This blog is the Third blog on my blog-series on Retirement planning. In the previous two blogs (Blog 1, Blog2), I discussed 11 core ideas on Retirement and Retirement Planning. (Featured image reference: Photo by Andrea Piacquadio)

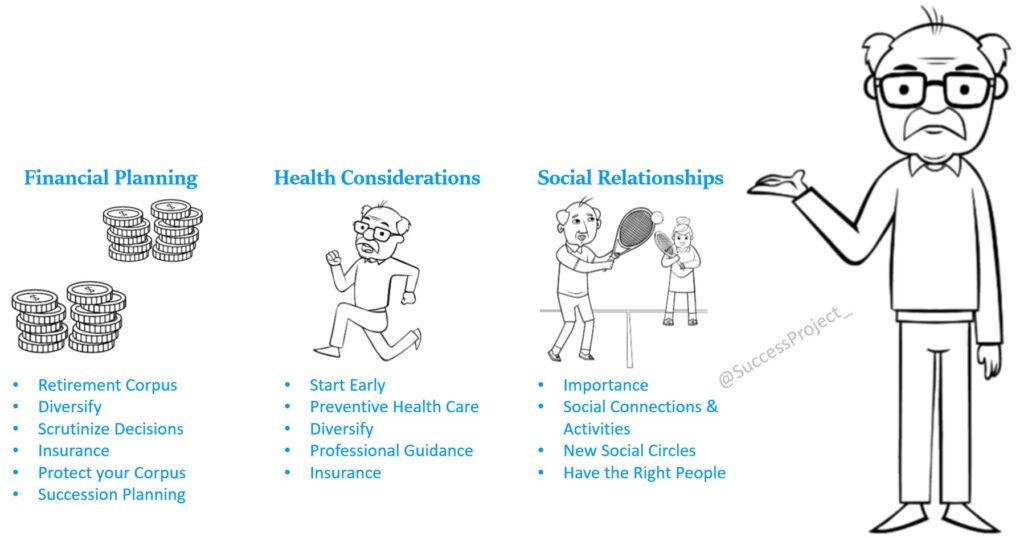

This blog will discuss in detail 3 of the ideas: Financial Planning, Health Considerations and Social Relationships

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

Prioritize Finance Planning in your Retirement Planning

Every one of us knows and understands the importance of planning the finances for retirement. There are tons of articles and people who discuss this. So I would not cover this elaborately in this blog. Infact, this blog series is more focused on all other planning and decision other than topics around finance. However, will discuss this in brief:

Retirement Corpus

Plan and start building your retirement corpus, much early in your career. Earlier the better, to exploit the power of compounding. The corpus should be sufficient to cover the number of years, you and your spouse live.

Diversify

Diversification helps to manage risk. It plays a vital role in both the accumulation phase, where you build your retirement corpus, and the distribution phase, where you invest the corpus to generate income post-retirement.

- Diversification during corpus building: Use multiple options like Mutual Funds, PPF etc.

- Diversification for generating post-retirement income: As you approach retirement you invest the accumulated corpus to generate regular monthly income Here again, you diversify your investments across different investment options. Your monthly income comes from multiple sources.

Real life example: During a discussion, a compelling example emerged highlighting the significance of diversification. A retired individual relied heavily on rental income in addition to their pension benefits. They occupied one portion of a property on the ground floor and rented out the remaining two portions on the second floor. However, when the COVID-19 pandemic struck, the tenants vacated the property, leaving it unoccupied for nearly a year. As a result, the retiree experienced a significant loss of rental income and had limited funds to cover their monthly expenses. Diversification helps in such scenarios.

Scrutinize your Decisions

As you approach retirement, it is crucial to carefully evaluate all your investment decisions. It is advisable to discuss these matters with your spouse and make informed decisions together.

Real life example: One case I encountered involved an individual who was considering an early retirement by a few years. However, they recently purchased a villa using their savings and took on additional EMIs. As a result, their retirement corpus has been depleted, and they now need to continue working until retirement to meet the EMI obligations. While they do own two houses, their situation can be described as asset-rich but cash poor. Making the right decision would have allowed them to retire a few years earlier.

Insurance

The importance of health insurance for retirement cannot be overstated. Securing health insurance coverage is a crucial step that should be taken well in advance, rather than waiting until just before or after retirement. Insurance companies often impose restrictions and waiting periods for senior citizen insurance policies, which can limit coverage options. Additionally, there is a possibility of being denied insurance based on pre-existing health conditions. This health insurance offers huge financial protection. A single hospitalization can wipe out a good part of your retirement corpus. This also provides peace of mind.

Note: This is a common topic for Financial and Health considerations. I have however covered it here.

Protect Your Corpus

This holds immense significance but is a much-underrated idea.

- The first part is successfully building a substantial retirement corpus, setting yourself up for a comfortable retirement journey.

- The second part is to safeguard this corpus to ensure the smooth trajectory of your entire retirement phase.

Avoid allocating your retirement funds to high-risk investment plans or ideas solely to pursue higher returns. Your friends, neighbors, peers, or relatives are well aware of the sizable corpus you have accumulated for your retirement. It is no secret as it is expected that you have a corpus to support your retirement. Consequently, they may approach you with tempting investment opportunities that promise lucrative returns.

