An emergency fund, often overlooked in personal finance, is a crucial priority. Before we proceed, let’s determine which description resonates with you:

- Are you concerned about the possibility of a layoff?

- Does the mere thought of losing your job leave you sleepless?

- Are you eager to establish an emergency fund but have numerous questions and uncertainties about the process?

- Are you frustrated by your unsuccessful attempts at creating an emergency fund?

If you answered “Yes” to any of these questions, you’ve come to the right place. Stay with me until the end, and by the time you finish reading this blog, you will have all the necessary details to create an emergency fund for yourself.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index for all my blogs.

- 5 Priorities in Life

- A-Z of Emergency Fund

- Emergency Fund - Is it Important?

- How big should this fund be?

- Where to invest your Emergency Fund?

- Building a Emergency Fund

-

FAQ and Misconceptions

- I have a credit card for Emergency. Do I need an Emergency Fund?

- Inflation eating returns in Emergency Fund. Can I invest Emergency Fund in Mutual Fund or Stocks?

- Can I use the Emergency Fund for the Housing loan down payment?

- On losing a job, I will cut down my expenses…Can I have a light emergency fund to manage only 2-month expenses?

- Benefits of Emergency Fund

- Time for Action

- Conclusion

5 Priorities in Life

When it comes to personal finance, there are five key priorities for every one of us. They are,

- Emergency fund

- Insurance (Health & Term)

- Planning for life goals

- Retirement planning

- Succession planning

Among these priorities, the emergency fund stands as the foundational and primary step for everyone. It should take precedence even before investing in Mutual Funds, Stocks, or purchasing a home.

While the concept of an emergency fund is widely discussed in financial planning, many people still haven’t given it much thought. Despite the abundance of information available through online searches, several factors contribute to this oversight:

- Lack of understanding about the severity of financial emergencies,

- Difficulties in establishing an emergency fund, and

- Absence of a practical and customizable framework to guide the process.

In this blog, I aim to address these shortcomings by providing a step-by-step approach to:

- Determining the appropriate size of your emergency fund,

- Exploring various investment options for deploying the funds, and

- Highlighting the often overlooked benefits of having such a fund.

I believe that understanding these benefits will serve as strong motivators for you to create an emergency fund. Creating an emergency fund is easier than you might think. So let’s delve into the details.

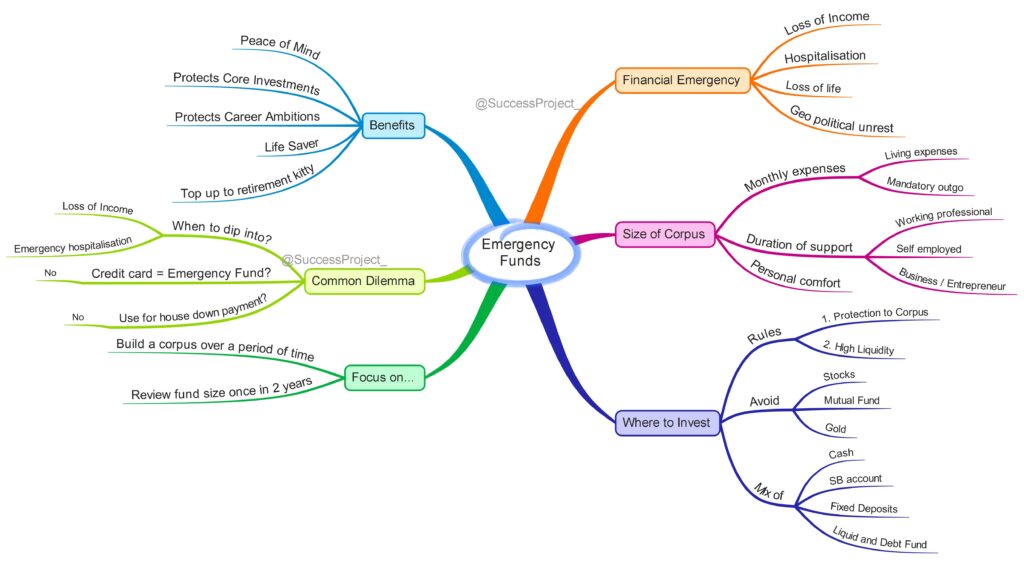

The mind map below will help you quickly recall the key ideas presented in this blog.

