This blog is the Fourth and final blog on my blog series on Retirement planning. Do not miss out on the previous 3 blogs (Blog 1, Blog2 and Blog 3), I discussed 11 core ideas on Retirement and Retirement Planning. (Featured image reference: Photo by Andrea Piacquadio)

In this blog, we will delve into three more crucial concepts: Working after retirement, Choosing the Ideal City of Living, and Exploring Activities for Your Time. Additionally, I will share insightful snippets from my discussions with various retired friends as a bonus.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

Your Living City

Planning your post-retirement living arrangements (The city where you live) is a crucial decision that requires careful consideration. It may be staying in your current city, returning to your hometown, or seeking a peaceful countryside retreat, or retirement communities etc. Start discussing this topic with your spouse and children months before actual retirement. This decision sets the stage for other considerations, such as selling or acquiring a new property, and ensures a smooth transition into your desired retirement lifestyle. A few options are

Relocate to a calmer city/village or native

- Native place: Ideal if you have an ancestral house or plan to buy one. If you already do not have one, you could still purchase a new house at your native.

- Relocation to a calmer city/village: Another choice is to move to a peaceful city or village.

Note: You can purchase a new living house in your native place or a village and sell your current property. This can significantly boost your investment corpus, as housing prices are often lower in rural areas compared to cities.

Living with Children

Evaluate the long-term viability of moving with your children, considering their career growth, life stage changes (Getting married), and potential overseas moves as part of their career.

Retirement Community

While gaining popularity, it is advisable to explore other options unless no viable alternatives exist, such as relocation constraints or limited social connections (Living in loneliness).

Working after Retirement

Making this decision is of utmost importance. Because you are getting less time with your loved ones and continue to carry a life of responsibility and stress.

When is it needed?

It may become necessary if your retirement savings are insufficient or if you have family responsibilities that require additional financial support. You have two options available:

- Work as a freelancer or part-time

- Start your own business.

- Reflect on your passion, hobbies and skills.

- Identify ways to create and sell products or services related to your interests in the marketplace.

- This approach allows you to generate income while indulging in enjoyable work.

Avoid Stress

In either option, if possible, take up something that you like to do. It could be stressful to work in the retirement phase. Your nature of work should not add additional stress. For work or business, choose something that aligns with your preferences and abilities, ensuring that it does not add unnecessary stress to your retirement phase.

A word in case of Business

If you decide to start a business, it requires capital, which you may draw from your retirement corpus. This decision is crucial, as the success of the business is of utmost importance. Failure could result in the loss of both your business and a portion of your retirement savings. Your choice of doing business should be based on the business’s ability to bring in more than what your corpus could generate from other investment avenues.

Balanced life

When contemplating work after retirement, it is essential to prioritize your well-being and satisfaction. The chosen work does not bring stress or detract from the benefits of retirement. Maintaining a balance between work and leisure is crucial.

Remember, the decision to work after retirement is personal, and it should be based on your financial needs, personal goals, and overall happiness. Evaluate your options carefully, considering both financial implications and personal fulfilment.

Do not take this option purely for filling your time. There are multiple other ways which we will discuss in the next topic.

Explore New Horizons

We explored this as one of the key ideas in our second blog of this series.

It is the problem of Abundant time

Upon retirement, you suddenly find yourself with an abundance of free time. Initially, you may enjoy taking a well-deserved rest and engaging in travel and leisure activities. However, after some time, you may encounter a stage where you struggle to find meaningful ways to occupy your days.

To prevent this, it is important to plan activities that bring fulfillment to your life. Consider pursuing hobbies and interests that you longed to explore while you were working. This could involve engaging in activities related to your unique talents, such as writing books or exploring new places. Additionally, spending quality time with family, friends, and relatives can add joy and purpose to your retired life.

A Tentative Schedule

Retirement grants you a surplus of free time compared to your previous routine. It is essential to devise a plan to effectively manage and make the most of this newfound time. Consider your preferences and interests and envision a fulfilling daily or weekly schedule. Incorporate activities that bring you joy and contribute to personal growth. Strive for a balanced schedule that allows for leisure, learning, and engaging in meaningful pursuits. By structuring your time, you can find purpose and fulfilment in your retirement journey.

