Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

Hawkins Cookers

Hawkins is the only listed company that gets most of its revenues from Pressure cookers. With approximately 25% of the market share (Refer 2021 AGM Transcript), Hawkins has established itself as a leading player in the industry.

The company’s global presence is evident from its sales of over 11 Crore pressure cookers (as of September 2022) across 64 countries. Hawkins adopts a premium positioning strategy, emphasizing its commitment to delivering high-quality products to consumers.

Company Profile

- Year established: 1959

- Number of Employees: 595 (as of March 2022)

- Number of Factories: 3

- Hoshiarpur, the Punjab

- Jaunpur, Uttar Pradesh

- Thane, Maharashtra

Product Profile

Hawkins offers a wide range of products ranging from 88 different models of pressure cookers in 13 types.

All Hawkins models are categorized as “Inner Lid” cookers, which are considered safer than their “outer fitting” counterparts due to physical, scientific, mechanical, and engineering reasons (2020 Call Transcripts).

The Hawkins cooker line includes popular brands such as Future, Contura, Hevibase, Big Boy, Miss Mary, and Ventura.

Financial Profile

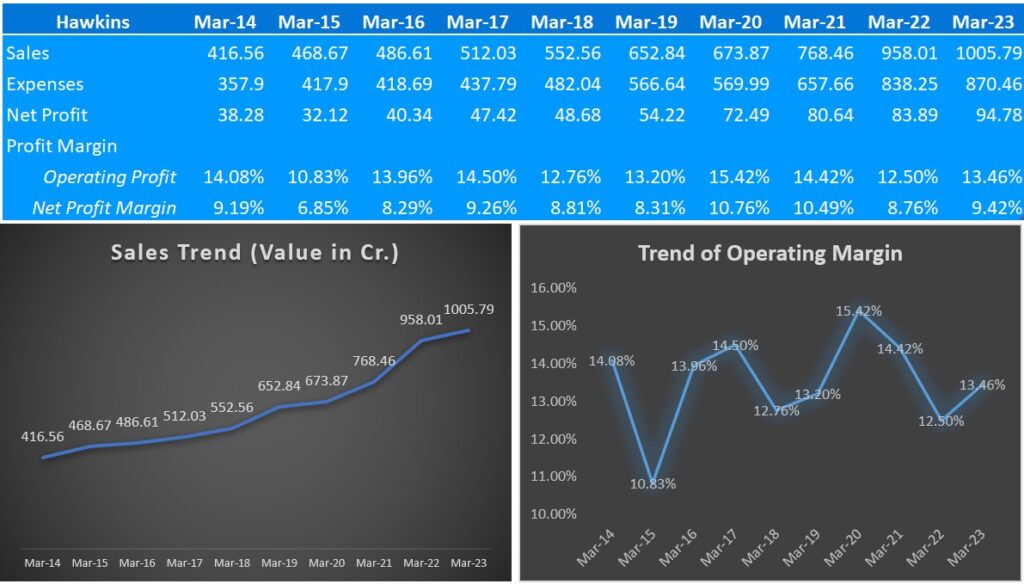

Source of data: Screener.in

Key Financial Insights

- 10 years sales growth: 10.3%

- Sales trend shows a secular growth and not cyclic behaviour

- Revenue split: Hawkins operates in two segments (1) Pressure Cookers and (2) Cookware & others. The revenue split between the two is 80% to 20%.

- Export is 8% of total revenue

- The Pressure cooker has a higher margin than the cookware segment (2022 AGM Transcript)

- The operating profit margin fluctuation reflects that there are increases in input costs (like raw material or wages) which is not passed on to the customers

Strength and Weakness

Strength

Strong Brand

Hawkins has established a powerful brand name, allowing it to command premium prices and ensure cash-based sales to dealers, avoiding credit risks. The company sells cookers at approximately 30-40% higher prices than the market average.

Strong Financial Position

Hawkins relies on internal accruals rather than aggressive borrowing to support its growth ambitions, maintaining a robust financial position.

Complete Product Spectrum

Hawkins offers a comprehensive spectrum of products, covering various capacities, price points, and types. Their cooker capacities range from 1.5 to 22 litres, catering to different customer preferences and budgets (products across price points). The brand portfolio includes Aluminium, Stainless Steel, and Hard Anodized cookers.

Weakness

Concentrated Product Focus

Hawkins heavily relies on the cooker segment, which poses a concentration risk. However, the company has recently started diversifying into cookware to mitigate this weakness.

