In this blog, we will understand the landscape of the Power Distribution Industry. Understanding the intricacies and opportunities within the power distribution industry can provide valuable insights for making informed investment decisions. We will explore the key aspects of the power distribution sector in detail covering industry trends, the Indian scenario and investment prospects. (Featured image credits: https://prsindia.org/files/policy/policy_analytical_reports/Overview_of_the_Power_Sector_final_web.pdf)

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

- The power distribution industry serves as a crucial link in the entire power sector value chain.

- It acts as an interface between utilities, including the power generation and transmission industry, and end consumers.

- It plays a vital role as the ultimate delivery point of service, and acts as the key source of collection, leading to revenue generation for the power sector.

In essence, it functions as the cash register for the entire sector.

DISCOMs

- The Distribution Companies are shortly referred to as DISCOMS

- DISCOMs manage the distribution infrastructure, including substations, distribution transformers, and distribution lines.

- DISCOMS are also responsible for metering, billing, and collection of electricity charges from consumers, thus bringing in revenue not only to the distribution industry but to the entire power sector.

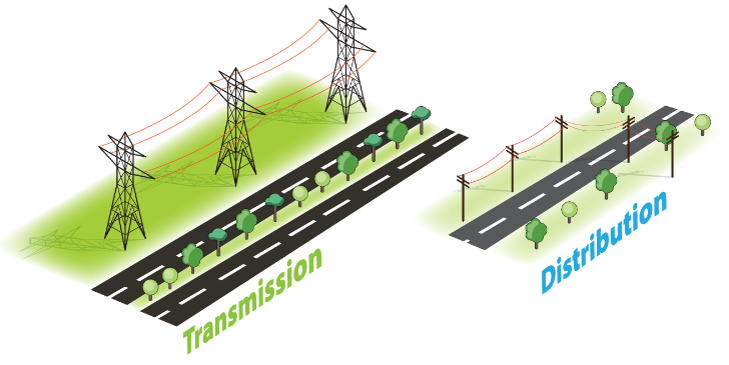

It is important to understand that distribution lines differ from transmission lines. Unlike transmission lines, distribution lines are the ones seen in our streets. They form the local network that brings electricity directly to our homes and businesses.

The below image brings out the difference.

Business Model in Power Distribution Industry

- Distribution companies are granted distribution licenses (DL) that enable them to actively supply power to customers within a specific geographical area.

- Within their licensed area, DISCOMs, procure power in bulk from transmission licensees and efficiently distribute it to a diverse range of customers.

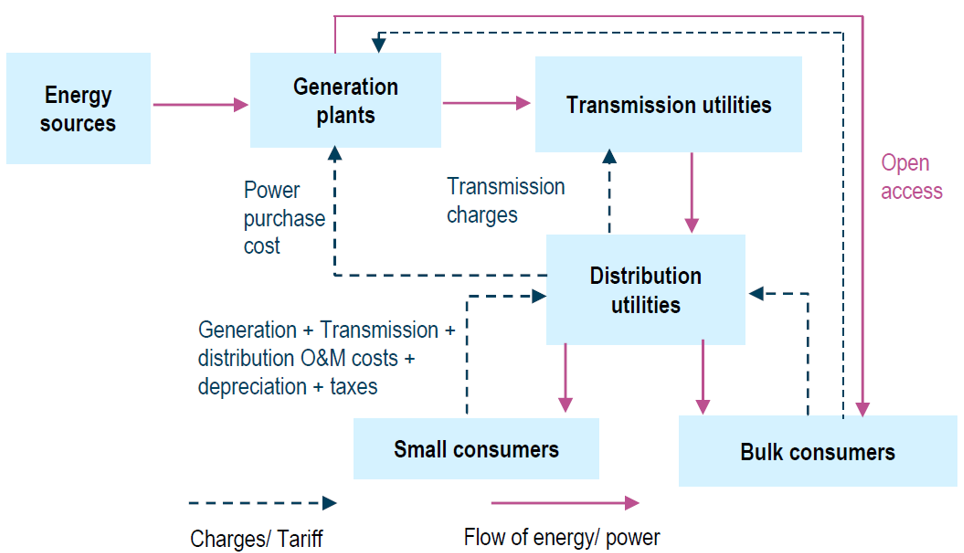

The following image provides a visual representation that enhances understanding of the flow of electric power, and money (Nature of transactions) among the three industries within the power segment: Generation, Transmission, and Distribution.

In the image you find mention of “Open Access”. What is this? The Electricity Act, 2003 allows for open access which enables consumers to buy power from any power-generating plant through non-discriminatory access to transmission and distribution lines.

End Consumers

The consumers in the power sector are categorized into six distinct groups. Here are the categories along with their respective percentages of electricity consumption, based on data from the financial year 2020-21.

