Raamdeo Agrawal, the co-founder of Motilal Oswal Financial Services (MOSL) and author of “The Art of Wealth Creation,” is a respected figure in the world of investing. Through his interviews, media appearances, and annual WEALTH CREATION STUDIES, he shares valuable insights and expertise.

In this blog, we will delve into two of Agrawal’s key concepts: diversification and the classification of companies into Great, Good, and Gruesome categories. By understanding these concepts, investors can make better decisions and achieve long-term success.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

DISCLAIMER

- Most of the contents in this blog are from the interviews by Mr Raamdeo Agrawal and Wealth Creation Studies report available public domain.

- Any stock mentions are only for the illustration of an idea. They are not any kind of recommendations.

Diversification

What is Diversification

It is a strategy that aims to hold a reasonable number of stocks across various sectors to ensure that any unexpected adverse events in a stock or sector do not affect the portfolio’s performance.

What Investing Legends say

Philip Fisher

buying a company without sufficient knowledge of it may be even more dangerous than having inadequate diversification.

Warren Buffett

Diversification serves as a protection against ignorance. It you want to make sure that nothing bad happens to you relative to the market, you should own everything. There is nothing wrong with that. It’s a perfectly sound approach for somebody who doesn’t know how to analyze businesses.

His own Experience

Raamdeo Agrawal had a portfolio of 225 stocks worth 10 crores when he started investing in 1995. He tracked these stocks in an Excel file with four sheets. However, after completing review of two sheets, he became mentally tired and did not review the remaining two sheets.

One Key Lesson: More the number of stocks, the more of your time and Energy is needed.

Advice to Retail Investors

Raamdeo Agrawal suggests that individual investors should hold a maximum of 5 stocks in their portfolio, regardless of its size. Diversification with 15 stocks achieves 92% of the desired diversification, and holding any more stocks only provides marginal benefits.

Great, Good and Gruesome

The concept of classifying businesses as Great, Good, and Gruesome was first introduced in the Berkshire Hathaway Annual Report of 2007 (Page 6-7). In his interview, Power of Focus, Raamdeo Agrawal also discusses this idea in his interview Power of Focus. Let me take you through the summary from the interview.

Business is primarily intended to make money and functions as a cash flow machine. The combination of capital provided by outsiders and entrepreneurship from management enables businesses to seize opportunities and generate profits. Depending on their performance, businesses can be classified:

- Great or Good companies if they succeed or

- Gruesome companies if they fail.

To begin investing, it is essential to identify whether a company belongs to the Great, Good or Gruesome category, rather than focusing on the price. Starting with the price is often the root of investment problems. By understanding this classification, investors can make better decisions.

Business Classification

Mr. Raamdeo Agrawal has often spoken about this idea in the Indian context in many of his media appearances. However, the 25th Wealth Creation Study shared in 2020 provides a structured framework for this idea. The report is the source of content for this section.

What would be a proper definition of this three category of companies?

Buffett equates the Great, the Good and the Gruesome companies to three types of bank savings accounts, where the interest rate is RoE. He says, “Think of three types of savings accounts.

- The Great one pays an extraordinarily high interest rate that will rise as the years pass.

- The Good one pays an attractive rate of interest that will be earned also on deposits that are added.

- The Gruesome account both pays an inadequate interest rate and requires you to keep adding money at those disappointing returns.”

Great Business

- A truly Great company is characterized by a long-term competitive advantage or “enduring moat” that leads to excellent returns on invested capital.

- Such a competitive advantage can stem from (1) a powerful brand or (2) the ability to be a low-cost producer.

- Although Great companies tend to grow at a slower pace than Good and Gruesome companies, they do so with minimal additional capital.

- Consequently, these companies are almost self-sufficient and require little or no additional capital.

Over time, Great companies become significant cash machines with high RoE and dividend payouts.

