In this blog we will explore Berkshire Hathaway, a conglomerate renowned for its multifaceted businesses, distinctive corporate culture, and meticulous succession planning. As we journey through the intricate tapestry of Berkshire, we will unveil the fascinating diversity of its operations, from controlled, non-controlled businesses, and shared businesses. Beyond the financial aspects, we’ll delve into the cultural ethos that shapes Berkshire’s unique working environment—a blend of autonomy, ownership mentality, and long-term focus. Furthermore, we’ll dissect the carefully crafted succession strategy orchestrated by none other than Warren Buffett himself, ensuring the company’s enduring prosperity and leadership continuity.

Featured image credit: full recap of the best moments from Warren Buffett at Berkshire Hathaway’s annual meeting

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index for all my blogs.

A Closer Look at the Business Portfolio of Berkshire

In the 2018 BRK Shareholder letter, Warren Buffett delved into the Berkshire Business, elaborating on Berkshire’s composition as a collection of 5 distinct businesses, or “groves” as he terms them.

“…our forest contains five “groves” of major importance, each of which can be appraised, with reasonable accuracy, in its entirety. Four of those groves are differentiated clusters of businesses and financial assets that are easy to understand. The fifth – our huge and diverse insurance operation – delivers great value to Berkshire in a less obvious manner…”

The Five "Groves"

- Controlled business: Where Berkshire holds 100% and not less than 80%.

- Non-controlled/Listed business: A collection of equities involving a 5% to 10% ownership position in a very large company. These have dividends and retain earnings. These retained earnings bring in capital gain in future.

- Shared controlled business: These are businesses where Berkshire shares control with other companies.

- Treasure bills and cash equivalent: The amount is 100+ billion to protect against external calamities.

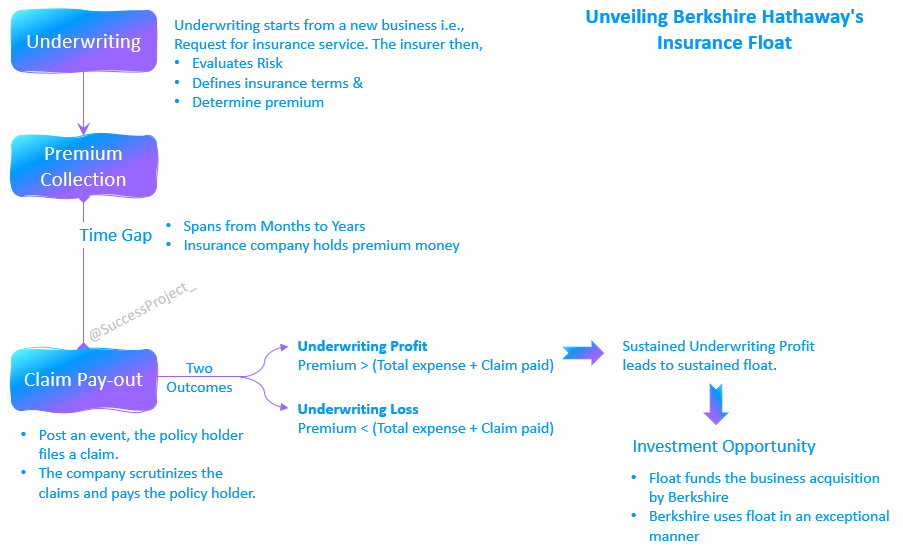

- Diverse insurance operation: The ownership of the first four businesses is funded by this business. This is a collection of exceptional insurance companies. This has been the engine propelling Berkshire’s growth since 1967.

As previously explored in our earlier blog post, the insurance sector serves as significant support for Berkshire Hathaway’s diverse business ventures.

In the words of Warren Buffett, “…much of our ownership of the first four groves is financed by funds generated from Berkshire’s fifth grove – a collection of exceptional insurance companies. We call those funds ‘float,’ a source of financing that we expect to be cost-free…“

Controlled and Uncontrolled/Listed Business

Now, let’s delve a little deeper into the initial two types of businesses under Berkshire’s purview.

Controlled Business

- Typically entails the complete acquisition of a business.

- Such businesses are often not available at discounted rates and usually command a premium.

- Owners tend not to sell at distressed valuations unless under significant pressure.

- In these ventures, Berkshire Hathaway directs the allocation of capital and determines the CEO for day-to-day operational decisions.

Uncontrolled/Listed Business

- Involves publicly traded companies where Berkshire holds passive ownership stakes.

- The primary focus is to acquire shares of exceptional businesses at attractive prices. (Note: During instances of market irrationality, stocks might be available at discounted and appealing prices.)

- Berkshire Hathaway does not wield influence over the management of these businesses.

Measurement of Investment Performance

- We do not measure the progress of our investments by what their market prices do during any given year.

- We evaluate their performance by the two methods we apply to the businesses we own.

- The first test is improvement in earnings, with our making due allowance for industry conditions.

- The second test, more subjective, is whether their “moats” – a metaphor for the superiorities they possess that make life difficult for their competitors – have widened during the year.

– BRK Shareholder Letter 2007.

Culture at Berkshire

The culture at Berkshire enhances the effectiveness of CEOs and managers. This is done by,

Firstly, eliminating customary ritualistic and nonproductive activities tied to the CEO role. This environment also provides managers with complete autonomy over their personal schedules.

Secondly, each manager receives a precise directive:

- Operate the business as though they have 100% ownership.