A-Z of Emergency Fund

The definition of an emergency, according to the dictionary, is “a serious, unexpected, and often dangerous situation requiring immediate action.”

Now, let’s delve into the meaning of a financial emergency. It represents a sudden and typically unforeseen situation where an individual urgently requires a substantial amount of money, exceeding their usual financial resources or expenses, often with limited notice. Failing to secure the necessary funds would result in severe and undesirable consequences, placing one’s financial security at risk.

What are the common situations that can be categorized as financial emergencies?

If you ask individuals about the situations they perceive as financial emergencies, the top three responses usually include:

Loss of Income

This can occur due to business setbacks or the loss of a job through a layoff. When the income stops, one still needs to manage daily living expenses and fulfill mandatory obligations such as loan payments and utility bills.

Hospitalisation

Although health insurance is often viewed as a solution to this financial emergency, it’s essential to consider the various factors related to insurance coverage, such as waiting periods, policy exceptions, and specific treatments that may not be covered. In critical situations, a significant sum of money is required on short notice for life-saving treatments. Additionally, there may be instances where parents are not covered by insurance and rely on you for their medical expenses during a health crisis.

Loss of Life

This is a situation nobody wishes to experience. If the primary breadwinner of a family passes away, it not only has emotional implications but also significantly impacts the dependents’ finances. While term insurance is often seen as a solution, it’s important to recognize that the settlement process does not occur immediately. One needs to overcome emotional shock, grief, and submit specific documents to the insurance company for settlement processing. This procedure can take 30-45 days. During this time, funds are required to manage daily living expenses and mandatory obligations.

Considering recent geopolitical events, I would like to add one more point to this list:

Geopolitical Tensions

Imagine finding yourself in a foreign country experiencing a financial crisis, political turmoil, instability, or even war. In such circumstances, there may be a need to relocate to another country or return to your homeland quickly before the situation worsens. Once again, having access to liquid funds becomes crucial.

How does one mitigate or face these emergencies? The answer lies in an emergency fund.

In these financial emergency situations, an emergency fund serves as your first line of defense.

Emergency Fund - Is it Important?

Before the 2000s, the term “emergency fund” was relatively unknown. In the 90s, it simply referred to keeping some cash on hand to cover 2-3 days’ worth of expenses. This was particularly useful in two situations: (1) when we ran out of money towards the end of the month, and (2) when unexpected guests visited our house. During those times, widespread layoffs were uncommon, and hospital expenses were not as exorbitant. The term gained relevance after the 2000 IT meltdown and subsequent job losses. Today, we live in a different era characterized by numerous, diverse, and unexpected uncertainties.

- In 2020, during the COVID lockdown, layoffs became rampant as every business suffered and took a hit.

- In today’s start-up bubbles, mass layoffs are not unusual.

- The IT industry, in particular, has resorted to layoffs as a means of cost-cutting during project losses, project ramp-downs, or restructuring.

Given this reality, having an emergency fund is crucial for everyone to navigate financial emergencies. Each one of us faces this reality today, and an emergency fund is necessary for financial stability when faced with such uncertainties.

A real-life incident

In mid-April 2020, after the COVID lockdown, I received a call from my close friend. In a distressed tone, he said, “Hey Venkatesh, I’ve been informed that I’ll be laid off from my company in xx days. I’m desperate to find a job as soon as possible. I really need your help.” Trying to reassure him, I said not to worry because with his skills and qualifications, he should be able to secure a new job within 2 to 3 months. However, his response hit me with a harsh reality. “Venkatesh, I will be on my knees, even if don’t get one month’s salary. I would not be able to pay EMI nor manage living expenses.“

How big should this fund be?

