This blog covers key insights about the frameworks of Saurabh Mukherjea. We will cover 4 main ideas from the books and interviews of Mr Saurabh Mukherjea. In a way, the ideas are very much interrelated.

Featured image credits: https://www.aajtak.in/education/story/inspiring-story-of-saurabh-mukherjea-285658-2015-01-07

Most contents of this blog is from his book and interview appearances. Saurabh Mukherjea has written 5 books.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

DISCLAIMER

- Most of the contents in this blog are from the books authored by Mr Saurabh Mukherjea and his interviews available in the public domain.

- Any stock mentions are only for the illustration of an idea. They are not any kind of recommendations.

Return on Capital Employed

In his books, Saurabh Mukherjea talks about building a Coffee Can Portfolio. This portfolio can be created using two filters.

- Revenue growth is min 10% every year for the last 10 years (Do not use CAGR, it must be year on year)

- ROCE > 15% for every single year for the last 10 years, where ROCE stands for Return on Capital Employed

What is ROCE?

- ROCE is a measure of the efficiency of capital deployment for a company.

- It is calculated as EBIT in the numerator and Capital Employed (Sum of debt and shareholder’s equity) in the denominator.

- Higher the ROCE, the better is the efficiency of capital deployment.

How much ROCE is good?

We just saw that the higher the ROCE, the better for a company. What shall be the minimum or a threshold value?

Saurabh Mukherjea puts this at 15% as being the bare minimum which is required to beat the cost of capital. An immediate question that would come up is “How was this 15% is arrived?”. He has arrived it as a sum of:

- The risk-free rate of 8% in India and

- The equity risk premium of 6 to 7%.

The equity risk premium is the additional return that an investor expects over and above the risk-free return rate for investing in equities.

What is the importance of ROCE?

A company deploys capital in assets to generate profits/cash. The total capital deployed combines both equity and debt.

A great company has to deliver a ROCE in excess of 15% for long periods of time. (Note the word, “…long periods of time”. So a ROCE of 15% for just 1 or 2 years is not sufficient. That is the reason why he suggests 15% ROCE for every single year for the last 10 years in the Coffee Can Portfolio.)

When ROCE is higher than Cost of capital (CoC), it adds value to shareholders.

High ROCE is not always good...

- The biggest drawback of high ROCE is that it attracts competitors.

- With more competition getting in the ROCE of the incumbents is driven low.

- That is where the competitive advantage of a company becomes important.

- This competitive advantage enables a company to outperform its competitors and thereby protect its ROCE.

- A mere competitive advantage is not sufficient, but it must be a sustainable one to ensure ROCE > CoC, for a long period of time. (Note here too the emphasis is on “…long period of time’. The company must have a sustainable competitive advantage that helps it to earn above CoC for many years.)

- A strong competitive advantage creates a barrier to entry and also protects its pricing power.

But this is not enough...

- A high ROCE with sustainable competitive advantage merely does not suffice to benefit the shareholders.

- This should be supported by high reinvestment opportunities in business.

- It should not be mere reinvestment opportunities but something that can also bring a return of ROCE > CoC

- This enables the company to deliver higher and more sustainable earnings in future when compared to companies with higher ROCE but not many reinvestment opportunities.

- Reinvestment in opportunities with ROCE < CoC makes little business sense.

To Sum Up

A company must have:

- Sustainable competitive advantage + High pricing power

- This leads to high ROCE (which is greater than CoC)

- Huge Reinvestment opportunities to deploy the cash flows due to high ROCE

- The reinvestment opportunities must also deliver high ROCE.

In this topic, we came across the main idea of sustainable competitive advantage. This leads us to the next topic.

