Every field is prone to mistakes, and this is especially true when doing something for the first time. Similarly, when starting your investing journey, errors are almost unavoidable. Unfortunately, mistakes in investing can result in losing your invested money, which is something no investor wants. Consequently, mistakes are viewed negatively in the investing world. (Featured image credits: Photo by RODNAE Productions: https://www.pexels.com/photo/an-encouragement-quotes-on-brown-paper-8363153/)

But there is another side of this story – The positive side of investing mistakes. There are two fundamental truths to consider when it comes to investing:

- First, mistakes are inevitable, and

- Second, they also serve as valuable learning experiences.

By acknowledging and analyzing mistakes, investors can gain insights into their decision-making processes and improve their approach in the future. Learning from mistakes allows investors to identify what went wrong and what they can do differently next time to avoid repeating the same errors. This approach helps refine an investment approach, checklist, and framework, ultimately leading to better investment decisions and improved overall investment returns.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

Do check the blog Index page for all my previous blogs.

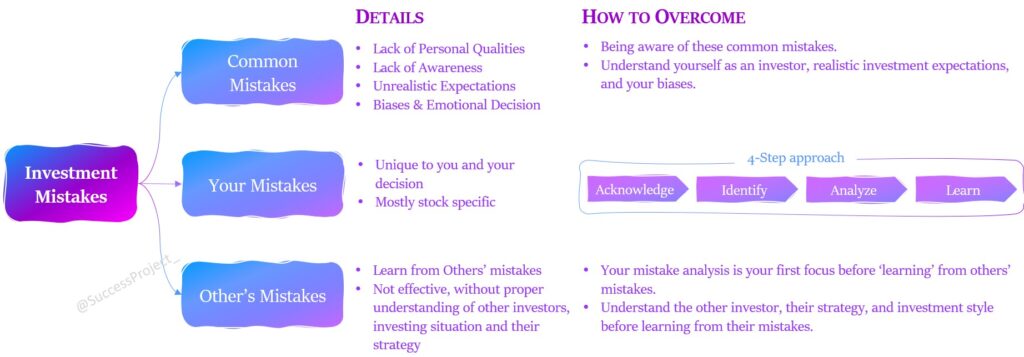

Common Mistakes

This is something that all (or most) investors come across in our investment journey. We are typically “first time investors”, who embraced investing without much knowledge about investing, great expectations, myths and beliefs. We will see the reasons in a bit detail.

Lack of Personal Qualities

In the last few blogs, we are discussing the personal qualities and behaviours needed for investing. We lack these qualities in the beginning of the journey. A few of them,

- Short-term focus instead of long-term focus

- Lack of Patience leading to selling the stock during market volatility

Lack of Awareness

In the beginning, investors lack: (1) The needed knowledge to invest, (2) awareness of investment risk, (3) Awareness about their risk profile, etc. All this leads to mistakes around,

Diversification

A adequate diversification to match your return expectations and your risk profile. Under diversification increases risk and over diversification decreases your returns.

Allocation mistakes

Very less allocation to a great stock idea. E.g. The allocation would be a meagre 1% of the overall portfolio. Even if this stock becomes 10x, it will not have a huge impact on your networth.

Time the market

This is possible, but it is very hard and not for everyone. First time investors must avoid this. This leads to selling good stocks for few %-point gains thus losing x-time returns over years.

Unrealistic Expectations

- Making money in stock markets is easy. This belief leads to not focusing time on knowing the market/company and thus risking the money.

- Other form of unrealistic expectations is around returns. When I talk with my friends, who are new to investing, their return expectations are just unrealistic. They look for x-times in span of weeks or months. Someone was wanting their money to double every 3 months.

- One must remember that such things may happen one or two times but not consistently. One cannot keep on doubling their money every 3 months. Investing needs long term focus.

Biases / Emotional decision

- Lot of biases come into play in stock investing: Anchoring bias, confirmation bias, herd mentality etc.

