In the ever-evolving world of social media, financial influencers (finfluencers) have carved a niche, sharing advice and insights on investments and wealth creation. However, not all finfluencers are the same, and understanding their motivations can help you discern between those genuinely offering value and those merely chasing personal gains.

This blog delves into two critical aspects: the purpose behind finfluencers’ social media presence and how to identify the ones worth following. By exploring these topics, you’ll be better equipped to navigate the crowded landscape of Finfluencers.

Note: This is the last part of the five part blog series on Finfluencers.

Do read my earlier blogs, Rise of Finfluencers, Red flags (Part 1, Part 2) for better understanding of this blog.

Purpose of Being in Social Media

Here you do a two-end study to understand your purpose and the finfluencers purpose of being in Social Media.

Why are you in Social Media?

Ask this question and put one of the truthful response/purpose

- Are you in for time pass, fun, memes, mock at others?

- Gaining Knowledge from others?

If the first one is the purpose, it does not matter whom you follow. You can follow anyone and everyone. Many people I came across said that they are on Social media to learn investing from their role models and successful investors. This approach is flawed and needs you to introspect further. Let me deep-dive into why this does not work.

Social Media vs. Traditional Learning: Where to Focus?

- If it is for gaining knowledge, why social media? Why not pick the best book on personal finance or stock investing?

- A tweet or tweet chain or 15-minute YouTube video would not bring much change.

- Yes, there are some really good videos or lectures that help.

- But once you get into social media, the noise and chit-chatter are bigger.

- You fall into a rabbit hole and pick up things which you originally did not intend to see or read.

- The search results very rarely put up good content in the results.

- Generally, people prefer easily digestible content, which is passive learning.

- This approach would not help.

- You need to embrace active learning which is usually out of your comfort zone.

- However active learning stretches your limits and helps in your learning journey.

So focus on Active learning from traditional means like books.

The 1/100-Second Snapshot vs. the Full Picture

- A successful investor would have dedicated years to be whatever they are today.

- It would carry hours of learning multiple books or interacting with other investors and years of experience.

- Watching their tweet for education purposes is like looking at a 1/100-second snap poster in a 2 hour movie!

- better option would be to watch their interviews or read their books (if they have published any) which would help you with some depth of learning.

So if your purpose is to gain knowledge, switch off Social media and instead pick up Books and videos. A few quick sources would be

- Do you want to learn about valuation? Mr. Aswath Damodaran has put all lectures in his site.

- Do you want to learn about financial statement analysis, pick Prof. Anil K Sharma’s lectures hosted in NPTEL site.

- Even my own knowledge centre on stocks will help with 100+ articles on stocks investing.

Why the Finfluencer is in Social Media?

Like how you have a purpose to be in social media, your finfluencer also has a purpose. Identifying is needed for you to match and follow the right contents and finfluencers. Identifying your purpose is relatively easy. All that is needed is a few minutes of reflection on your purpose of being in social media. But knowing the same for your finfluencer is bit tricky. But you must understand their purpose of being in Social Media. Look at their 1 month contents and run these questions:

- Is any learning being shared?

- Is the content providing you with any valuable financial knowledge or personal experience or some generic Gyan which is already know publicly?

- Are they posting thought-provoking questions that encourages you to critically think about investments?

- Nature of content:

- Shallow/Superficial content vs well researched content

- Are they just involved in sarcasm around market movements?

- Does their posts have more of memes, sarcasm or mockery at the investment choice of on other fund manager’s/investor’s stock picks?

- Do they just pick hot topic of the day to stay relevant and gather engagements?

- Do they share their experience which includes both success and failures (Usually focus is on sharing the success while rolling the failures under the carpet)

- Do they share their investment journey with both ups and downs

- Have they put some effort into creating the content?

The answers to the above should be able to determine if the finfluencer is genuinely interested in educating their followers or simply chasing engagements. I repeat Social media is a dark world where the true intentions and backgrounds of influencers are often obscured. Though the above analysis is neither exhaustive nor foolproof for forming an opinion, but a good start to understand your Finfluencers.

