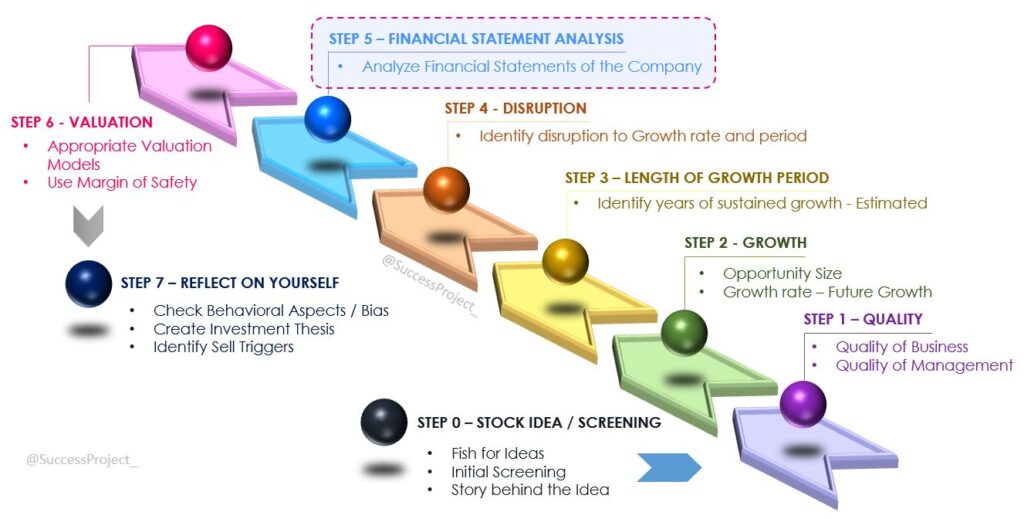

In the last blog, we learned that Financial Statement Analysis acts as a window through which investors can observe the financial performance of a company. To better comprehend this blog, I encourage you to read the earlier blog titled “Stock Analysis Framework“. This analysis deals with hard information and holds a central position in a stock’s fundamental analysis. When combined with other investment dimensions, the articulation of the Financial Statement analysis reveals a company’s story and provides valuable insights into its future. (Featured image credits: Image by Tumisu from Pixabay)

Financial Statement analysis stands as a key step in stock analysis for long-term investment. It heavily relies on the financial statements published by a company. In the broader framework, this analysis serves as Step 5 after a company successfully passes through the evaluations of a good quality business, capable management, and strong future growth over many years.

In this blog, we will understand in detail financial statements, important users of these statements, financial statement analysis, and different kinds of analysis.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index for all my blogs.

You might also be interested to read these related articles:

Financial Statements

What are Financial Statements?

The American Institute of Certified Public Accountants defines Financial statement as “the statements prepared for the purpose of presenting a periodical review of report on progress by the management and deal with the status of investment in the business and the results achieved during the period under review. They reflect a combination of recorded facts, accounting principles and personal judgements”.

A company prepares and publishes these statements. The accounting process collects, records, and presents all financial transactions of an organization. The end products of the accounting process are financial statements, which provide financial information about a business’s performance.

Different Financial Statements

There are three financial statements

- Balance sheet: It has the details of the liabilities and assets held by a company at a point in time.

- Income Statement: This is also called a Profit and Loss statement. This has the details of the revenue earned by the company, the expenses and the profits (or loss) that the company made. This statement is for a period of time.

- Cash Flow Statement: This demonstrates the actual cash movement to and from the company as it receives and pays cash to different entities/stakeholders through various transactions. The cash flow statement is also for a specific period of time.

Auditors Report (Read my earlier blog on mining insights from Auditor’s Reports) and notes accompanying the financial statements are equally important not much widely discussed.

- The Auditor’s Report represents the opinion of the auditor based on their audit of the financial statements. This report is presented before the three financial statements, providing insights into the quality of accounting, i.e., the purity of the numbers in financial statements.

- Notes accompany the financial statements and are provided after the three financial statements. They carry a detailed breakdown and schedule of various line items in these three statements.

Where to get these Financial Statements?

Annual reports carry the full-year financial statements, while the quarterly reports include 3 months’ financial statements. Both the annual and quarterly reports are accessible on the company’s website under the “Investors” or “Financials” section. Additionally, these documents are part of exchange filings, making them downloadable from the BSE or NSE websites. Moreover, many financial websites also display financial statements.

As an investor, it is essential to refer to the financial statements from the annual report of a company, as the original source is always the best.

Who all are interested in Financial Statements?

