This blog continues on my earlier blog on Retirement planning. In my previous blog, I discussed three core ideas on Retirement and Retirement Planning. In this blog will discuss remaining 8 core ideas (Featured image reference: Photo by Vlada Karpovich: https://www.pexels.com/photo/lovely-elderly-couple-5790837/)

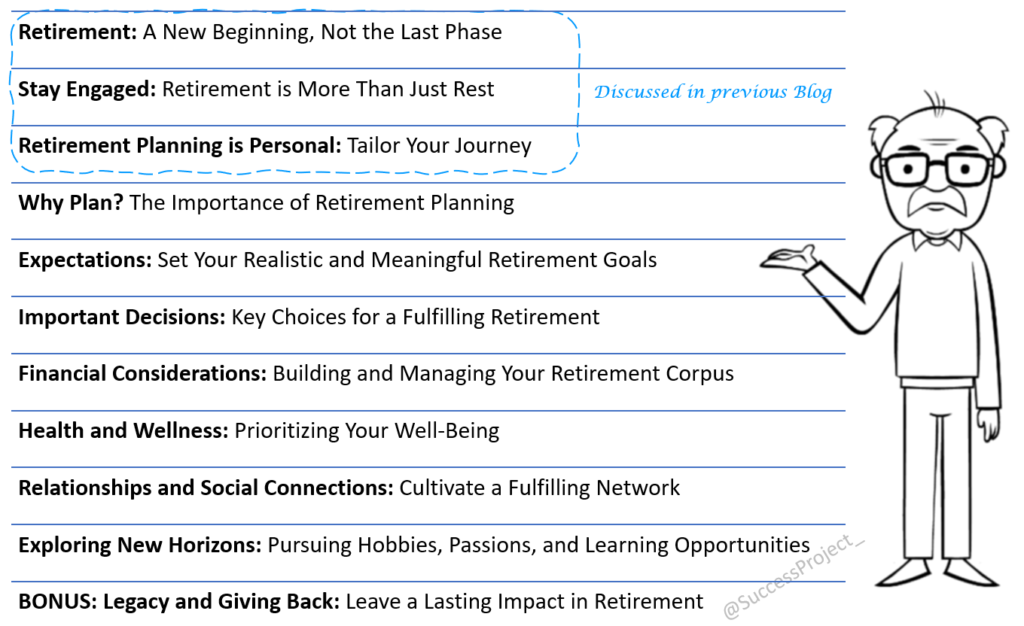

In the below image is 11 core ideas on Retirement and Retirement Planning.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

-

Unveiling the Core Ideas on Retirement and Retirement Planning

- Why Plan? The Importance of Retirement Planning

- Example

- Expectations: Set Your Realistic and Meaningful Retirement Goals

- Important Decisions: Key Choices for a Fulfilling Retirement

- Financial Considerations: Building and Managing Your Retirement Corpus

- Health and Wellness: Prioritizing Your Well-Being

- Relationships and Social Connections: Cultivate a Fulfilling Network

- Exploring New Horizons: Pursuing Hobbies, Passions, and Learning Opportunities

- Legacy and Giving Back: Leave a Lasting Impact in Retirement

- Conclusion

Unveiling the Core Ideas on Retirement and Retirement Planning

Check my earlier blog for details of the first three core ideas.

Why Plan? The Importance of Retirement Planning

I had invited thoughts on Twitter regarding retirement planning, one response challenged the notion of planning. It said that the idea of planning was a delusion and advocated for embracing life as it unfolds. Intrigued by this perspective, I engaged in further reflection and sought insights from other retirees on the fundamental question: “Is planning truly necessary?”

The following ideas became apparent:

- Planning offers a level of visibility that instils confidence in navigating the retired life.

- However, what is equally true is life rarely unfolds exactly as we plan. It is filled with surprises and uncertainties that can disrupt our best-laid plans.

- So even if plan, be ready to face uncertainties and suitably re-align your plans.

- Planning serves as a compass. It helps to know what is lagging and what needs to be arranged before retirement. This planning helps to make informed decisions.

- Consider this analogy: For a single-day event like a birthday party or a one-week vacation, we meticulously plan and engage in countless discussions. Then why not plan for a multi-year event like retirement, which is uncharted territory on our life journey?

Example

A striking example exemplifies the significance of the fourth point above. One retiree had initiated discussions on retirement planning a couple of years before his retirement. He understood that his corpus would not be sufficient to manage a comfortable retired life. After several discussions with family member, he made a bold decision. Around the time of his retirement, he sold his house in the city. He relocated to his village, where he took a house at one-third of the sale amount. This strategic move yielded multiple benefits:

Boost in Retirement Corpus

This swabbing of the property augmented his retirement corpus, providing him with greater financial stability for the future.

Reduced Cost of Living

His cost of living in his village was much less than in the city.

Enhanced Social Connections

Improved social connection with relatives, with whom he could spend time.

Giving back to Society

Lastly, he got an opportunity to back to society. How? He could guide career guidance to children in his village on promising courses and job prospects. Thus, he actively contributed to the growth and development of the youngsters in his village.

