In this blog, I will visually present 10 easily accessible sources of data for industry analysis. (Featured image credits: Image by Gerd Altmann from Pixabay)

In the last blog, I covered 18 questions to do Industry Analysis. As you read the last blog you might have seen it as more of an academic exercise. You could have felt that it is very difficult to get the needed data to answer these questions. This blog aims show that your initial perception was incorrect.

There are 10 sources of data, which can help you in industry analysis. By exploring these 10 sources in detail, accompanied by informative images, I will demonstrate how obtaining the necessary data for industry analysis is not as challenging as it may seem.

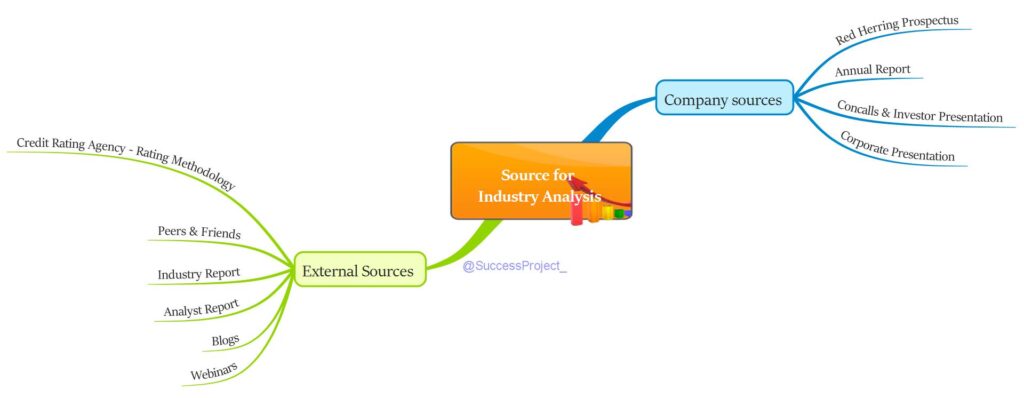

To provide a clear overview, I have included a mind map below that outlines the 10 sources for conducting comprehensive industry analysis.

Disclaimer

- The industries and companies referred to are mentioned only for ease of understanding and not any kind of investment views like buying, selling or holding.

- There is not an exhaustive source for doing industry analysis. These are the sources from which I look for information.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index for all my blogs.

Company Sources

Red Herring Prospectus (RHP)

What is a RHP?

- It is a document filed by a company with the stock exchanges.

- This is shared with the public when a company makes an IPO.

- RHP helps the investors in making an informed investment decision in the IPO.

- Sharing this document is a mandatory regulatory requirement.

How is an RHP useful for industry analysis?

The purpose of the RHP is to provide investors with a comprehensive understanding of the IPO and the company. It includes detailed information on the company’s financial situation, management team, future plans, and more. Interestingly, the RHP also contains ample information about the industry in which the company operates.

While the primary focus of the RHP is to aid in making investment decisions regarding the IPO or company, it also serves as a valuable source of industry-specific information for investors.

Where to get an RHP?

There are two options:

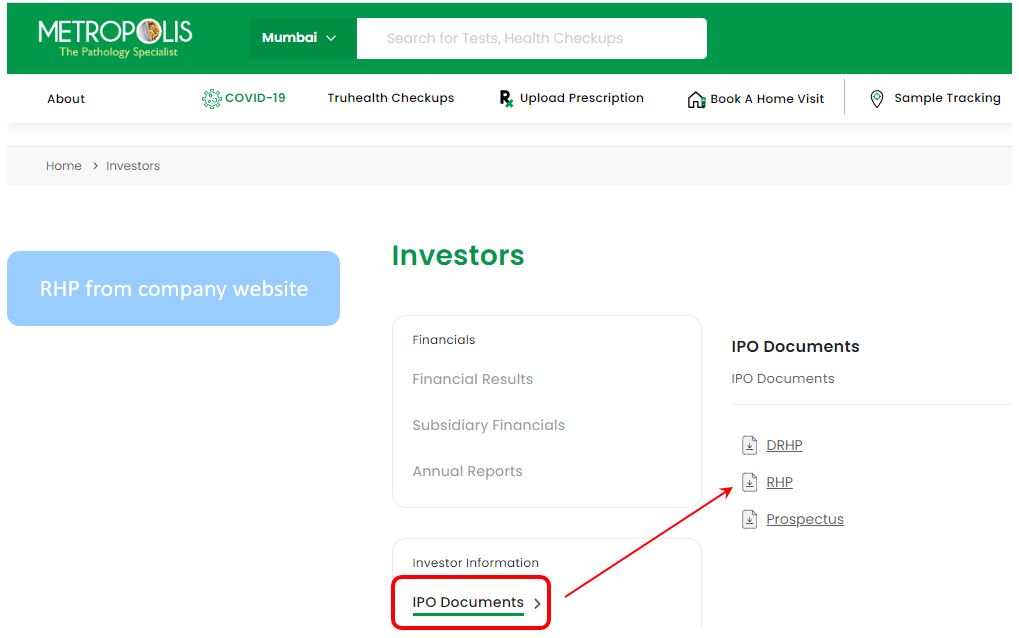

Option 1 – Company website: RHP can be located in the “Investors” / “Investor Relations” section of the company website.

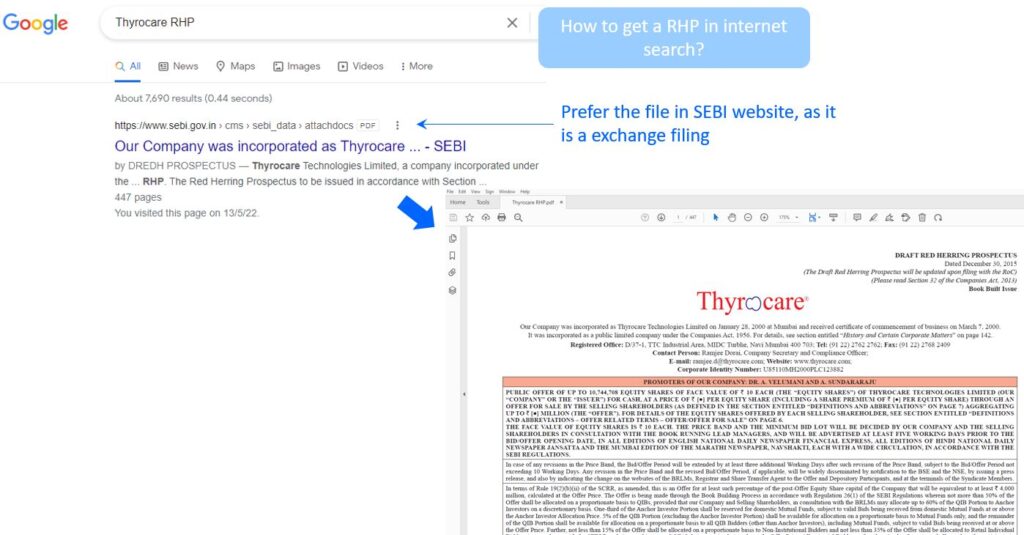

Option 2 – Internet Search: Use keyword “Company Name + RHP”.

Where to get industry-related information on an RHP?

