Bajaj Holdings & Investment Limited (BHIL) is a premier investment company in India, formed as a result of the demerger of Bajaj Auto Ltd. in 2007. It is a Non-Banking Financial Company (NBFC) with strategic stakes in prominent Bajaj group companies.

This blog delves into BHIL’s business model, offers insights for investors, and explores its diversified investments in various financial instruments.

(Do not miss my earlier blog on Bajaj Group and Bajaj Finance/Bajaj FinServ.)

Please read this caution first, before reading further!

- I have shared the insights I gathered from my study.

- These are not any specific investment recommendations.

- Many of these insights are based on current business growth, my assumption on future growth and potential future developments that may or may not materialize.

- Please use these insights as a supplement information for your investment decisions, fully realizing that this is not a recommendation.

- If you choose to invest in any of these companies based solely on this blog and incur a loss, please recognize that it is due to a lack of adequate due diligence on your part, not because of me or this blog.

I want to emphasize that THIS BLOG IS NOT INTENDED TO BE AN INVESTMENT RECOMMENDATION, but only to understand the business of Bajaj Holdings.

Overview of Bajaj Holdings & Investment Limited

Journey of the Company

Bajaj Auto Limited, initially known as Bachhraj Trading Corporation Pvt Ltd, was incorporated in 1945 to manufacture scooters. Bajaj Holdings & Investment Ltd. (BHIL) came into existence from 1 April 2007 post the demerger of erstwhile Bajaj Auto Ltd. into three entities:

- Bajaj Auto Ltd. (BAL),

- Bajaj Finserv Ltd. (BFS), and

- BHIL (renamed from Bajaj Auto Ltd.),

BHIL is a Non-Banking Financial Company (NBFC) and is classified as a ‘Systemically Important Non-deposit taking NBFC.’

Note: BAL and BFS are associate companies of BHIL which allows BAL and BFS to access its cash pool for future growth opportunities, on an arm’s length basis. – This is positive for BAL and BFS.

Business Model - High Level Overview

- BHIL is a Holding company with no core operations on its own.

- It has investments in companies of Bajaj group and debt instruments (Details of the investments will unfold in the later part of this blog.)

- BHIL focuses on earning income through dividends, interest, and investment profits.

- The company depends largely on equity and debt markets for its income.

- The company’s business model is intricately linked to the performance of the equity and debt markets.

A detailed overview of the investments and business model will be covered in the subsequent sections of the blog.

Management

Shekar Bajaj

Chairman

Sanjiv Bajaj

CEO

Investment Policy of Bajaj Holdings

The Board-approved investment policy dictates:

Asset Allocation

- Minimum 35% of surplus funds (excluding strategic investments) in debt instruments.

- Maximum 65% of surplus funds (excluding strategic investments) in equity and equity-linked instruments.

Investment Management

An Investment Committee comprising the Managing Director & CEO and management members, meeting monthly.

Team

Professional team of fund managers, research, and credit analysts led by the Chief Investment Officer.

Investments Portfolio of Bajaj Holdings

We saw earlier that BHIL is a holding and investment company with no other operations of its own. We will now discuss in detail the investments made by the company.