Determining the size of your emergency fund is a personal matter, much like every aspect of personal finance. The answer to this question can be derived from another important question: “If you were to face a period without any income, how many months’ worth of expenses would you feel comfortable having as a financial cushion?” Upon closer examination, you’ll notice that this single question encompasses three interconnected inquiries.

Expenses

What is your monthly expense? Your monthly expenses should cover:

- Living expenses

- Mandatory expenses like EMI (or house rent), utility bills, and routine health expenses.

Duration

The duration for which your emergency fund should support you depends on your individual circumstances and occupation. Consider the following scenarios:

Working professional: If you are employed, ask yourself questions such as “What is the current job market situation for my skillset?” and “How long would it likely take for me to find my next job?” Tentatively, it is advisable to have an emergency fund that can sustain you for a period of 3 to 6 months.

Self-employed: As a self-employed individual, it is prudent to have a larger corpus that can cover at least one year’s worth of expenses. This provides a safety net in case your business experiences a downturn or faces unforeseen challenges.

Business owner or entrepreneur: For those involved in business ventures or entrepreneurship, it is recommended to have a more substantial emergency fund that can support you for a period of two years. While this may seem high, it is important to consider that a business downturn may require significant resources, dedicated focus, and an uncertain amount of time to rectify.

By aligning your emergency fund with the specific needs and risks associated with your occupation, you can better prepare yourself for unforeseen circumstances and financial challenges.

Ease

How much of an emergency fund are you comfortable with? Unlike the previous considerations, this aspect is subjective and based on your personal comfort level. While you may have confidence in securing alternative employment within three months, you might feel more at ease knowing you have a financial cushion that covers four months’ worth of expenses.

To illustrate this concept, let’s look at a case study based on the three questions discussed earlier. Please note that the numbers used in this example are for illustrative purposes only and will vary for each individual.

- Consider Mr. Xyz, who works in an industry where they are confident about finding a job within four months in the event of a job loss. This answers the first question.

- Xyz’s monthly expenses amount to approximately 70,000 INR, with 25,000 INR allocated to living expenses and 45,000 INR for EMI and utility payments. This addresses the second question.

- Based on these factors, the minimum corpus needed would be 2.8 lakhs INR (4 months x 70,000 INR expenses per month). However, Xyz desires a buffer for added security and is not comfortable with only four months’ worth of expenses. Instead, they opt for a five-month duration. This answers the third question.

- Therefore, a total of 3.5 lakhs INR (5 months x 70,000 INR expenses per month) is the size of the emergency fund needed for Mr. Xyz.

Remember, these numbers are merely an illustration, and the actual size of your emergency fund will depend on your unique circumstances and comfort level.

Where to invest your Emergency Fund?

To answer this question, keep in mind two important rules:

The first rule is the protection of the corpus. It is crucial that the amount you invest remains safe and doesn’t suffer any erosion or depreciation. When an emergency arises, you should be able to access the intended corpus without any complications.

The second rule is high liquidity. This means having quick and easy access to your funds. The investment option you choose should allow you to withdraw the money when you need it, preferably with no or minimal delays.

While it is preferred to have no penalty for premature closure of the investment, it is not always a mandatory rule. Some investment options may have a small percentage of penalty in case of pre-closure.

Evaluation of Options

Now, let’s assess various investment options based on these two rules:

The first rule eliminates all volatile investment options.

- These investments are prone to fluctuations and may have a lesser value at the time you need them.

- Examples of such options include stocks, mutual funds, and gold, which can be subject to market volatility.

The second rule eliminates investment options that have a lock-in period and are non-liquid.

- Lock-in periods restrict your access to the invested amount for a specified duration, which may not align with the immediate nature of financial emergencies.

- Non-liquid investments refer to those that cannot be easily converted into cash without significant delays or penalties.

The Four Options

Cash

- It is the most ideal option for immediate accessibility. However, it does not generate any returns.

- Another downside is that holding cash for an emergency fund can be tempting to use for other purposes, defeating the purpose of the fund.

Savings Account

- A savings account earns some returns compared to idle cash.