- Agricultural – 17.5%,

- Commercial – 8.3%,

- Domestic – 25.7%,

- Industrial – 41.1%,

- Traction & Railways – 1.5%, and

- Others – 5.9%

Additional insights:

- DISCOMs serve a mixed customer base, each with unique voltage requirements, thereby ensuring their diverse energy needs are met.

- Sales of power to commercial and industrial consumers are often seen as more favorable compared to other consumer categories, given their larger proportion and impact on revenue generation.

Indian Scenario

- The states are entrusted with the responsibility of distributing and supplying power to both rural and urban consumers.

- Historically, the distribution of power has been monopolized by government-owned utilities, primarily under the jurisdiction of state governments, with limited involvement of the private sector.

- In India, the power distribution segment is primarily dominated by state-owned entities, with 28 state governments having control. However, there are a few private-owned distribution utilities that serve consumers in select urban areas of Maharashtra, West Bengal, Gujarat, Delhi, and Odisha.

While the power distribution industry is primarily owned by state governments with limited private sector participation, there are still a few listed entities involved in distribution activities. One notable example is the Calcutta Electric Supply Corporation (CESC), which operates four power generation plants and has its own Transmission & Distribution system to supply electricity to consumers. We will discuss these companies in the future blogs.

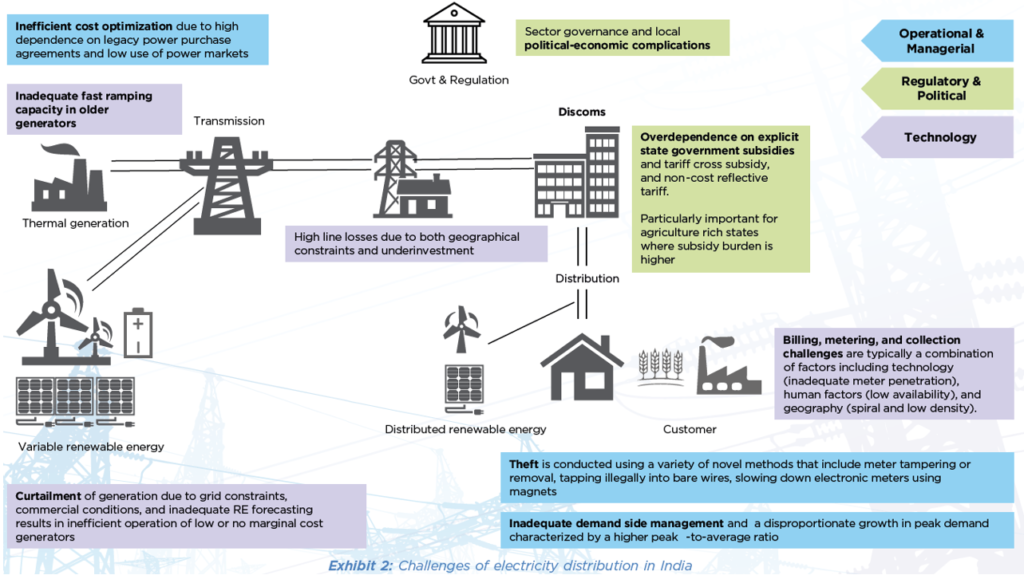

Challenges in Power Distribution

- Most DISCOMs incur losses and hence are not able to pay the power generators. This affects the power generation as they are unable to make investments for expanding the needed infrastructure.

- DISCOMS are locked into long-term, expensive power purchase agreements (PPAs).

Times are Changing

The power distribution sector is facing significant challenges, but there is an ongoing shift in the industry. The financial strain experienced by distribution utilities, which affects the sector and lenders, has led the government to implement various policies targeted at improving distribution. Active initiatives such as:

- Ujwal DISCOM Assurance Yojana (UDAY) focus on operational turnaround and debt restructuring,

- Deendayal Upadhyaya Gram Jyoti Yojana (DDUGJY) aims to ensure reliable power supply through feeder segregation.

- Integrated Power Development Scheme (IPDS) facilitates network upgrades and enhances auditing and billing systems.

In our upcoming blogs, we will explore these policies further and examine their implications.

Conclusion

It is evident that the Power Distribution industry is predominantly controlled by state governments, with limited involvement from the private sector. Even among private companies, pure distribution entities may be scarce, as power generation companies often have their own distribution arms. As a result, the Power Distribution industry may offer limited opportunities for equity investors. However, gaining a thorough understanding of the industry helps in analyzing the potential of companies operating within it. We hope this blog has provided you with valuable information and sparked your interest in exploring the dynamic realm of power distribution as an equity investor. Happy Investing.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.