This blog covers the company analysis of Dr Lal Pathlabs (https://www.lalpathlabs.com/). The company is a leader in the North region (69% of revenues)

DISCLAIMER: This blog is related to Company Analysis and NOT Stock Analysis. The contents of this blog are not any kind of investment advice on the company. DO NOT make any investment decisions on the company based on this blog. All the information used in this blog has been sourced from the 2022 Annual Report and Nov 2022 Investor Presentation.

(Featured Image Credits: Cover page of 2022 Annual Report.)

Brief Background of this Blog Series

Diagnostics Industry was of interest to me since 2017. However, I could spend dedicated time only during 2021 to study this industry. The contents that you see in the coming blogs were mined from Annual Reports, Concalls, RHP, and Management interviews.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

Earlier Blogs in Diagnostics Industry

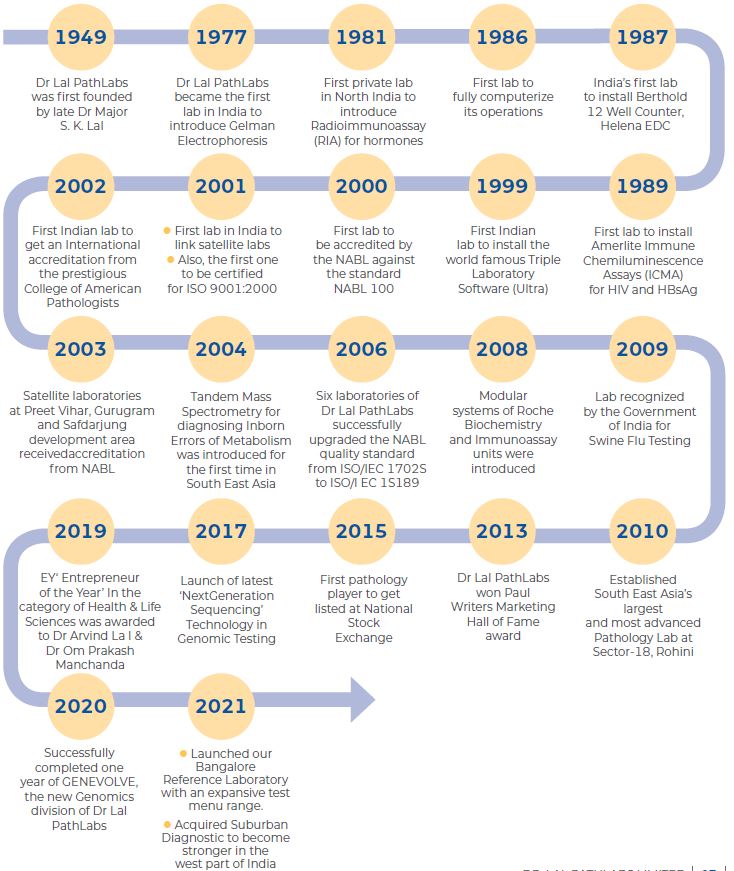

Dr Lal Pathlabs started its journey in 1949. It has a rich 70+ years legacy.

A slightly different version with some additional details as published in their investor presentation.