Beyond investors, financial statements are utilized by many stakeholders for financial statement analysis. Although the blog primarily focuses on investors, we will still explore the perspectives of different stakeholders. Additionally, this approach highlights the significance of financial statements for various individuals and entities.

Management

Company management could be the first people to use financial statements. They use the statements to:

- Evaluate their current and past performance.

- Compare their performance against competitors or industry benchmarks.

- Make business decisions such as growth, capacity expansion, acquisitions, and means to improve operational efficiencies.

- Make financial decisions such as taking more debt, repaying existing debt, and determining dividend payouts.

Employees & Union

- Employees are interested in knowing how the company is performing as it impacts their future career and financial prospects.

- Unions use financial statements to understand the company’s financial situation and leverage it during wage hike negotiations, bonuses, and profit-sharing discussions. Consequently, all employees of the company benefit from this information.

Competitors

- Companies are interested in knowing the financial status of their competing companies.

- They have two main reasons for this interest: (1) to maintain a competitive edge over their rivals and (2) to understand their competitor’s business and financial strategies.

- Consequently, companies utilize the competitor’s financial statements to make various strategic decisions on pricing, credit terms, improving operational efficiencies, and many more.

Lenders

- Companies borrow money for their operations, which can be short or long-term.

- Short-term borrowing is for short-term needs, such as working capital, spanning a few months.

- On the other hand, long-term borrowings are for expansion and growth, in the form of CAPEX and acquisitions.

- Companies borrow from lenders like financial institutions, such as Banks.

- Lenders are interested in the safety of their capital, timely payment of interest, and prompt repayment of the principal.

- Their analysis focuses on the company’s profitability over a period of time and its ability to generate cash to meet interest payments and repay the principal amount.

Vendors/Suppliers

- Vendors/Suppliers supply raw materials and services required for a company’s operations.

- Generally, the items (or services) are supplied first, and the company pays its vendors/suppliers after a certain number of days, usually ranging between 15 days to 60 days.

- This arrangement represents a credit agreement between the company and vendors/suppliers, with a credit limit and specified number of credit days.

- Thus, vendors and suppliers can be seen as special kinds of lenders. They expect prompt payment by the company by the due date.

- To make decisions regarding providing credit to the company, credit terms, and duration of credit, they use the company’s financial statements.

- Suppliers are interested in dealing with companies that have good financial health.

Credit Rating Agencies

- Companies raise funds from the capital markets to meet their financial needs, often through debt instruments such as bonds or fixed deposits.

- In this process, investors considering such debt instruments seek a clear view of the risk and return profile to make their investment decision.

- Credit Rating Agencies play a crucial role in providing this view in the form of credit ratings, which in turn assist investors in making informed investment decisions.

- Alongside various factors, these agencies utilize financial statements to assign ratings to the debt instruments.

It’s worth noting that credit rating agencies take a comprehensive view of the business condition and consider many other factors when arriving at the rating, with the financial statements of the company being one of those significant factors.

Investors & Shareholders

- Investors, both current and prospective, invest their money in the company’s shares, making them actual owners of the company.

- They are keenly interested in understanding the company’s recent and past performance through the financial statements.

- Their interest and expectations from these statements are multi-faceted, encompassing aspects such as earnings, profitability, return on capital, dividend payout, and future growth prospects.

- Through this analysis, they seek answers to questions like whether the company is worth investing in, whether it can provide expected returns on their invested capital (usually a mix of dividends and capital appreciation), and whether the investment is safe.

Moreover, investment analysis and broker houses also rely on these financial statements to recommend stocks to their clients for investment purposes.

Government

- The different agencies of the government use the statement for different purposes.

- The tax department utilizes it for checking the proper payment of taxes.

Except for management, employees and union, all others are external stakeholders.

Financial Statement Analysis

What is Financial Statement Anaysis?

- Financial statement analysis is the term for the analysis of data in financial statements and the gathering of insights for decision-making.

- It involves a critical evaluation of the financial information contained in the statements using various mathematical models and techniques.

- The analysis studies the relationship among different financial facts and figures to gain insights into the profitability and operational efficiency of the firm, assessing its financial health and future prospects.

Ultimately, the analysis must culminate in the interpretation of financial statements. Without such interpretation, the analysis is of no use.

Stephen Penman in his Book “Financial Statement Analysis & Security Valuation” beautifully ties the relationship between financial statements and financial statement analysis as below:

“Financial statements are a lens to business. Financial Statement Analysis calibrates the lens to bring the business into focus. Imperfect financial statements dirty the lens and distort the picture.”

How does this analysis help an investor?

