In this blog, we delve into the lesser-known or less-discussed industries within the power sector: Power Financing, Power Trading, and Power Ancillary. While the traditional focus has been on Power Generation, Transmission, and Distribution, it’s important to recognize the vital role played by these additional industries. (Featured image reference: Privatization of India’s Power Sector – A New Opportunity)

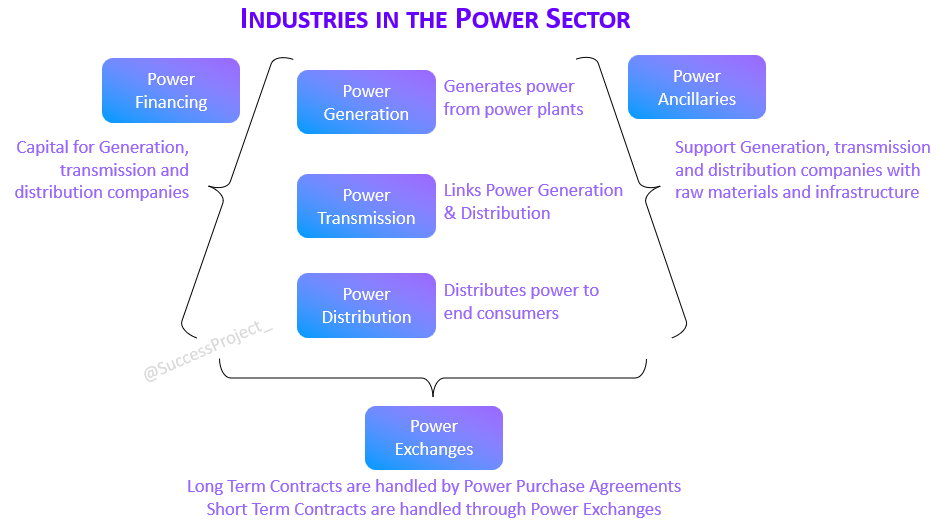

Here is an overview of all six industries in the power sector:

By understanding the interconnectedness of these industries, we gain a comprehensive perspective on the power sector.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

Power Finance Industry

What is this Industry about?

This industry comprises companies that specialize in lending to companies involved in Power Generation, Power Transmission, and Power Distribution. They are specialized Non-Banking Financial Companies (NBFCs) with a specific focus on financing power projects. These companies play a crucial role in providing financial assistance, loans, and other financial instruments to support the development, expansion, and modernization of power infrastructure in India.

Why is this Industry Crucial to Power Sector?

In the power sector, substantial capital investment is a necessity across power generation, transmission, and distribution. Companies within this sector heavily depend on financing for their initial investments. Consequently, the Power Finance industry assumes a pivotal role in meeting their financial needs. By serving as a crucial link between various stakeholders in the power sector, such as power generating companies, transmission companies, distribution companies, and renewable energy developers, these finance companies actively provide the necessary funding and support. Their contributions drive the growth and development of the power sector.

Notable Companies

There are three companies in this industry.

- Power Finance Corporation Limited (PFC)

- Rural Electrification Corporation Limited (REC)

- PTC India Financial Services (PFS)

These companies are PSU (Majorly owned by the Government). They play a vital role in providing financial assistance and acting as nodal agencies for various schemes such as Revamped Distribution Sector Scheme (RDSS), Ultra Mega Power Projects (UMPPs), and Integrated Power Development Scheme (IPDS).

In future blogs, we will delve into detailed discussions about these companies and their contributions to the power sector.

Power Ancilliary Industry

The term “Power Ancillary” may not be widely used, especially within the investor community. I have adopted this term by drawing inspiration from the concept of the Auto Ancillary Industry.

What is this Industry about?

The power ancillary industry plays a vital role in supporting power generation, transmission, and distribution companies. It provides essential materials, infrastructure, and specialized skills necessary for their operations. The key components of the power ancillary industry include:

- Raw materials

- Equipments

- Infrastructure

- Service

These components work together to ensure the smooth functioning of the power sector and contribute to its overall efficiency and growth.

Why is this Industry Crucial to Power Sector?

The power ancillary industry serves as a crucial lifeline for the power sector. While it may seem like an exaggeration, a closer examination reveals its vital importance. This industry supplies a wide range of essential components, including raw materials, equipment, infrastructure, and services.

These offerings are indispensable for the smooth functioning and growth of the power sector. Without the support of the power ancillary industry, the power sector would face significant challenges in meeting the demands of power generation, transmission, and distribution efficiently.

Raw Materials

- Natural gas & Coal: These are the fuel to fire the Thermal power plants.

- Coolants: In thermal and nuclear power plants, coolants such as water or specialized fluids are used to maintain proper temperature levels in the power generation process.

Equipment

The power sector needs many equipment for its operations:

- Transmission and distribution: Transformers, switch gears, circuit breakers, relays control systems etc

- Power Generation: Boilers in Thermal power generation to generate steam that run the turbine and Solar panels in solar power plants to convert sunlight into electricity

Infrastructure

Infrastructure plays a pivotal role in the smooth operations of the three key industries in the power sector: generation, transmission, and distribution.

