In this blog, we will cover the key insights of Krsnaa Diagnostics (https://krsnaadiagnostics.com/). The company provides a range of technology-enabled diagnostic services such as imaging (including radiology), pathology/clinical laboratory and teleradiology services to public and private hospitals, medical colleges and community health centres pan-India.

Krsnaa Diagnostics is unique in many ways:

- It is a Radiology-focused player in a saturated Pathology-focused market with unique business model in comparison to industry peers. The Radiology business is bigger than Pathology.

- The company is primarily into B2G / PPP Business Model

- The company has a unique value proposition in terms of Teleradiology services.

All these aspects shall be discussed in this blog.

DISCLAIMER: This blog is related to Company Analysis and NOT Stock Analysis. The contents of this blog are not any kind of investment advice on the company. DO NOT make any investment decisions on the company based on this blog. All the information used in this blog has been sourced from the 2022 Annual Report and Nov 2022 Investor Presentation.

(Featured Image Credits: Cover page of 2022 Annual Report.)

Brief Background of this Blog Series

Diagnostics Industry was of interest to me since 2017. However, I could spend dedicated time only during 2021 to study this industry. The contents that you see in the coming blogs were mined from Annual Reports, Concalls, RHP, and Management interviews.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

Earlier Blogs in Diagnostics Industry

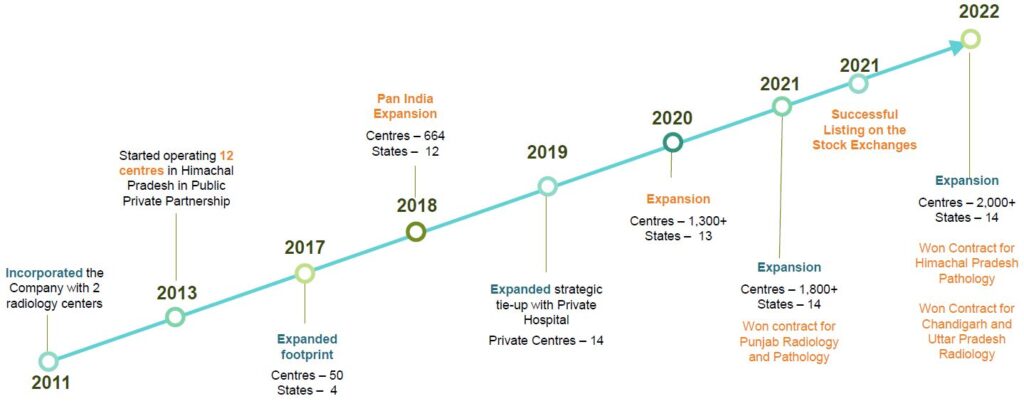

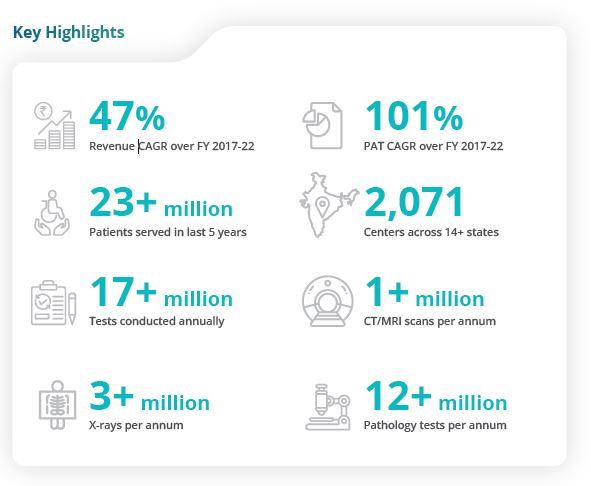

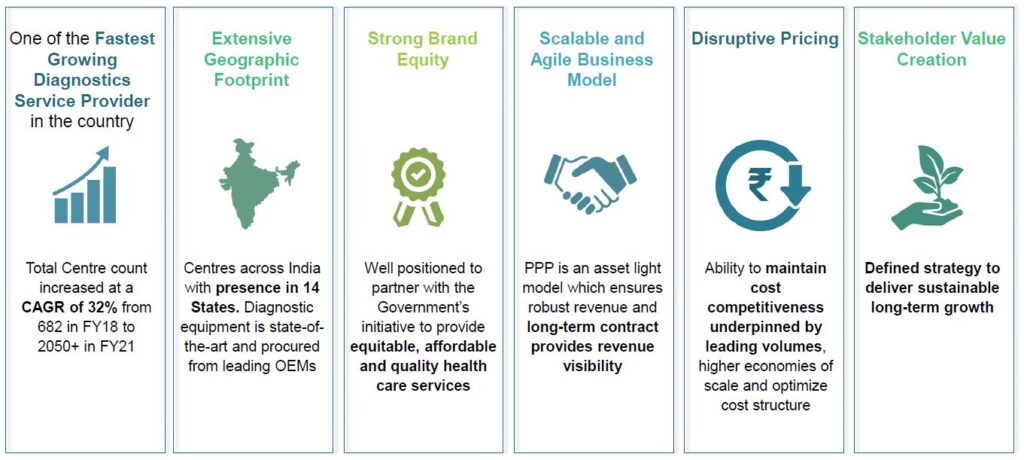

Krsnaa Diagnostics started their journey in 2011 with 2 radiology centres. It has a 12 years legacy.

Business Segments

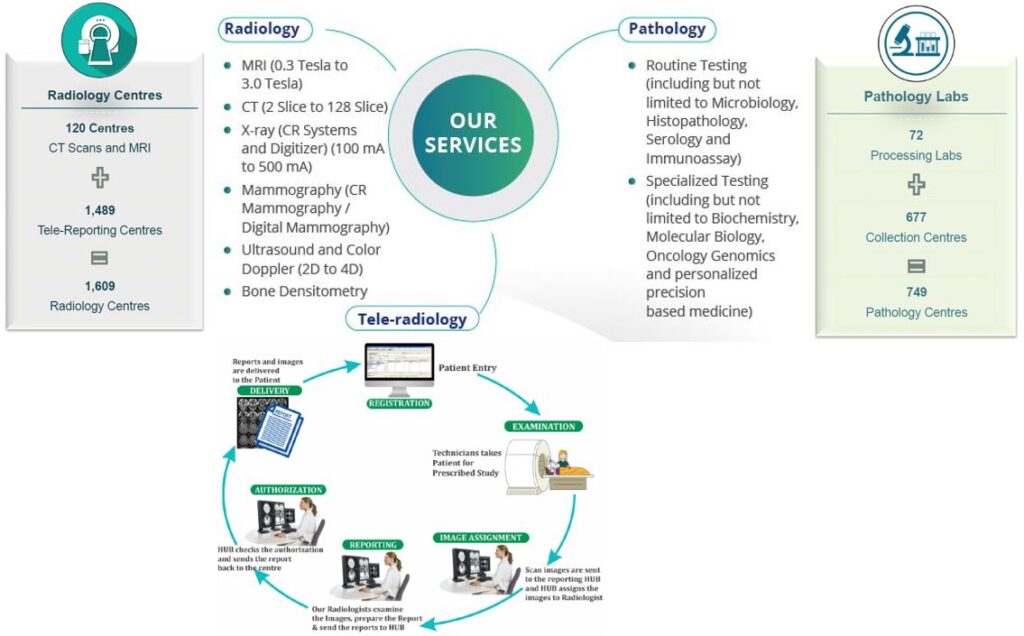

Krsnaa Diagnostics has three business segments as below

- Pathology

- Radiology

- Tele-reporting

Pathology

The company all the key disciplines of the conventional as well as specialized lab services such as biochemistry, haematology, clinical pathology, histopathology and cytopathology, microbiology, serology and immunology. These tests are part of the offerings with 2,544 pathological tests provided through 583 centres.

Radiology

The company has pan-India operations across 14 states with 1,488 Radiology centers offering 1,394 Radiology tests. Company’s principal diagnostics services include imaging modalities such as MRI, CT Scans, X-Rays, Mammography, Bone Densitometry, Ultrasound and Color Doppler.