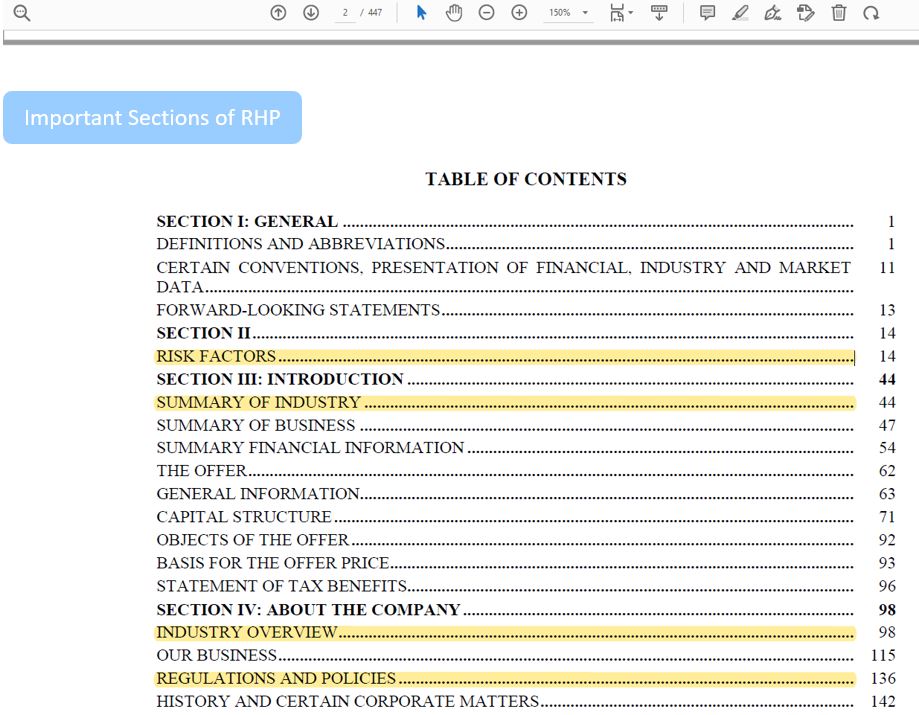

The RHP is a comprehensive document, often exceeding 400 pages in length. However, investors need not go through the entire document to extract the relevant details for industry analysis. The key information pertaining to industry analysis can be found under specific headings, such as the:

- Summary of Industry,

- Industry Overview,

- Risk Factors, and

- Regulations and Policies.

By referring to the table of contents of the RHP, investors can easily locate these sections, which contain ample information necessary for conducting industry analysis.