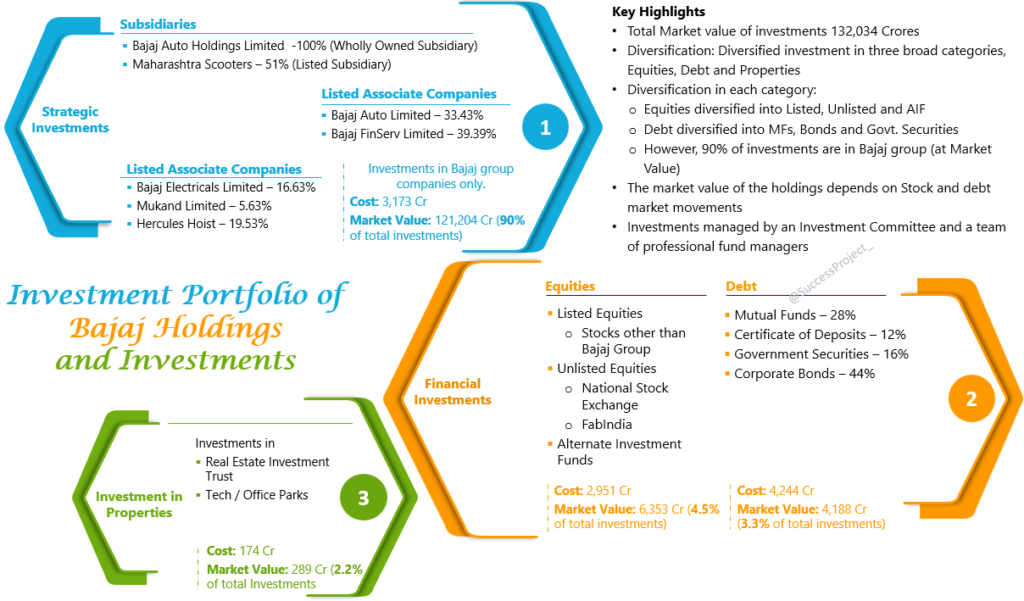

The company has investments in three channels as in the below image

Note: All the numbers and data are as of March 31, 2023 as referred from the Annual Report

Strategic Investments

These are the investments in Bajaj group companies. In a few companies they have large and controlling stakes, while in others the stakes are low.

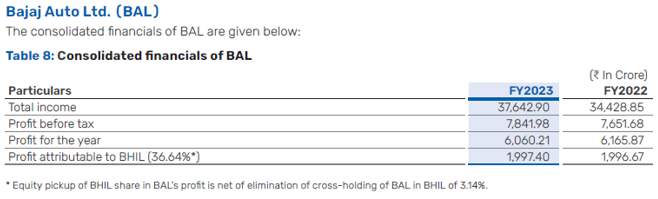

Bajaj Auto Limited

- Products: Manufactures and sells motorcycles and commercial vehicles.

- Electric Vehicles: Participates in the EV market through Chetak Technology Ltd.

- International Partnerships:90% holding in Pierer Bajaj AG (KTM and Husqvarna) and partnership with Triumph.

- BHIL’s Stake:43%

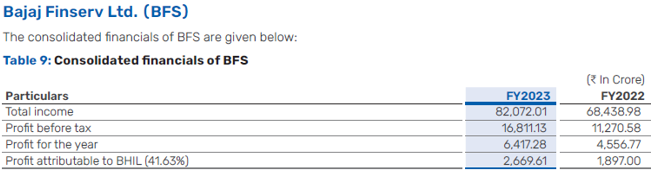

Bajaj FinServ

- Vision: To be a diversified financial services group with a pan-India presence.

- Holdings:

- Bajaj Finance Ltd. (BFL): 52.49%

- Bajaj Allianz General Insurance Company Ltd. (BAGIC): 74%

- Bajaj Allianz Life Insurance Company Ltd. (BALIC): 74%

- Subsidiaries: Asset management company, digital marketplace for loans, insurance, investments, and a digital health tech venture.

- BHIL’s Stake: 39.29%

Do read my earlier blog on Bajaj FinServ for a complete understanding of the company.

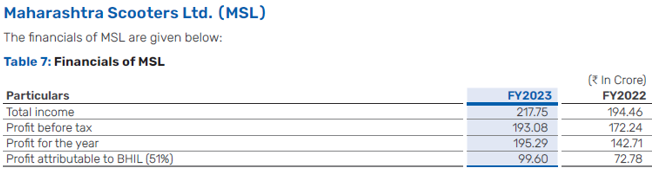

Maharashtra Scooters

- History:

- Incorporated as a joint sector company in the year 1975, promoted by Bajaj Auto Ltd and WMDC (a Government of Maharashtra undertaking) for manufacturing geared scooters.

- The company discontinued production of geared scooters in 2006.

- Currently, the Company is engaged in the business of manufacturing dies, Jigs, fixtures and die-casting components primarily for the automobiles industry etc.

- BHIL’s Stake: 51%

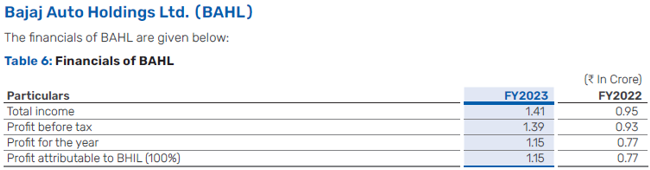

Bajaj Auto Holdings Limited

It is a wholly-owned subsidiary of Bajaj Holdings. Not many details are available. However, the numbers are too small in the bigger scheme of things.

Bajaj Electricals Limited

- Products: Focuses on consumer appliances, lighting, fans and engineering projects.

