Mr. Raamdeo Agrawal has offered numerous insights and advice to retail investors, empowering them to navigate the stock market with confidence. In this blog, we will explore some of his key advice for retail investors and demonstrate how they can apply it to their investment journey.

I will share the links to my earlier blogs covering wisdom by Mr. Raamdeo Agrawal in the appropriate place. It may be necessary for you to read them for better understanding.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

DISCLAIMER

- Most of the contents in this blog are from the interviews by Mr Raamdeo Agrawal and Wealth Creation Studies report available public domain.

- Any stock mentions are only for the illustration of an idea. They are not any kind of recommendations.

When investors get a stock idea, they usually start by analyzing the price. However, it is important for them to shift their focus from price to value. Ultimately, price will follow value. Price represents what an investor pays for a stock, while value represents what a stock provides to the investor. Despite this, the world is often preoccupied with the price of a stock and only a few investors can truly focus on value.

Source: Source: How to Invest in Equities, Part – 1 (Power of Focus)

For more on this topic, please refer to my earlier blog, Raamdeology: Investment Wisdom from Raamdeo Agrawal – Part 3.

Know your Business & Company

Investors should deeply understand the company they invest in and its business. For a moment it may sound that Business and Company are the same. No there are not.

For instance, to invest in a company in the airline industry, investors should understand both the airline industry as a whole and a specific stock such as Southwest Airlines. Understanding the airline industry is understanding the business, while understanding Southwest Airlines is understanding the company.

Business

Understanding the business is crucial, and it can be categorized as Good, Great, or Gruesome. The focus should be on having Good and Great businesses in the portfolio while avoiding Gruesome ones. The understanding of the business should include aspects such as the moat, pricing power, and the returns it can generate.

I my earlier blog, Raamdeology: Investment Wisdom from Raamdeo Agrawal – Part, I have covered this three categoriziation in detail. You need to read it for better understanding.

Company

Similarly, understanding the company should be to the extent that investors know enough about it after the management. This includes aspects such as market share, customer satisfaction, cost structure, competitors etc.

Know your Management

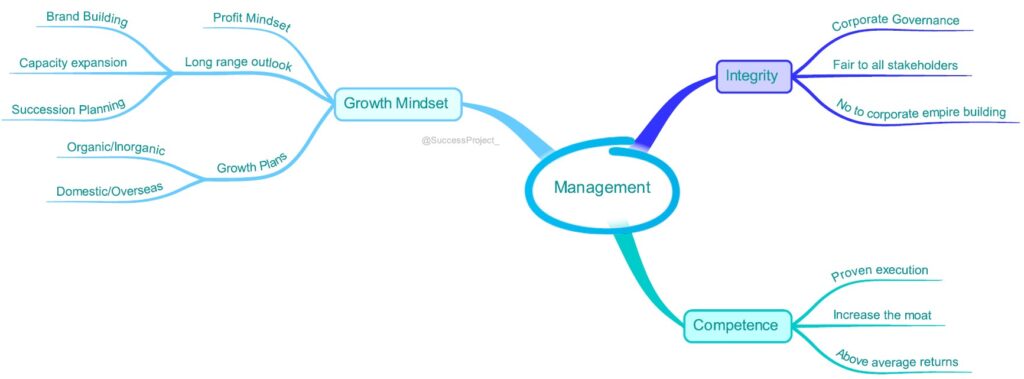

Mr. Raamdeo Agrawal frequently emphasizes that management is a single factor that can ‘Make’ or ‘Mar’ (Destroy) the fortunes of a company. The importance of having the right management cannot be overstated, even if the company has a great or good business. Management must possess three essential dimensions, which are:

- Integrity

- Competence and

- Passion / Growth – Profit mindset

Two traps that investors come across are

- Good Business – Bad Management

- Bad business – Good Management

Either of them is of little use. Both should be good. Request the readers to read my earlier blog, Raamdeology, Investment Wisdom from Raamdeo Agrawal – 2, fully dedicated to Mr. Raamdeo Agrawal’s view on Management. It deep dives into the above three qualities in detail.

In a business monopoly, a mediocre management may suffice since customers have no other options but to buy the company’s products. However, in a competitive environment, top-quality managements are necessary. The more competition there is, the more crucial good management becomes.

QGLP Framework

Mr. Raamdeo Agrawal stresses the importance of the QGLP framework, which includes Quality (Both Business and Management), Growth, Longevity, and Price, during his media appearances and Wealth Creation Studies. He emphasizes that these factors should be considered in a particular order, and investors should not overlook QGL while focusing on price. The QGLP Checklist, which is included in the 2020 Wealth Creation Studies, provides a comprehensive guide to this framework, and it is recommended that readers download and study it.

Furthermore, for a deeper understanding of the QGLP framework, readers can refer to my previous blog post, Raamdeology, QGLP by Raamdeo Agrawal. This post collects ideas and insights from various interviews with Mr. Raamdeo Agrawal.