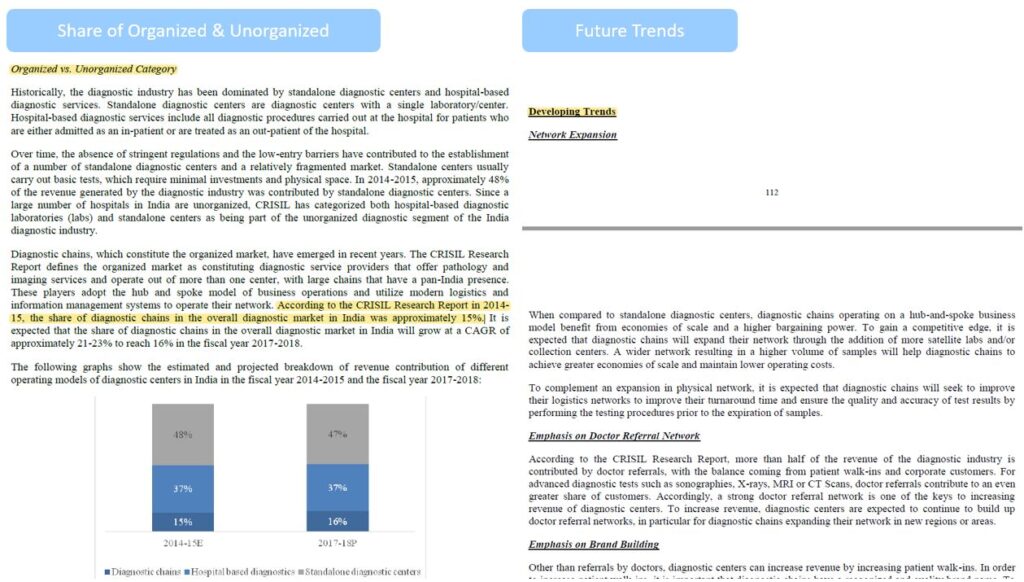

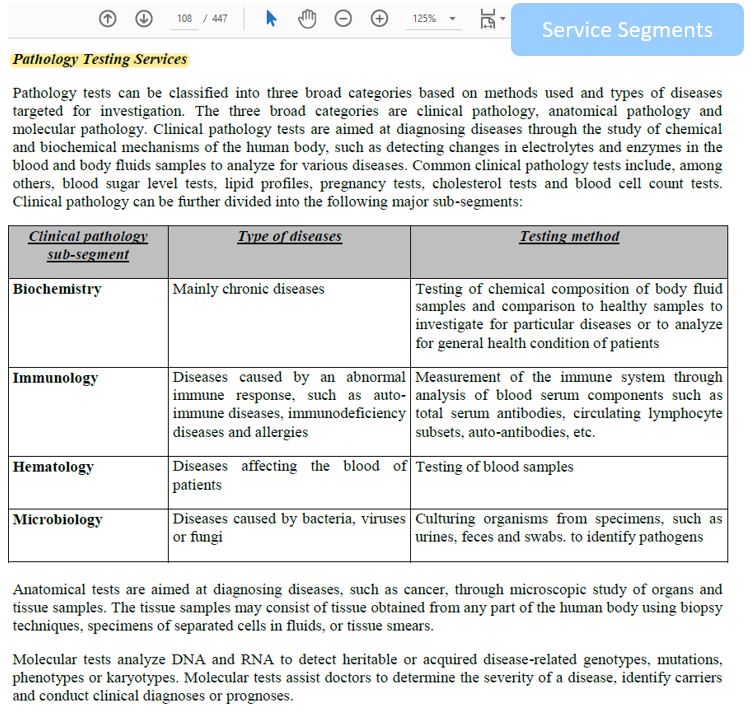

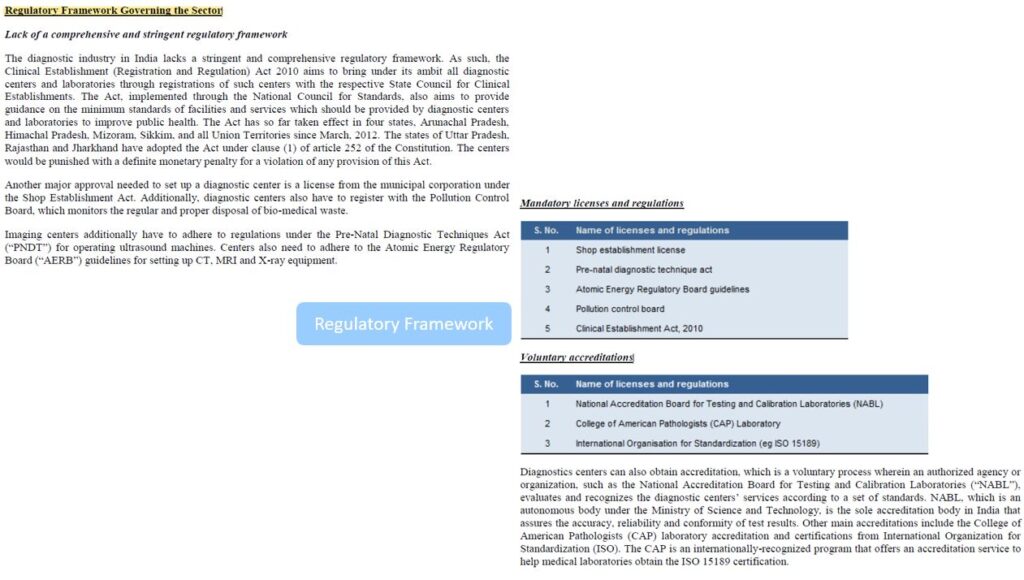

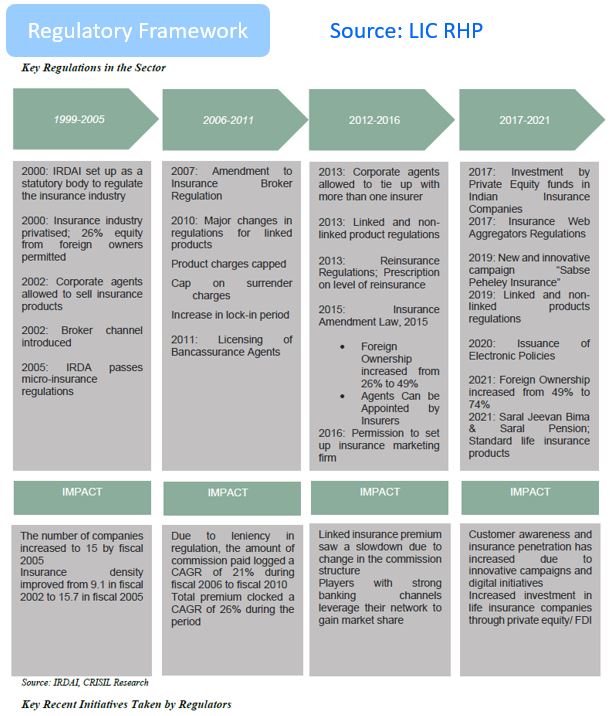

What information can investors get from an RHP?

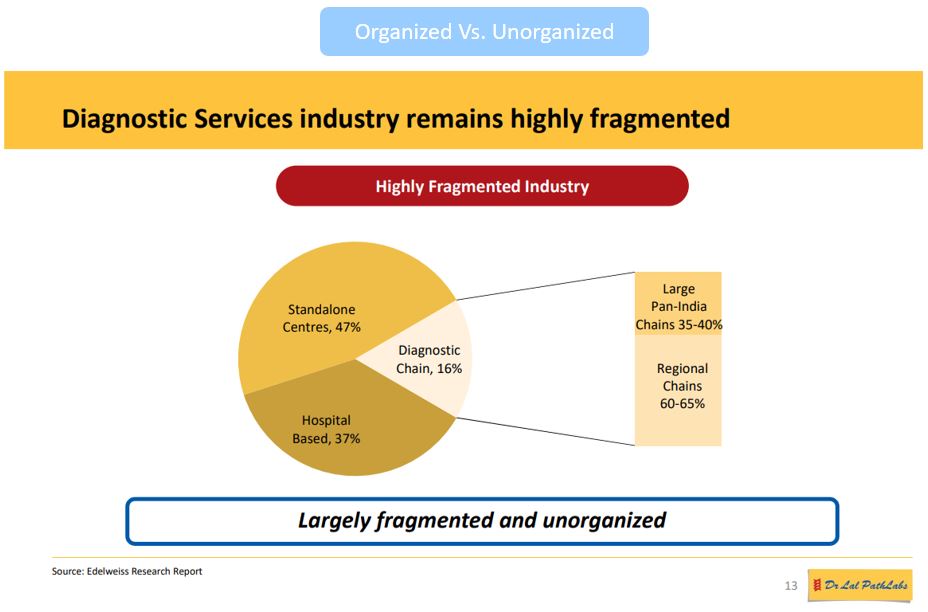

The industry landscape in terms of:

- The overall industry size

- Number of players,

- Expected future growth,

- Growth drivers,

- Technology trends,

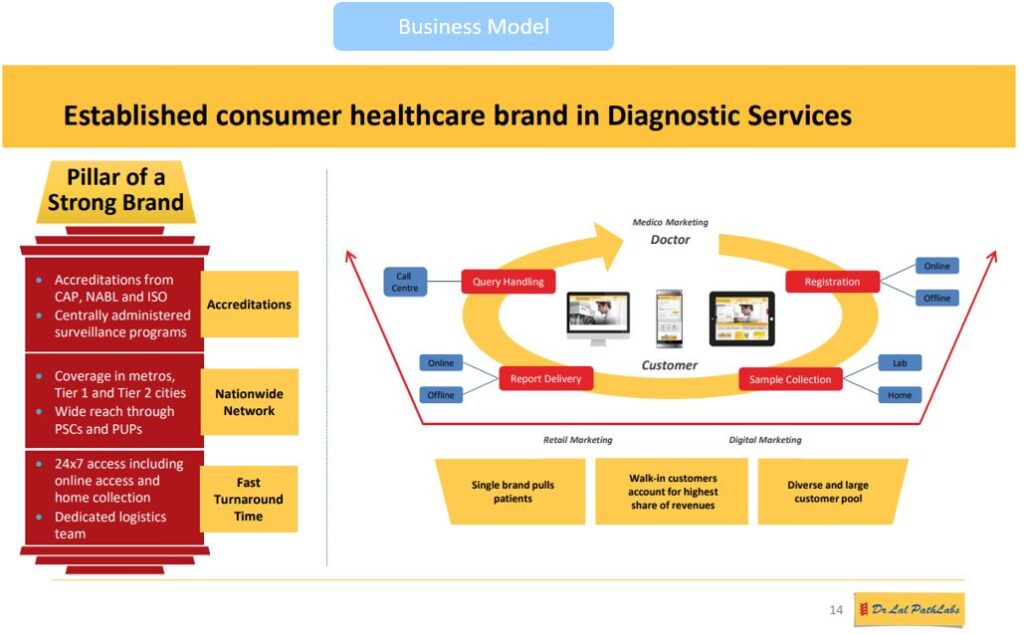

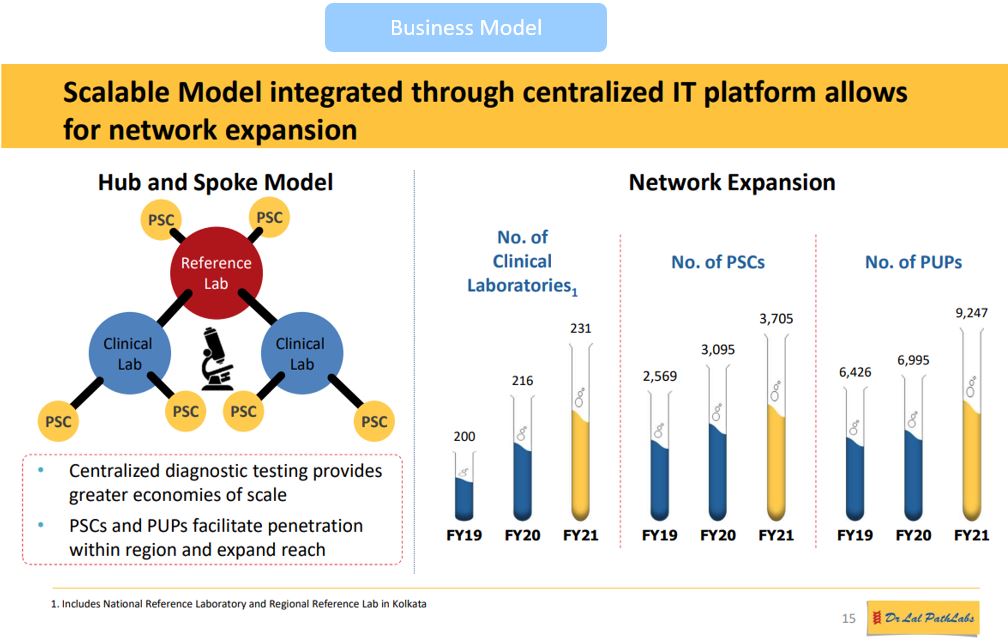

- Business model,

- Competitors,

- Different market/product segments,

- Market share of organized Vs. unorganized and

- Regulatory environment.

