In the last blog we discussed the learnings from Raamdeo Agrawal about Great, Good and Gruesome Business.

In his book Paths to Wealth Through Common Stocks, investment guru Philip Fisher writes, “In evaluating a common stock, the management is 90 per cent, the industry is 9 per cent, and all other factors are 1 per cent.”

Hence getting the management right is the first and critical step. Let us see the insights that Mr. Raamdeo Agrawal has shared in his interviews and wealth creation studies on the analysis of management.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

DISCLAIMER

- Most of the contents in this blog are from the interviews by Mr Raamdeo Agrawal and Wealth Creation Studies report available public domain.

- Any stock mentions are only for the illustration of an idea. They are not any kind of recommendations.

How Important is Management Quality?

In the previous blog, we discussed the three types of businesses: Great, Good, and Gruesome. It is imperative to own a Great or Good business. However, that does not mean investors should ignore bad management. Instead, investors should prioritize Great/Good businesses run by Good Management.

Good business run by a bad management is of no use. Vice versa is also true. Consider this equation 10 x 0 = 0 and 0 x10 =0. Same holds good here. Good business and good management equates to 10×10 = 100 baggers.

Key to successful investing is knowing about the business or management that others don’t. While the business is known to everyone, the competence of management is the biggest unknown.

However, identifying management quality is not easy. It is an art which requires experience and learning from past mistakes.

Putting it altogether

Investors give utmost importance to honesty/integrity as the primary factor for evaluating management quality. Although it is crucial, integrity alone cannot suffice without the other two qualities – competence and growth mindset. For instance, a management team with high integrity but lacking competence may result in unsuccessful execution and losing to competitors, ultimately affecting investment prospects.

In addition, investors must re-evaluate these factors whenever there is a change in management.

What forms the Management Quality

Assessing management quality is more of an art than science as all three dimensions are subjective and non-quantifiable. We will explore these three dimensions and a few indicators that can help investors assess management quality.

Note: The below ideas are from the interviews of Raamdeo Agrawal and 2020 Wealth Creation Studies.

Integrity

The integrity should be unquestionable. Raamdeo Agrawal often gives the example of hiring a car driver when discussing the dimensions of management quality. For instance, he asks, “Would you hire a driver who defaults on the fuel bill by taking Rs.5000 from you and loading petrol only for Rs.4500?“. Same goes for company management.

A few indicators are:

- Impeccable track record of corporate governance, fully respecting the law of the land

- Concern for all stakeholders (and not only the majority shareholders). Other stakeholders include customers, employees, debt-holders, government, community, and minority shareholders

- Paying full tax and a well-articulated dividend policy are key favourable indicators of management integrity

- Corporate empire-building to the detriment of minority shareholders is a negative indicator

Competence

The management team should have demonstratable competence. Although anyone can obtain a banking or insurance license, the ability to make the most of it requires competence. Extending it to the case of a driver, it is essential to look for someone who is good at driving, rather than a bad driver who may fall asleep at the wheel. If we choose a competent driver, we can relax during the journey; otherwise, we need to remain alert to ensure the driver does not sleep. This analogy applies to management as well.

A few indicators are:

- Excellence in strategic planning and execution

- This should mainly reflect in the company enjoying a sustainable competitive advantage over its peers, reflecting by way of above-average return on capital (RoE, RoCE)

- “Keeping the growth going” is yet another key indicator of management competence

Growth and Profit Mindset

The management must have passion for growth of the company and the work they do. Back to the same driver example. Consider a driver who has no interest in driving and only works to receive their paycheck. This stands in stark contrast to a driver who loves and enjoys driving, prioritizing their passion over their paycheck.

A few indicators are:

- Long-range profit outlook, i.e. ensuring sufficient resources go into long-term issues like product development, brand building, capacity creation/expansion, succession planning, etc.

- Efficient capital allocation including decisions like organic or inorganic growth, same-franchise or diversified growth, domestic or overseas growth, etc.

- Persisting with growth plans despite temporary setbacks.

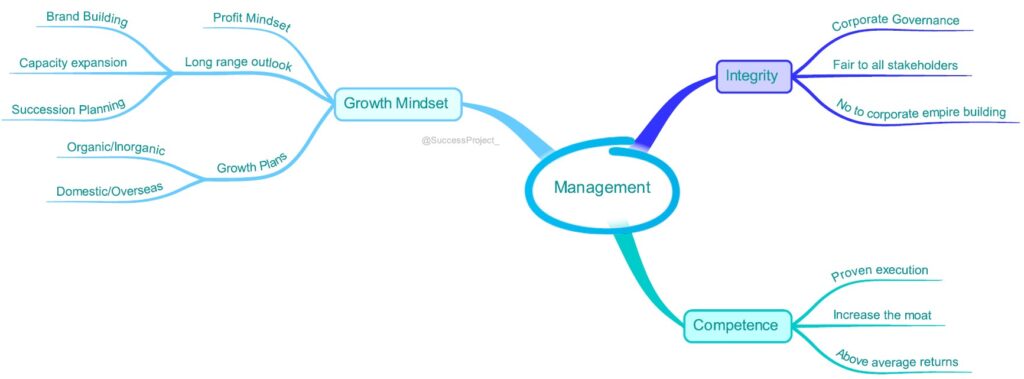

The idea are captured in the Mind Map below.

Putting it altogether

Investors give utmost importance to honesty/integrity as the primary factor for evaluating management quality. Although it is crucial, integrity alone cannot suffice without the other two qualities – competence and growth mindset. For instance, a management team with high integrity but lacking competence may result in unsuccessful execution and losing to competitors, ultimately affecting investment prospects.

In addition, investors must re-evaluate these factors whenever there is a change in management.

In the next blog will share insights from Mr. Raamdeo Agrawal on Price-Value and Value Migration.

Hope you found this blog useful. Do share any additional resources you have in the comments section. Kindly share my blogs with your friends, peers and fellow investors.