resign over irregularities by the company or due to non-cooperation by the management.

A few recent instances illustrating this change are:

Example 1

Example 2

Example 3

Practical Cases of our Learnings

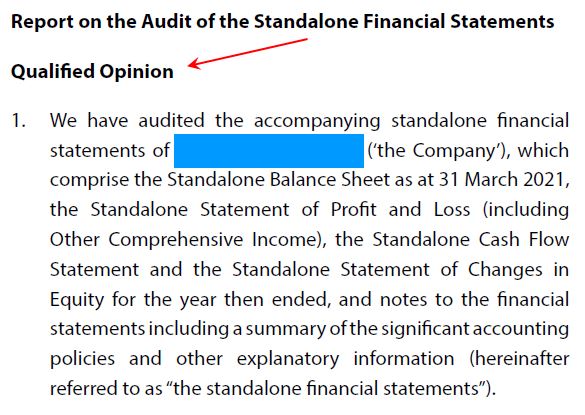

Different Kind of Modified Audit Opinion

Below are the examples of 3 kinds of modified opinions.

1. Qualified Opinion

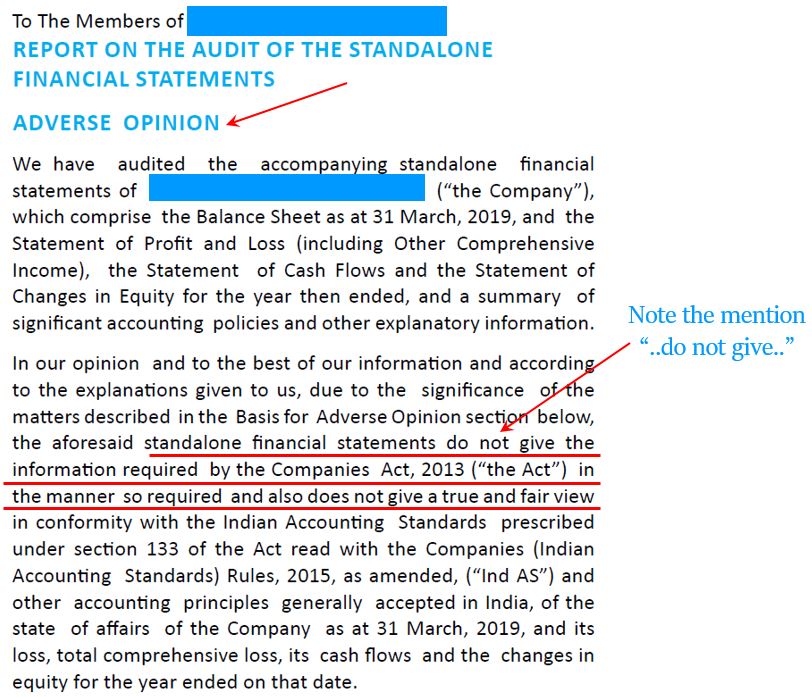

2. Adverse Opinion

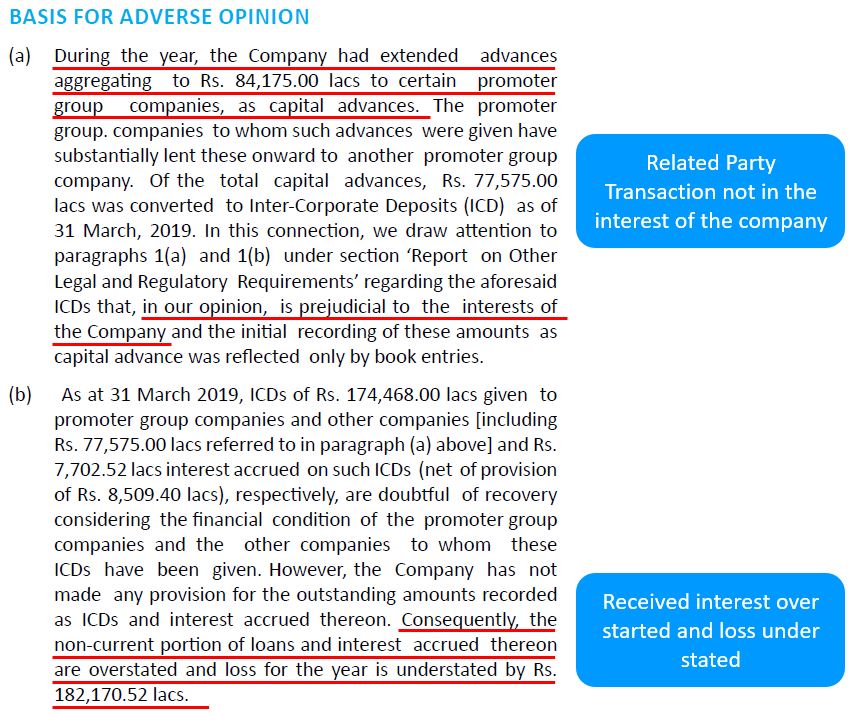

The auditor gives the “Basis for Adverse Opinion”. These give insights into the discrepancies observed in financial statements, corporate governance and management integrity.

