In this blog, we will explore the different health insurance documents, understand the details they contain, and recognize their importance. By comprehending the significance of each document, you will be equipped to choose the right insurance policy that suits your needs. (Featured image: Photo by RODNAE Productions)

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index for all my blogs.

Different Health Insurance Documents

There are many health insurance documents that you would need to refer to before you decide on buying a policy. The most common documents are:

- Brochure

- Prospectus

- Policy Wordings

- Customer Information Sheet

- Proposal Form

- Claim Form

Note: These forms may have slightly different terms as used by different companies.

Where to get these health insurance documents

You can find these documents in the “Download” section of the health insurance company website.

If you cannot locate them easily, you can search the internet for “Insurance company name + documents download.” This search will provide you with the web page or download page where you can access these documents.

Below is a sample screen of a search, which gives links to the download page for obtaining these documents.

Below is the image from the “Download” page.

What do these Health Insurance Documents contain?

Each of these documents contains different information and is meant for different purposes. We will see what each document contains.

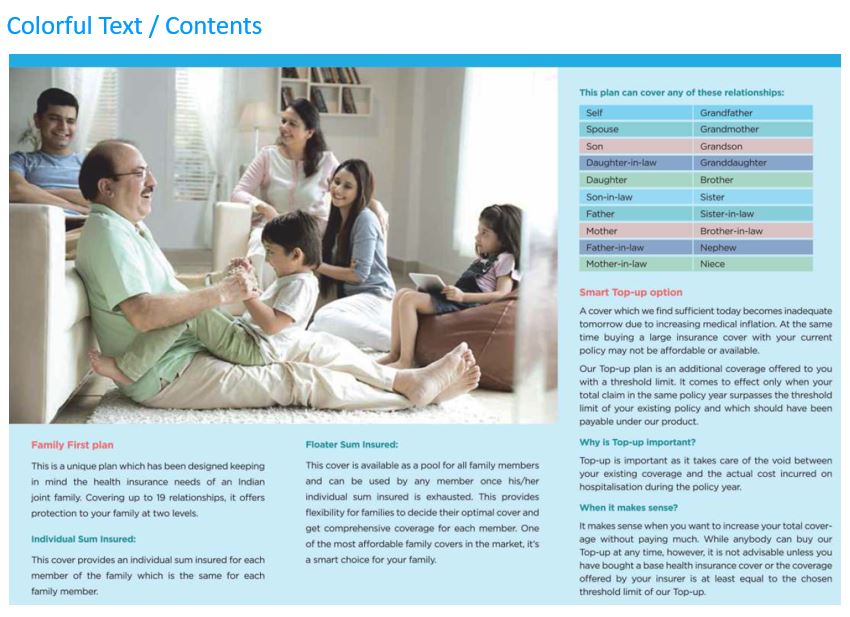

Brochure

- The document provides a high-level overview of the plan benefits and features.

- It includes details of the various expenses covered by the plan during hospitalization.

- The plan options encompass various sum insured options, the choice between family floater or individual plans, and the availability of enhanced features such as Gold, Silver, or Platinum plans.

- The selling proposition highlights different points to answer the question in your mind, “Why should I buy this policy?”

- The document consists of 10 pages in total.