- Buying companies that they like very much or have a beautiful story around in the main and social media.

- Taking impulsive decisions due to emotions like envy, greed, fear etc.

How to Overcome

One effective way knows about these mistakes. There is so much literature is available in this topic. Kindly read the articles in the below links to be aware of these mistakes.

Your Mistakes

Your decisions dictate these mistakes, and they are unique to each person. It is very unique to everyone, and it could be different mistakes each time. They can be considered “personal mistakes”. This is mostly stock-specific around two things:

• Missing a good investment opportunity despite conducting a proper analysis

• Investing in wrong opportunities after analysis.

Acknowledging these mistakes can be difficult, making them even more important. In fact, this type of mistake is the focus of this blog.

How to Overcome

As an investor, working on your mistakes is crucial to improve investment decisions and avoid making the same mistakes again. Here is one way that has worked for me well.

Acknowledge

- This is an important and challenging initial step.

- Typically, when investments succeed, we take credit but attribute failures to external factors like the economy or politics.

- However, taking responsibility and admitting to the mistake is critical.

- You need to acknowledge the mistake at least to yourself.

- It allows you to learn from it, identify areas for improvement, and avoid repeating it.

- Humility is a valuable personal quality that enables you to stay open to the possibility of you being wrong.

Identify

- The second important step is to identify what went wrong.

- You need to take time to reflect on your investment and the mistake.

- At times there could be multiple mistakes also.

- Basically, you are trying to find out the root cause of the mistake.

Analyse

- As you try to analyze your mistake, it is important to pinpoint the underlying cause.

- You need to examine what led you to invest in the company and where you went wrong.

- This involves identifying the factors that you overlooked or underestimated.

- For instance, did you disregard overvaluation or fail to read Auditor’s report, which revealed issues with accounting quality?

- Did you make an unrealistic assumption about future growth?

- By answering these questions, you can gain a clearer understanding of your mistake and take steps to avoid repeating it.

Learn

- Now it is time to transform the negative aspect of mistakes in a positive learning opportunity.

- You try to answer, what should be done to avoid this in future.

- It could be to add or change some points in your checklist or add some analysis in your framework etc.

Other's Mistakes

Every investor makes their own “Your Mistakes”. Successful investors understand that making mistakes is an inevitable part of the investing process, and they use these mistakes as opportunities for growth and development. In this you try to learn from investing mistakes of other investors. This practice is not new and is often discussed in media interactions and interviews with successful investors and fund managers. A common question that arises during these discussions is “What are your top mistakes?”

Is this Effective?

While it is always good to learn from other mistakes, I am personally not a strong advocate of this idea. The reason being:

- To begin with, as investors, we must first focus on our own mistakes and checkpoints to avoid repeating them in the future. Delving deeper into our own mistakes is crucial for our personal growth as investors.

- The above reason may not seem convincing. You could feel what is wrong in learning from others’ mistakes. This is because, when it comes to others’ mistakes, their thought process, investment framework, knowledge, situation, risk profile, and emotions involved are completely different from ours. It is difficult to understand their background, situation and decision-making process unless you know that investor very closely/personally. Thus, it is not so effective approach to trying to learn from others’ mistakes.

- Finally, we did not experience the same impact or emotions as the other investor had. Therefore, we cannot fully comprehend the pain associated with that mistake.

How to Overcome?

How to conclude on this? Working on others’ mistakes is a futile exercise? I would see this way.

- First focus on your mistake. This should be your priority before working on other’s mistake

- When trying to learn from other’s mistake, try to delve to have deeper understanding of the mistake, the investor’s framework/checklist,

- With this understanding, you then try identify where the learning will fit “your reality”.

In the end, the key is to embrace mistakes as opportunities for growth and improvement in order to become a more successful investor. By working on mistakes, an investor can improve their investment process, reduce the risk of loss and increase the chances of success in the long term.

Hope you found this blog useful. Kindly share my blogs with your friends, peers and fellow investors.

Good stuff…