- BHIL’s Stake: 16.63%

Mukand Limited

- Products: Manufactures of stainless steel, alloy steel, and stainless steel billets, and is an exporter of hot rolled bars.

- Industries served: The company is a key supplier of high-quality steel products for automotive, engineering, and construction industries.

- BHIL’s Stake: 5.63%

Hercules Hoist

- Products: manufacturing of mechanical hoists, electric chain hoists, wire rope hoists, stackers and storage and retrieval solutions, and other engineering machinery.

- BHIL’s Stake: 19.53%

Financial Investments

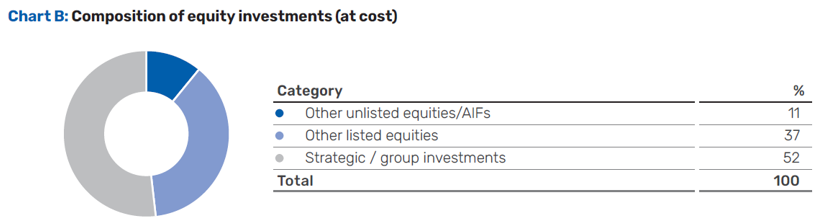

Equity

- Listed equities: These are investments in equities other than Bajaj group companies

- Unlisted Equities BHIL continues to remain invested in the National Stock Exchange (NSE) and Fabindia.

- Alternative Investment Funds (AIF)

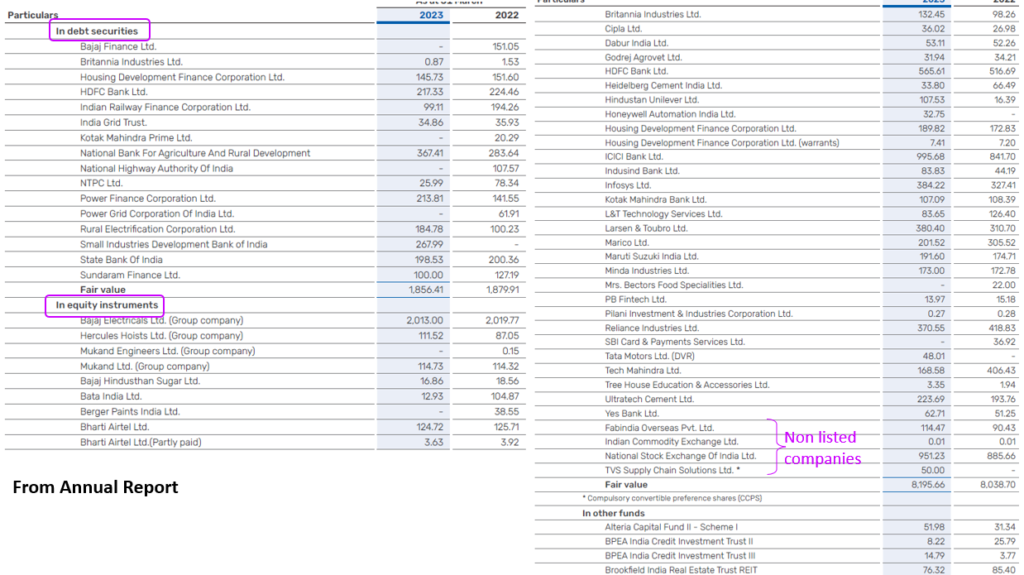

Details of equity holdings is disclosed in their Annual Report as below.

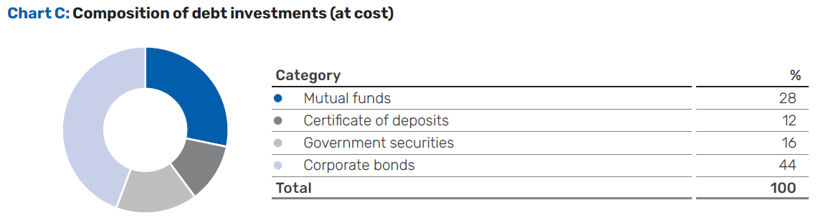

Debt

BHIL, focuses on optimising risk-adjusted returns for fixed-income investments by investing in high-quality debt instruments, managing interest rate risk and minimizing liquidity risk. The aim is to first provide safety of capital, liquidity and a reasonable return. Majority of the investments are into Government securities, high-quality AAA corporate bonds and debt mutual funds with similar underlying investments.