Prospectus

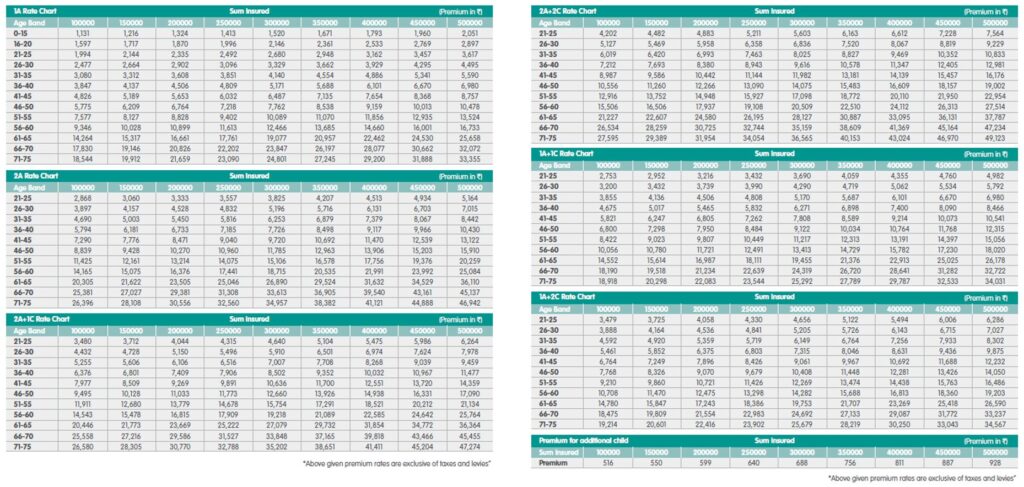

This document serves as a price grid, containing details of premiums for different age groups and sum insured amounts. It also includes rates for various combinations in case of family floaters, such as 2 Adults+1 Child or 1 Adult+1 Child.

At times, brochures and prospectus may be combined into a single document, and the following sample serves as an example of such consolidation.

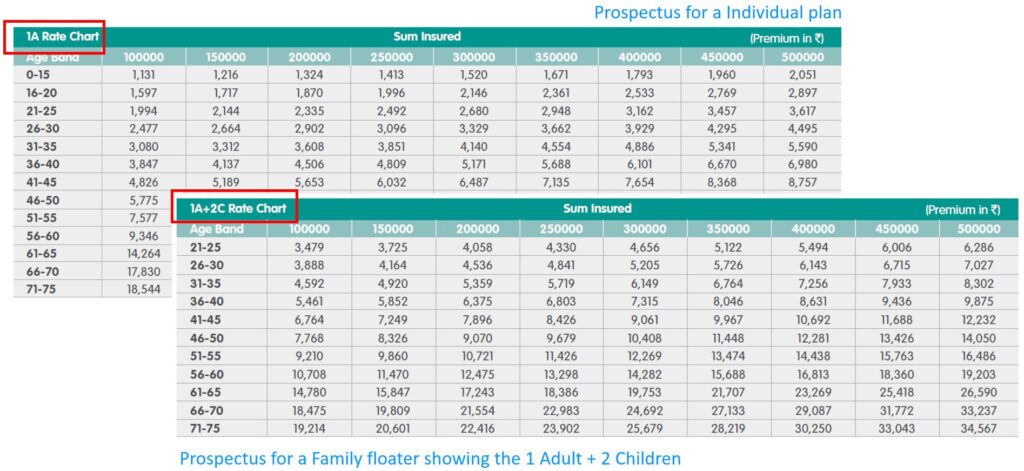

Below is the difference in the prospectus for an individual and family floater plan.

