I have recently finished reading all of the Berkshire Hathaway Shareholder letters. I will present the insights I’ve acquired through a series of blog posts. Among the plethora of concepts that Warren Buffett consistently underscores in nearly every letter, a few pivotal ideas stand out. These encompass the notion of float, the significance of share repurchases (buybacks), the prudent management of retained earnings, and the succession planning at Berkshire. (Featured Image Reference: https://edition.cnn.com/2023/08/03/business/warren-buffett-fitch-downgrade/index.html)

The focal point of this blog is to understand the intricacies of Berkshire Float. To comprehend the genesis and workings of this float, it’s imperative to first acquaint yourself with some basics covering:

- A succinct introduction to Berkshire Hathaway,

- Subsequently, explore its insurance operations, and

- Finally, grasp the fundamentals of the insurance business.

This preliminary exploration helps us delve deep into the heart of the matter: A comprehensive analysis of float.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index for all my blogs.

- Berkshire Hathaway

- The Significance of Berkshire Hathaway's Insurance Business

- Understanding the Mechanisms of Insurance

- The Ingenious Concept of Float

- The Nexus between Float and Underwriting

- Investment Opportunity

- Float Can be Stable, Grow or even decline

- Not every float is of Berkshire Hathaway Quality

- How this Float is important to Berkshire

- Conclusion: A Symphony of Strategy

Berkshire Hathaway

Journey from a Textile Company to a Conglomerate

- Berkshire Hathaway stands as a beacon of success and innovation in the business world.

- It traces its roots back to its modest origins as a textile manufacturing company in 1839.

- However, a monumental shift occurred when Warren Buffett, an iconoclastic investor and philanthropist, assumed leadership in 1965.

- From then on it has undergone a transformation under the visionary leadership of Warren Buffett

- Today, Berkshire Hathaway commands a diverse portfolio spanning industries like insurance, utilities, manufacturing, retail, and transportation.

- Remarkably, Buffett’s annual shareholder assemblies have earned the mark “Woodstock of Capitalism,” attracting throngs of investors eager to understand his sagacity and insights.

The Significance of Berkshire Hathaway's Insurance Business

Berkshire Hathaway started as a Textile company and is a conglomerate today. Central to this Berkshire Hathaway’s stature is its insurance business. Its insurance subsidiaries are:

- GEICO: Revolutionizing Auto Insurance

GEICO, or Government Employees Insurance Company is the leader in auto insurance. It represents one of Berkshire Hathaway’s towering subsidiaries. GEICO’s hallmark lies in its direct-to-consumer approach, streamlined claims processing, and competitive pricing.

- Berkshire Hathaway Reinsurance Group: A Safety Net in the Face of Catastrophe

This specializes in providing reinsurance coverage, including Super Cat insurance (catastrophe insurance), which safeguards other insurers against catastrophic events such as natural disasters or large-scale human-made disasters.

- Berkshire Hathaway Primary Group: Nurturing Protection with Property and Casualty Insurance

This group focus on property and casualty insurance. This coverage extends to safeguarding assets against damage, as well as providing liability coverage for injuries and damages inflicted upon others.

Understanding the Mechanisms of Insurance

To grasp the concept of float, it’s essential to gain insight into the broader landscape and economics of the insurance industry.

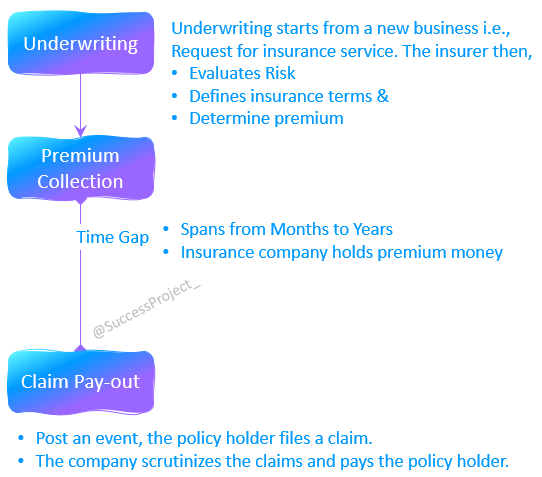

Underwriting

This is core to insurance operations. It is the process of evaluating risks, defining insurance terms and determining the premium to be collected from the policyholder.

Premium Collection

Central to the financial mechanics is a premium collection. It brings in money for the insurance company. Insurance companies gather premiums from policyholders, forming the primary source of the float. While these premiums are received upfront, the claims associated with them might not be immediately paid out.