Details of debt holdings is disclosed in their Annual Report as below.

The complete breakdown of all investments by Bajaj Holdings is available in the annual report.

How to approach Bajaj Holdings - Insights for Investors

Investment Structure

- Resemblance of Mutual Fund: Bajaj Holdings & Investment Limited (BHIL) resembles a diversified mutual fund due to its wide-ranging investments. BHIL’s portfolio includes stakes in Bajaj Group companies, 20-30 listed companies, debt instruments, alternative investments, and real estate.

- Control stake: Unlike a typical mutual fund, nearly 90% of BHIL’s investments are in Bajaj Group companies, aiming at maintaining control stakes.

- Comparison limitation: Despite the diversified portfolio, this focus on control stakes makes BHIL’s structure an imperfect comparison to a mutual fund.

No Product & No Competition - Unique Business Model

- Core operations: Bajaj Holdings does not have any core operations, but functioning solely as a holding and investment entity. It does not have any product or serve to offer to customers.

- Competition: Since there is no product there is no competition. Bajaj Holdings does not compete with other companies for market share, thus making it unique in its operation.

- Challenges: While not having competition is good, it possess an unique challenge of non-availability of competition to compare operational metrics, financial parameters and relative valuation.

Market Dependence

- Influence of Market Conditions: The share price movement of Bajaj Holdings is directly linked to the performance of its investment portfolio, influenced by stock and money market conditions.

- Broad Spectrum Investments: Bajaj Holdings’ portfolio spans various asset classes, providing a diverse investment landscape.

Reserve Fund

- Regulatory requirement: Under section 45-IC of the RBI Act 1934, NBFCs must transfer a minimum of 20% of net profit to a reserve fund before declaring dividends.

- Current reserve: Bajaj Holdings has transferred ₹2,815.48 crore to this reserve fund which is locked and cannot be used for other purposes.

Valuation

Valuing a holding company like Bajaj Holdings differs significantly from valuing manufacturing companies like ITC or HUL. Unlike these companies, BHIL does not have any core operations and revenue comes from interest income, dividend income, and gains from investments.

Valuation by Parts – Simplified Approach

- Assessment Method: This approach assesses the current value of BHIL’s assets and compares it with BHIL’s market cap to determine if it is priced accurately, undervalued, or overvalued.

- Hypothetical Example: If BHIL holds only 51% of Maharashtra Scooters and 33% of Bajaj Auto, the market value of these holdings provides a basis for BHIL’s valuation. This method is akin to the NAV calculation of mutual funds, where the unit price corresponds to the current market price of underlying assets. (This was one reason, why I compared this company structure similar to that of Mutual Funds)

Challenges in Valuation

While the “Valuation by Parts” method is mathematically straightforward, two main challenges affect its reliability:

Discount on Holding Companies: Universally, holding companies trade at a discount relative to the underlying asset value. Unlike mutual funds, where the value is direct, holding companies may trade at a discount of 10%, 20%, or even 50%. There is no benchmark for the ideal discount rate, adding uncertainty for investors. Valuation by this method may show a discount of even 40 – 50% giving a false notion of deep value. But it is a value trap.

Perceptional Value of Holdings: The market value of BHIL’s holdings, such as 51% of Maharashtra Scooters and 33% of Bajaj Auto, itself is a perceptional value. It is based on their stock prices, which fluctuate daily. They may not be priced to perfection. The accurate valuation of these holdings is uncertain, as their market prices may be overvalued, undervalued, or accurately priced, impacting the overall valuation of BHIL.

Conclusion

Bajaj Holdings & Investment Limited (BHIL) exemplifies a robust investment entity within the Bajaj Group, characterized by its strategic stakes in key group companies and a diversified investment portfolio. Its prudent investment policy, combined with a professional management team, ensures optimized risk-adjusted returns.

For investors, BHIL represents a promising opportunity. Although there seems to be a value gap, uncertainties about closing this gap could impact the realization of significant gains. As a holding company, BHIL might continue to trade at a discount to the value of its underlying assets.

Bajaj Holdings operates similarly to a diversified mutual fund, with substantial investments across various asset classes, particularly within the Bajaj Group. However, its valuation approach and market behavior present unique challenges and opportunities for investors. Understanding these nuances and the inherent uncertainties can help investors navigate their investment decisions with a comfortable margin of safety.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.

A complete source of information about the BHIL., Simply superb. I am holding 80 shares @ Rs 800.