- Power plant construction: Construction companies play a vital role in building power plants, structural development, installation of equipment, and commissioning.

- Transmission Line Construction: Construction firms specializing in transmission lines undertake the installation of high-voltage power lines, towers, and related infrastructure required for transmitting electricity over long distances.

- Substation Development: Substation construction companies are responsible for setting up substations that act as distribution hubs and voltage regulation points, ensuring reliable power supply to different regions.

Services

These could be in the form of special expertise or support functions like,

- Consultation: Consulting firms offer expertise in the development, design, and implementation of renewable energy projects, including solar, wind, and hydroelectric power.

- Drone Monitoring: Companies providing drone monitoring services utilize unmanned aerial vehicles to inspect and monitor transmission lines, identifying potential issues and facilitating proactive maintenance.

- Billing Systems and Customer Support: Service providers develop billing systems and customer support solutions for power distribution companies, facilitating accurate billing, metering, and addressing customer queries.

Notable Companies

There is a big list of companies in this industry. There are companies of all size. Below are a few companies.

Raw Materials

- Coal India Limited

- NLC Limited

Equipment Manufacturers, Infrastructure and Service Providers

There is a significant overlap in this space. Companies not only manufacture essential equipment but also contribute to the development of infrastructure. Hence we will see this as a single bucket.

- Schneider Electric

- ABB

- BHEL

- Siemens Limited

- CG Power and Industrial Solutions Limited

- Triveni Turbines

- Power Mech projects

- Voltamp Transformers Limited

- Viviana Power Tech Limited

- Energy Development company limited

- Kalpataru Projects International Limited

We will discuss more companies and their operations in the future blogs.

Power Trading Industry

What is this Industry about?

The Power Trading industry acts as a vital intermediary between Power Generators and Power Distribution companies or end users. In India, the power sales business can be classified into two segments:

- Long-Term Purchase: These transactions are facilitated through Power Purchase Agreements, which establish long-term contracts between power generators and buyers.

- Short-Term Purchase: These transactions are conducted through Power Exchanges, providing a platform for short-term power trading among various market participants.

Power Purchase Agreements

- In India, power is transacted largely through long term PPA entered between Power generating companies (Seller) and the Distribution utilities (Buyer)

- The contractual periods range from 20-25 years

- PPAs allow industrial buyers and project developers to enter into an agreement that allows the company to guarantee the cost for a longer period i.e. 20 to 25 years.

- The PPA has includes the price at which the electricity would be purchased, terms and conditions and termination clauses

- Advantage of PPA: Foreseeable cost of electricity over the contract term.

Short Term Trading

- A small portion is transacted through various short-term mechanisms

- The contract is of less than one-year period

- This happens through electricity transacted through inter-State Trading Licensees and directly by the Distribution Licensees, and Power exchanges

In the financial year 2021-22, around 95% of power generated in the country was transacted through the long-term PPA route and about 5% of the power was transacted through short-term trading mechanisms. (Reference: NPTC 2021-22 AR)

Power Exchanges

The Trading company brings together the sellers and buyers. Members of a power exchange are:

- Sellers: Independent power producers, captive power plants, state utilities

- Buyers: Industrial consumers and state utilities (DISCOMs)

Trade happens between these two members of the power exchange. The exchanges have the following products:

Day-Ahead-Market (DAM)

Power delivery occurs the next day after transactions is contracted.

Real Time Market (RTM)

This is introduced in June 2020 with the objective of providing a market mechanism to generating stations to sell their surplus power and opportunity to the DISCOMS to buy power to meet their contingent requirements. These markets bring together consumers and sellers just an hour before power delivery.

Term-Ahead-Market (TAM)

The power transfer schedule can vary from 3 hours later on the same day up to 11 days in the future. There are 4 types of contracts:

- Intraday: delivery within the same day (0400 to 2400 hours)

- Day ahead contingency: hourly contracts to substitute day-ahead markets for next-day delivery

- Daily

- Weekly

Green Day-Ahead Market

This segment provides auction in renewable energy. The segment was commenced on 26 October 2021. The Exchanges invites bids for conventional and renewable power generators.

Green Term-Ahead Market

This segment is for trading in delivery-based renewable energy. This was started on 21 August 2020. There are separate market segments for solar and non-solar based renewable power.

Notable Companies in India

The long term contracts (PPA) is handled by PTC India Limited (formerly known as Power Trading Corporation of India Limited). PTC India acts as an intermediary in the power market, facilitating the buying and selling of electricity between power generators and distribution companies.

The short term trading of power is handled by Power exchanges. In India there are three major power exchanges:

- Indian Energy Exchange

- Power Exchange India Limited

- Hindustan Power Exchange – This is backed by PTC India and BSE

Conclusion

In conclusion, the Power Finance, Power Ancillary, and Power Trading industries play significant roles in the overall power sector. These industries, although lesser-known, contribute immensely to the growth and sustainability of the power sector. As an investor, understanding their importance and dynamics can present unique opportunities. As the power sector continues to evolve, keeping an eye on these industries and staying informed about their developments can help investors navigate the ever-changing landscape.

Stay informed, explore the possibilities, and make informed decisions to harness the potential of these industries and contribute to the sustainable growth of the power sector. Happy investing!

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.