This single example serves as a powerful testament to the benefits of thoughtful retirement planning. As a general rule, any event that is planned tends to unfold more smoothly than a completely unplanned one. Planning also serves as a safeguard against future regrets. The REGRET OF NOT PLANNING. During our discussions, we encountered individuals facing various challenges during retirement. A common regret in all of the was not having engaged in proper planning.

Therefore, it is imperative to recognize the importance of planning for retirement well before the actual retirement date. By doing so, we gain a sense of direction, preparedness, and adaptability to navigate the uncertainties that lie ahead.

Expectations: Set Your Realistic and Meaningful Retirement Goals

When envisioning retired life, individuals have a range of expectations that reflect their unique desires and circumstances. Some fundamental expectations that are commonly shared include a stable income, good health, happiness, a stress-free lifestyle, and the freedom to live life on one’s own terms.

Retirement planning is a highly personal endeavour, and so too are the individual expectations associated with it. It is essential to delve into your own expectations for your retired life, as they will serve as a guiding compass throughout the planning process and making certain decisions.

Important Decisions: Key Choices for a Fulfilling Retirement

We just saw that the right expectations is needed for making certain decisions. What are they?

Several important decisions need to be made well in advance of retirement. These decisions play a significant role in shaping your expectations and experiences during retirement. A few key decisions:

- Choosing your retirement city

- Work/Business considerations: Would you continue to work / Do business?

- Utilizing your ample time: What are you going to do with the ample time you get?

- Where and how your money is invested?

These decisions are influenced by your own and your spouse’s expectations for retired life. Discuss these much before retirement.

Financial Considerations: Building and Managing Your Retirement Corpus

In this new phase of life, where your regular income ceases but expenses persist. So careful financial planning becomes paramount.

It is essential to develop a robust strategy to build your retirement corpus and generate a reliable monthly income stream post-retirement. While financial planning alone may not suffice to ensure a fulfilling retirement, it serves as a critical foundation. The thought of not generating sufficient monthly income can be incredibly stressful. You need to plan to:

- Build a retirement corpus during your working years.

- Manage the corpus wisely to generate monthly income during the retired years.

Health and Wellness: Prioritizing Your Well-Being

While financial planning is undeniably crucial. However, it is vital to recognize that good health plays an equally significant role in rewarding retirement experiences. After all, what good is a substantial financial portfolio if one’s health deteriorates, leaving one bedridden.

Health should be a priority throughout all phases of life, not just during the retirement years or in the lead-up to retirement. It is an ongoing commitment that requires consistent attention and care.

Relationships and Social Connections: Cultivate a Fulfilling Network

Throughout the retirement phase, the people who surround you play a pivotal role in shaping your experience and overall well-being. The presence of the right individuals can significantly enrich your daily life, bringing happiness, motivation, and a sense of belonging. These individuals serve as a source of laughter, shared activities, and provide much-needed support during times of distress. These could be your neighbors, friends, ex-colleagues, and relatives.

As you embark on this exciting new chapter of life, it becomes essential to carefully consider the key individuals who will be part of your retirement journey.

Note: We will discuss more on Financial, Health considerations and social relationships in our next blog.

Exploring New Horizons: Pursuing Hobbies, Passions, and Learning Opportunities

What would you do in the ample time you have?

You now have all the time in the world for you. Embrace retirement as an opportunity to focus on personal growth, hobbies, volunteering for a cause and spending quality time with loved ones. Make sure that you engage in activities that bring in joy, happiness and inner fulfilment. Do not take some activity merely for the same of engaging your time.

As you embark on this new chapter, consider pursuing your hobbies, passions, and interests that may have taken a backseat during your career years. Whether it’s painting, gardening, playing an instrument, or engaging in physical activities, immerse yourself in the activities that ignite your soul.

Above all, prioritize quality time with your loved ones. Cherish moments with family and friends, nurturing deeper connections and creating lasting memories. This is an opportunity to strengthen bonds and cultivate meaningful relationships that bring joy and fulfillment.

Legacy and Giving Back: Leave a Lasting Impact in Retirement

(THIS IS YOUR BONUS IDEA)

I originally intended to capture 10 core ideas. Despite initially not being part of the agenda, its significance was too compelling to ignore. This unique approach of a retired friend captured our attention and compelled us to explore it further.

I request each of you to place consideration for this aspect in your retirement journey.

After dedicating three to four decades to your career, you have a huge experience in life and work. This reservoir of wisdom can be invaluable for the next generation. By imparting your expertise and life experiences, you not only contribute to the growth and development of others but also establish meaningful social connections.

Sharing your knowledge can take various forms, such as mentoring younger professionals, volunteering, or participating in community initiatives. These activities allow you to put your time to good use and provide a sense of purpose and fulfilment during your retirement years.

Retirement offers a unique opportunity to give back, leveraging your accumulated wisdom to benefit others. By sharing your insights and experiences, you create a legacy that extends far beyond your own retired journey.

Conclusion

After thoroughly exploring the core ideas on Retirement Planning in this and my previous blogs, our next blog will delve deeper into three pivotal areas: financial planning, health considerations, and relationships.

Join me to unravel the intricacies of these essential aspects to enhance your understanding and preparation for a fulfilling retirement.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.