Concentrated Customer Base

The company’s major customer is CSD (Canteen Stores Department), indicating a concentration in the customer base.

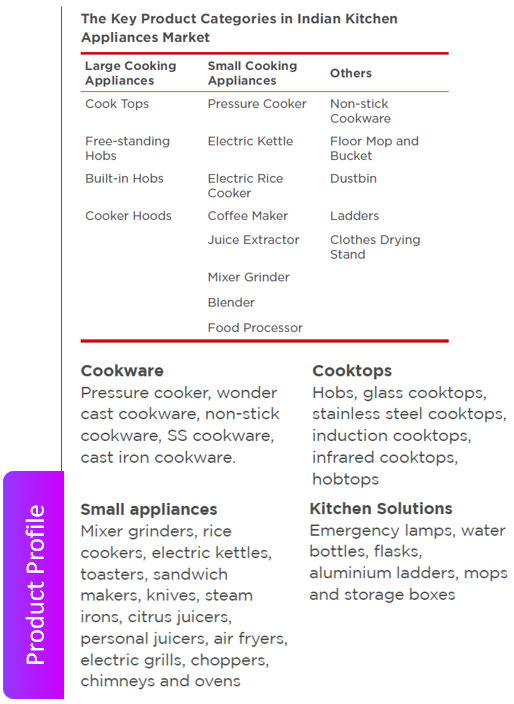

TTK Prestige

Unlike Hawkins, TTK is not involved only in the manufacture of Pressure cookers. TTK is involved in the manufacture of Pressure Cookers, Cookware, Kitchen Electrical Appliances, Gas Stoves, and Home Appliances. The company has also entered into cleaning solutions from 2017-18.

Company Profile

- Year established: 1955

- Number of Employees: 1419 (as of March 2022)

- Number of Factories: 6

Note: The details of number of employees is for the entire product range and not only cookers.

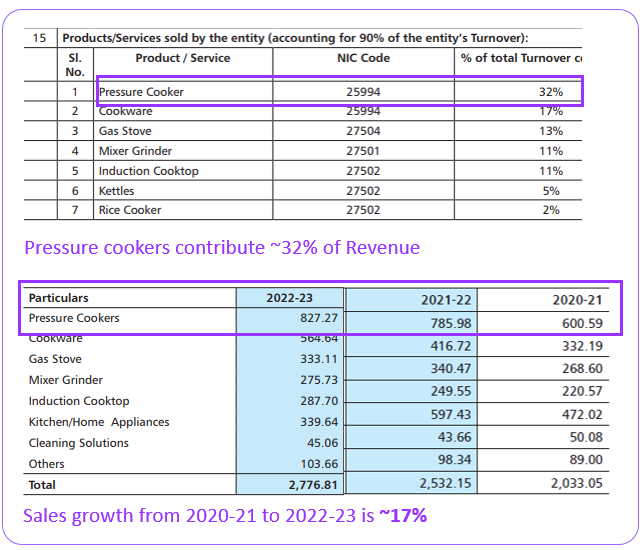

Product Profile

TTK started manufacturing pressure cookers in 1959 with technical collaboration from Prestige Group of the United Kingdom. TTK has a market share of ~60% in the outer-lid pressure cooker, ~15% in inner-lid pressure cooker within the organized market and in Induction cook-top space they enjoy a market share of about ~25%.

Svachh Pressure Cookers

These cookers are associated with spillage particularly when food with more liquid contents is cooked, causing inconvenience to the user. The spillage sometimes risks the clogging of the Stoves requiring extra care to clean. The design incorporates a special feature lid which contains the spillage hence reducing the usage of chemicals/solvents to clean the products.