- However, it shares the same disadvantage as holding cash, as the funds are easily accessible for spending through card swipes or net banking.

Liquid / Debt Fund

- Liquid funds and debt funds are investment options that do not have equity exposure but are invested in high-grade and liquid debt instruments.

- Liquid funds generally offer higher returns than a savings account, while debt funds may provide higher returns than a fixed deposit.

- These options also offer a tax advantage through indexation benefit if no withdrawals are made for a minimum of three years.

- The impact of this benefit varies based on the individual’s tax bracket.

Fixed Deposit

- Fixed deposits generally provide higher returns than a savings account.

- However, when liquidating a fixed deposit prematurely, banks may offer a reduced interest rate based on the applicable lower tenure of the deposit.

- Additionally, there may be a small percentage of penalty imposed by banks for premature withdrawal.

Which Options should you Consider?

If you are primarily concerned about the possibility of losing your job, it is crucial to understand that you typically have some time to prepare for this situation. It is not an immediate or overnight emergency. Companies usually provide a few weeks or months of advance notice for layoffs, giving you some leeway to plan ahead. Even in the unlikely scenario of being terminated without prior information, you can manage for a day or two until you can access funds from a fixed deposit or liquid fund. Considering these factors, it is advisable to invest your emergency fund in a combination of fixed deposits and liquid/debt funds.

On the other hand, if your main concern is a hospitalization emergency, you may need to allocate a portion of your emergency fund as cash or in a savings account. Having around 10-20% of the total emergency fund readily available as cash or in a savings account can provide a sense of psychological comfort. The remaining amount can be evenly distributed between fixed deposits and liquid/debt funds. It’s important to note that if you have a credit card, you may not need to allocate a significant portion of your emergency fund specifically for medical emergencies. In such cases, as long as you are employed and your earning power remains intact, you can utilize a credit card to address immediate medical needs and subsequently pay off the incurred expenses within a few days using your salary.

Ultimately, the decision to allocate cash or funds in a savings account for psychological comfort is a personal preference. As a general guideline, having 10-20% of your emergency fund in cash or a savings account and dividing the remaining amount equally between fixed deposits and liquid/debt funds is a reasonable approach.

Building a Emergency Fund

It cannot be built overnight

Creating an emergency fund immediately can pose challenges for many of us. It requires discipline and takes time, especially considering the size of the desired corpus. This challenge becomes even more pronounced if you are already fully committed financially, with a significant portion of your income going towards loan repayments, living expenses, and minimal savings. In the conservative illustration provided earlier, accumulating 3.5 lakhs might seem like a substantial amount that is not easily achievable in one go. Building this corpus over time is a more feasible approach. One method is to consider a recurring deposit, where you make regular contributions and accumulate savings over a few months until you reach the desired corpus.

Another approach is to start small by aiming to save for a 15-day emergency fund as the initial target. Once you achieve this, you can gradually scale up to a one-month emergency fund and continue to increase the duration until you reach your goal of a 6-month (or desired number of months) emergency fund. This step-by-step approach allows for a gradual accumulation of savings, making it more manageable and achievable.

Review your Emergency Fund Periodically

Lifestyle changes are an ongoing process, and as you transition through different phases of life, your expenses tend to increase. Whether it’s going from being single to getting married or becoming a parent, new financial obligations may arise, such as loan EMIs, children education, and other mandatory outflows. It is essential to regularly review your emergency fund corpus and adjust it accordingly.

Reassessing your emergency fund should be done periodically, ideally once every two years or after experiencing a significant life change. This allows you to evaluate if your emergency fund is still sufficient to cover your current expenses and financial responsibilities. If necessary, you can make adjustments and increase the corpus to align with your new financial situation. By staying proactive and periodically reviewing and adjusting your emergency fund, you can be assured that it provides necessary financial security in times of unforeseen circumstances.

FAQ and Misconceptions

I have a credit card for Emergency. Do I need an Emergency Fund?

- We have discussed two types of emergencies: (1) loss of job and (2) hospitalization.