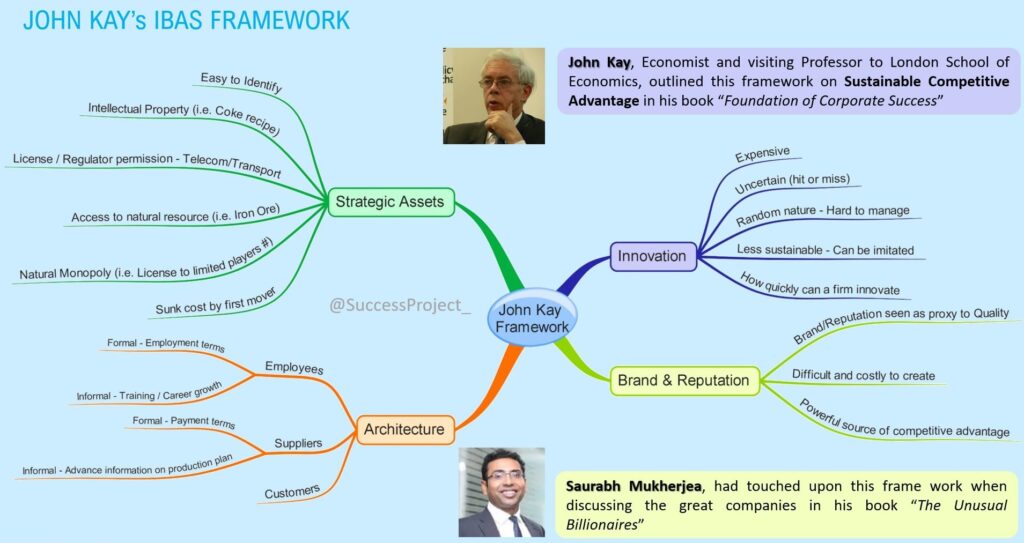

IBAS Framework

In the previous topic, it was repeatedly emphasized that the company must have a sustainable competitive advantage. How does it happen? The answer comes from the IBAS Framework.

The IBAS Framework covers 4 sources of Competitive advantage. Innovation, Brand and Reputation, Architecture and Strategic assets. Mr. John Kay, founder of London Economics introduced this framework. He states that sustainable competitive advantages come from two sources:

- Distinctive capabilities: This is intangible in nature. These are relationships that a company has with its customer, suppliers, or employees. This cannot be easily replicated by competitors. There are three key elements, Brand and Reputation, Architecture and Innovation.

- Strategic assets.

Let us see a bit of all these.

Innovation

It is a source of competitive advantage. But it has drawbacks,

- Innovation is expensive

- It is uncertain – It may not give the expected outcomes or impact

- Innovation is more random in nature

- Innovations can be easily copied.

Brand and Reputation

Customers use the strength of the company’s reputation as a proxy for the quality of its product/service. This is a powerful source of competitive advantage. However it is difficulty and costly to create this. It also takes times to build a brand.

Architecture

It is the contract network (formal and informal) with its employees, suppliers, and customers. The term “formal and informal” is to be seen as. The firm’s legal obligation to pay its suppliers on time is a formal requirement. The informal obligation is to help the customers improve their quality or strengthen their logistics, distribution networks etc.

Strategic Assets

This can take different avatars like

Intellectual property like patents or proprietary know-how

- Licenses and regulatory permission

- Access to natural resources as in the case of mining companies

- Natural monopolies that can accommodate only 1 or 2 companies. In a city, there can be only 2 or 3 power companies.

- Wide geographic spread of the supply chain network

- Deep-rooted relations with dealers in the industry

Below is a simple mind map with these ideas.

The above ideas might seem to be very theoretical or academic in nature. Saurabh Mukherjea has covered these dimensions and the IBAS framework in-depth for a few companies in his book. You can find a more practical hands-on in his book “The Unusual Billionaires”.

Free Cash Flow

This idea is closely related to the ROCE and CoC.

The gap or the difference between the ROCE and CoC is the key determinant of Free Cash Flow (FCF) generation for any business. If the company has a ROCE of 45% and assumes CoC is 15%. The difference is 30% of capital employed is annual FCF.

