There are 5 pillars in Personal Finance, (1) Emergency Fund, (2) Planning for Life Goals, (3) Insurance – Health & Term, (4) Retirement Planning, and (5) Succession Planning. Of the five, Succession Planning is an underrated but essential idea in Personal Finance and Financial Planning. (Featured image credits: https://www.tofler.in/)

All of us spend a huge portion of our life in earning money, sacrifice many happiness (and even basic needs in our life) to save money and invest them to earn higher returns. But there is a knot missing in this loop. It is about Succession Planning. Many of us do not think about this in our lifetime. But this is something that you need to act upon before it is too late.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

Do check the blog Index page for all my previous blogs.

What is Succession Planning

We must leave a legacy…A legacy for our hard earned wealth. Succession Planning helps to create this legacy.

- A clear Succession Planning and some measures will support the dependents in case of the unfortunate departure of the person running the show.

- Many do not even give a thought about this in their lifetimes.

- This topic is not something one feels comfortable reading or even thinking about. But it is a must

- Succession Planning is not about only creating/writing a ‘Will’, it is much beyond and a person needs to think and have a proper planning. Even a few minor things would make a lot of difference.

- Succession Planning is for any one irrespective of the age. Whether you are 27 or 72 years old does not matter. A proper succession planning is needed.

It is an emotional topic to think or discuss. Think about the contents of this blog for a day or two, and take the necessary ACTIONS. Over this weekend put your on SUCCESSION PLANNING. Tis blog would guide you with needed pointers. Make a plan and action them.

Questions to Ask

WHO

The first and key step is identifying who is/are the beneficiary/beneficiaries. They could be your parents, spouse, children, brothers or sisters. Give sufficient thoughts for each of the people in your life.

HOW MANY?

This question arises if there are multiple beneficiaries

HOW MUCH?

Applicable in case of multiple beneficiaries

WHAT?

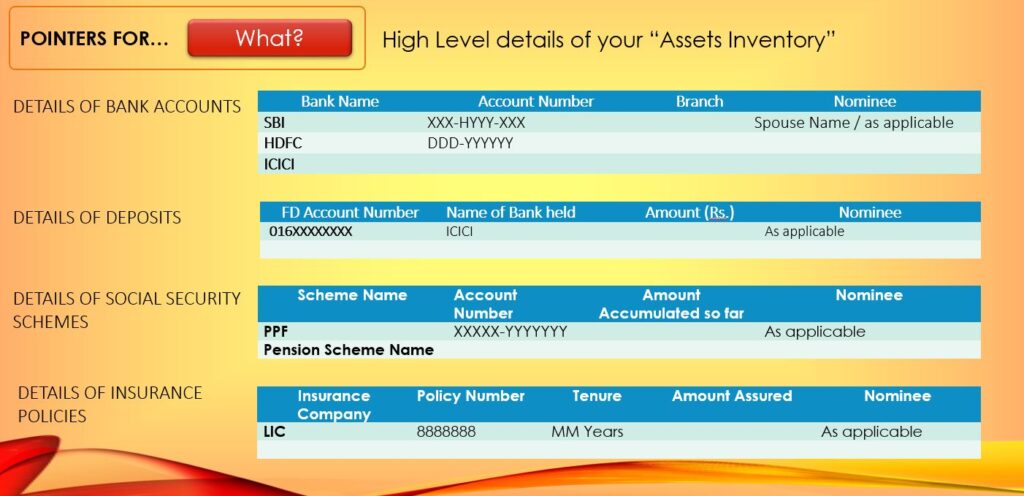

Details of what you have for the beneficiaries. This activity becomes a bit simpler if you create and periodically update a “Asset Inventory”.

There are no correct answers…It depends on the Individual. Spend some time on these questions to help you make the right move on Succession Planning.

Options for Succession Planning

Nomination

- Nomination is the right given to a person of an investment product to appoint another person to receive the money in case of their unfortunate death.

- It is a simple way to discharge the payments in the event of the death of investor.

- Only individuals can nominate – Non individuals like trust, Karta of HUL, Corporate bodies cannot Nominate.

- Any number of nominees can be made with percentage identified for each nominee.

- The nomination can be made when the investment is made or subsequently any time after it.

- The nominees can be changed any number of times.

Remember: A Will Supersedes a Nomination.

What should you do?

The next step you need to do is to link the details of beneficiaries in the form of a nomination to your investment instruments if it is not already done.

- Every investment option will have a nomination facility/column. Be it your SB account, FD, Insurance, Post office schemes like NSC etc.

- Fill in the details of the nomination without fail.

- If you have not done so far… get the nomination form and update nomination details

- For SB account, nomination details can be viewed in net banking. (Not sure if every Bank offer this visibility in net banking)

- If those details are empty, please go to the branch in person and update the nomination details

- This should be done on PRIORITY

Such minor detail helps the beneficiary or nominee to get the invested amount smoothly, in an unfortunate event.