The analysis must provide the company’s interpretation/opinion, enabling investors to make informed investment decisions. With proper analysis, an investor can gather insights about:

- The current financial performance of the company

- The past performance of the company

- The trend of a few past performance metrics, indicating how the company has been improving or declining (such trends serve as indicators for the future)

- The financial strengths and weaknesses of the company

- The management strategy

- Indicative insights into the future

- How the company compares with competitors in the same industry.

Limitations of Financial Statement Analysis

- Financial statement analysis is a judgmental process that aims to estimate current and past financial positions, with the primary objective of determining the best possible estimates and predictions about future performance.

- Two different investors analyzing the same financial statement could form different opinions about the company and its future performance.

- So, remember that this analysis provides only clues about the future but not the conclusion.

To partly overcome these limitations, this analysis must be related to soft information like management quality, the competitive structure of the industry, pricing power, future size of the opportunity, etc.

Types of Financial Statement Analysis

The numbers in the financial statements, by themselves, do not convey many insights. For example, if the revenue is 10 Crores, it does not provide any meaningful basis for decision-making. However, to derive valuable insights, these numbers must be compared with something to determine if the value is good or bad or if it has been improving or declining over a period of time.

The key lies in the comparison of values in the financial statement with something else. Financial statement analysis offers tools for conducting various types of comparisons, enabling investors to gather meaningful insights and make informed decisions. There are different kinds of analysis as listed below, based on the nature of the comparison.

Horizontal Analysis

- It is also called comparative analysis.

- The current year’s statement is compared with the previous year’s statement.

- This comparison is made on the absolute value of change and percentage change.

- This gives a view of year-on-year performance of the company.

- The below can be seen as sub-sets or a special kind of horizontal analysis.

- Trend analysis: It is a technique of studying the operational results and financial position over a series of years. By looking at a trend in a particular item, one may find whether the ratio is falling, rising or remaining relatively constant. This observation gives insights into improving (or worsening) the condition of the item.

- Analysis of 10 years financial summary (Refer to my previous article)

Vertical Analysis

- These statements are also known as common-size statements.

- In this analysis, the absolute values in the financial statements are converted to 100%.

- This comparison is performed by relating each line in the statement to one of the important items in the statement.

- Common-size analysis proves useful for both intra-firm comparisons across different years and inter-firm comparisons for the same year or multiple years.

- By standardizing the values, this method facilitates a clearer understanding of the relative proportions of different items within the financial statements.

Ratio Analysis

- This analysis involves considering two selected numerical values from the financial statement.

- The ratios establish mathematical relationships or comparisons between two or more items in a financial statement.

- It’s essential to understand that financial ratios are interrelated, and viewing one in isolation provides little insight.

- As an investor, you must consider a set of ratios together to gather meaningful inferences about the company’s financial health and performance.

Competitor Analysis

- This is an extension of all the above analyses.

- The different analyses are compared between your target company and its competitors.

- The various ratios of the competing companies are compared to identify the weakness and strengths between the companies.

The above classification does overlap. The values arrived from ratio analysis can be compared over a period of time. So, you find that the ratio analysis overlaps with horizontal analysis.

Additional References & Further reads

These are some of the materials that I have read in the past to understand financial statement analysis. I am sure you will find it useful for knowing more about financial statement analysis.

This four-part lesson by NCERT covers Financial Statement Analysis, Accounting Ratios and Cash Flow Analysis.

- https://ncert.nic.in/textbook/pdf/leac203.pdf

- https://ncert.nic.in/textbook/pdf/leac204.pdf

- https://ncert.nic.in/textbook/pdf/leac205.pdf

- https://ncert.nic.in/textbook/pdf/leac206.pdf

60 Part Videos from the course “Financial Statement Analysis and Reporting” by Prof. Anil K Sharma.

Short articles on various Financial Statement analysis by Wall Street Mojo.

Conclusion

Financial statement analysis is an indispensable tool for investors and other stakeholders seeking to gain deeper insights into a company’s financial performance and future prospects.

- By scrutinizing the numbers presented in the financial statements and employing various analytical techniques, investors can make well-informed decisions about their investments.

- The analysis allows investors to understand the company’s current and past financial position, evaluate its profitability and operational efficiency, and assess its overall financial health.

- Moreover, by comparing financial ratios and performance metrics with industry peers, investors can gauge the company’s competitive standing and identify potential strengths and weaknesses.

However, it is essential to remember that financial statement analysis is not a crystal ball for predicting the future but rather a guiding compass for making informed decisions based on available data.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.

Pingback: Financial Ratio Analysis, All you need to know - Venkatesh

Pingback: Dividends analysis is important for investment - Venkatesh