- They are to view it as the sole asset for themselves and their families, both now and in the future.

Furthermore, a strong emphasis is placed on the fact that their decisions should remain uninfluenced by accounting considerations, regardless of how minor they may seem.

The code for Berkshire Board

The Berkshire board sets an example in multiple respects: (a) Every director belongs to a family owning at least $4 million in stock; (b) None of these shares were acquired from Berkshire through options or grants; (c) Directors’ compensation for committee work, consulting, or board responsibilities from the company remains modest compared to their annual income; and (d) Despite having a standard corporate indemnity arrangement, the board does not carry liability insurance for directors.

What does Warren Buffett do?

In good and bad years, Warren Buffett and Charlie Munger concentrates on four main goals:

- Firstly, maintain Berkshire’s solid financial position, characterized by ample excess liquidity, reasonable near-term obligations, and a diverse array of revenue sources and cash flow.

- Secondly, reinforce the protective “moats” surrounding the operational businesses, thereby enhancing their enduring competitive advantages.

- Thirdly, actively seeks out and develops novel and diverse revenue streams.

- Lastly, expand and nurture the cadre of exceptional operating managers who have consistently delivered remarkable results for Berkshire throughout the years.

Skin in the Game

The director have their skin in the came. If something goes wrong in Berkshire Hathaway, they also have a financial impact. The directors behave like owners of the business/company.

“…the directors who represent you think and act like owners. They receive token compensation: no options, no restricted stock and, for that matter, virtually no cash. If they mess up with your money, they will lose their money as well. Leaving my holdings aside, directors and their families own Berkshire shares worth more than $3 billion. Our directors, therefore, monitor Berkshire’s actions and results with keen interest and an owner’s eye.” – BRK Shareholder Letter 2010.

Succession Planning

Warren Buffett has implemented a flawless succession planning mechanism for Berkshire Hathaway, a subject he frequently discusses in the BRK Shareholder letters. There are three dimensions to aspects.

- Succession planning for Berkshire

- Safety gap arrangement for Succession Planning

- His own Succession Planning – Philanthropic activities

Succession planning for Berkshire

In the world of stock investing, few risks are as significant as the “Management Personal Risk.” This encompasses factors such as the competence, character, integrity, dedication, and dynamism of the management personnel, among others. Even when all these attributes are in place, a critical vulnerability arises when a key person is no longer able to lead the company, or when there’s a shift in leadership.

Warren Buffett, renowned for his prudent strategies, has deeply contemplated this eventual reality. He recognizes that his absence should not compromise the performance and operational integrity of Berkshire Hathaway. With this foresight, he has meticulously identified three capable candidates poised to succeed him. These potential successors are known to the board, and also have a high level of readiness to execute the succession planning when the situation arises.

“I have told you that Berkshire has three outstanding candidates to replace me as CEO and that the Board knows exactly who should take over if I should die tonight. Each of the three is much younger than I. The directors believe it’s important that my successor have the prospect of a long tenure.” – BRK Shareholder letter 2006.

“Berkshire’s board has fully discussed each of the three CEO candidates and has unanimously agreed on the person who should succeed me if a replacement were needed today. The directors stay updated on this subject and could alter their view as circumstances change – new managerial stars may emerge and present ones will age. The important point is that the directors know now – and will always know in the future – exactly what they will do when the need arises.” – BRK Shareholder letter 2006.

Safety Gap arrangement in Succession Planning

Warren Buffett’s son, Howard, is positioned to step into the role of non-executive Chairman following his father’s tenure. This arrangement serves as a protective measure that would be invoked solely in cases where a director encounters concerns with the CEO. Otherwise, Howard’s involvement would not extend to the daily operations of Berkshire Hathaway. This strategic decision reflects a nuanced foresight, particularly in considering potential challenges that may arise with the individual succeeding as CEO.

“If elected, Howard will receive no pay and will spend no time at the job other than that required of all directors. He will simply be a safety valve to whom any director can go if he or she has concerns about the CEO and wishes to learn if other directors are expressing doubts as well. Should multiple directors be apprehensive, Howard’s chairmanship will allow the matter to be promptly and properly addressed.” – BRK Shareholder Letter, 2014.

His own Succession Planning

While the focus of this succession planning isn’t exclusive to Berkshire Hathaway, it remains pertinent to our discussion on the topic. Warren Buffett’s approach to succession involves his holdings of Berkshire being designated for philanthropic endeavours. All his holdings in Berkshire will be used for philanthropic purposes with clear instructions provided for the management of the trust.

“In my will I’ve stipulated that the proceeds from all Berkshire shares I still own at death are to be used for philanthropic purposes within ten years after my estate is closed.” – BRK Shareholder Letter 2006.

“More than 98% of my net worth is in Berkshire stock, all of which will go to various philanthropies.” – BRK Shareholder Letter 2011.

“My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.)” – BRK Shareholder Letter 2013.

Conclusion

Delving into Berkshire Hathaway’s diverse portfolio of businesses, unique culture, and meticulous succession planning strategy provides a comprehensive view of the company’s exceptional approach to business management and long-term sustainability. Moreover, the distinctive Berkshire culture, characterized by autonomy, ownership mentality, and a focus on long-term results, underpins the company’s enduring success. Additionally, Warren Buffett’s meticulous succession planning, highlighted by the identification of successor candidates and the establishment of a clear transition plan, reflects his commitment to ensuring the continuation of Berkshire’s legacy.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.