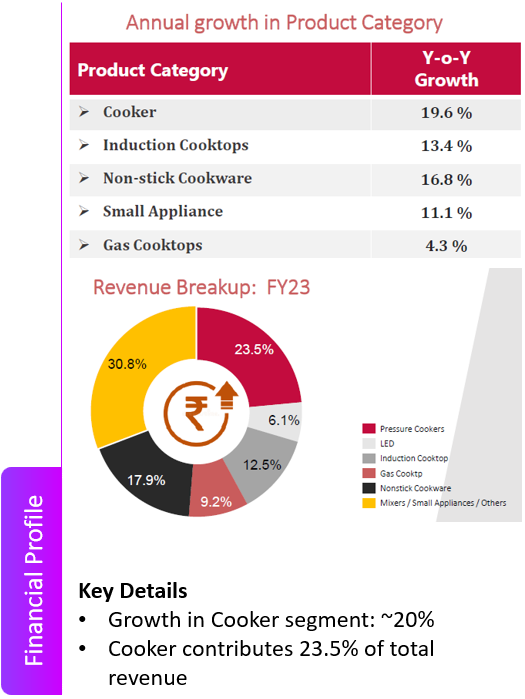

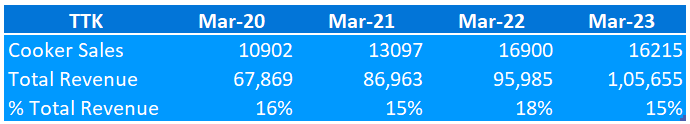

Financial Profile

- Pressure cooker sales contribute to 29-31% of the overall company revenues. (2022 Company Annual Report)

- Aluminium pressure cooker contributes to around 10 to 12% of total revenues. (2023-05 Call Transcript)

- The recent 3 years growth is ~17%

Stove Kraft Limited

Stove Kraft manufacturers a wide range of Kitchen appliances like Pressure Cookers, Non-Stick Cookware, Induction Cooktops, Mixer Grinders, LED Bulbs & Batten, Handy Choppers, PCB and Gas Stoves.

Product Profile

Financial Profile

- Stove Kraft is into pressure cooker manufacturing from 2015.

- The cooker manufacturing plant is in Karnataka.

Super Cooker

This product is a Pressure Cooker is made by virgin aluminium circle and are non-stick coated or hard anodised. The design of product helps the food to be cooked much faster than normal cooker and also helps to retain foods nutrients.

Butterfly Gandhimati Appliances Limited

Butterfly Gandhimathi Appliances is a renowned kitchen appliance manufacturer with a dominant presence in South India. It enjoys a significant market share in South India. The robust and exclusive distribution network in South India is a critical strength of the brand. Its products range from mixers, wet grinders, cookers and stoves.

In a strategic move, Crompton Greaves Consumer Electricals Ltd acquired stakes in Butterfly Gandhimathi Appliances. Recently, Butterfly Gandhimathi Appliances announced a merger with Crompton Greaves Consumer Electricals Ltd.

Company Profile

- Year established: 1986

- Number of Employees: 1,349 (as of March 2023)

- Number of Factories: 3

- Number of distributors: 500+

Note: The details of number of employees is for the entire product range and not only cookers.

Product Profile

Their product range caters to a significant portion of the kitchen appliances market.

When it comes to cookers,

- They manufacture Stainless Steel & Aluminium Pressure Cookers

- They are the pioneers of Stainless Steel (SS) Pressure cookers. They introduce SS Pressure Cookers in 1986

- They have a market share of ~5% in the pressure cooker segment.

- Brand: Tez, Butterfly’s signature Triply series.

- They also sell electric rice cookers

Financial Profile

- Sales growth:

- Recent Financial year ending March 2023, there has been decline in sales.

- Last 4 years CAGR has been around 10%

- Cookers contribute to 15-18% of the total revenue (Data from last 4 years)

Since the Financial Statements has details of their entire product spectrum, it is not possible to calculate the profit margins for the cooker segment alone.

Bajaj Electricals

Bajaj Electricals Limited is a part of the Bajaj Group of companies. Its products is spread across Consumer Products – Appliances, Fans, Lighting, Exports, and EPC – Illumination, Transmission Towers and Power Distribution. It also has its presence in premium home appliances and cookware segments with brands like Murphy Richards and Nirlep.

Product Profile

Bajaj Electrical has a huge line up of products. Below is the details of the consumer products. You can see they manufacture electrical cookers as part of “cooking essentials”.

The pressure cookers are part of the “Consumer Appliances” segment.

Image reference: Bajaj Electrical 2022 Annual Report.

It is evident that the company has a limited variety of pressure cooker models in comparison to its extensive range of other products. Moreover, cookers contribute only a small fraction of the company’s overall revenue.

Conclusion

These companies have established themselves as key players in the market, with strong brand recognition and a diverse range of cooker products. While they face challenges such as intense competition, fluctuating raw material costs, and evolving consumer trends, they leverage their strengths like strong financial positions, wide product spectrums, and strategic market positioning to maintain their market share and drive growth. Overall, the cooker manufacturing sector in India presents opportunities and challenges for investors and stakeholders, making it an interesting industry to watch and explore.

In the next blog, we will discuss more about the strategy and insights of Hawkins Cookers. The insights are primarily from the company’s AGM speech and concall transcript.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.