Claim Payout

When an unforeseen event triggers a financial loss, the process of claim payout comes into play. On the occurrence of the event leading to financial loss, the policyholder files a claim with the insurance company to receive the benefits. The insurance company steps in to scrutinize the claim, verify its legitimacy, evaluate the magnitude of the loss or damage, and subsequently provide a payout to the policyholder.

Time Gap

The temporal juncture between premium collection and claim payout introduces a phenomenon known as the “time gap.” This could vary from months to years. For instance, in our country, motor insurance entails a one-year gap, while term insurance might extend over several years.

The above discussion is depicted in the below image.

The Ingenious Concept of Float

We saw that there is a time gap between premium collection and claim payout. During this time gap, the collected premium is there with the insurance company. Buffett sees float as money that doesn’t belong to Berkshire but they hold it temporarily. The company gains leverage from this float as the loss events that occur do not always result in immediate payment of paying claims. Sometimes it takes many months for losses to be reported, investigated, negotiated, and settled.

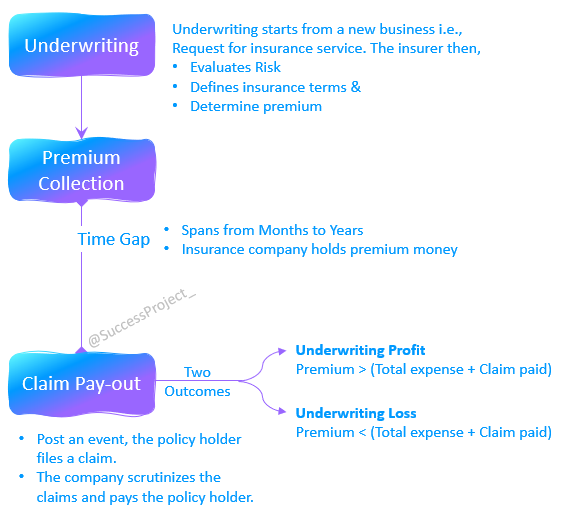

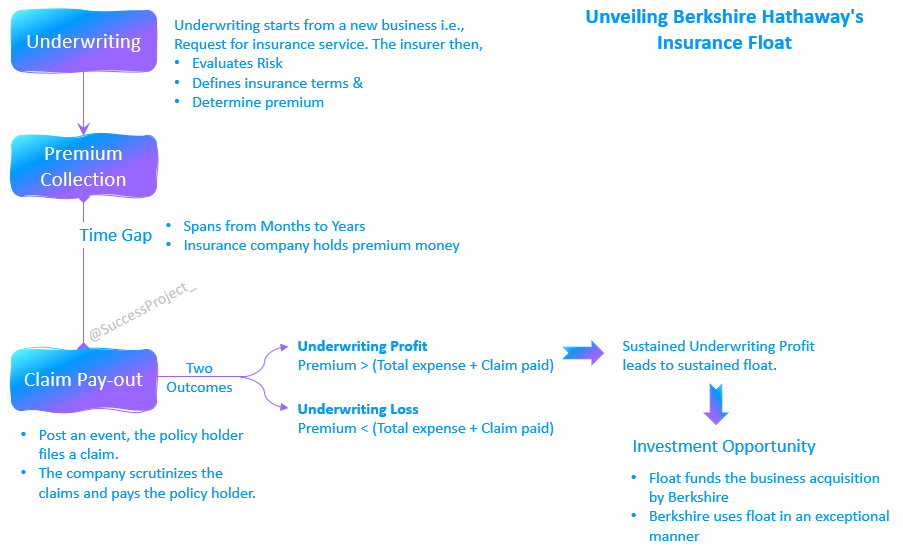

The Nexus between Float and Underwriting

During this business, there are two possibilities:

- Underwriting Profit: The premiums exceed the total expenses and claims paid,

- Underwriting Loss: The premiums are less than the total expenses and claims paid

A symbiotic relationship exists between insurance float and underwriting performance. To have sustainable float the insurance companies must generate consistently generate underwriting profits.

How Warren Buffett Views Float

“When an insurer earns an underwriting profit, the float is better than free. In such years, we are actually paid for holding other people’s money. The property-casualty industry almost invariably operates at an underwriting loss. When that loss is large, float becomes expensive, sometimes devastatingly so.” – Warren Buffett, 2005 Berkshire Shareholder Letter.

Warren Buffett regards underwriting profit as an additional contribution to the income derived from the float.

“If our premiums exceed the total of our expenses and eventual losses, our insurance operation registers an underwriting profit that adds to the investment income the float produces.” – Warren Buffett, 2018 Berkshire Shareholder Letter.

Berkshire's Performance

Let us see how Berkshire has performed in its float and underwriting.