Below is the screen carrying these information.

Reading a RHP helps to answer most of the questions that we saw in the my previous blog, How to do Industry Analysis.

What to do, if you do not get the RHP?

Obtaining the RHP (Red Herring Prospectus) of old listed companies can be challenging due to two main reasons:

- Firstly, the mandate for RHP by stock exchanges is a relatively recent development, limited to the last few years or decades. Therefore, very old companies, like those in the Cigarette manufacturing industry such as ITC (100+ years), VST Industries (90+ years), and Godfrey Phillips (85+ years), may not have an RHP as it was not a requirement when they got listed.

- Secondly, even for companies that listed a few years ago with an RHP, these documents might not be readily available in the public domain. Accessing them from the internet or stock exchange filings could prove to be difficult.

In such cases, investors may need to rely on alternative sources of information, such as annual reports, financial statements, and other industry-related publications, to gather relevant data for industry analysis.

What should an investor do in such cases?

In my personal view, pushing hard for RHP of old companies may not be advisable due to the potentially outdated nature of the information, which may not reflect the current state of the industry. Instead, two workarounds can be considered:

- Firstly, read the RHP of recent listed companies in the same industry. These documents are likely to provide more up-to-date and relevant information about the industry.

- Secondly, If obtaining recent RHPs is not feasible, then rely on annual reports, which serve as another valuable source for industry analysis. Annual reports can provide valuable insights into the company’s performance, industry trends, and future plans, helping investors make informed decisions without relying solely on outdated RHPs.

Annual Reports

What is an Annual Report?

- An annual report is a document that companies share with the public on a yearly basis.

- It is published after the end of the financial year and provides comprehensive details of the company’s financial performance, including the balance sheet, income statement, and cash flow statement.

- Additionally, the annual report includes management commentary on future ambitions and growth plans, as well as insights into industry challenges, opportunities, and other relevant information.

How annual report is used for industrial analysis?

While the annual report primarily focuses on the company, it contains a wealth of information about the industry that can be highly valuable for investors and analysts. Understanding the industry-related insights within the annual report provides key knowledge about the broader market and can significantly aid in industry analysis.

Where to get the Annual Report

- You will find them in the “Investors” section of the company website.

- Annual reports are also filed with the exchanges, so they are available on the BSE and NSE websites as well.

- You can easily access 10 (or even 20) years of annual reports for most companies.

Reading 10+ years Annual reports provides valuable insights into how the industry has evolved over the years, though it is not mandatory. The below image from the BSE shows that more than 20 years of annual reports are available for reference.

Where to get Industry related information in an Annual Report?

There are two places to find insights into the industry within the annual report:

(1) Letter to Shareholders: Also known as “Chairman’s message,” this communication from the management to stakeholders, including investors, can be found in the initial pages of the Annual report. While it primarily covers the company’s performance and future plans, it also provides some valuable insights into the industry and economic conditions.

(2) Management Discussion and Analysis (MDA) section: This section begins with an outlook on the Indian economy and then delves into industry-specific information. It further discusses the company’s overall performance within the context of the economic and industrial environment. These sections offer key data and analysis for industry analysis in the annual report.

What information can one get from Annual Report?

The industry landscape in terms of:

- Expected industry growth for the next 3 to 5 years

- Growth drivers,

- Industry challenges & opportunities

- Regulatory environment

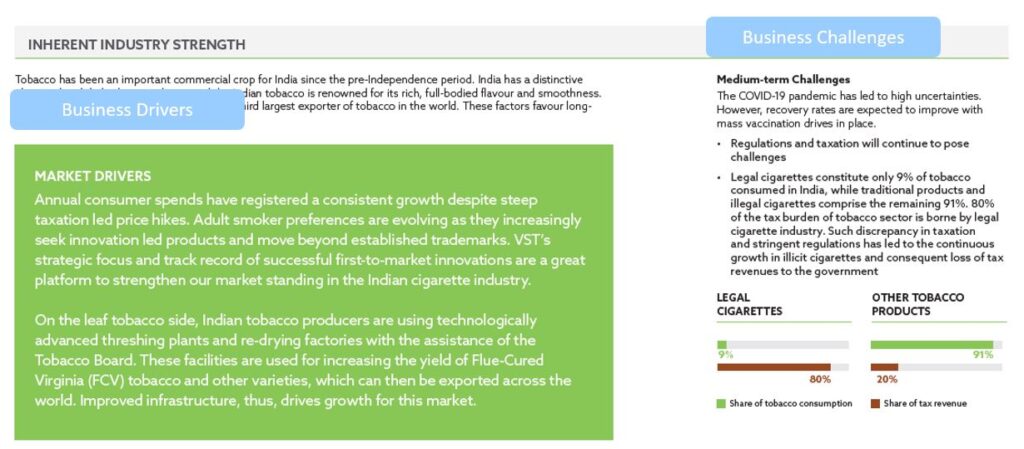

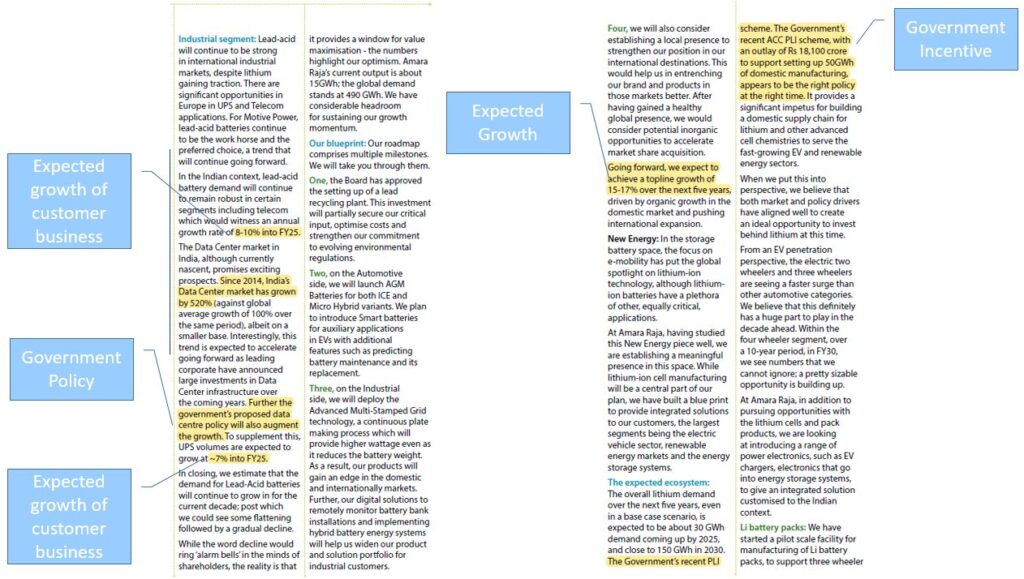

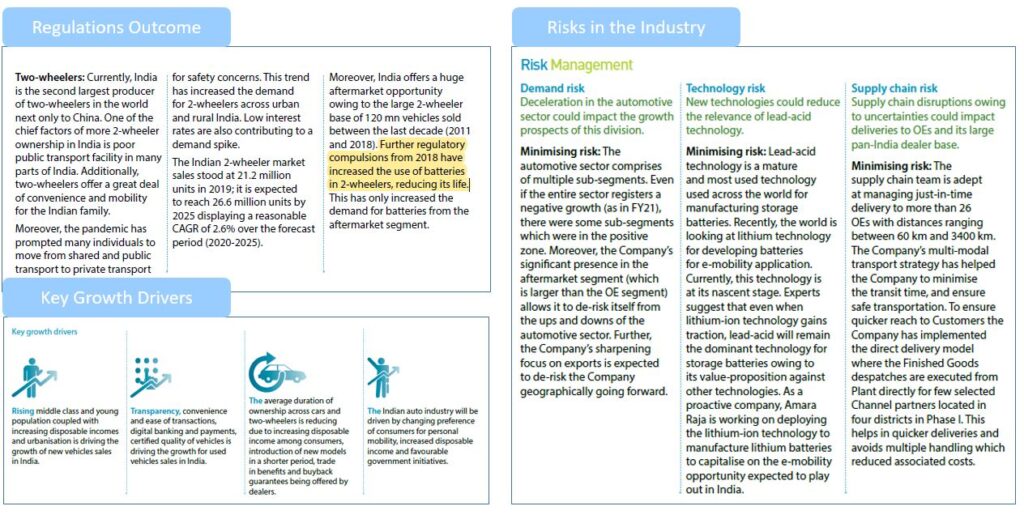

Below is the screen of insights from the Annual Report.

(1) From “Letter to Shareholders”

(2) Insights from Management, Discussion and Analysis Section.

Important Note

These documents are aimed to give an opinion about their company. Hence the companies could be biased with information that is favourable to them. To avoid potential bias and gain a comprehensive understanding, it is advisable to read the RHP and/or Annual reports of multiple companies within the industry, not just one. There are no strict rules for this process.

- One approach is to focus on the major players in the industry. For example, if you’re interested in the diagnostics space, consider reading documents from companies like Thyrocare, Dr Lal Pathlabs, Metropolis, Krsnaa Diagnostics, and SRL Ranbaxy.

- In the case of banks, select the top 2 to 3 banks along with regional banks like JK Bank and City Union Bank.

- Another strategy is to choose 2 companies from each of the large-cap, mid-cap, and small-cap segments within the same industry. By analyzing multiple companies, you can obtain a more well-rounded and informed view of the industry’s dynamics and trends.

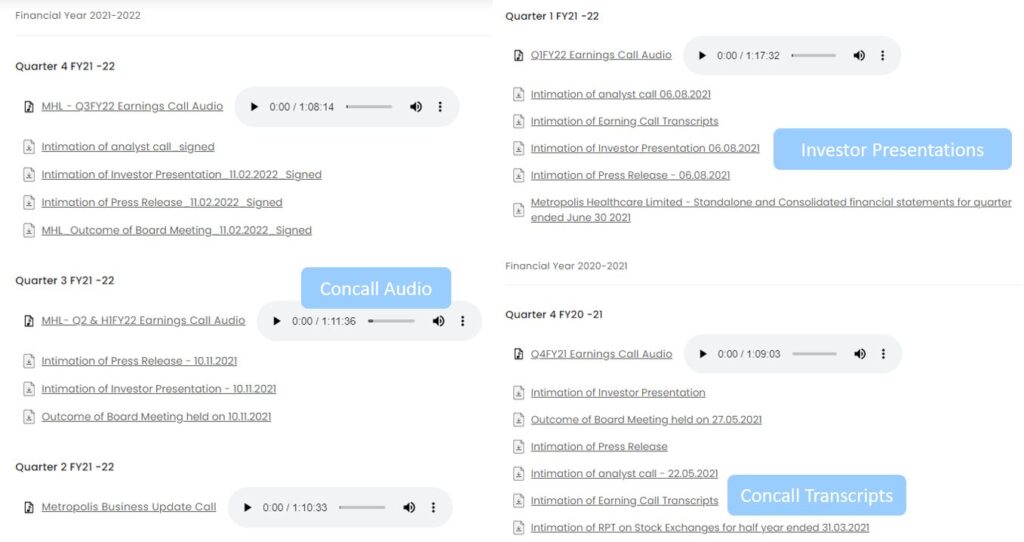

Concalls and Investor Presentations

Concalls

- Companies actively participate in earnings calls, also known as Concalls or conference calls, arranged by analysts.

- Typically held quarterly after the release of financial results, these calls involve the company’s management discussing recent performance and providing insights into the future outlook, both in the near and long term.

- While some responses may be specific to the company, a few may offer valuable industry perspectives.

- It is important to note that not every response or detail from these Concalls would provide industry insights; one needs to carefully extract and analyze relevant information.

- The transcripts or notes of these calls are usually uploaded to the company website after a few days, allowing investors to access past Concall records and even participate in future calls to raise questions.

However, Concalls alone may not suffice for a comprehensive industry analysis. Instead, they serve as supplementary sources, supporting information obtained from other credible sources. On occasion, they may offer subtle nuances that contribute to a better understanding of the industry’s current situation.

Investor Presentations

Companies also share investor presentation after every quarterly result. They also carry some industry insights. This can also be found in the “Investors” section of the company website.

A few images of concalls and investor presentations.

