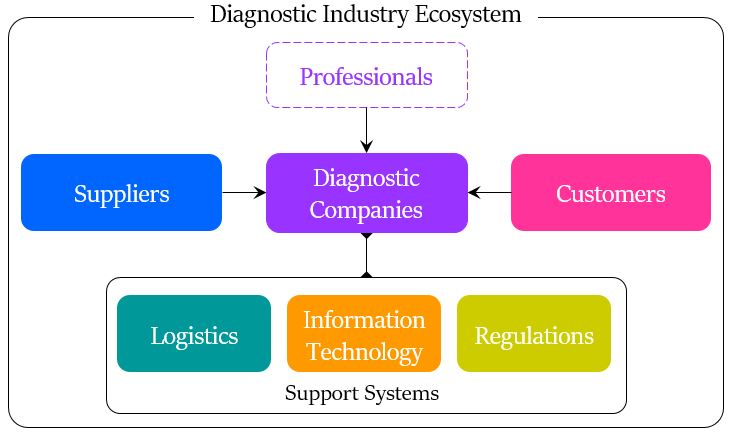

In the last blog, we discussed the below three components of the Diagnostics Industry ecosystem.

- Diagnostic company: The individual companies in the Diagnostic Industry

- Professionals: They work in the Diagnostic companies

- Suppliers: They are vendors supplying equipment and supplies needed for operation of Diagnostic companies

In this blog, we will continue to discuss the below three components.

- Customers: They are the end users who pay and receive the services from the Diagnostic companies.

- Regulations: These are government bodies, agencies and institutions that regulate the industry.

- Information Technology (IT): Helps to integrate the operations in Diagnostic companies

Logistics Partners, is reserved for the next blog considering the depth of content covered.

(Feature image credits: https://ehealth.eletsonline.com/2021/02/future-prospects-of-the-indian-diagnostics-sector-the-resurgence-post-pandemic/)

Brief Background of this Blog Series

Diagnostics Industry was of interest to me since 2017. However, I could spend dedicated time only during 2021 to study this industry. The contents that you see in the coming blogs were mined from Annual Reports, Concalls, RHP, Management interviews and a few Twitter spaces by Mr Aditya Khemka and Dr Velumani.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

You might also be interested to read these related articles:

Customers

They are the end users in this value chain. They bring in money to the industry.

Types of Customers

There are 3 types of customers.

Acute Patients

They suffer from a disease and require immediate treatment. As per the report by Bain & Company, acute patients suffering from heart, lung, kidney disease or cancer or something critical are the most influenced by doctors and less concerned about prices as improvement in their health is their major priority. In fact, it is impossible for patients who are nonmedical to understand the differences in tests, lab quality, raw material ingredients and, therefore, the decision maker and chief influencer is the doctor and not the patient.

Chronic Patients

They require testing at regular intervals to monitor their health conditions. Chronic patients who suffer from diabetes or blood sugar or thyroid disorders or the like are moderately influenced by doctors and slightly influenced by prices. They need consistent reporting from one lab as they need to monitor levels of test results through the last result for them to know if they are okay. Changing labs just for prices and discounts will be harmful to the health as labs give different results and different normal ranges based on different equipment.

Preventive Customers

They opt for wellness tests when they are well. They do not go for testing after they are ill. These customers come from “wellness times” and not during “illness space”. These consumers are least influenced by doctors. Less aware consumers are highly influenced by prices, and the more aware consumers care for quality and service. We saw in a earlier blog that this industry depends on Medical referrals and the trust the doctors have in the lab. New players in the industry do not have doctors’ trust. So they enter this preventive segment to create an impact followed by the chronic segment to some extent but extremely challenging in the acute segment.

Reference: Metropolis Healthcare May 2022, Concall Transcript.

Business Models

The business models depend on the type of customers.

B2C Model

- Individual customers who are patients approaching the diagnostic centres with a prescribed test request from a physician, or a qualified healthcare professional or a hospital, clinic or nursing home.

- They are also direct ‘Walk-in’ customers, with more focus on Preventive diagnosis and not driven by any request from the medical community.

B2B Model

- The customers of the Diagnostics companies are private laboratories, hospital laboratories, clinics, nursing homes, and polyclinics.

- The payment charged by diagnostic chains to such customers is a fee schedule contractually agreed with each of them or at the otherwise standard rates applicable to the client.

- The focus is more on Prescriptive diagnosis, Semi specialised and Special tests

B2G Model

The services are offered to customers through Government. These could be various Government bodies like Central Government, State Government, Municipals and Government Hospitals.

Customer Reach-Out Network

Diagnostic chains reach their customers through a network of centres which comprise of

Owned Centres

These are the centres which are directly owned by the company by investing in land or rent space, analysers and medical devices.

Franchises

These are the centres where franchisee rights are given to an operating partner who takes care of operations and in turn has to share revenue with the diagnostic chain. Diagnostic chains have extensively used the franchisee route for rapid expansion of their business as this requires minimal capital cost investment.

Managed Labs

- These are the laboratories which are owned by individuals or hospitals whose operations are outsourced to a third party – mostly a larger diagnostic player, who manages the day-to-day operations of the laboratory with the agreement to share revenue.

- This segment is lucrative for diagnostic chains and they are entering into agreements with various smaller laboratories and hospitals for managing their laboratories.

