In stock investing (or trading), there are many stock analysis approaches like technical analysis, fundamental analysis, and momentum approach. Based on duration, there are short and long-term investing. When it comes to long-term investing, an investor needs to consider many aspects (or dimensions). A few are:

- Growth prospects of the stock

- Competition scenario

- Management analysis

- Financial statement analysis

- Accounting / Financial forensics

- Industry structure and outlook

- Pricing power of the company

- Moat analysis

- Valuation

- Margin of Safety

These variables must not be analyzed in silos. Instead, by analyzing them comprehensively, the analysis becomes complete, as you cannot:

- Evaluate the growth prospects without knowing the industry outlook and management capability.

- Understand Management’s past performance without financial statement analysis.

- Rely on results of financial statement analysis without a view on the quality of the numbers behind the analysis. Such a view can be made only with an understanding of management integrity and Accounting / Financial forensics.

- Gauge pricing power without understanding the competitive scenario.

- Grasp the competitive scenario without knowing the industry structure.

Thus, you will see that the different aspects are related. To understand the story behind the investment and what can go well or wrong, all these aspects must be related and articulated.

This can be achieved through an “Investing Framework.” In this blog, we will delve into a detailed discussion of this topic.

Note: I have created a multiple-part video series on this topic. I will refer to those videos under the respective sections of the investment framework. headings.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index for all my blogs.

You might also be interested to read these related articles:

Investing Framework

What is this?

It is a structured and systematic approach used by investors to evaluate and make informed decisions about investments. It consists of a clear set of guidelines and principles that help investors assess potential investments. This is a valuable tool for investors to enhance their decision-making process, reduce emotional biases, and increase the likelihood of success in investing.

Importance of Investing Framework

An investor needs to have an investing framework which builds upon all these aspects. Such a framework helps to:

- Firstly, articulate the inferences from different investing aspects into a coherent story about: (1) The company’s past, (2) Future prospects, and (3) Management strategy.

- Secondly, use this story to arrive at a judgement about the investment worthiness of the company.

- Lastly, evaluate the fair value (with a sufficient Margin of Safety) of such an investment-worthy company.

Is there only one Framework?

In investing, all of us hunt for a secret formula or framework or tool that would help us make a lot of money. However, unfortunately, when it comes to investing, there is no one-size-fits-all approach. Different individuals may find success with varying frameworks. Thus, there is NO one accepted framework.

In this blog, we will explore one particular framework that I personally developed back in 2015. Moreover, over the years, I have continuously refined and improved this framework by incorporating insights from renowned investors and fund managers, both from India and around the globe. By drawing from a diverse range of sources, I aimed to create a comprehensive and well-rounded approach to investing.

While there could be diverse frameworks adopted by different investors, there is nothing like a superior or inferior one. What truly matters is:

- You understand the framework,

- You are comfortable using it,

- The framework suits your investing style and goals.

- You refine the framework periodically as you gain new knowledge or learn from past mistakes.

A word of Disclaimer

However, it is essential to emphasize that this framework is not presented as a guaranteed path to successful investments or as some secret formula for generating wealth. Instead, it serves as an illustration of how one can construct a framework to integrate the various critical aspects of investing.

My intention in sharing this framework is to demonstrate how different elements of investing can be harmoniously linked to create a more informed and strategic investment approach. In doing so, I hope to provide you with valuable insights and perspectives to develop YOUR OWN FRAMEWORK.

Moreover, I encourage readers to view this framework as a starting point and an inspiration to develop their methodologies tailored to their personality and investment objectives. Remember that successful investing is a journey of continuous learning and improvement, and this framework serves as a stepping stone in that direction.

Information Used in Analysis

Investors deal with a lot of information for stock analysis. These come from:

Formal sources: Annual reports, con calls, analyst reports, financial websites, exchange filings etc.

Informal source: Investors receive insights from another investor, opinions shared by industry experts, and opinions in the media, among other sources. Additionally, there is information that we assume, estimate, or expect.

- Assumption: Investors resort to assuming certain information as fillers in the absence of data from both formal and informal sources.

- Estimation: This occurs when investors try to project (or derive) some data which is not available. They base these projections on certain criteria, mathematical models, or assumptions. Examples would be future earnings, cash flows, growth, etc.

- Expectation (or speculation): This can be seen as a kind of estimation that is based on an investor’s judgment. It is not backed by a mathematical model or criteria but rather relies on intuition or gut feeling.

Accordingly, we can classify information as hard and soft. (This terminology is from the book “Financial Statement Analysis & Security Valuation” by Stephen H. Penman).

Hard Information

- All investors have access to this information.

- It is not variable, i.e., it does not change between investors.

- It can be described as “written on stone,” and a good example of such information is published financial statements.

- These statements are available to all investors, and the information they contain is the same for whoever refers to them.

Soft Information

- This information varies with the individual.

- These are assumptions, expectations, future projections/estimations, and judgments concerning future growth, future PE expansion, industry prospects, technology change, quality of management, pricing power, etc.