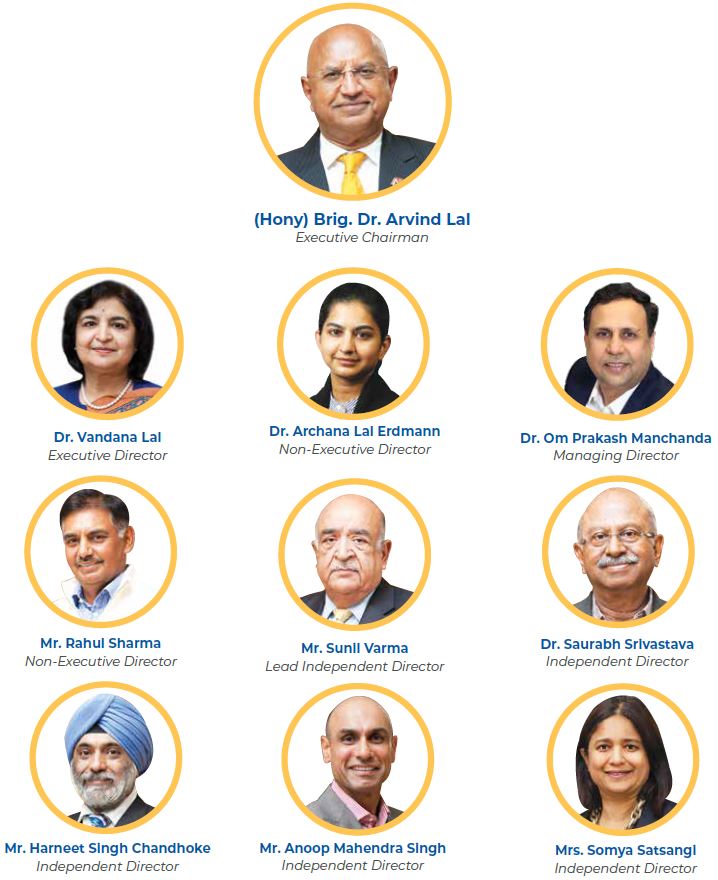

Management

Management Views

These below are the key ideas shared by Shri Om Prakash Manchanda in a webinar with Fund Manager Saurabh Mukherjea.

Challenges to Scale Nationally in a Profitable and Sustainable Manner

Reason 1 - Trust Factor

There is a historical reason behind this.

- It is much fragmented, the expenses are out of pocket, it is a prescription-driven business and this prescription in from the doctor.

- Brand building in healthcare is building relationships between two individuals, patients and doctors.

- There is a trust factor behind it – The patient trusts the doctor and consumes the medicine prescribed by the doctor.

- This relationship idea also applies to diagnosis – This relationship is very unique and cannot be brought.

- One cannot buy this relationship by throwing money advertising it – It has to happen one on one.

- There is a therapy which happens when you talk to the doctor, which does not exist in consulting. (Thought it did raise with covid times and came down steeply post covid)

- Even without a doctor prescribing medicines a small amount of interaction does the magic.

- Similarly there is also a relationship between a doctor and a lab.

- It is required as part of their brand building that they diagnose the illness correctly.

The doctor needs to trust a lab that provides the quality report. This makes scaling a bit difficult. I may a big person in Delhi, but when I go to Chennai, there is someone who is already enjoying that trust and relationship that I am enjoying there. It is very difficult to break that relationship. It is similar to investment banking where you nurture the relationship over a period of time.

Reason 2 - Large Gestation Periods

- Health care is a need and not a want.

- None of us got to the hospital or lab by choice.

- It is not a frequent purchase cycle in healthcare – The current situation is unusual, so forget the covid situation.

- In normal times for a normal person in a younger age group and not having any chronic disease, you would visit the hospital once in a while.

- If a lab is opened, it requires a lot of patience to build a customer base.

- There should be 100 walk-ins (or pickups), the broad maths is that you must have 100 patients a day to make the business viable.

- This is not easy to build in a new market and it takes time, which needs patience.

- By that time, lot of operating cost is incurred.

This is another barrier – a kind of large gestation period of several years. Clubbed with the relationship (First factor) it is quite a bit of a challenge.

Reason 3 - OTG

Let us see what has happened in the last 10 – 15 years.

- This industry has taken the shape of direct-to-consumer.

- There is a nice journey of Rx to OTC, Prescription to OTC. OTC brands are not build with consumers in mind to start with.

- They also start with doctor’s prescribed brands. In the later part of the life cycle, they become OTC brands, assuming that technically they qualify to be OTC.

- From a behavioural perspective it is a shift from Rx to OTC.

- That is the kind of switch I see in the Pathology space.

- What makes the switch to OTC? It is not about the test, as that has to be prescribed by the doctor. But where to get this test done is getting shifted to the consumer or the patient. Here branding takes importance.

Challenges in Home Collection

- The operational aspect becomes complex as another layer of logistics gets added i.e. Home to drop-up point.

- The second aspect is the capacity of the collection gets reduced.

- A phlebologist sitting in one place can collect 30 – 40 samples but by home collection the company can collect only 5 or 6 samples.

- To collect the same number of samples, you need more people.

- There is a bit of a challenge from the patient’s point of view also.

- Because many of the tests involve fasting and if the phlebologist does not land up it is a problem.

