Investing in holding companies presents unique challenges, from accurate valuation to understanding valuation gaps. Let’s delve into the intricacies of these challenges and explore why holding companies can be a valuable, yet complex, investment. Do check my previous blog with operational details of holding companies.

Holding Companies in India

There are 72 holding companies as in an article of Value Research. I however do not have the list of all 72 companies. Below are the ones, that I know or came across. Readers may help with missing names in the comments section.

Note: The above list has only listed Holding Companies. There could be Non Listed Holding companies as well. These are usually the Ultimate Holding Companies. A few examples are,

- Tata Sons of the Tata group

- Bajaj Sevashram of the Bajaj group

- Ambadi investments of the Murugappa group.

How to Value Holding Companies?

Valuing a holding company differs significantly from valuing manufacturing companies like ITC or HUL. Unlike these companies, a holding company does not generate earnings on its own and cannot be valued based on its earnings. However, it does earn income from its holdings in the form of interest income, dividend income, and capital gains. So, what is the workaround? The value is determined by assessing its holdings and investments.

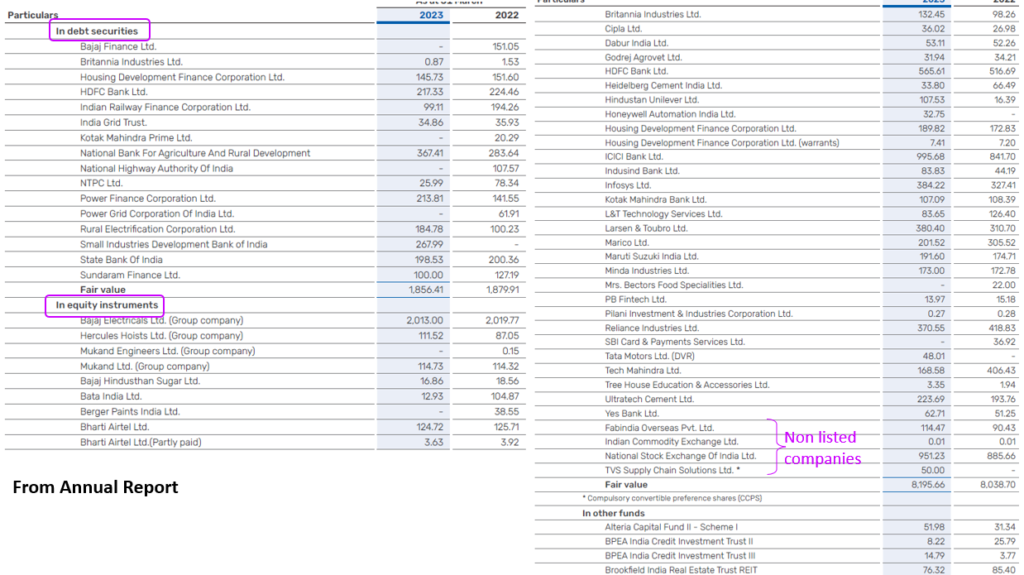

Valuation is relatively straightforward using the “Valuation by Parts” approach. This method is akin to the NAV calculation of mutual funds, where the unit price corresponds to the current market price of the underlying assets. In this approach, an investor assesses the current value of the assets held by the holding company and compares it with the market cap to determine if it is priced accurately, undervalued, or overvalued. The details of all holdings and investments of the holding company are available in the annual report. All you need to do is sum up the value of these investments.

Hypothetical Example: If Bajaj Holdings holds only 51% of Maharashtra Scooters and 33% of Bajaj Auto, the market value of these holdings provides a basis for Bajaj Holdings’ valuation.

Challenges in Valuation

While the “Valuation by Parts” method is mathematically straightforward, two main challenges can affect its reliability:

Holding Companies Discount

- Universally, holding companies trade at a discount relative to their underlying asset value.

- In simpler terms, they trade at a price lower than the total market price of their investments (portfolio value).

- Unlike mutual funds, where the value is direct, holding companies may trade at a discount of 10%, 20%, or even 50%. There is no benchmark for the ideal discount rate, adding uncertainty for investors. Valuation by this method may show a discount of 40-50%, giving a false impression of deep value. However, this could potentially be a value trap.

Perceptional Value of Holdings

Consider the same example of Bajaj Holdings that we saw above.

- The market value of Bajaj Holdings’, the market value of 51% of Maharashtra Scooters and 33% of Bajaj Auto, itself is a perceptional value.

- It is based on their stock prices, which fluctuate daily. They may not be priced to perfection.

- The accurate valuation of these holdings is uncertain, as their market prices may be overvalued, undervalued, or accurately priced, impacting the overall valuation of the holding parent.

Valuing Unlisted Entities

- Sometimes the Holding company would have invested in unlisted or private entities.

- It is difficult to get the market values of these investments, adding another layer of complexity to the valuation process.

Market Dependence

- The share price movement of the holding companies is directly linked to the performance of its investment portfolio, influenced by stock and money market conditions.

- The market value of the holdings can fluctuate, making it challenging to arrive at a consistent valuation.

- The performance of the Holding Companies to a great extend depend on operational and financial performance of the subsidiary companies.

Holding Company Discounts are there to Stay

We have observed that holding companies often trade at steep discounts to their portfolio’s value. Investors should not see these discounts as value buy. These discounts will be there for future also, thus making it difficult to profit by investing in these companies. Here are two main reasons why these discounts may persist:

Investments not for Sale

- In many cases, investments are not intended to be sold for profit but are held to maintain the ownership chain and control.

- For example, Bajaj Holdings and Investment has significant holdings in various Bajaj group companies.

- These investments have grown substantially, from an initial investment of over ₹3,000 crore to more than ₹121,000 crore.

- These are strategic investments meant for ownership control.

- Therefore, even if the investments increase in value by another 100 times from here, without selling these stakes, the value of the gain cannot be realized by the company and its investors.

Huge Liquidity

Even if a holding company is willing to sell its holdings in a listed entity, the large stake it holds can complicate the process. Such high volumes of shares can trigger a price decline when sold, and finding a buyer for such a large lot can be challenging. Even if the holding company want so to exit an investment, it is not going to be easy to sell its stake at the blink of an eye.

Situations for such sales are rare. However, this might occur if a holding company has acquired smaller stakes in other companies with the intention of selling them for profits at a future date. For instance, Bajaj Holdings has invested in equities of companies outside the Bajaj group, which may be sold later for profits. Even in such cases, selling these investments could trigger a price decline. Below is the image of minority stakes of Bajaj holdings in other listed companies apart from Bajaj group companies. Investors can get details of the invested companies from the Annual Report.

Unique Value Play for Investors

Investing in holding companies can be a unique value play, but caution is needed as the value gap may never close. Three main pointers to consider are:

- High Discount: The holding company discount should be very high. If a company has investments worth ₹1,000 crores, look to buy the company at significantly lower valuation levels. There are no strict benchmarks for how low this should be, but the greater the discount, the better the potential value.

- Good dividends: Deep discounts coupled with a good dividend yield can be an attractive option to consider.

- Diversified Investments: The investments of the holding company must be diversified. Concentrated investments pose the risk of volatility.

Conclusion

While investing in holding companies can be tricky, with a deep understanding of their valuation and the associated challenges, investors can uncover hidden value and potentially achieve significant returns. However, due diligence and a cautious approach are essential to avoid value traps.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.