Be Realistic

While you may have numerous aspirations for your retirement, practical considerations must be taken into account. For example, while you may desire extensive travel. You need to assess whether your retirement corpus can support such endeavours and if your health allows for frequent journeys. Balancing your dreams with practicality and realism ensures a more achievable and satisfying retirement plan.

Not planning or giving a thought to this, may lead you to spend time on trivial things.

Retirement Planning - Key Insights from Discussions

We are close to the end of the blog-series. In this section, I share a few interesting updates that came out during the discussion. It is the life of a few of my friends and common regrets that came from many people.

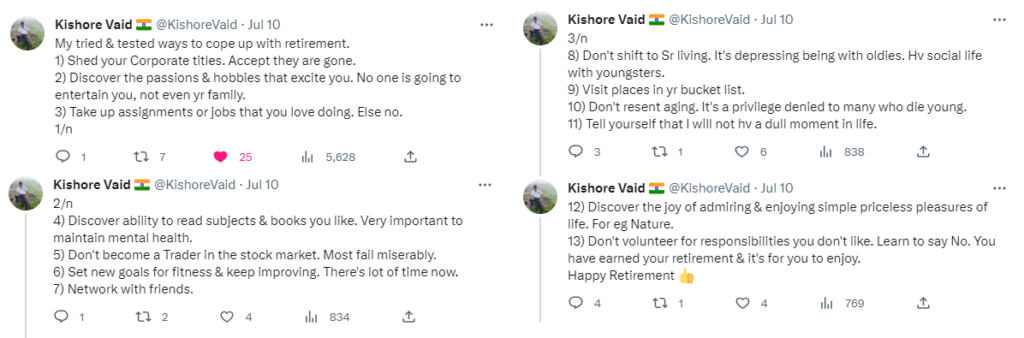

Retirement life of Shri Kishore Vaid

I raised this topic on retirement in Twitter to have move views and thoughts. Shri Kishore Vaid came forward and shared this experience. Below is the image of his views:

Retirement life of Friend 1

This friend has structured his schedule and time with his social circle and family. He is happy in his retirement phase.

- Morning walks with fellow retirees

- Assisting in dropping Grandson off at school

- Enjoying conversations with fellow retirees at the park

- Taking time to relax in the afternoon, watching TV, having lunch, and taking a one-hour nap

- Picking up Grandson from school

- Spending quality time playing with Grandson or going for an evening walk (if Grandson has homework)

- In the evenings watching TV, Chat with Son/Daughter-in-law, having dinner, and winding down for the day

- Participating in social activities if requested by the local community association.

Retirement life of Friend 2

This friend has an abundance of financial resources. He is primarily supported by finances from his children living overseas. Retirement corpus is secondary. However, he lacks strong social connections in his life. He has developed a sense of distrust towards relatives and people around him. He believes* that they are solely interested in his wealth and money. So he prefers to be lonely and avoids much socialization.

*His belief may be correct or merely perception. However, he is the best judge for the intentions of people around him.

He often goes for morning walks alone. Although I offer him occasional companionship during walks or chats in the park. These interactions happen once in 2 to 3 weeks. His main regret is not having a robust social circle to spend time with. His children come once in 2 – 3 years and spend a few days with him. Additionally, his wife is bedridden, and he devotes most of his time to her care.

(Note: While this story may not be an extraordinary tale, it holds valuable insights that can assist readers in planning their retirement lives.)

Common Regrets

These regrets were shared by numerous individuals with whom I engaged in discussions.

- Failure to plan and build a sufficient retirement corpus during the working years. Result: Cautionary consideration before every expenditure.

- Lack of financial awareness to accumulate and manage the retirement corpus, affecting monthly income stability.

- Insufficient prioritization of health during the working years, resulting in health issues during retirement.

- Inadequate investment of time with family during the working years.

- Regret among some retirees who have surpassed 10 years of retirement for not making optimal use of their abundant free time.

Conclusion

With this conclusion, the four-part blog series on Retirement Planning comes to an end. If you have stumbled upon this article first, make sure to check out the earlier three articles, which can be found in the Blog Index page.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.