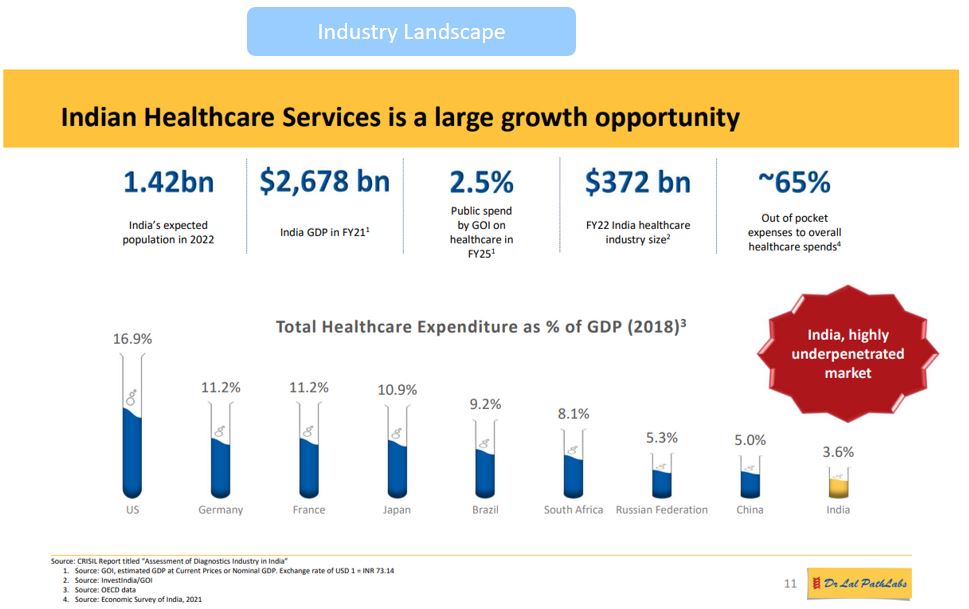

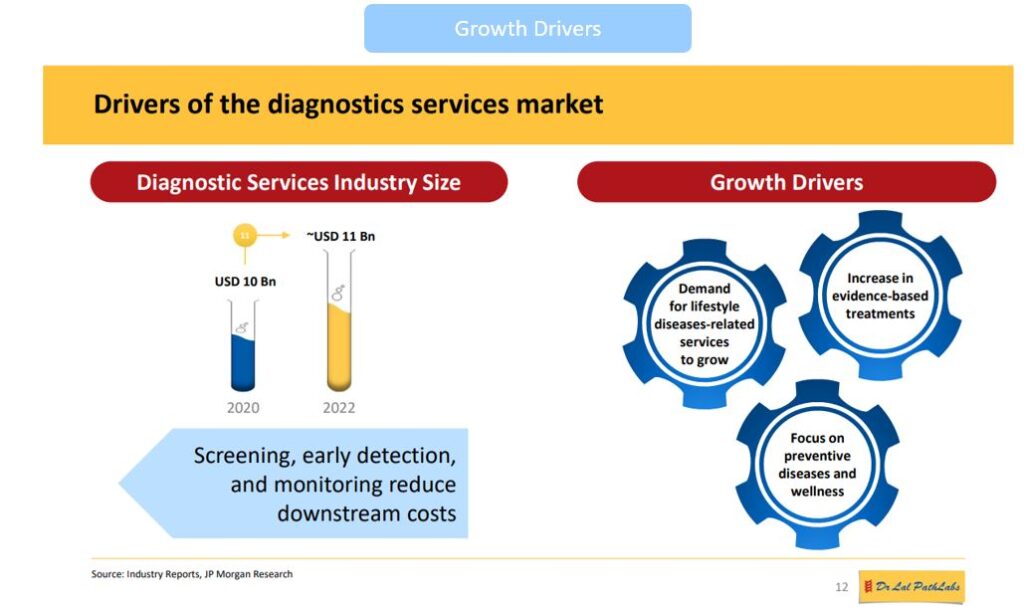

Corporate Presentation

- You can find these corporate presentations on the company’s website.

They aim to provide an overview of the company, but they often include industry insights, growth opportunities, threats, and more.

It’s important to note that not every listed company is required to have a corporate presentation available. However, when available, these presentations offer valuable insights into the industry and the company’s position within it. Below are some screens with industry insights from corporate presentations:

External Sources

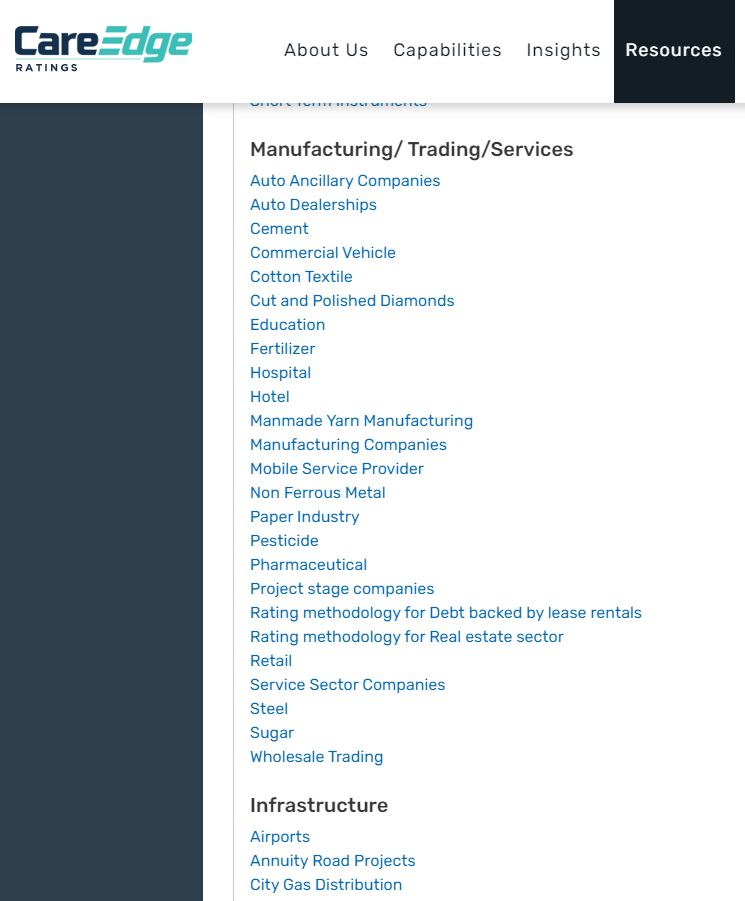

Credit Agency Report

This was a good source that I came across from Dr Vijay Malik’s blog, How to analyse New Companies in Unknown Industries?. I strongly recommend you to read this, to understand the complete nitty-gritty of this approach.