- When it comes to hospitalization, the option of using a credit card can be suitable, especially if you are still earning and have the ability to repay the expenses.

- However, the situation is quite different in the case of a job loss.

- When you lose your job, your income comes to a halt.

- In such circumstances, relying on credit cards can be extremely harmful as it can lead you into a deep debt trap.

- You are already facing a loss of income, and using a credit card adds to your financial burden.

- The expenses you charge on the credit card must be paid off after a certain number of days, but how will you repay when you have no income following a layoff?

- It becomes a challenging situation to fulfil the credit card obligations, potentially pushing you further into financial distress.

Inflation eating returns in Emergency Fund. Can I invest Emergency Fund in Mutual Fund or Stocks?

As mentioned earlier, when considering investment options for an emergency fund, it is important to prioritize the safety of the corpus, liquidity, and any associated penalties for premature withdrawal.

- The focus should not be on generating high investment returns for the emergency fund.

- It is true that the returns on an emergency fund may not surpass inflation.

- However, it’s important to remember the purpose of an emergency fund.

- It is not intended to create wealth or generate substantial returns.

- Rather, it serves as a financial safety net.

- Even if the returns on the emergency funds, it is unlikely to significantly impact your overall financial situation.

It is crucial to be more conscious of the returns on your core investments, which typically make up a larger portion of your net worth. These investments are the ones where higher returns are sought, and the impact of inflation becomes more relevant.

Therefore, there is no need to worry excessively about inflation affecting the returns from your emergency fund. The concept of an emergency fund is often underestimated, while concerns about inflation eroding its returns are often overrated. Emergency funds are not for earnings returns!

Can I use the Emergency Fund for the Housing loan down payment?

Absolutely not. Let’s consider a hypothetical situation: if you were to use your emergency fund to pay for a housing loan, and your monthly EMI payments begin, you would face significant challenges in rebuilding your emergency corpus. During this time, if you were to lose your job, you would be faced with a dual ordeal. Not only would you have no emergency fund to manage your living expenses, but you would also still be obligated to make your EMI payments.

In this scenario, it is essential to think in the opposite direction. When you take out a housing loan, there is a mandatory monthly expense in the form of EMI. Therefore, it is crucial to consider increasing your emergency fund corpus to account for this additional financial commitment. By doing so, you can ensure that you have sufficient funds to cover your living expenses and EMI payments for a period of 3 to 6 months in the event of a loss of income.

On losing a job, I will cut down my expenses…Can I have a light emergency fund to manage only 2-month expenses?

That’s absolutely true! After losing a job, it becomes necessary to make significant lifestyle changes by cutting out all discretionary expenses. Activities such as dining out, attending parties, discretionary shopping, and visiting malls are usually avoided. However, there are other essential expenses that cannot be completely eliminated:

- Travel expenses for attending job interviews or meeting contacts.

- Investing in courses or training programs to enhance your employability and skills.

- Seeking paid services of job portals or hiring career coaches to support your job search.

- If you decide to pursue employment opportunities in a foreign country, there are additional expenses involved, such as paying an agent, visa fees, and travel costs.

Given these factors, it is important not to focus too much on precision when determining the size of your emergency fund. It is recommended to build a corpus that covers at least 6 months of living expenses or even more. By having a larger emergency fund, you can navigate through these challenging times with greater financial security and peace of mind.

Benefits of Emergency Fund

The true value of the Emergency Fund becomes apparent only during times of crisis or emergency. Until then, it may be perceived as redundant or an underperformer (Low returns not beating inflation) compared to other investment options. To fully grasp and appreciate the benefits of having an Emergency Fund, take a moment to imagine yourself in a situation where you have lost your job. There is not income but have to cover your living expenses without the safety net of a regular paycheck. This imaginary scenario allows you to understand the crucial role that an Emergency Fund plays in your life.

Peace of Mind

Imagine the state of mind you would be in if the unfortunate event of job loss occurs without having an emergency fund in place. The worry and stress of not only dealing with unemployment but also the financial burden of supporting your family until you find new employment can be overwhelming. However, having an emergency fund provides immense value and brings significant relief and peace of mind.

