Retirement planning goes beyond financial considerations. It embodies a significant life transition. Rather than perceiving retirement as the culmination of one’s career, embrace it as the beginning of a new chapter filled with renewed expectations and abundant opportunities. By actively engaging in meticulous planning, you can make the most of your retirement journey. (Featured image reference: Photo by Vlada Karpovich: https://www.pexels.com/photo/lovely-elderly-couple-5790837/)

This blog series delves deeply into the multifaceted aspects of retirement like the identifying expectations, opportunities, myths on the topic and indispensable planning considerations essential during the transition to retirement and in the period leading up to it. With this comprehensive exploration, readers will acquire the essential knowledge and guidance necessary for their individual retirement journeys.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

Retirement Planning - Why this Blog?

The choice of this topic on Retirement Planning and the subsequent decision to write a blog series is rooted in an intriguing backstory. Here it goes.

Where it all Started

A few months ago, I had a conversation with a senior colleague who is nearing retirement. Driven by curiosity, I inquired about his plans for the post-retirement phase. To my surprise (and to his own greater astonishment), he confessed to having no clear direction regarding his desired activities, preferred location of living, or other aspects of his retired life. Apart from the primary focus on building a retirement corpus, he had devoted little (or no) thought to the intricacies of his impending retirement.

It seemed to worry him a bit not to have clear answers. I reassured him that there was no need to panic and that he had plenty of time to ponder and make decisions. To lend support, I facilitated connections with retired neighbours in my locality and relatives circle who could share their experiences and insights.

Quest for a magical key to Successful Retirement Planning

I actively participated in the majority of discussions involving my senior colleagues and retired friends. During our conversations with retired friends, we unearthed a wealth of fascinating insights. Within these discussions, we came across many individuals who were successfully managing their retirement years, as well as a few facing challenges. Eager to expand my perspective, I took to Twitter and engaged in fruitful discussions. A few generous individuals shared their personal experiences.

From these exchanges, three key themes surfaced, shedding light on important aspects of retirement planning:

Proactive Retirement Planning

Most of them emphasized the significance of planning ahead for retirement and highlighted the benefits of actively preparing for this phase of life.

Beyond Financial Planning

Another realization was that financial considerations alone are insufficient. It is important to address other crucial aspects beyond monetary preparations. This exactly is the focus of this blog series.

Retirement Myths

The conversations threw new light on preconceived notions and debunked common misconceptions surrounding retirement life that we carry.

A case for Blog Series

The core objective of this blog series is to share the valuable insights that I came across in these meaningful discussions. The series will delve into various subjects, including the fundamentals of retirement, crucial considerations in retirement planning (with a specific emphasis on aspects beyond financial planning), common pitfalls to steer clear of, myths we carry and the personal experiences generously shared by a few friends.

Unveiling the Core Ideas on Retirement and Retirement Planning

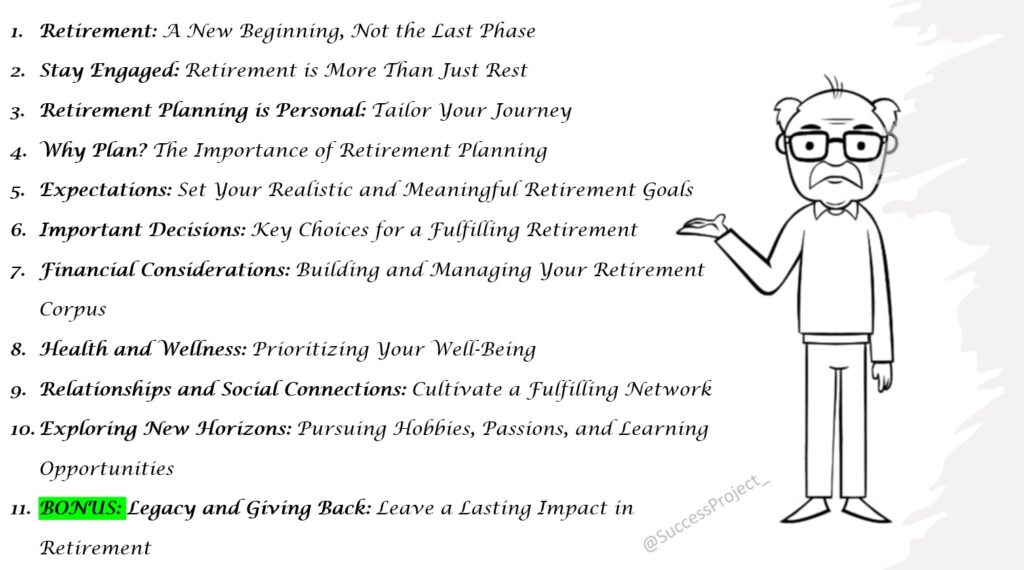

There are 10 core ideas and an additional bonus idea.

- Retirement: A New Beginning, Not the Last Phase

- Stay Engaged: Retirement is More Than Just Rest

- Retirement Planning is Personal: Tailor Your Journey

- Why Plan? The Importance of Retirement Planning

- Expectations: Set Your Realistic and Meaningful Retirement Goals

- Important Decisions: Key Choices for a Fulfilling Retirement

- Financial Considerations: Building and Managing Your Retirement Corpus

- Health and Wellness: Prioritizing Your Well-Being

- Relationships and Social Connections: Cultivate a Fulfilling

- New Horizons: Pursuing Hobbies, Passions, and Learning Opportunities

- Legacy and Giving Back: Leave a Lasting Impact in Retirement (Bonus Idea)

In this blog, we will cover the first three core ideas. The remaining will follow in the next blog.

Retirement: A New Beginning, Not the Last Phase

Retirement is often mistakenly viewed as the final chapter of one’s life. This thought process leads to emotional strain. However, it is essential to redefine retirement as a fresh and promising phase.

In this new phase of life, you have the freedom to explore uncharted paths, acquire new skills, embark on entrepreneurial ventures, cherish quality time with family, contribute to social causes through volunteering, and much more.

By embracing retirement as a new beginning and prioritizing health, happiness, and purpose, you can fully seize the potential of this life stage. It is crucial that you approach retirement with this mindset.

Stay Engaged: Retirement is More Than Just Rest

It is common to encounter individuals who view retirement as an opportunity to solely rest and relax. No doubt it is important to unwind after 3 – 4 decades of hard work. But how long can one spend time only on rest? Perhaps a month or two at most? It is crucial to recognize that retirement extends beyond short-term relaxation.

Retirement should not be limited to a period of rest, relaxing, and watching television. Instead, it should be seen as a time to actively seek opportunities for personal growth, meaningful pursuits, and enhanced well-being. Then only you can transform retirement into a fulfilling and enjoyable journey.

Retirement Planning is Personal: Tailor Your Journey

Any and every topic in Personal finance is unique to every individual. Retirement planning is no exception. To ensure a successful transition into this new phase of life, it is important to customize your plan according to your unique circumstances, goals, and aspirations. You need to start discussing and organizing your thoughts on retirement well in advance.

Engage in open discussions with your spouse, children, and other significant individuals in your life to get their perspectives. These discussions enable you to craft a comprehensive plan that also considers the needs and aspirations of your loved ones as well.

Moreover, regularly reviewing and reassessing your retirement plan is essential. As time progresses, your financial situation and lifestyle may change. So periodic review and adjustment are essential.

Conclusion

We discussed 3 core ideas in this blog. In the next blog, I will discuss the remaining 8 core ideas.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.