In my opinion, it’s essential for every investor to establish a framework that outlines the boundaries of their investments, such as limiting investments to profitable companies with low debt. This type of framework can provide clarity and structure to the decision-making process. Although investors can create their own framework, the QGLP framework has evolved over the years and is readily available, and can be tailored to meet their specific needs. Therefore, there is no need to reinvent the wheel.

Bi Pole 'Q's - Quantitative and Qualitative

Investing is a complex process that involves both art and science. It cannot be easily reduced to a set of formulas or logics that yield simple ‘Yes/No’, ‘Invest/Avoid’, or ‘Buy/Sell’ answers. In addition to quantitative factors, such as financial metrics and market trends, qualitative factors also play a crucial role in investment decisions. The extent to which investors consider these factors depends largely on their level of knowledge and experience. Below are some examples of both qualitative and quantitative factors to consider when making investment decisions.

Quantitative

- ROE is a good starting point

- RoE, RoCE on quarterly basis available (The minimum cut off is 15%)

- If a company makes more than 20% then you need to understand that there is something going on there.

- RoE should not be fluctuating

- Check how fast the company can collect money (Note: If there is less than 30 days collection period sustained over a period of time, then it means that the company is a franchise.)

- If the company makes profit, is it because of the industry or any specific advantage

- Check the OCF/FCF

Qualitative

- Large profit pool

- Size of opportunity

- Competitive landscape

- Management Quality

- Growth and Longevity of Growth

- Favorable demand supply

As a general rule, good quality is normally reflected in healthy RoE.

Reference: Interview by Raamdeo Agrawal, HOW TO INVEST IN EQUITIES – SERIES 3: POWER OF QUALITY.

Pointers for Retail Investors

Financial Statements

- To assess a company’s performance, it is recommended to analyze its financial statements from the last 10 years.

- This will provide an impression of how the company has conducted itself and whether it possesses any unique selling proposition or advantage.

- It is important to ensure that such advantages are reflected in the company’s return on capital.

- For instance, if a company is earning 30% year on year, it is a clear indication that they must be doing something unusual.

- Check other metrics like “Receivable days”, OCF and FCF.

Build knowledge of the company & its operations

- What it produces?

- What are its raw materials?

- What is their market share?

- What is its cost structure

- Competition – How would the competition be? are the competitors Chinese?

- Size of the opportunity

- Is it a growing of shrinking opportunity?

- Is it a global or local opportunity?

- If the business is going to be bigger and larger? (It is making 10 Crore revenue today, can it make 100 Crore revenue in 10 years?)

Stories and Numbers

Behind every stock/business, there is a story that reveals the investing theme and predicts future profitability. However, many stocks have fancy stories that may not be reliable. To avoid falling for such stories, investors need to validate the numbers behind them. The story and numbers must match for a reliable investment.

For instance, Maruti has 50-60% of the Indian market share, with the next two and third players having 10-12%. With India’s high demand for cars, the growth market for cars in India is undeniable. This is the story, but the numbers must also match. While a story may be fantastic, it will not suffice without adequate numbers. Market is ultimately a slave to numbers. Investors often fall into the trap of stories that are not adequately backed by numbers.

Key question that an investor must ask to themself is

- Every story is right. But will it make money?

- How long can this story go? 5 years or 10 years?

Future Projection

Finally, project the company’s value for the next 3, 4, or 10 years and base it on the projection. Consider if the company will reach a valuation of one lakh crore by that time. Then, assess if the company is currently available for 2000-3000 crores or 10000 crores.

Snippets by Raamdeo Agrawal

Raamdeo Agrawal has shared the following bits of wisdom in various media appearances for investors to ponder and reflect on their deep inner meaning.

- Investing means sacrificing current consumption for future consumption and enhances the purchasing power of savings.

- The biggest challenge for Indian investors is to first preserve their capital and then make a profit.

- Have faith in the country’s future and the company’s management. (Note: This is not applicable for every management, but only to

- Investors only make as much money as the company makes.

- An investor requires vision to make a purchase, courage to invest, and patience to hold. However, patience is the rarest virtue.

- Invest confidently and avoid making decisions based on fear.

- Avoid investing in anything that makes you uncomfortable.

- The purchase price ultimately determines the return.

- The timing of the purchase is not as important as what was purchased and how long it is held.

- Companies cannot make money by the hour, but traders want to. Ultimately, stockbrokers only make money by the hour.

- High-quality companies at a reasonable price are rare opportunity.

- When purchased at the right price, have patience.

- No one knows which stocks will be the next 100X.

- Corrections and deep corrections are part of the investment journey.

- Investment returns have four phases: very high, very low, no, and negative. Expect a mix of all four during the investment journey, not just high returns.

In conclusion, Raamdeo Agrawal’s wisdom for retail investors emphasizes the importance of having a long-term perspective, focusing on quality businesses with sustainable growth, and having a disciplined approach to investing. By following these principles, investors can increase their chances of success in investing. It is crucial for retail investors to have a framework and avoid making impulsive decisions based on short-term market fluctuations.

In the next blog will cover the different resources of Mr. Raamdeo Agrawal.

Hope you found this blog useful. Do share any additional resources you have in the comments section. Kindly share my blogs with your friends, peers and fellow investors.