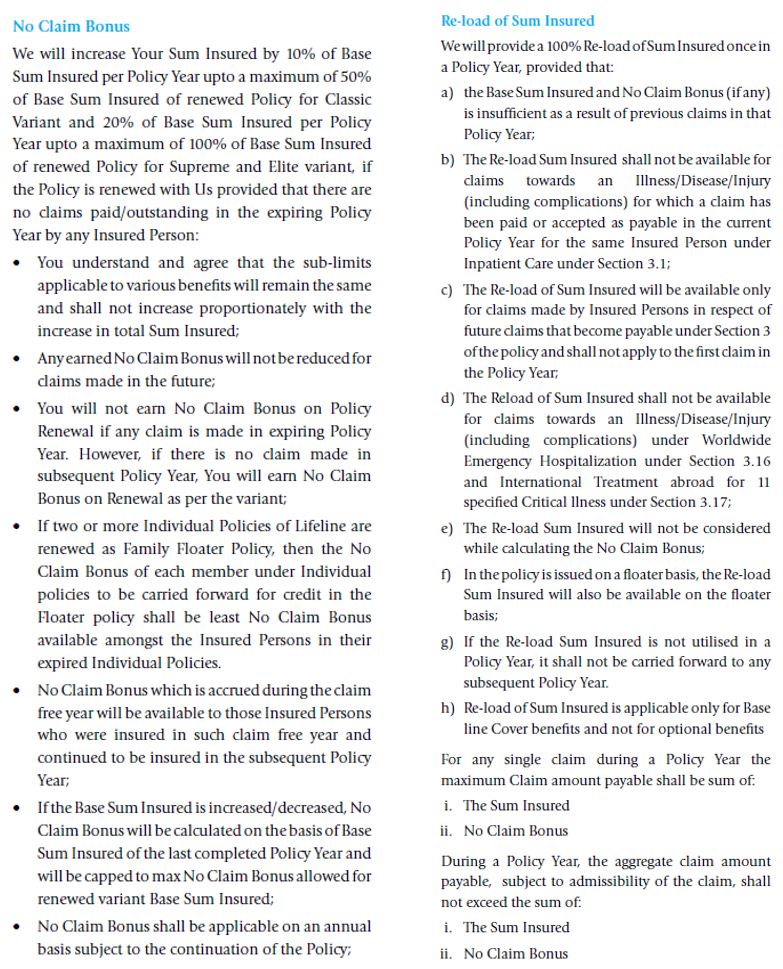

Policy Wording Document

- This legal or contractual document provides complete details on each feature of the policy.

- It covers what a policyholder will get, what they will not get, and any exceptions for each feature.

- The document spans from 20 to 40 pages, encompassing comprehensive information to ensure clarity and transparency for the policyholder.

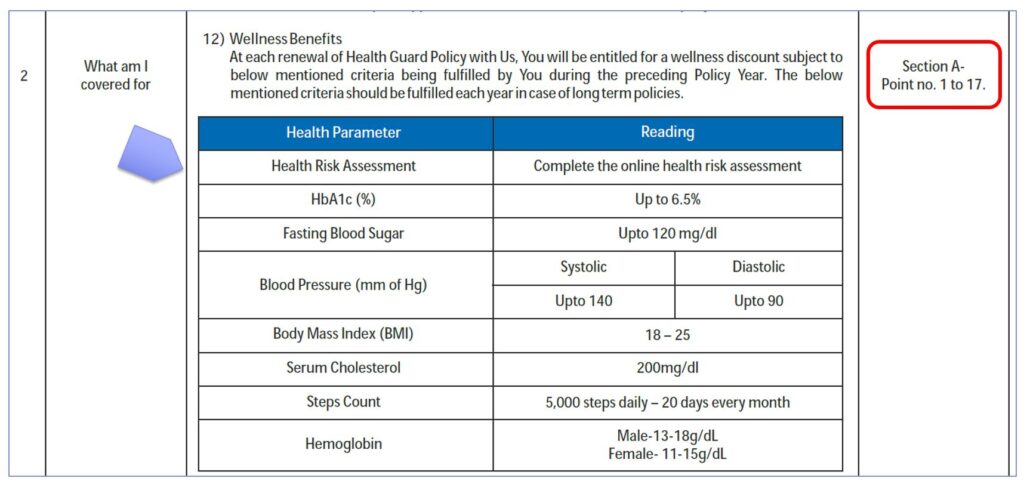

Customer Information Sheet

- This “Table of Contents” serves as a guide to the different sections in the policy wording document.

- It directs you to various contents/sections in the policy wording, making it easier to navigate through the information.

- The handout, which could span one or two pages, provides details of the section numbers in the policy wording document to be referred for each feature.

- Additionally, it may include hypothetical calculations and simulations to illustrate the benefits.

In some cases, the “Customer Information Sheet” and “Policy Wording” are combined into a single document, consisting of two parts:

- First Part: Customer Information Sheet

- Second Part: Policy wording document

The first image depicts the table mapping, while the second image offers a zoomed view that references the policy wording document.