Joint Holding

Joint holding means that the property/investment is held jointly by more than one person and access is subject to the mode of operation.

- Joint holding gives easy access to specific members of the family like a spouse, and children.

- Joint holding applies to all asset classes, however, there could be some differences in procedural aspects in terms of:

- Number of joint holders

- Mode of operations

- Kind of transactions that needs the consent of joint holders

- Usually the First holder is the registered holder of the asset having access to information and benefits of the asset.

- Different modes of operations in a joint holding includes,

- Jointly approval of all transactions by every joint holder

- Either survivor

- Anyone

- Survivor basis

Will

By and large, this is the most uncomfortable topic that one would like to talk or discuss or hear or even think about In the words of Shankar Pai who has done some commendable work in area of spreading awareness on making Will. In his words,

“A will is a sensitive topic to open up to People are not comfortable discussing a will in India. There is a misconception that if someone tells you to make a will, the person thinks that indirectly you are telling him that his end is near or that you are eyeing his property. However, all apprehensions disappear when I tell them the consequences of not making a Will.“

If you are still not convinced, let me put the situation in a different way. Do you want to leave your wealth without a Will and let your loved one’s fight each other, spend hefty amount on their lawyers, spend their time in the courts to get their RIGHTFUL shares after many years” – Surely not!

Dying Intestate

A person dying without making a “is said to have died”. In such cases their property is inherited by their heirs in accordance to the succession law applicable to them. In India there are three succession laws

- Hindu Succession Act, 1956 Applicable to Hindus, Jains, Buddhists and Sikhs

- Indian Succession Act, 1925 Applicable to Christians, Jews and Parsis

- Mohammedan Personal Laws Governs inheritance of Muslims.

This kind of inheritance takes lot of time and Money. A ‘Will’ prevents a lot of problems from occurring and also ensures the efficient passing of property to the right people. Gift some time of yours for your beloved ones and create a ‘Will’.

What is a Will?

“…means the legal declaration of the intention of a testator with respect to his property which he desires to be carried into effect after his death – Definition according to Indian succession Act 1925. There are three parties to a ‘Will’

- Testator: The person who makes the Will. The will comes into force only after the death of the testator.

- Legatee: The person named in the Will who receives a portion of the deceased person’s wealth.

- Executor: The person named in the Will to administer the deceased person’s Estate.

Essential Features of a Will

- A Testator can write what he owns and can be transferred legally

- A ‘Will’ can be modified any number of times

- Such changes to ‘Will’ is called as ‘ Codicils

- Testator can revoke (Meaning: Cancel or Annul) a Will any time before their death

- A person must be fit to write a ‘Will’, minors and mentally unsound cannot make a Will

- Will be written and signed in the presence of two witnesses. (There are some exceptions like people in the armed forces can create an oral Will)

Contents of a Will

- Name, address of the testator and a statement that they are making the Will voluntarily

- Clearly identify the beneficiaries as the property that is being bequeathed

- Identify an executor

- Signed by the testator and attested by two witnesses

- The witnesses must sign in the presence of each other

- There should be no ambiguity in the contents and the intent must be brought out clearly

- A statement that the current will revokes all previous bequests of any kind

- To avoid any disputes there should be only one single copy of the latest Will should be in existence

- Residual statement to the effect that any unnamed property in the Will to go to a identified beneficiary

Registering a Will

This is not mandatory, however a good practice. A registered Will cannot be, (1) tampered with, stolen/lost, mutilated or destroyed, (2) A registered Will cannot be viewed without the written permission of the testator.

Will Structure

Reference: This section of ‘Will’ structure has been referred from https://www.jagoinvestor.com/2010/11/how-to-make-a-will-in-india-and-its-importance.html / Read this article fully for complete guidance.

Declaration Section

- In the first paragraph, you have to declare that you are making this will in your full senses and free from any kind of pressure.

- You have to mention your name, address, age, etc at the time of writing the will.

Details of Property and Documents

- List of items and their current values, like house, land, bank fixed deposits, postal investments, mutual funds, share certificates owned by you.

- Indicate, where all these documents are stored.

Details of Ownership

- At the end of the will, mention who should own your assets items and in what proportion, after your lifetime.

- If you are giving your assets to a minor, make sure you appoint a custodian of your assets till the individual you have selected, reaches an adult age (This custodian obviously, has to be a trustworthy person)

Signing the Will

- Sign the will very carefully in presence of at least two independent witnesses, who have to sign after your signature, certifying that you have signed the will in their presence.

- The date and place, also must be indicated clearly at the bottom of the will.

- The envelope has to be sealed after completing all the formalities and the seal must bear your signature and the date of sealing.

Hope you found this blog useful. Do share any additional resources you have in the comments section. Kindly share my blogs with your friends, peers and fellow investors.