- Over the past 16 years, Berkshire Hathaway has achieved underwriting profits in 15 of them. This exceptional track record is not coincidental; it is a testament to the meticulous risk assessment carried out by Berkshire’s insurance team. They understand that the potential advantages of the float could be negated by unfavourable underwriting outcomes.

- Berkshire as of 2022 had a float of 164 Billion USD.

“Our insurance float increased during 2022 from $147 billion to $164 billion.” – 2022 Berkshire Shareholder Letter.

Investment Opportunity

The float with the insurance companies gives them an investment opportunity. The ‘Time gap’ serves as a chance for insurers to invest these funds, earning returns from it before claim payments come due.

A related idea is investment returns. It is the earnings generated from the investments made using the float.

Central to Berkshire Hathaway’s prowess is its exceptional utilization of insurance float. Warren Buffett’s adept use of this strategy has enabled Berkshire Hathaway to finance acquisitions and make strategic investments across various sectors.

Note: Most of the discussion around float in BRK Annual Report is around Property & Casualty Insurance.

Float Can be Stable, Grow or even decline

While individual policies and claims come and go, the quantum of float retained by an insurer generally maintains a consistent equilibrium. As the business expands, an augmented premium collection fosters a proportional augmentation in the float’s magnitude. However, there may be instances where a diminution in float becomes discernible.

“Daily, we pay old claims and related expenses. But every day we write new business that will soon generate its own claims, adding to float. Owing $1 that in effect will never leave the premises – because new business is almost certain to deliver a substitute – is worlds different from owing $1 that will go out the door tomorrow and not be replaced.” – Warren Buffett, 2016 Berkshire Shareholder Letter.

Not every float is of Berkshire Hathaway Quality

Buffett emphasizes that the notion of a cost-free float isn’t a realistic anticipation for the insurance industry as a whole. He underscores that the notion of “Berkshire-quality” float isn’t commonly found within the insurance landscape. Over the course of many years, the industry has faced the challenge of premiums that frequently fall short of adequately addressing both claims and operational expenditures.

“The wish of all insurers to achieve this happy result creates intense competition. The competition is so vigorous that it sometimes causes the industry as a whole to operate at a significant underwriting loss. This loss, in effect, is what the industry pays to hold its float. Competitive dynamics almost guarantee that the insurance industry, despite the float income all its companies enjoy, will continue its dismal record of earning subnormal returns on tangible net worth as compared to other American businesses.” – Warren Buffett, 2018 Berkshire Shareholder Letter.

How this Float is important to Berkshire

The traditional sources of funding for companies are Debt and Equity. In the case of Berkshire, Warren Buffett does not prefer Debt as it becomes financially fatal at some point in time. Beyond these two sources, Berkshire has two less commonly known sources:

- Float from its insurance business. These are recorded as liabilities in the balance sheet.

- Deferred taxes. These will eventually have to be paid, but they are interest-free till then.

The float from the insurance business acts as funding for Berkshire to acquire other businesses.

Quotes on Floats - From Berkshire Shareholder Letters

Warren Buffett has expressed a strong affinity for float, emphasizing its significance in many Berkshire’s Annual Report. This float stands as a foundational pillar for Berkshire’s achievements. Here are a few quotes from various reports that underscore its importance.

“Since purchasing our first property-casualty insurer in 1967, Berkshire’s float has increased 8,000-fold through acquisitions, operations and innovations. Though not recognized in our financial statements, this float has been an extraordinary asset for Berkshire” – 2022 Berkshire Shareholder Letter

“When such a profit is earned, we enjoy the use of free money – and, better yet, get paid for holding it.” – 2018 Berkshire Shareholder Letter

“We register an underwriting profit that adds to the investment income our float produces. When such a profit is earned, we enjoy the use of free money – and, better yet, get paid for holding it. That’s like you’re taking out a loan and having the bank pay you interest.” – 2012 Berkshire Shareholder Letter

“This float is “free” as long as insurance underwriting breaks even, meaning that the premiums we receive equal the losses and expenses we incur.” – 2007 Berkshire Shareholder Letter

“Float is wonderful – if it doesn’t come at a high price.” – 2005 Berkshire Shareholder Letter

“When an underwriting profit is achieved we have been in the insurance business – float is better than free. In such years, we are actually paid for holding other people’s money.” – 2005 Berkshire Shareholder Letter

Conclusion: A Symphony of Strategy

Berkshire Hathaway’s insurance operations represent an orchestrated symphony of strategic management, prudent underwriting, and leveraging the power of insurance float. The artful management of insurance float and the symbiotic relationship with underwriting underscore the profound strategies driving Berkshire Hathaway’s longevity and prosperity.

The next blog will cover other insights from my readings of Berkshire letters.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.