- Another way also can happen when patients make phleobo wait as they have other appointments.

- Many people are confusing home collection as home delivery businesses say Pizza.

- In delivery you can drop the box outside and walk off, but in a home collection he goes inside and there is a different level of interaction.

- If the patient delays it affects another appointment of Phlebo.

- In Pathology 70% of the errors are due to pre-analytical errors, which is the stage before loading the sample into the machine.

- We are further losing control in this aspect as well.

- So far home collection we were doing ourselves.

- But during home collection we have to pull in the entire franchise network into this.

- If something does not go well at franchise level, I get an email that your phlebologist did not turn up. I cannot say it is not my mistake, it is franchise mistake. Client would say that I only know you and not your franchise.

Consumers want home collection, but it is operationally more challenging. However, challenges are an opportunity for us to excel and to that extent reduce the competition.

Business Insights

Key Numbers

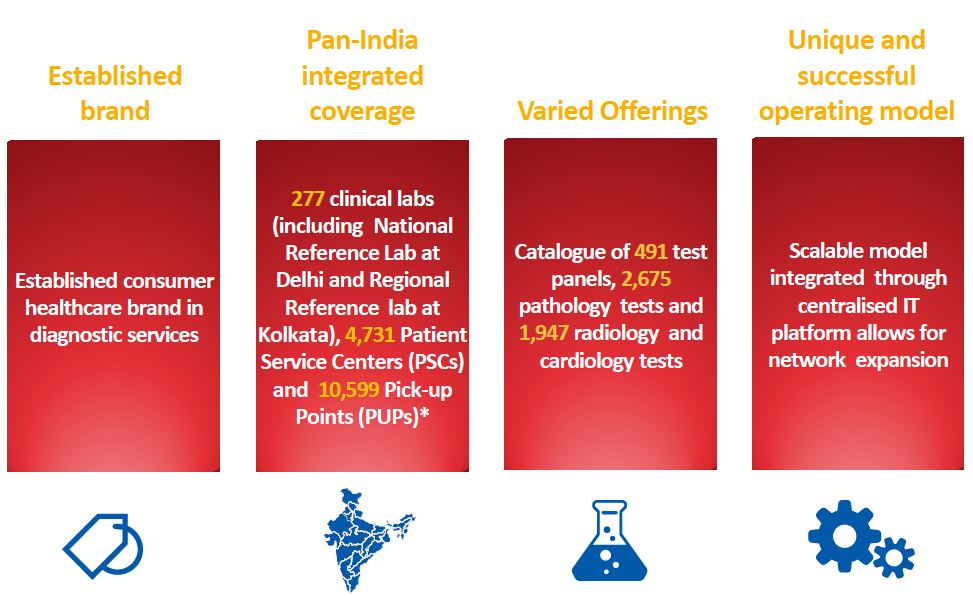

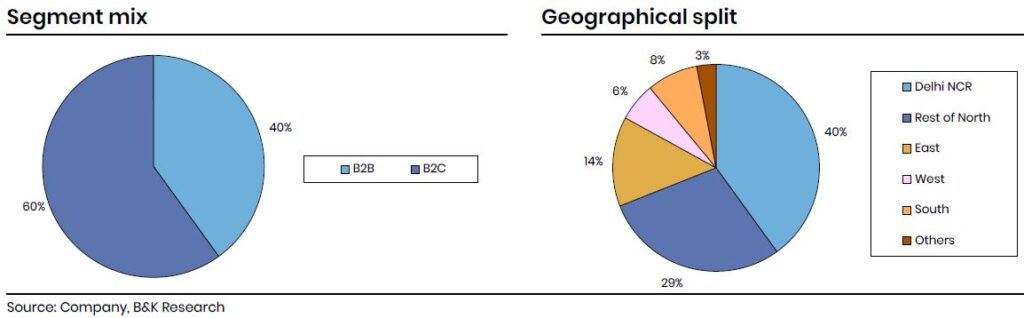

The below data is from B&K Securities report released in 2020. It can be seen that the company has lion share of revenue from the Delhi NCR region. In terms of business model, it generates nearly 60% of revenues from B2C and 40% from B2B. (To understand more about B2B and B2C business read my earlier blog).

Growth Strategy

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.