Raamdeo Agrawal often discusses about QGLP (Quality, Growth, Longevity, and Price) philosophy. This philosophy focuses on investing in high-quality companies with sustainable growth prospects at a reasonable price, and holding on to them for the long term.

In the QGLP philosophy all elements are multiplicative rather than additive. So even if one of the element is zero, the output is zero.

In this blog, we will explore each element of the QGLP philosophy in detail and understand how it can help investors make better investment decisions.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

DISCLAIMER

- Most of the contents in this blog are from the interviews by Mr Raamdeo Agrawal and Wealth Creation Studies report available public domain.

- Any stock mentions are only for the illustration of an idea. They are not any kind of recommendations.

Quality

This has two dimensions, (1) Quality of Business, and (2) Quality of Management. Both of them are important. If either quality of management or business is Zero, the result ends up Zero. The main inspiration of this idea comes from Warren Buffett’s investment process in 2007 Berkshire Hathaway AR, where he states his investment universe around:

- A business we understand

- Favorable long-term economics

- Able and trustworthy management

- Sensible price tag.

Business

Business can be classified as three types: Great, Good and Gruesome. Investors must focus on Great and Good business while ignoring Gruesome business. Do check my earlier blog to understand in detail about these three types of business. One of the key characteristics of Great and Good business is the economic moat (aka Entry barriers).

Note: The below are from the MOSL Wealth Creation Studies 2015.

- The concept of ‘Economic Moat’ has its roots in the traditional moat.

- A moat is a deep, wide trench, usually filled with water, surrounding a castle or fortified place.

- Akin to the traditional moat, Economic Moat protects a company’s profits from being attacked by competitive forces.

- Two key indicators to test whether a company enjoys Economic Moat or not are:

- A distinct value proposition that gives the company an edge over its competitors

- Return on Equity consistently higher than the cost of equity.

Management

There are three aspects to Management quality,

- Unquestionable Integrity

- Demonstratable Competence

- Growth and Profit Mindset

This analysis is a very crucial aspect in the whole framework. But is a very subjective one and is an unknown dark horse. This analysis comes with experience and past mistakes. Read my earlier blog to understand Management. In this blog, I have delved into Mr. Raamdeo Agrawal’s views on Management.

Growth

For long-term investing, Quality or Moat is a necessary condition, but not sufficient. What is important is the long term growth (Both revenue and profits) of the company.

- Business should grow over a period of time.

- There is no point in buying a business that earns 10 crore profit today and the same 10 crore even after 10 years.

- The ideal business which is having growth earns 10 crores this year and 100 crores after 10 years – Here is where the power of compounding comes into the picture.

- A company earning 100 crores today and at the rate of 25% compounding after 10 years it can earn 1000 crores.

- But to earn 1000 crores, Management capability with the three mentioned qualities is important.

- In the 10th year to earn 1000 crores the management must have the competency to handle the scale

- Good companies are valued fully on the expectation of growth.

What is important is understanding the growth of a company.

Growth-Quality Matrix

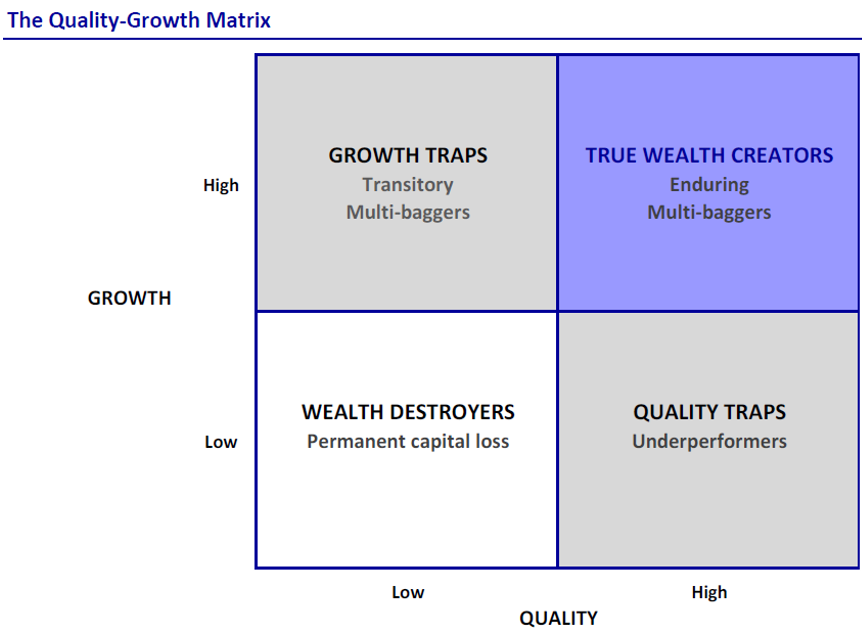

Raamdeo Agrawal warns that the best business and management can become a trap without growth, also known as the “Growth Trap”. To better understand the relationship between growth and quality, their Wealth Creation Studies have identified 4 combinations based on a “Low-High” measure for both parameters. The 2020 Wealth Creation Studies include a visual representation of these combinations, as shown below.