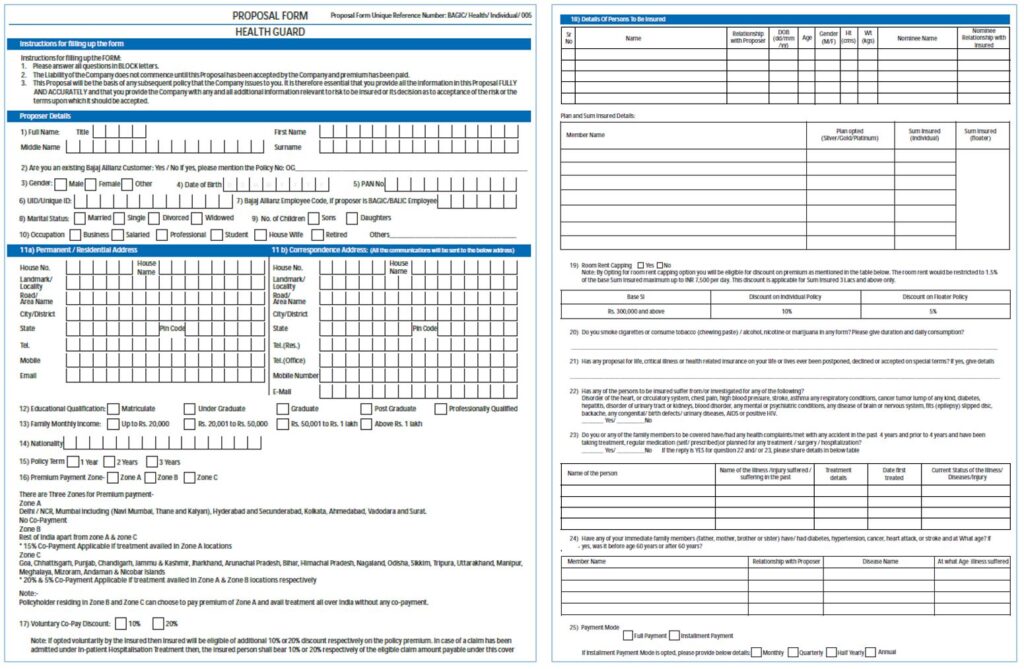

Proposal Form

- This is the application form used by the policyholder to apply to the health insurance company for buying a policy.

- After deciding to purchase a specific policy, the policyholder fills out this form.

- The form captures all personal details, lifestyle choices (Smoking or consuming tobacco), pre-existing medical conditions, and preferences regarding plan name, sum insured details, etc.

However, presently, online applications are more widely used for this purpose. Below is the sample proposal form.

Claim Form

This is used when you have already taken the policy and claim the expenses incurred in hospitalization.