Even during normal times, the presence of an emergency fund offers a sense of security. It eliminates the constant hypothetical worry of “What will I do if something goes wrong?” This peace of mind that comes from having an emergency fund is invaluable.

Protects Core Investments

Not having an emergency fund can lead to a disruption in your core investments. In the absence of a dedicated emergency fund, you may be compelled to dip into other assets such as gold, fixed deposits, or even your retirement corpus to meet unexpected financial needs. This can have a significant impact on your long-term financial goals. Having a separate emergency fund allows you to safeguard your core investments and protect them from unexpected financial shocks.

Protects Career Ambitions

Without an emergency fund, you are in a desperate situation if you were to experience a job loss.The desperation to secure immediate income may force you to accept the first job opportunity that comes along, regardless of whether it aligns with your career goals, utilizes your skills, or offers a comparable salary.

Having an emergency fund provides you with the resilience and flexibility to navigate through this difficult period. It allows you to sustain yourself for a few days or weeks while you search for the right job that aligns with your career ambitions and meets your financial needs. With the financial cushion provided by an emergency fund, you can avoid making hasty decisions driven solely by the need for immediate income. It empowers you to prioritize finding the job that truly aligns with your aspirations, rather than settling for an unfavorable or unsatisfying job out of desperation.

Life Saver

During times of geopolitical crisis, having an emergency fund proves to be immensely valuable. It allows you to swiftly relocate yourself and your family from the affected region or country. Without an emergency fund, you become reliant on the assistance of others, which may be scarce during such crises, as they are also dealing with the same challenges. This gives you a greater sense of control and autonomy in navigating through the crisis.

May serve as Top-Up for your Retirement Kitty

Do I sound crazy? How can the emergency fund be connected to the retirement fund? Well, let’s consider a fortunate scenario where you don’t need to utilize your emergency fund throughout your working years. In such a case, the money set aside for emergencies, when left untouched and allowed to compound over the years, can grow into a significant sum that can serve as a valuable top-up to your retirement savings.

So, it may seem unconventional at first, but if you are fortunate enough not to require your emergency fund, it can evolve into a valuable asset that contributes to your retirement goals.

Time for Action

- If you did not have an emergency fund all these years, then this is the right time you prioritize it to act

- If you had an emergency fund, evaluate the need for a bigger size of the fund in wake of the new reality!

- Talk to at least 5 of your friends, peers, and relatives about this idea and guide them to create an emergency fund – Yes, You can bring a change in someone’s life.

Conclusion

The importance of an emergency fund cannot be overstated in personal finance. It serves as a crucial safety net that provides financial security and peace of mind during times of unexpected events or emergencies. Whether it is a job loss, medical crisis, or geopolitical turmoil, having a dedicated fund allows you to navigate through these challenges without compromising your long-term financial goals or resorting to high-interest debt. By assessing your individual circumstances, determining the appropriate size of the fund, and choosing suitable investment options, you can build a strong foundation of financial resilience. Remember, the key is to start now and make consistent contributions towards your emergency fund. Your future self will thank you for the financial security and stability it brings. Don’t wait for the unexpected to happen – prioritize your emergency fund and embark on the path to a more secure and prepared financial future.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.

Which one good mutual fund for nxt 20 years

By sip mode

Thanks

Mohan.m

Mohan. My sincere answer is I don’t know. But 20 years is too long term for anyone to identify a fund. Do connect with a financial/MF advisor (Not a broker, who has some product to sell you) for further advice. Make sure that the MF advisor does not have any product to sell.

A small portion of Hard cash is key due to the following (Severity is very high and it’s a very low probability of occurrence)

1) ATM not available ( not working or may be in remote areas)

2) debit card not working / network issue / wrong pin ( many times we do forget pin during critical time)

3) at some places only cash accepted

Etc etc

4) UPI or any other digital channel failure

5) Bank holidays/ hartal / traffic jam/ non availability vehicles for travel.

And more and more