Teleradiology

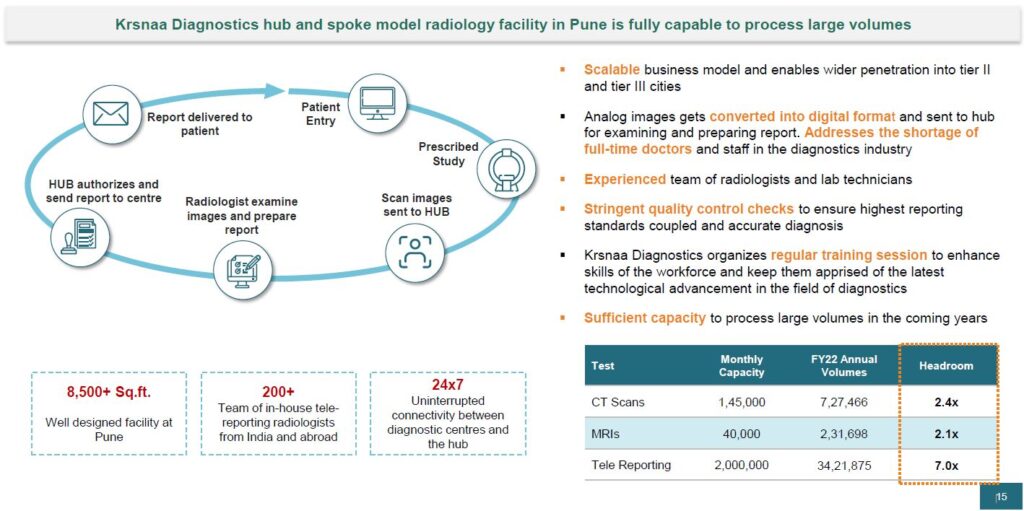

This is a suite of diagnostic equipment is located at the teleradiology hub in Pune. Tele-reporting is a critical and unique aspect of the business model that enables to serve patients in remote locations where diagnostic facilities are limited.

- Krsnaa Diagnostics has the largest Teleradiology reporting hub in India

- This can be seen as a hub-and-spoke model in Radiology

- The hub is located in Pune in a 8500+ Sq. Ft facility housing a team of 200+ Radiologists (reporting on reporting on CT/ MRI / X-ray)

These specialists come from India and abroad - It has a roboust infrastructure with uninterrupted connected between the its diagnostics centres across India and the hub in Pune

The flow of telereporting can seen in the below image.

The Diagnostics centre sends the images to the hub in Pune. These Radiologist do the reporting, and the report is released to the center after a final quality check. For example, the test could be in Jammu but the images are processed at the hub at Pune. Through this model, the reporting happens (Even to the remote location in India) between the stipulated turnaround time which is on average two to six hours for a CT scan or MRI cases.

This is a unique value proposition from Krsnaa Diagnostics as it addresses the shortage of full time of doctors and also allows serving patient in remote location where diagnostic facility is limited.

Business Model

Krsnaa Diagnostics is predominantly in the B2G / PPP Business Model. Kindly read my earlier blog on PPP – Public Private Partnership for a complete understanding of this model in the context of Diagnostics Industry.

In this business model the company engage and collaborate with central, state governments, municipal corporations to provide diagnostic services at the public hospital.

The government hospital provides the required space for setting up diagnostic centers per the contract requirement. The company then installs specified equipment and deploys the required manpower to provide affordable and high-quality diagnostic services.

Management

Business Insights

Key Numbers

In the below image are key numbers on the revenue mix. It can be clearly seen that the Radiology business is dominating in comparison to the Radiology business. This is both in terms of the number of centres and revenue earned.