Good Business

- These businesses grow at a healthy rate, but they require large increases in capital to sustain their growth,

- Similar to Great companies they also have a competitive advantage and earn healthy profits.

- However, they need to reinvest a significant proportion of these profits to maintain their growth.

- This phenomenon, called the “put-up-more-to-earn-more,” is true of most companies in different countries according to Buffett.

- Compared to Great companies, these companies will have lower return ratios and dividend payouts.

However, only 10% of the companies listed on Indian exchanges, which amounts to approximately 400-500 companies, can be classified as Great and Good companies.

Gruesome Companies

- A high growth rate is enjoyed by them, which is a trap.

- Such growth requires significant capital, and then little or no money is earned.

- This category is where almost 90% of the companies fall.

Buffett says, “Think airlines. Here a durable competitive advantage has proven elusive since the days of the Wright brothers … The airline industry’s demand for capital ever since that first flight has been insatiable. Investors have poured money into a bottomless pit, attracted by growth when they should have been repelled by it.”

Investors fall into the trap of high growth rates, causing such companies to enter their portfolio.

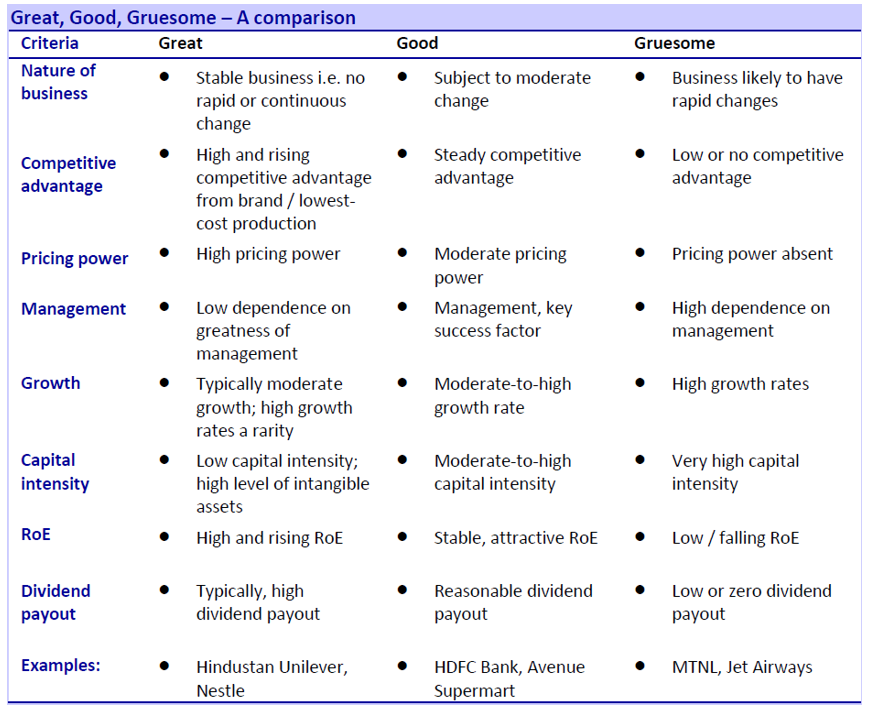

Characteristics of Great, Good and Gruesome companies

Image source: MOSL 25th Wealth Creation Study shared in 2020.

Investors must focus to avoid Gruesome companies entering their portfolio while focusing on Great and Good companies.

In the next blog will share the insights of Mr. Raamdeo Agrawal on Management Quality.

Hope you found this blog useful. Do share any additional resources you have in the comments section. Kindly share my blogs with your friends, peers and fellow investors.

Recommend best companies to invest for long term

Hi Suresh, Thanks for your message. I do not recommend any stocks. Every idea in stock investing is subjective. Say “What qualifies as best company?”, “How long is long term?” and so on. My intention of blog is to share my approach which has worked well for me over the years. I wish that readers pick this approach (If it resonates within them) and try using it for “their reality”. Good luck.