Pointers for Good Finfluencers

Now, I cant Paint every one in the same brush. Not All Finfluencers Are the Same. While many finfluencers are just engagement chasers, there are genuine, knowledgeable ones out there as well. They are fewer in number but not impossible to find. Look for those who consistently provide well-researched, thoughtful content and maintain transparency. The below pointers will help you find the right Finfluencers to follow.

Financial Education

- Look for influencers focussing on providing educational content to help their followers improve their financial literacy.

- This can include budgeting tips, savings strategies, and explanations of complex financial concepts.

Background of the FInfluencer

- This is bit difficult to make out, because most of them boast and post only success

- Ensure the finfluencer has relevant qualifications or professional experience in finance.

- Be wary of those who have no verifiable background in financial planning or investment management.

- Answers to the questions that we saw under the previous heading “Why the Finfluencer is on Social Media”, helps to get a fair opinion of their background.

Qualities of good FinFluencers

Typically this would be the reverse of whatever was discussed as Red flags in my two earlier blogs (Part 1, Part 2). A few of them would be:

- Share educative content that helps followers to build an investment process of their own

- Share thought provocative contents or questions

- Avoid mockery of other investor’s stock picks or sarcasm about market movements

- Spend time and effort to bring up contents in social media

- No conflict of interest (Even if they have commercial interests the same could be transparently disclosed to the followers)

- In Depth content support with research, and statistics instead of shallow content is preferable

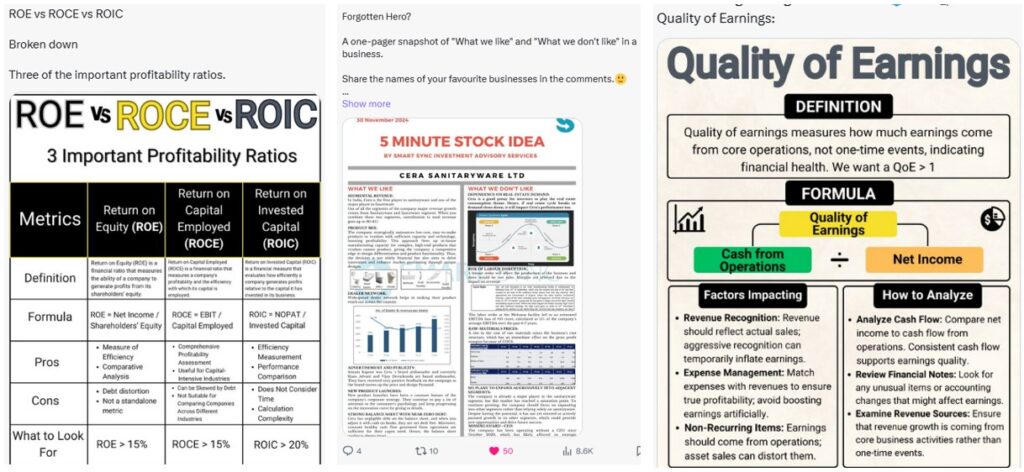

Below are a few samples. The influencers have spent time to create this visual, sharing knowledge for their followers.

They Avoid...

- Mockery of down market movements, investment choices of other investors/fund managers

- Giving very generic gyan, which is already known

- Boasting of only their success while putting their failure under the carpet.

- Chasing the hot topics of the day to stay relevant

Other Pointers

- Choose to follow individuals whose investment strategies align with your financial goals and personal circumstances, rather than simply focusing on those with a large follower base.

- If you’re a short-term trader but follow someone who emphasizes long-term investing, their advice may not be practical or helpful in building your strategy.

Conclusion

Social media offers incredible opportunities to learn and grow, but it also comes with the risk of encountering misleading or harmful advice. By understanding why finfluencers share content and learning how to identify trustworthy ones, you can make smarter decisions about who to follow. Always approach financial advice critically, prioritize credible sources, and remember that your financial journey is uniquely yours. With the right awareness, you can harness the power of social media to your advantage without falling prey to its pitfalls.

Remember, your investment success requires your own path and philosophy. You need to consider your options carefully and critically, not just follow the latest social media trends. I hope that this five-part blog on Influencers will help you achieve this objective.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.