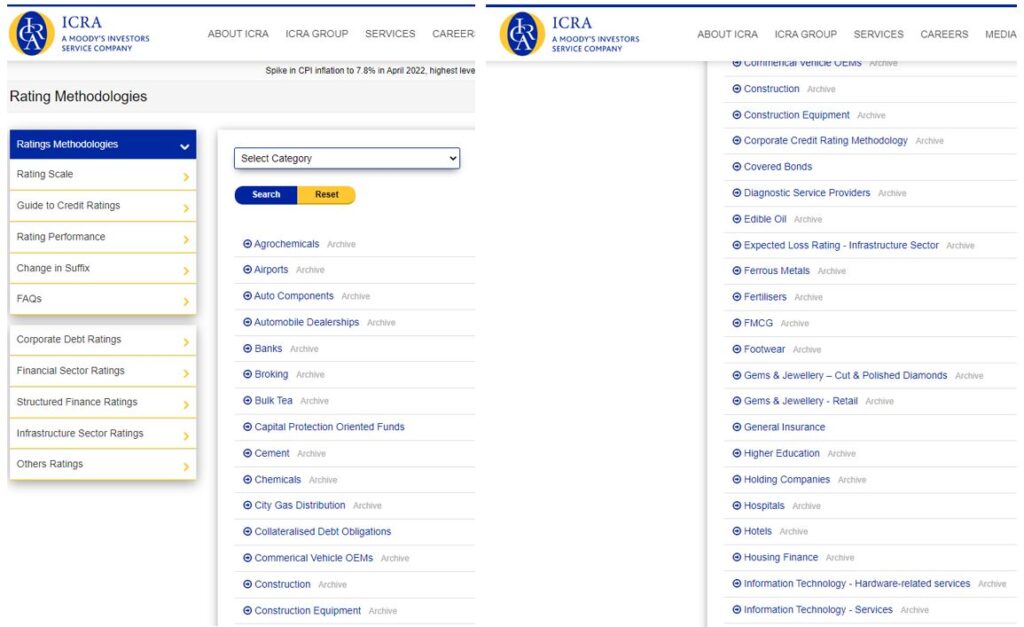

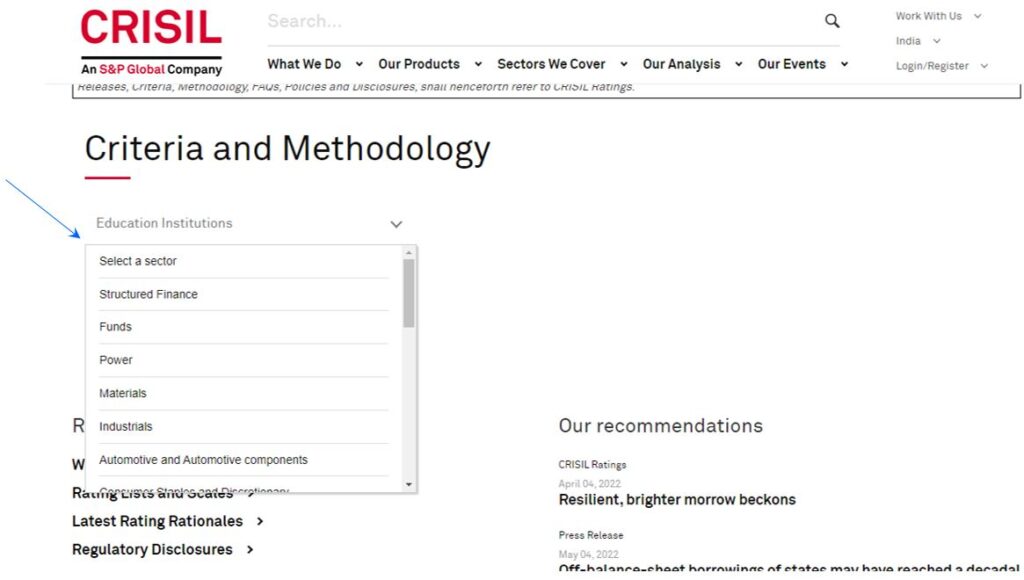

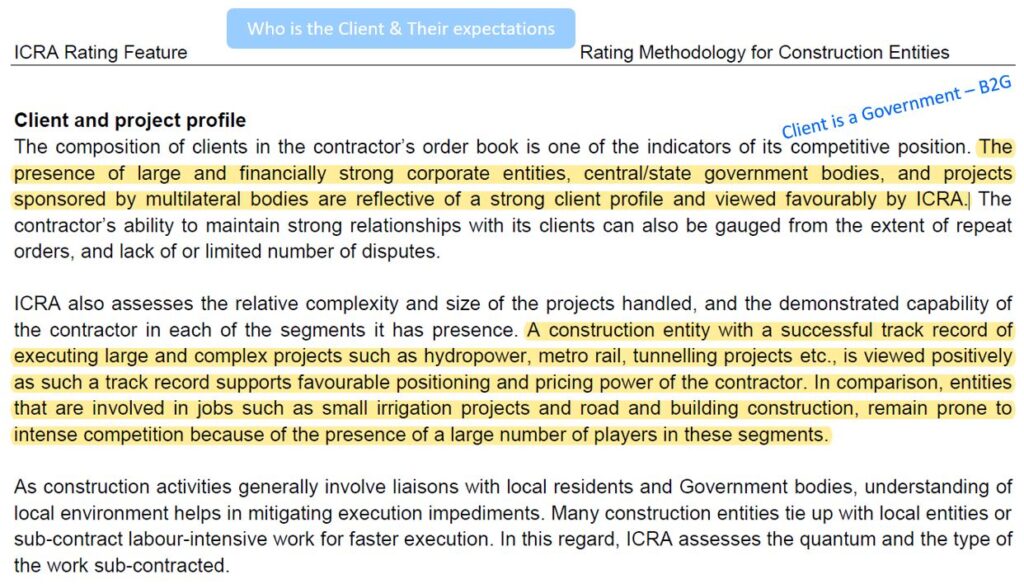

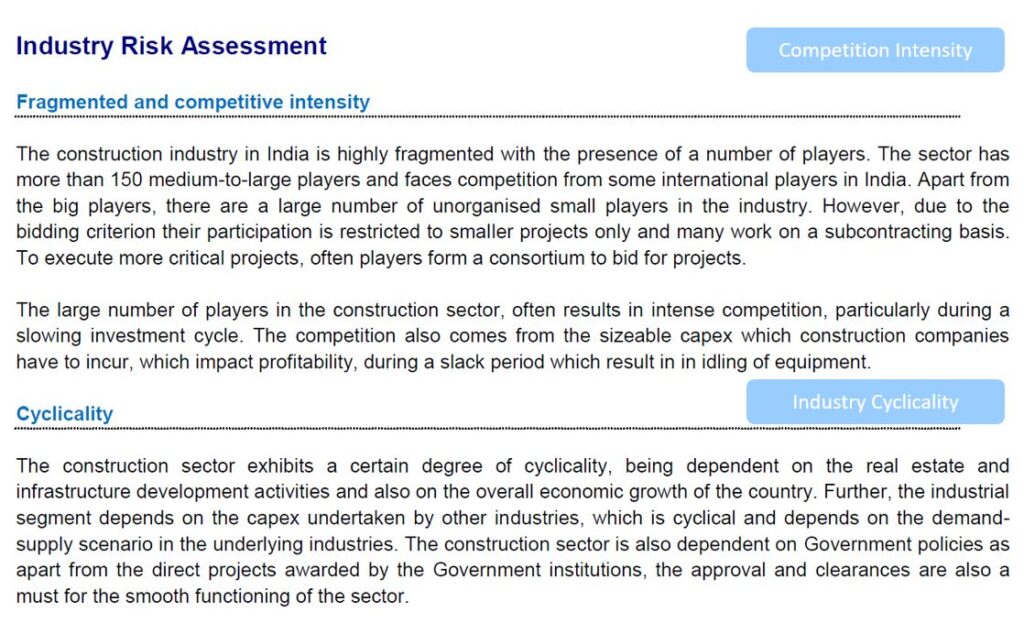

Rating agencies thoroughly analyze companies and industries as part of their evaluation process using a structured checklist called “Rating Criteria.” This in-depth research provides valuable insights into industry cyclicality, risks, competition, and structure. As part of their evaluation process, they analyze the company as well as the industry. It is a rigorous and structured analysis, like a checklist. This checklist is called “Rating Criteria”.

This document is valuable even for an equity investor. The reason is professionals have done deep-dive research on the industry. Such reports are available for almost every industry. If you are interested in self-study mode, this option is very enriching. There are three big listed rating agencies in India: CRISIL, CARE & ICRA. You can find these reports for most industries from these three rating agencies.

Given below is the link to the pages along with the image of the page.

Below are few images of “Rating Methodology” document from the construction industry.

Peers and Friends

Every investor should have at least one industry within their circle of competence, and this can be easily achieved through our professions or businesses. For example, working in a bank associates you with the banking industry, and being employed in an IT company aligns you with the IT industry. Some individuals may have experience in multiple companies, providing exposure to multiple industries.

However, it is essential to ask ourselves whether we fully understand the industry we work in. In most cases, the answer is ‘No.’ Industries like IT are vast, comprising a wide range of products, technologies, and services. As individuals, our knowledge often lies within a specific segment or technology, leaving us with a limited understanding of the industry as a whole.

To bridge this gap and gain a comprehensive understanding, it is crucial to communicate with colleagues from various departments. Engaging with individuals in marketing, customer service, and R&D can provide valuable insights into competition, customer market segmentation, industry trends, and more. This collaborative effort will help us achieve a well-rounded comprehension of the industry we are associated with and aid in making more informed investment decisions.

