In this blog we will be discussing two more powerful ideas in investing put forward by Raamdeo Agrawal. We will delve into the concepts of “Price Vs Value” and “Value Migration”.

- Understanding the difference between price and value is crucial in investing as it can help investors identify undervalued stocks and make informed investment decisions.

- On the other hand, value migration is a powerful management concept that enables investors to identify companies that are gaining value and those that are losing value, and make informed investment decisions accordingly.

Featured image credits: https://moneyexcel.com/raamdeo-agrawal-success-story/

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

DISCLAIMER

- Most of the contents in this blog are from the interviews by Mr Raamdeo Agrawal and Wealth Creation Studies report available public domain.

- Any stock mentions are only for the illustration of an idea. They are not any kind of recommendations.

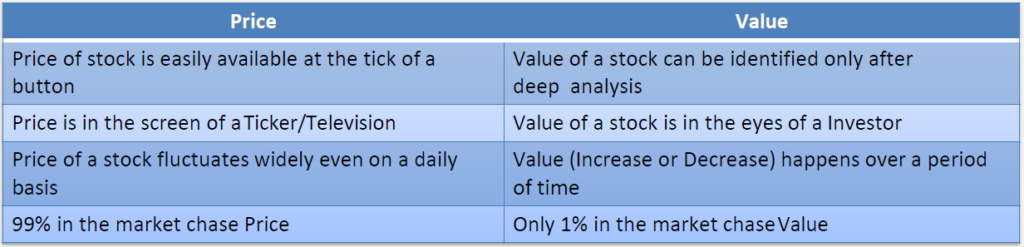

Price

- The price of a stock is widely accessible to everyone through various channels, including business news and online indices.

- It is highly dynamic and can change rapidly, even within seconds.

- This price is a fixed number at a given point of time.

Value

- In contrast, the true value of a stock is not overtly indicated but is rather a subjective perception by an investor. As a result, even the two best investors can have different valuations for the same stock. Although the price of a stock is publicly available to everyone, the true value of a stock is only known to those who have conducted thorough research and analysis.

- The value of a stock does not fluctuate dynamically but rather changes over time.

- While price is a fixed number, value is not a static figure but rather a range. Furthermore, this range varies as the business expands and evolves.

Below is the tabulation of the key differences.

What should Investors do?

A popular saying goes, “Price is what you pay, and value is what you get.” The stock market is a place where you can find a 1-rupee stock selling for 10 rupees and vice versa. However, the opportunity to purchase a 10-rupee stock for 1 rupee exists only if you have determined the true value of a stock to be 10-rupee.

Thus, investors must shift their focus from price to value, as the change in price reflects the change in value. Unfortunately, most people concentrate on price, neglecting the importance of value. This provides a significant advantage to the 1% of long-term retail investors who understand the value of a stock. To assess the value of a stock, the first step is to evaluate the quality of the underlying business and management, rather than solely fixating on the current price.

Value Migration

Background

- Value migration, a concept introduced in the 1990s by Adrian Slyworzky in his book “Value Migration”, remains relevant and applicable today.

- The phenomenon occurs globally and across various industries, leading to the emergence of new businesses and companies.

- Investors can harness the power of this management concept to make informed investment decisions by identifying companies that are gaining or losing value.

Brief Academic Information on Value Migration

I have provided a brief summary to help readers better understand this blog. I urge readers to watch the 45-minute video by Adrian J Slywotzky for a more comprehensive understanding of the topic. This video is a strong recommendation by Mr. Raamdeo Agrawal.

Definition

“Value migrates from outmoded business designs to new ones that are better able to satisfy customers’ most important priorities.” – Adrian J Slywotzky

Types of Value Migration

It has two broad varieties –

- Global Value Migration

- IT and Healthcare sectors migrating to India

- Manufacturing migrating to China

- Domestic Value Migration

- Wired to wireless telephones

- PSU to Private banks

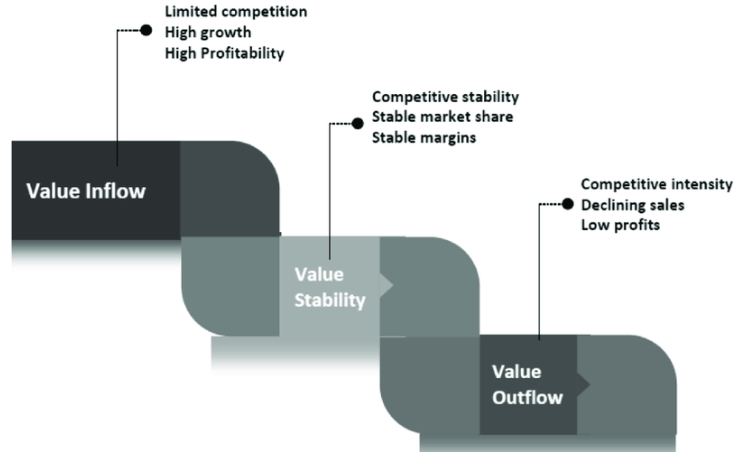

Three stages in Value Migration

- Value Inflow phase: The company captures value from an old, outdated business model, which results in an improvement of profits.

- Migration phase: The growth of profit becomes stable.

- Value outflow phase: The value migrates to a new, updated business model, resulting in a situation where profits cease to grow.

Insights from Raamdeo Agrawal

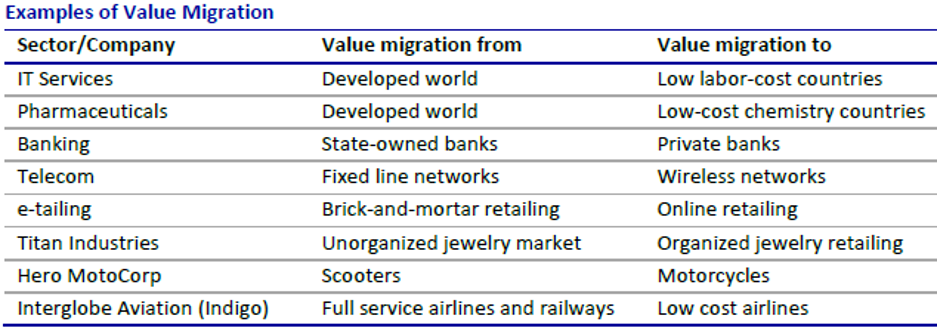

Value migration is a prominent theme in India, and it has brought about significant progress in the country. The world’s most massive migration is in the IT sector, which he captions as “Boston to Bangalore”. Moreover, India is at the forefront of generic production. The driving force behind migration is the need for better margins, and there is no reason to outsource if Bangalore and Boston’s margins are the same. Currently, the financial sector is experiencing this migration, with state-owned banks making way for NBFC and private sector banks. This transition presents a vast opportunity for the coming decade.

Below are a few examples (Source: MOSL Wealth Creation Studies)

Investors can detect value migration through:

- Market share movement

- Innovation and leadership

- Customer satisfaction score

Identifying value migration early can lead to significant profits for investors. The next biggest opportunity could be from Internal Combustion Engines to Electric Engines.

To Sum Up…

The concepts of Price vs Value and Value Migration are essential for investors to understand and apply. By focusing on value rather than price and recognizing the ongoing process of value migration, investors can stay ahead of the curve. In the next blog, will discuss the QGLP Methodology by Raamdeo Agrawal.

Hope you found this blog useful. Do share any additional resources you have in the comments section. Kindly share my blogs with your friends, peers and fellow investors.