Investing in the stock market can be both challenging and rewarding. It takes a mix of knowledge, skills, personal qualities, and some luck to succeed. We all want to do well when investing in stocks, and while many factors are important, our personal qualities and behaviors are especially crucial.

This blog discusses how our personal qualities and behaviours are connected and how they play a vital role in successful investing.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

Do check the blog Index page for all my previous blogs.

Is this Important?

You might be wondering if I am exaggerating or overrating this idea. The answer to the importance of this idea dates to 1960. The below lines are from the book “Paths to Wealth in Common Stocks” by Philip Fisher.

“… there is a quite different way in which psychological type studies of human behaviour in regard to the handling of common stocks may prove even more helpful to investors. It is in this area that I believe sizable developments will come in the period ahead. For years, it has been known that few fields of human activity are inherently as deceptive as managing of equity investments. What seems like so obviously the right thing to do is time and again exactly the wrong thing…”

Imagine that 60+ years ago, Philip Fisher mentioned this idea, possibly even before the terms “Behavioural Finance” or “Behavioural Economics” had been coined. This forward-thinking view was held in 1960 and this idea has been in the minds of great investors like Philip Fisher since then.

What to Expect?

Before proceeding, I want to clarify that my writing is not focused on Behavioral Finance, which explores various human biases in investing and ways to overcome them. Although I like Behavioral Finance greatly and read extensively about it, I may write about this a few months later.

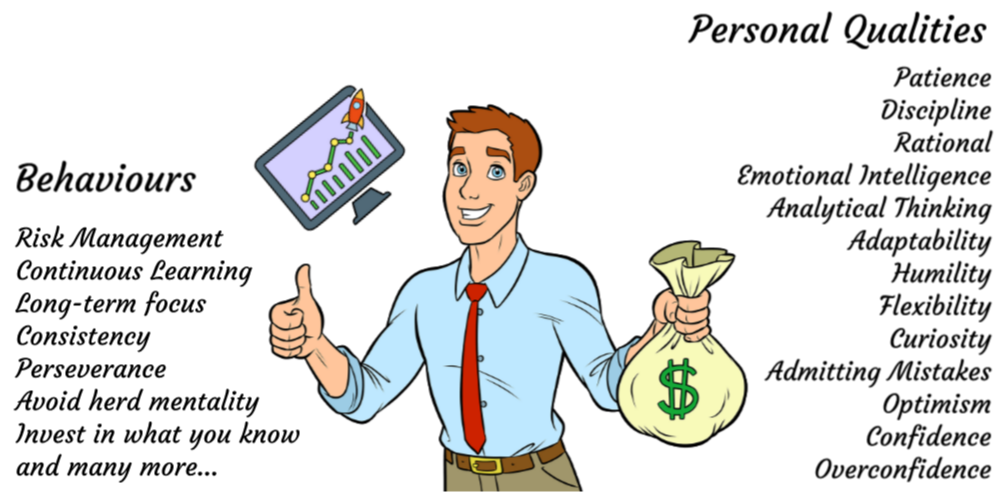

This and the upcoming blogs will concentrate on the personal qualities and behaviours necessary for successful investing. Personal qualities and behaviours are crucial factors in investment success and understanding them is essential for making informed investment decisions.

While the terms personal qualities and behaviours may seem alike, they are different. Let’s first understand the distinction.

Personal Qualities

These are inherent to each individual and define “what you are as a person inside”. A few such personal qualities are:

- Patience

- Passion

- Discipline

- Decision Making

- Rationality

- Emotional Intelligence

- Analytical Thinking

- Adaptability

- Humility

- Flexibility

- Focus

- Curiosity

- Admitting mistakes

- Optimism

- Confidence

- Overconfidence

- Invest in what you understand

These personal qualities are unique to each person. The right qualities help you to remain calm and composed during volatile markets, make rational decisions based on data and facts, and be open to learning from mistakes.

Behaviours

Your behaviour is a reaction or response to external stimuli. This behaviour is greatly influenced by your personal qualities that we just discussed. However, it’s important to note that behaviour is not solely determined by personal qualities, but also by other factors such as individual experience, social/cultural norms, situation and other factors.

To further clarify this point, let’s consider a daily example. A team member is late to the office. You are not happy with this and talk to him/her issue right away. Whereas your peer may choose to excuse/ignore it as a first-time occurrence and only address if it is a repeated problem. Although the situation is the same, the behaviour exhibited by each of you is different. This difference is explained by the differences in your personal qualities.

Behaviours In Investing

Let us understand a bit more about this in the field of investing. As an investor, you encounter external stimuli like markets going up/down, steep changes in the price of individual stocks, and bad news in a sector, company or economy. All these have an impact on your investments. Your action and feelings about these external stimuli are your behaviours, which are in turn influenced by your personal qualities. Some important behaviours are:

- Risk Management

- Continuous Learning

- Long-term focus

- Consistency

- Perseverance

- Embrace Uncertainty

- Avoid herd mentality

- Planning and many more

Summing the Idea

Personal qualities and behaviours are interconnected. For example,

- Investors who demonstrate patience and discipline are more likely to retain their investments during market downturns and avoid hasty decisions.

- In the same way, emotionally intelligent investors are better equipped to manage their own biases and make informed decisions based on evidence.

Therefore, it is essential for investors to have a clear understanding of their personal qualities and behaviours to make informed investment decisions. However, remember a few things

- This idea is subjective and cannot be measured or quantified.

- It is difficult to bring changes in your personal qualities or your behaviour to external stimuli from the stock markets

- However, awareness makes you a much better investor.

In the next blog, I will explore some of these related qualities and behaviours.

Hope you found this blog useful. Kindly share my blogs with your friends, peers and fellow investors.