Extend this approach

Now, you can expand this approach to gain insights into other industries. Wondering how to proceed?

- Reach out to your friends who are associated with different industries.

- Engage in conversations to obtain a high-level overview of their respective industries.

- While they may not provide a comprehensive understanding, it serves as a valuable starting point.

- You will acquire a fair view of the industry ecosystem, including aspects like suppliers, customers, regulations, and products.

- Following this, conduct rigorous analyses using RHPs and Annual Reports to delve deeper into the industry’s nuances and make informed investment decisions.

Industry Reports

India Brand Equity Foundation (IBEF) Reports

IBEF is a Trust established by the Department of Commerce, Ministry of Commerce and Industry, Government of India. It has the industry-wise report, with a focus on Government initiatives, opportunities, industry overview, trends and strategies, growth drivers etc. The industry-wise reports can be found here.

Below is the image of one such industry report.

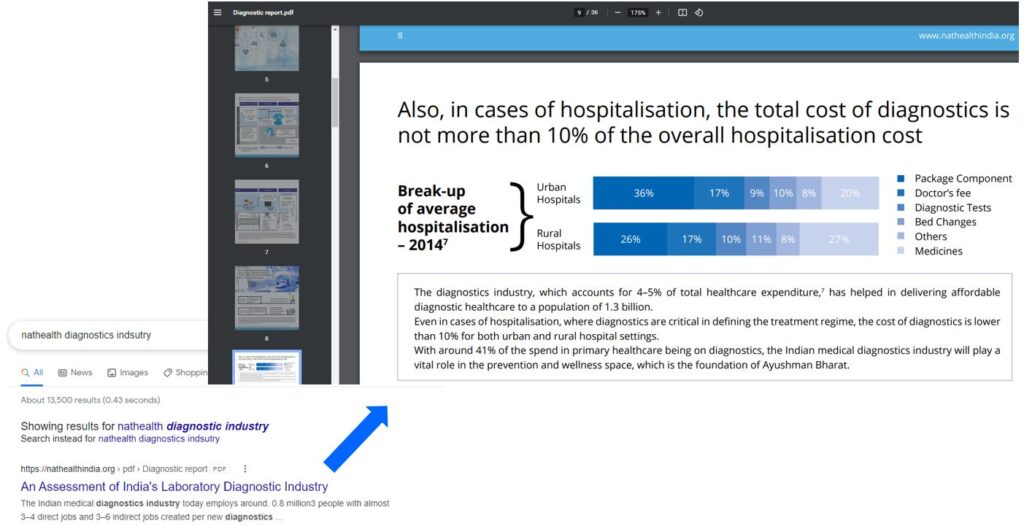

There are many such reports available for specific industries. It could be from the association or an industry-specific body. Below is the Diagnostics report from one such body. It has the complete details of the diagnostics industry ecosystem.

In all the above sources, you need to spend times reading different Annual Reports, RHP, Concalls, and gather insights about an industry. Is there a quicker way to do it? The answer is Yes. There are three options: (1) Analyst Reports, (2) Blogs and (3) Webinar.

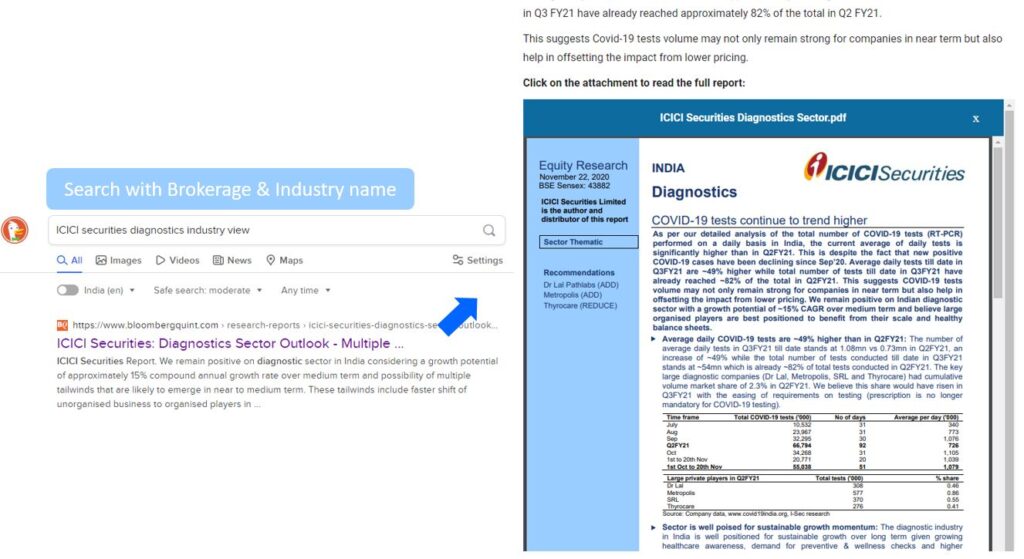

Analyst Report

Brokerage firms regularly disseminate analyst reports covering various industries. Many of these reports are freely accessible in the public domain. Typically, these reports draw insights from RHPs and Annual Reports of companies within the industry.

To find such reports, conduct an internet search using the name of the brokerage firm along with the specific industry you are interested in. Here’s a sample of how you can search for these reports: [Brokerage Firm Name] + [Industry Name]. This approach can lead you to valuable resources that further aid your industry analysis and investment decisions.

Blogs

Several valuable blogs and open sources offer quality content to gain insights into different industries. The authors of these blogs have conducted in-depth analyses using information from various sources such as RHPs, Annual Reports, and Credit Rating agencies’ rating criteria, among others, to present comprehensive summaries. These blogs offer a 360-degree view of the industries they cover.

One notable blog is authored by Dr. Vijay Malik, where he delves into discussions on various industries, providing valuable perspectives and analysis. In this link, you will find the sector insights of Diagnostic Labs, Hospitals, Textiles, Chemicals, the IT sector, Pharma, Cement, Paper and Auto Ancillary Industries.

The image below from is the blog page.

Webinars

There are some webinars on YouTube which gives industry insights. Two of them that I know:

(1) Webinar by CARE EDGE Ratings covering different industries.

(2) Videos of PPFAS Financial Opportunities Forum (FOF)

We saw 10 sources where an investor can gather insights for Industry analysis. This should be sufficient to know about any Industry in India. We come to the end of the three-part blog series on Sector and Industry analysis.

Conclusion

By leveraging various sources of information, such as RHPs, Annual Reports, Credit Rating agencies’ rating criteria, investor presentations, and analyst reports, investors can gain valuable insights into industry dynamics, competitive landscape, and growth prospects. Additionally, exploring government publications, industry association reports, and market research studies can provide further industry-specific data and trends. Moreover, engaging with professionals in the field, reading blogs by experts and participating in earnings calls can offer unique perspectives and nuances of the industry. By combining these diverse sources, investors can develop a comprehensive 360-degree understanding of the industry, enabling them to navigate challenges, recognize growth opportunities, and ultimately make which helps in making well-informed investment decisions.

If you have any other useful sources or links, share them in the comments section. If you liked this article please do share it with your friends.

Pingback: How to Do Industry Analysis - Venkatesh

Pingback: Is Sector and Industry Analysis Important?

Pingback: How to analyze 10 year financial summary - Success Project

Pingback: Stock Analysis, Here is a Powerful Framework - Venkatesh

Thanks for finally writing about > 10 easy sources of Data

for Industry Analysis – Venkatesh < Liked it!