At times, it could be them borrowing from you for good returns. Exercise caution and conduct a thorough risk assessment before considering schemes. Sadly, numerous incidents in the recent past have witnessed senior citizens losing their hard-earned retirement funds due to ill-fated investments in questionable chit funds.

Succession Planning

This also needs to be done much before and not closer to your retirement years or post-retirement. You should have made the decision on “Who” gets “What” and “How much”. This should be well documented in a ‘Will’. You may read more of these aspects in my earlier blog on Succession Planning

To Sum-Up

The retirement corpus and the consistent monthly income greatly influence your post-retirement lifestyle, determining factors such as where you will live and the activities you can engage in. Undoubtedly, financial considerations hold significant importance in retirement planning.

However, financial aspects should not be the sole focus. After all, what good is all the wealth if one’s health deteriorates and they find themselves bedridden in their retirement years, without anyone to provide care and support? This underscores the importance of the other two dimensions: health and social connections. This is our next topic for discussion.

Health and Wellness in Retirement Planning

Health holds immense importance in retirement planning, and it should not be underestimated. Just because it is discussed after financial considerations it does not mean that it takes second importance after money. Life can be immensely challenging without good health, despite having a stable income or money during retirement. A few pointers would be:

Start Early

Prioritize your health and wellness from an early stage, rather than waiting until retirement. Begin by evaluating your current health status and taking proactive measures to maintain or improve it.

Prioritize Preventive Health care

Make it a priority to undergo periodic preventive check-ups years before retirement. This proactive approach allows for course corrections, such as lifestyle adjustments or necessary medications, to ensure optimal health during your entire retirement phase.

Diversify

Engage in a variety of physical to keep your body active and fit, such as walking in the morning, yoga, and some physical exercise

Seek Professional Guidance

Consult with doctors, fitness trainers, and nutritionists to create a tailored routine of exercises, medications, physical activities, and a healthy diet that will help you stay healthy and fit.

Insurance

We discussed the importance of health insurance in financial considerations. It is a common mistake for many to overlook health insurance until it is too late. Prioritizing health insurance during your working years is ideal to ensure comprehensive coverage and peace of mind.

To Sum-Up

Take a holistic approach to your wellness, considering physical, mental, and emotional well-being. Do not hesitate to take the help of experts and professionals.

Importance of Social Connections in Retirement Planning

Strong social connections are vital for overall well-being and happiness during retirement. The transition to retirement brings about a significant change in your social environment. In the workplace, there are colleagues, managers, and peers who are a regular part of daily life. However, in retirement, these interactions may diminish. So it becomes important to cultivate new social connections for your retirement phase of life.

What is the Importance of Social Connection?

The people who surround you during retirement have a profound impact on your experience and overall well-being. Having the right individuals in your life can greatly enhance daily life, bringing happiness, motivation, and a sense of belonging and thus contribute to creating a fulfilling retirement experience. Needless to say, these individuals provide valuable support during challenging times.

Social Connections and Activities

Your social network in retirement can consist of neighbors, friends, ex-colleagues, relatives, or even fellow retirees. There are various activities you can plan with your social circle. A few that I came across during the discussions were:

- Morning walks or exercise sessions together

- Occasional get-togethers for meals or outings

- Engaging in discussions on a wide range of topics of mutual interest

- Sharing companionship through regular communication, visits, and participating in shared activities like trips or attending yoga classes.

New Social Circles & Connections

At times your existing social circle may not have the right people aligning with your interest. The retirement phase offers a unique opportunity to expand your social circle and form connections with like-minded individuals who share similar interests, passions, or hobbies. You could do this by joining clubs, organizations, or community groups centered around your personal interests. Maybe you can even form your own group of like-minded people.

Who are the right people?

You need to give some thought on choosing the right people, maintain and develop meaningful social connections post-retirement. Decide on the right people who will be part of this new phase of life. It does not mean excluding certain individuals from your life, but rather:

- Prioritizing those who bring positivity, trust, and genuine intentions.

- Conversely, limit interactions with toxic people who drain your energy and lack good intentions.

Determining who falls into the category of the “right person” or “toxic person” is subjective. However, one way to gauge this is through your experience during conversations. One of the below will be the right fit.

- Do you find enjoyment and companionship in their presence, losing track of time? Do you eagerly anticipate seeing them again? Do you feel energized and uplifted during the conversation? OR

- On the other hand, Do you feel a sense of relief when the conversation ends and wish to avoid encounters? Next time when he/she is around does your inner feeling say “OMG, he/she is back”. This is a clear indication that they are not the right fit for your social circle.

By recognizing these cues, you can actively seek out and surround yourself with individuals who enhance your retired life and contribute to your overall well-being.

Ultimately, the decision of who to spend your time with is up to you. However, by considering the factors above, you can make sure that you are surrounding yourself with people who are good for you and who make you feel good about yourself.

To Sum-Up

The right people in your life can create a fulfilling and enjoyable retirement experience. Building a supportive network in retirement is crucial for creating lasting memories, finding solace during challenging times, and cultivating a fulfilling social life. As you embark on this exciting new chapter of life, it becomes essential to carefully consider the key individuals who will be part of your retirement journey.

Conclusion

We covered the considerations around financial, health, and social relationship in depth. The next and final blog will cover other important considerations and Experiences/Regrets shared by few friends.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.