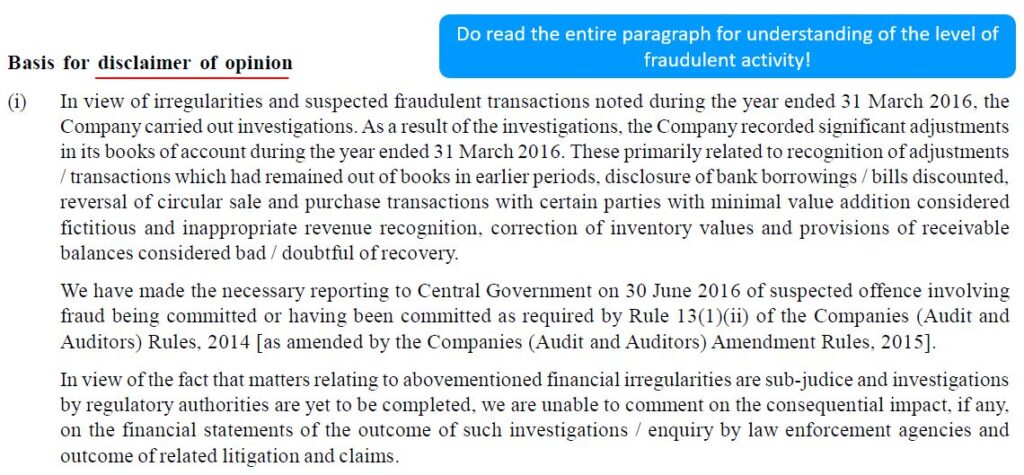

3. Disclaimer Opinion

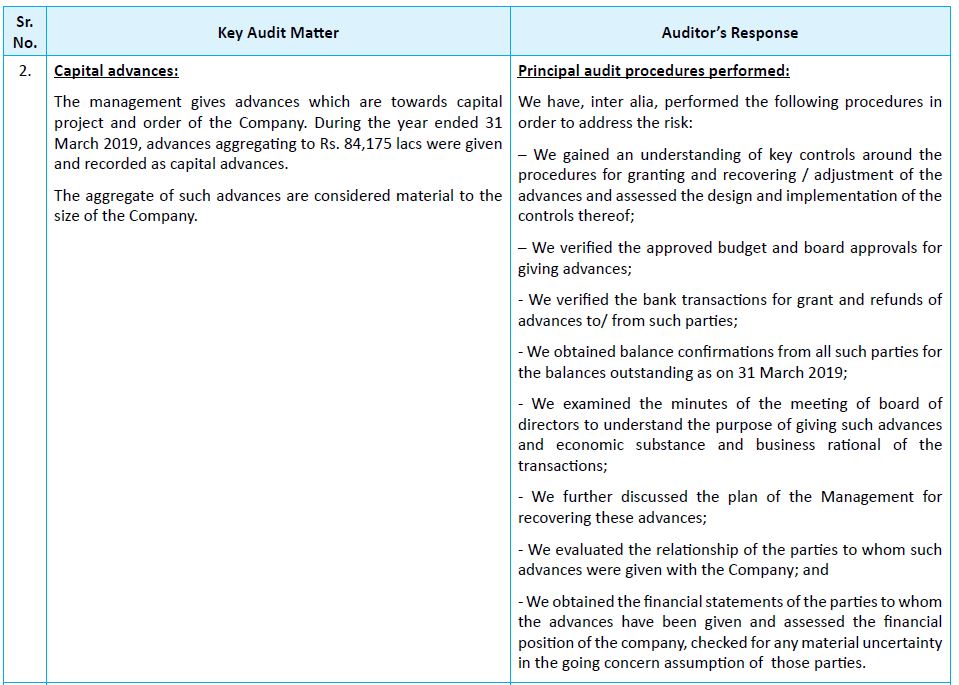

Key Audit Matter

The auditor lists the key audit observations along with the actions and procedures that they had initiated against it. The image below shows one such example.

Emphasis of Matters & Other Matters

Emphasis of Matters, points to information presented/disclosed in the financial statements. Whereas Other Matters, refer to information other than what is presented/disclosed in the financial statements.

Annexure to Auditor's Report

Read all the annexures to Auditor’s Report. It has much information on Auditor’s view on fixed assets, inventory, accounts receivable etc. It has information on the status of payments to statutory bodies, default to lenders, managerial compensation etc.

In the below example, the company has defaulted to its lenders. This is a sign of financial distress.

Next time you choose a company for long-term investment, make sure to read the Auditor’s report. Spending one or two hours on this report would save your investments.

Conclusion

The Auditor’s report holds immense significance in the realm of investing. As investors, we rely on financial statements to make informed decisions, and the Auditor’s report serves as a crucial tool for verifying the accuracy and reliability of these statements. Through their professional expertise and rigorous examination, auditors provide valuable insights into management integrity, corporate governance, accounting quality, and potential financial distress. By carefully studying the audit opinion and observations, investors can gain a deeper understanding of a company’s financial health. Thus, dedicating time to understanding and analyzing the Auditor’s report can be a prudent step towards informed investment decisions.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.

Pingback: Stock Analysis, Here is a Powerful Framework - Venkatesh

Really Awesome blog got great insights from this blog about the Auditor Report & more insights. Thanks for sharing this kind of information.

Very nice illustration. Sir.