What is it importance?

A business with high ROCE generates a huge amount of cash. It is very crucial that this cash be made as capital for future business growth. Also, this must be invested in opportunities that can earn high ROCE.

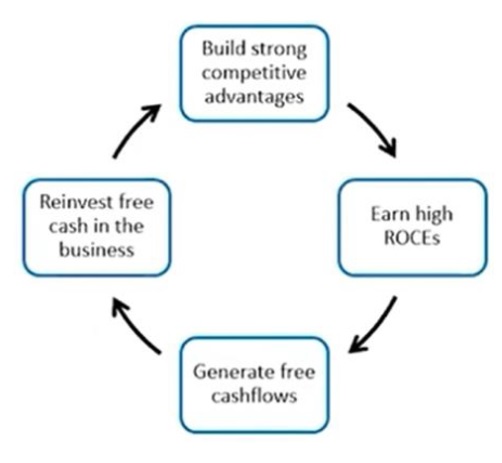

When a company is consistently able to reinvest the surplus cash flow which can earn at a rate higher than that CoC, it reflects on the (1) Competitive advantage of the company (2) Management’s ability to redeploy surplus capital with success. Basically, it reflects on the success of execution. The main objective of the management should be to keep the cycle going as in the below image.

Note: The image is from a presentation used by Saurabh Mukherjea.

It may not go on for ever...

However good and big is the opportunity, at some point in time, the amount of FCF generated will far exceed the available investible opportunities. Investing in opportunities where ROCE < CoC is not a sensible use of Free Cash Flow. In such situations, the company may not be able to redeploy the FCF generated. The company then payback this FCF to shareholders in the form of dividends or buybacks.

FCF and Company Lifecycle

The generation of FCF is closely related to the business lifecycle.

Nascent Stage

- No company can generate +ve FCF from day 1

- At this stage, cost is involved in building a brand, expanding the network, research & development etc

- There is no operating profit at this stage

- The company goes for high reinvestment along with borrowing and hence FCF is negative

- Many companies are stuck in this stage due to business model or poor execution or management integrity

- A small set of companies cross this stage and move to the next stage

Growth Stage

- These companies have some competitive advantage and there is some traction for their product

- The operation profit starts growing, but it is still low

- For growth the companies need to invest in building factories

- ROCE will be good, but FCF will still be patchy (A mix of +ve and -ve ROCE)

- At one stage the companies break the threshold of FCF generation

- The operating profit crosses a level that makes up for working capital and Capex requirement – This is the sweet spot for investing.

The company subsequently moves to mature and decline stage.

Note: The contents in this heading “FCF and Company Lifecycle” is from a Webinar titled “How Rising Giants drive acceleration in compounding“. You may watch from 1:46:18 onwards)

Monopolist

Saurabh Mukherjea talks about this idea in a Speech at MOCA. This is again closely related to the idea of ROCE that we discussed earlier.

For every single product that is essential for daily life in India, either 1 or 2 company account for 85% of profits generated from that product. A few to name are,

- Biscuits: Britannia dominates the high end, and Parle dominates low end. These two companies account 85% of the biscuit market.

- Cooking oil: Marico

- Hair oil: Marico and Bajaj Corp

- Paints: Asian paints and Berger.

There are several industries with two-player monopolies in our country. More fascinating, there are one-player monopolies, where the one-player nets the entire sector profits. E.g. cigarettes, Baby milk powder, adhesives, etc.

There are around 25 monopolists, whose average ROCE is 45%. These 25 companies can be seen as a special breed. This is because many companies in Nifty 50 cannot generate ROCE > Cost of Capital (CoC), even once in 10 years. But on the other hand, these 25 companies generate 45% ROCE every year.

Hope you found this blog useful. Do share any additional resources you have in the comments section. Kindly share my blogs with your friends, peers and fellow investors.