Holding companies,

Business with no business, Company holding one or many Companies!

My interest in these companies had there been for long. As I was writing my previous blog on Bajaj Holdings and Investment, I thought must write a separate blog on Holding companies. This incidentally coincided with SEBIs move on June 20, 24 to unlock value of Holding companies.

Unlike traditional manufacturing or service companies, holding companies operate by owning shares in other businesses. This unique structure offers numerous strategic advantages, such as risk mitigation, centralized control, and financial synergies. We will discuss these topics in detail.

Holding Companies - The Basics

What are Holding Companies?

- A holding company owns shares in other companies.

- It does not manufacture products, provide services, or engage in trading or any business activities.

- Instead, it holds stakes in one or more companies, called subsidiaries.

- Its primary purpose is to manage and control other companies, rather than to produce goods or services.

Note: The mention of “manage and control” has specific dimensions. If the holding company has a significant stake in a subsidiary, it plays a controlling role. However, if the stakes are smaller, these are considered investments, and the holding company takes on a managing role by overseeing these investments.

How Holding Companies make money?

If holding companies do not have operations of their own, then how do they earn? Holding companies make money in three main ways:

- Returns from Investments

- Interest from deposits/debt

- Dividends from equity

- Rent from real estate

- Providing relevant services to the owned companies

- Profits from buying and selling of investments.

Types of Holding Companies

There are two types of classifications: one based on the mode of operations and the other based on the hierarchy within the holding company.

Mode of Operations

Pure Holding Company

- It is formed for the sole purpose of owning stock in other companies.

- The company does not participate in any other business other than controlling one or more firms.

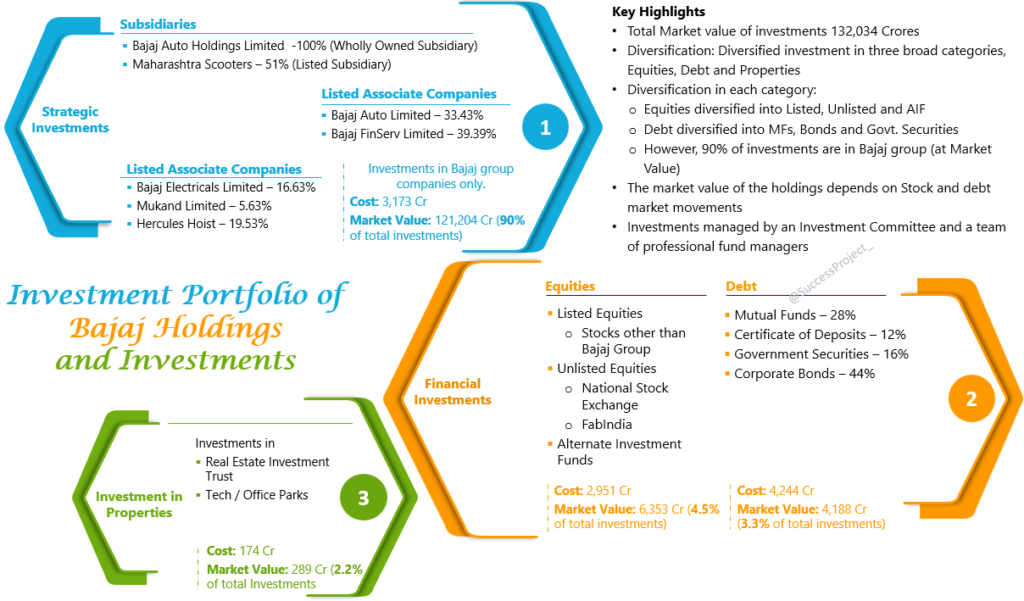

The best fitting example is Bajaj Holdings. It does not manufacture any products and has investments in other companies. It has three kinds of investments,

- Strategic Investments covering investments in various Bajaj group companies

- Financial Investments in various Equities (Listed, Unlisted and AIF) and Debt

- Investments in properties

Mixed Holding Company

- This company not only controls another firm but also engages in its own operations.

- It is also known as a Holding-Operating company.

Holding companies should not be confused with conglomerates, which operate multiple unrelated lines of business.

A prime example of this is the Bombay Burmah Trading Company. It serves as the holding company for Britannia Industries and Go Air while also operating its own businesses in tea production, coffee production, and auto electric components.

Hierarchy of the Holding Company

This classification depends on the position of the holding company in the ownership chain.

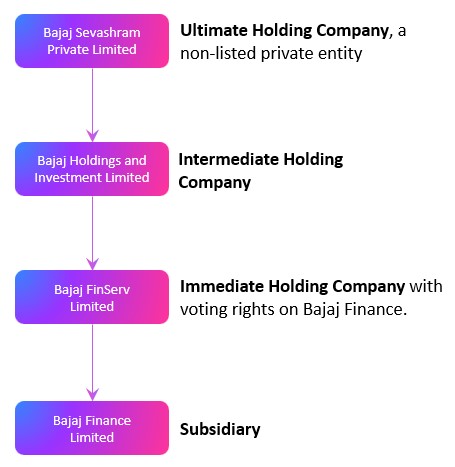

Immediate Holding Company

- This company retains voting stock or control its subsidiary while itself being a subsidiary of Intermediate Holding Company

- In simpler terms this holding company that is already a subsidiary of another.

Intermediate Holding Company

This company is both a holding company of another entity and a subsidiary of a larger corporation, which could either be the Ultimate Holding Company or another Intermediate Holding Company.

Ultimate Holding Company

- This is the topmost entity in the ownership chain

- It is not subsidiary to any other company and thus not controlled by other company.

I strongly request you to read my earlier blog Holding Pattern of MNC Parents. Not only the basics is covered in detail, but how this structure applies to MNC holdings.

Advantages of Holding Companies

Management Continuity

- Whenever a parent company acquires other subsidiaries, it almost always retains the management.

- This is an important factor for many owners of subsidiaries-to-be who are deciding whether to agree to the acquisition or not.

- The holding firm can choose not to be involved in the activities of the subsidiary except when it comes to strategic decisions and monitoring the subsidiary’s performance.

- That means that the managers of the subsidiary firm retain their previous roles and continue conducting business as usual.

- On the other hand, the holding company owner benefits financially without necessarily adding to their management duties.

Risk Mitigation

- By spreading investments across multiple subsidiaries, holding companies can mitigate risks.

- Losses in one subsidiary do not necessarily impact the holding company’s overall financial health.

Greater Control at Lesser Invesment

- Holding companies can gain controlling interests in other companies without significant investment.

- By purchasing 51% or more of a subsidiary, the holding company gains control without needing to buy 100%.

- This approach allows the holding company to control multiple entities with a relatively smaller total investment.

Independent Entities

- Each subsidiary under a holding company is considered an independent legal entity.

- If one subsidiary faces a lawsuit, the assets of other subsidiaries are protected and cannot be claimed by plaintiffs.

- Additionally, if the sued subsidiary acted independently, the parent company is unlikely to be held liable.

Strategic Flexibility

- Holding companies can easily restructure their portfolio by acquiring or divesting subsidiaries.

- This would help to pull out money from one investment and channelize the same on some high-demand/growth industry.

Conclusion

Despite their advantages, valuing a holding company is inherently complex due to factors like portfolio diversity, market fluctuations, and the inherent discount at which these companies trade. By understanding the unique characteristics and employing appropriate valuation methods, investors can better navigate the intricacies of holding companies. This shall be discussed in detail in my next blog.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.