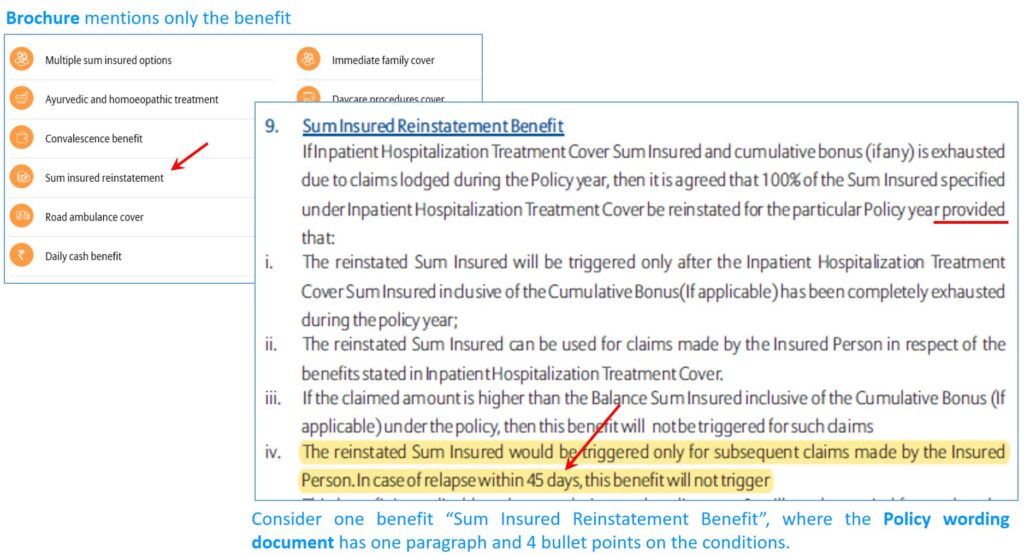

Difference between Brochure and Policy Wording document

Among all these documents, the Brochure and policy wording document play a crucial role in the purchase decision. Therefore, let us delve into these two documents in more detail. We will explore them in light of three dimensions.

Contents

In summary:

- A brochure provides a high-level overview of the policy features with key selling points. It does not cover the limits, sub-limits, or exceptions for these benefits. The purpose is to avoid any negative impact on the minds of prospective buyers.

- On the other hand, a policy wording document is highly detailed, mentioning the limits, sub-limits, and exceptions of the various features of the policy. In short, it clearly outlines what a policyholder will get and what they will not.

While a brochure may briefly cover each feature in one line, a policy wording document may require half a page to bring out the complete details. Reading a brochure may take 15 – 20 minutes, but a policy wording document would demand no less than 90 minutes to read and thoroughly understand.

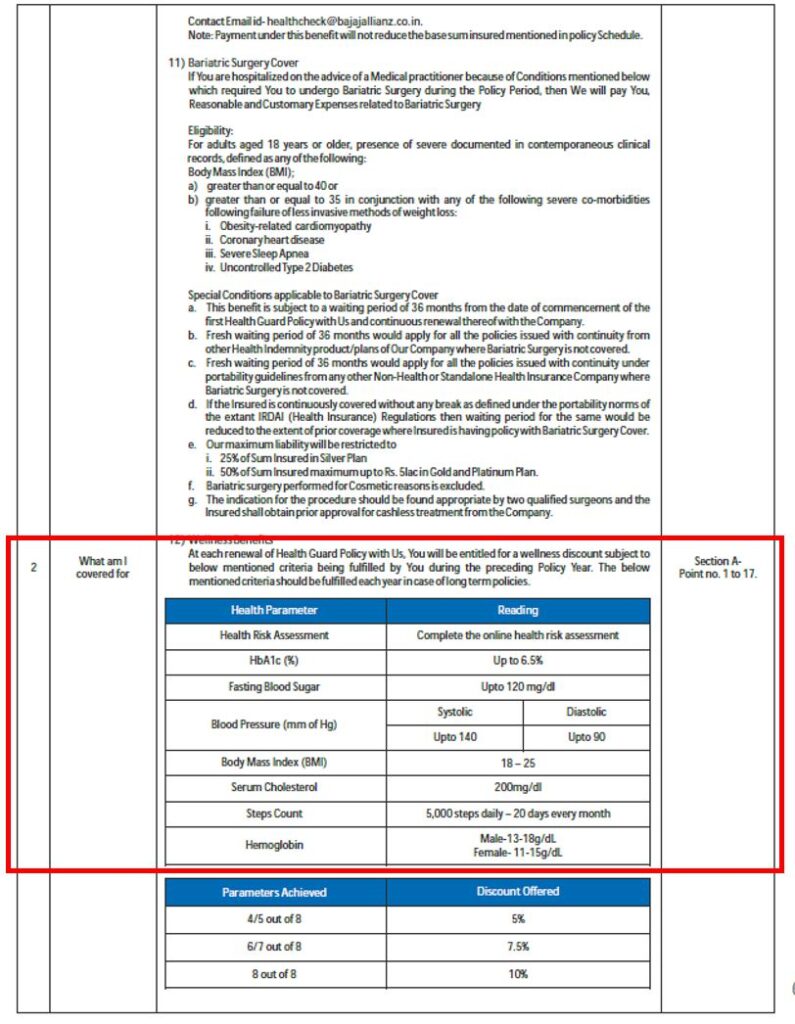

Below is a sample to illustrate the depth of information between a Brochure and Policy Wording document.