Brief details of Matrix quadrants

- Low-Quality-Low-Growth: These are Wealth Destroyers and such companies and their stocks are clearly avoidable.

- Low-Quality-High-Growth: Such companies may prove to be Growth Traps. The high growth in these companies is most likely due to cyclical upturns, but gets mistaken for secular high growth. If bought very cheap, such stocks may still end up as multi-baggers, but at best transitory.

- High-Quality-Low-Growth: Such companies may prove to be Quality Traps. The high quality in these companies blinds investors to the possibility that these companies may not be able to grow their earnings at a healthy pace due to low underlying base rate (e.g. Castrol in lubricants, Colgate in oral care, Hindustan Unilever in soaps & detergents, etc). As a result, stock performance remains muted.

- High-Quality-High-Growth: These are the Enduring Multi-baggers (True Wealth Creators), especially if bought at favorable valuations.

As an investor, identifying companies with high growth and high quality, also known as “Wealth Creators,” is crucial. The other three quadrants should be avoided with a strong rejection of low growth-low quality (Wealth Destroyers) companies.

In Wealth creators (Both high quality and growth), it is equally important to consider how long the growth will last. A company with high growth for just 2-3 years may not be a suitable investment. This is where the next part of the QGLP framework, “Longevity,” comes into play. The goal is to identify companies with sustainable growth potential over a longer period of time.

Drivers of Growth

- Value Migration – This was discussed in depth, in my previous blog. This is a very important idea, and request the readers to read the previous blog.

- Sustained sector tailwind

- Small base with large opportunity

- New large investment getting commissioned

- Inorganic growth through M&A: Successful mergers and acquisitions translate into high sales and earnings growth for the acquiring company

- Consolidation of competition: In rare cases, consolidation of competition ensures that incremental business growth accrues to the remaining incumbents

More details of these drivers is available in the 2020 Wealth Creation Study.

In Summary…

Like Management analysis, the idea of Growth is a subjective idea. There is no Book to read about growth or a formula to calculate growth. It comes from one’s understanding of a sector and the company.

Longevity

As long-term investors, we aim to invest in companies that have sustainable growth over an extended period. In the previous section, we talked about the importance of growth. However, it’s essential to note that high growth rates that last only a short period may not be favorable for investors. Instead, it’s better to focus on companies that have steady growth rates of around 20% for a more extended period, say, 10-15 years. By investing in such companies, investors can reap the benefits of compounding over the long term, leading to significant wealth creation. A few pointers would be:

- How long can the business grow?

- There are business that growth for 50 years, while others have only 2 years

- If you get a stock that has growth visibility for 5, 10 or 15 years, then we can buy, sit and forget (However in Today’s context, “Buy and forget” may not hold good. One must periodically evaluate their holdings)

- Like growth, the longevity of growth is also a subjective idea.

In addition to growth, longevity encompasses another dimension, which is the competitive advantage. For a sustained period of time, a company must be capable of generating returns that exceed the cost of capital. Profit or revenue growth alone is insufficient for the company if it does not satisfy these criteria.

Price

Once the first three parts of the QGLP framework are in place, investors should consider the company’s valuation.

- It is important to remember that an investor can only make as much as the company makes.

- For instance, if a company generates 25% returns, the investment will also generate 25% returns.

- In case of a re-rating, the investment may yield a few percentage points more, while in case of a de-rating, it may yield a few percentage points less.

Below is the framework in a nutshell.

To Sum Up…

In conclusion, investors can use the QGLP philosophy as a powerful investment framework to identify quality companies for long-term growth. The framework emphasizes four essential elements, which are the Quality of business, Growth potential, Longevity, and Valuation. By investing in companies that meet these criteria, investors can achieve sustained growth and returns.

Hope you found this blog useful. Do share any additional resources you have in the comments section. Kindly share my blogs with your friends, peers and fellow investors.