- Diagnostic chains due to their wide network benefit from economies of scale and hence are in a better position to operate these managed laboratories.

Home Collection

A phlebotomist visits customers at their premises to collect the sample. They then transport it in specially designed transportation box (cold box) to the designated processing centre. This can be seen as a value addition or convenience to the customers.

Source: Metropolis DRHP Page 129.

Information Technology

Diagnostic chains need strong support of Information Technology (IT) to support the entire network and day-to-day operations. IT system allows to fully integrate and automate processes ranging from registration, bar-coding and billing of specimens to analysis and reporting of test results. IT system enables to:

- Achieve standardization across operations

- Reduce errors due to human intervention

- Monitor technical operations

- Closely track key performance metrics and

- Provide convenience to patients and customers, by allowing them to book appointments, complete registration and access test reports online.

The IT systems serve customers and help to ensure the efficiency of business by monitoring network’s performance, refining resource allocation, tracking consumption patterns and proactively directing patients to certain locations and services. The main components include the following:

Laboratory Information Management System (LIMS)

LIMS stores and manages all clinical laboratory data, including all patient demographic and medical information. LIMS allows to track specimen collection, shipping and testing in real time.

Enterprise Resource Planning (ERP) System

This system helps in to maintain the record of accounts payable, accounts receivables and inventory, as well as banking and general ledgers. This allows better control finances, inventory and purchasing through the provision of real-time data from all locations.

Data Collection and Analytics

Through systems and operations, Diagnostic chains have large amounts of patient demographic data and other medical information. This data can be analyzed to determine: (1) To improve diagnostic services, (2) Predict the demand for healthcare services. This area has a large potential in future.

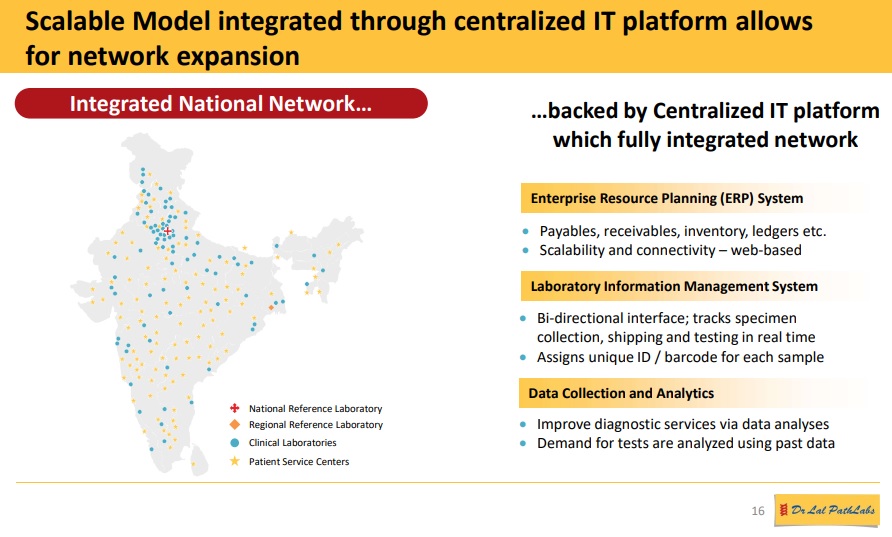

IT infrastructure is generally scalable to support the growth of business and help ensure reliability of operations as well as the security of customer information. However, it needs to be secure as it would have a huge volume of customer personal data. Below is a sample of IT operations of two Diagnostics chains.

1. Dr Lalpath Labs (Source, Recent investor Presentation of the company)

2. Metropolis (Source, Recent investor Presentation of the company)

Regulations

The diagnostic industry in India lacks a stringent and comprehensive regulatory framework. There are two kind of regulations.

Mandatory Regulations

A lab must adhere to these requirements and have the necessary approvals or licenses.

- Shop establishment license

- Pollution control board

- Clinical Establishment Act, 2010

- Pre-natal diagnostic technique act (Applicable only for imaging centres)

- Atomic Energy Regulator Board guidelines (Applicable only for imaging centres) – for installation and operation of radiology equipment like CT, MRI and X-Ray equipment

Voluntary Regulations

Diagnostics centres can also obtain accreditation, which are voluntary.

- National Accreditation Board for Testing and Calibration Laboratories (NABL): Evaluates and recognizes the diagnostic centers’ services according to a set of standards. NABL, which is an autonomous body under the Ministry of Science and Technology, is the sole accreditation body in India that assures the accuracy, reliability and conformity of test results. Laboratories are opting for various accreditations such as NABL to gain a competitive advantage and enhance their brand image.

- College of American Pathologists (CAP) laboratory accreditation: The CAP is an internationally-recognized program that offers an accreditation service to help medical laboratories obtain the ISO 15189 certification.

- Certifications from International Organization for Standardization (ISO).

- APLAC – Asia Pacific Laboratory Accreditation Co-operation

- ILAC – International Laboratory Accreditation Co-operation

- CDC – Centers for Disease Control and Prevention

- CLIA – Clinical Laboratory Improvement Amendments

To close…

In this blog and the last blog, we discussed the 6 components of the Diagnostics Industry ecosystem. In the next blog, we will cover the last component, Logistics Systems.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.