Below, you can observe the depth to which a policy wording document covers each benefit. It meticulously outlines the different clauses and sub-clauses determining when a benefit will be applicable and when it will not be applicable. In contrast, a brochure provides only a maximum one-line mention of the same information.

Purpose

Brochure:

- The brochure serves as a marketing document for the health insurance company.

- Its primary purpose is to create a feel-good factor for prospective buyers, capturing their attention with key features of the policy.

- Additionally, it is used as a selling tool, facilitating the flow of money from the policyholders to the company.

Policy Wording Document:

- On the other hand, the policy wording document functions more like a legal document.

- The health insurance company utilizes this document during the claim settlement process for policyholders.

- When a claim is made, money moves from the company to the policyholders to cover the insured benefits.

Look and Feel

The brochure is intended to give a feel-good factor and capture readers’ attention. As a result, it typically includes:

- Pictures of a happy family,

- Big fonts, icons, and graphics, and

- a colorful layout.

Below are a few images to illustrate this view:

The policy wording document uses smaller fonts (than what is used in the brochure), presents black and white, and lacks any pictures of a happy family. The text in this document may be perceived as dull and uninspiring, requiring readers to be cautious and attentive to understand the intent behind the wordings, as they can be somewhat ambiguous.

Which is more important, the Brochure or the Policy wording document?

To sum up, insurance companies use,

- Brochures to sell policies to prospective buyers, as it helps in finalizing the sale and obtaining money from the policyholder.

- On the other hand, during claim settlement, the health insurance company thoroughly examines every clause and sub-clause in the policy wording document before approving the claim.

It’s important to note that brokers or advisors of the company do not sell policies using the policy wording document, nor does the insurance company use the brochure during settlement. The critical nuance that potential buyers often overlook is that the brochure is solely used by companies during the policy-selling process. For settlement, the insurance company relies on the policy wording document.

As a prospective policyholder, it is essential to recognize this difference and refer to the policy wording documents of different policies and companies to make an informed decision when choosing the right policy for yourself.

Now you know which one is important…

Yes, the policy wording document is of utmost importance. It is the document you must read and thoroughly understand to make an informed decision about a plan. So, once you decide to buy a policy or when brokers or agents approach you with a policy, follow these steps:

- Firstly, spend no more than 5 minutes on the brochure (Just keep it aside. Insurance companies are not going to settle your claims referring to the brochure.)

- Next, use the brochure only to get a high-level understanding of the benefits of the policy.

- Then, pick the policy wording document and spend even 5 hours if needed to understand it completely.

- Make sure to take note of any details you do not understand.

- Finally, clarify these details with the company. Every health insurance company has chat options or toll-free numbers. Connect with them to get a clear understanding of the finer nuances of the policy wording document that you do not comprehend.

Conclusion

You must understand the different documents related to health insurance as it is crucial for making well-informed decisions in choosing the right policy.

- The Brochure serves as a marketing tool, providing you with a high-level overview of policy features to capture your attention as a prospective buyer.

- However, the Policy Wording Document holds the key to the actual terms, conditions, limits, and exceptions of the policy, playing a vital role during claim settlement.

As a potential policyholder, it is essential for you to prioritize the policy wording document, dedicating time to thoroughly comprehend its contents. Taking note of any uncertainties and seeking clarification from the insurance company through chat options or toll-free numbers helps you gain a complete understanding of the finer details. By delving into these documents and understanding their nuances, you can ensure you are well-protected and secure with the most suitable health insurance coverage for your needs.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.

Pingback: No Fear When Emergency Fund is There - Success Project

The insight on policy wording document is really useful. Many thanks for the information.

Regards,

Som