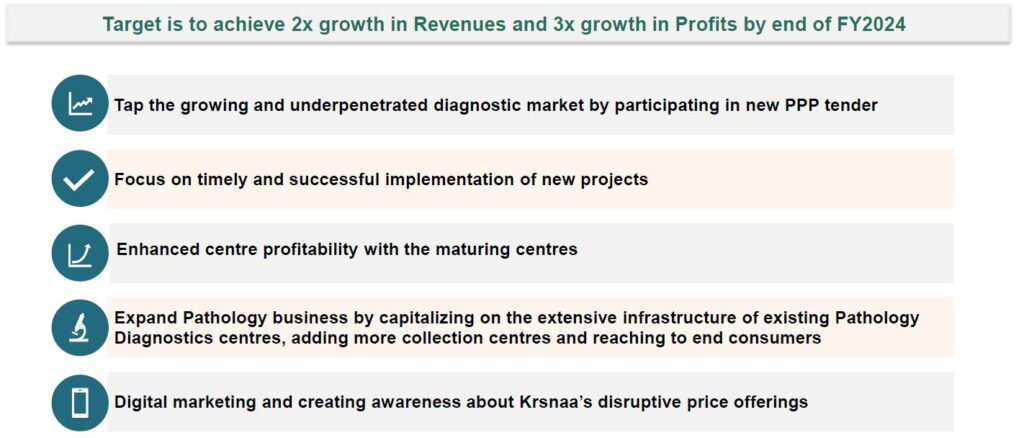

Expansion and Growth Strategy

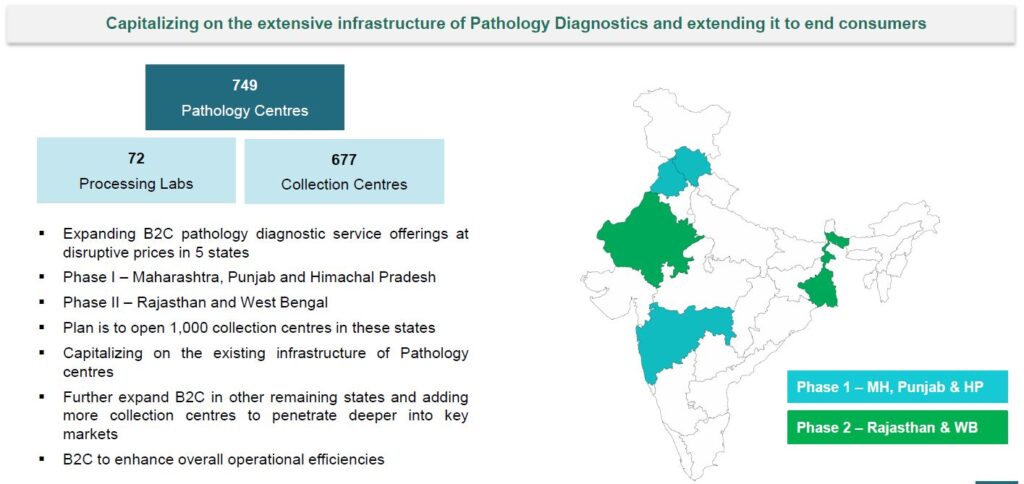

B2C - Future Growth Ambition

Krsnaa Diagnostics has been a big player in the B2G business model (PPP). As part of expansion strategy, the company is reaching out to the retail customer (B2C). The aim is to reach out to both Wellness and illness segments. Towards this objective, the company has a well thought strategy and uses branding to reach out to retail customers.

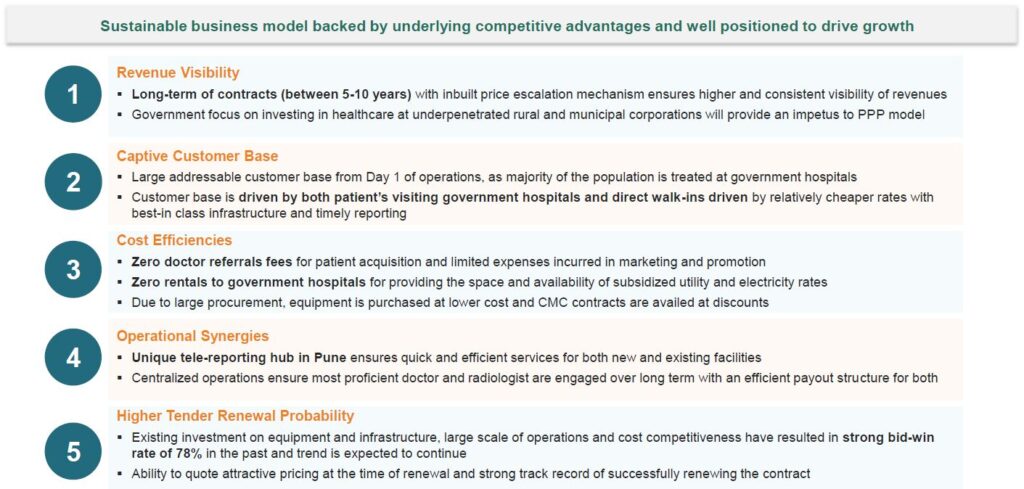

Competitive Advantage

To Close…

Did you find this kind of analysis of the company useful? If Yes, do give me a thumbs up.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.

Interesting prospects, relatively cheap valuation and lower leverage compared to peers due to smaller size and lesser brand visibility.

If execution and payments cycle are managed well mcap could multiple over a 5-10 yr investment horizon. Absolutely no investor or trader interest in the stock as of now as it languishing near all time low. Cmp 430.