- Two different investors could have different opinions (or even completely contrasting opinions) about a stock’s future growth.

Example

Past and current sales data, as published in the annual report, constitutes hard information. On the other hand, using the last few years’ sales information in a mathematical model to project next year’s sales represents soft information.

Note: It can be debated that even the information in the financial statements, to an extent, is based on the judgment of accountants and auditors. Thus, even this should be seen as soft information. True. However, the information in financial statements is relatively hard.

As an investor:

- Be mindful of the distinction of what forms hard/soft information in your analysis. Most often, we make the mistake of strongly believing soft information is hard one.

- Your investment decision should not have a huge weightage on soft information.

- Start with hard information (which mostly provides details on the past and current) and add soft information (your judgment, assumptions, and expectations) to gain an understanding of the future of the company.

Stock Analysis Framework

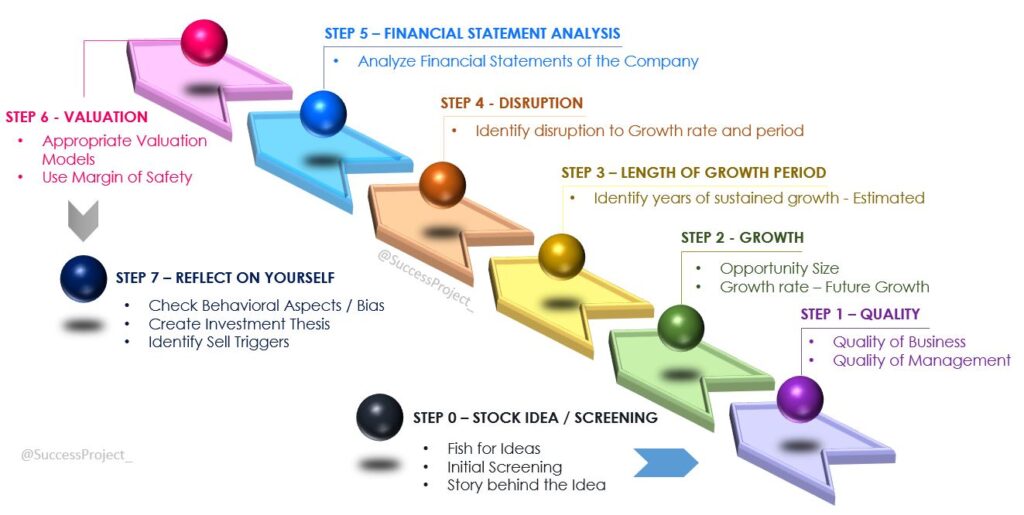

The framework presents a series of steps. Ideally, you should perform the analysis sequentially, i.e., proceed to the next step after completing the present one. However, you have absolute flexibility to revisit the previous step in light of new information and insights as the analysis progresses. Below is the image of the 7-step approach of the framework.

Identify Stock Ideas

This stage involves fishing for ideas, and there are many approaches to obtaining stock ideas.

- Top-down approach: It starts with macroeconomic factors, identifies promising sectors, and then drills down to individual stocks within those sectors.

- Bottom-up approach: This involves identifying individual companies based on specific parameters, and stock screens like Screener.in help pick stocks based on profitability ratios, growth rates, and various financial ratios.

- Pick what you see: This is an approach from Peter Lynch suggests. Here stock ideas are derived from products or services used/seen in daily life.

- Pick what you do or know: This involves investing in companies within one’s circle of competence, leveraging knowledge of a particular sector gained through one’s profession.

- Cloning stock ideas: This entails selecting stock ideas from the portfolios of big investors and fund houses. However, this is not coat-tailing, where one blindly invests in stock names without conviction. Instead, one clones the ideas and subjects them to rigorous analysis outlined in this blog or based on their framework before deciding to invest in the stock. At times, it may not be the right fit, and one may choose not to invest, despite a fund house holding it.

The following two videos delve into various approaches for identifying stock ideas, accompanied by illustrative examples.

Quality of Business and Management

This is the first step in the framework with a focus on the quality of business and management.

Quality of Business

The analysis focuses on soft information, including:

- How the company makes money and the products or services it sells.

- The company’s business model, such as whether it is asset-heavy or asset-light, its tangible or intangible assets, and whether it requires periodic heavy capital expenditures.

- The industry structure in which the company operates.

- The competitive scenario and whether the company enjoys a moat, which gives it a sustained competitive advantage.

- Customer stickiness.

- Whether the return on capital is higher than the cost of capital.

- The pricing power of the company for its products.

This analysis typically categorizes the stock as a Great, Good, or Gruesome Business. Warren Buffet shared this term in his Berkshire Hathaway 2007 Annual Report, Page 8. Your focus at the end of the analysis is to:

- Avoid Gruesome businesses.

- Buy Good businesses at bargains.

- Buy Great businesses at a fair or reasonable price.

Most companies fail in this filter, as the vast majority fall into the “Gruesome” category, leaving only a few in the “Good” or “Great” category.

The video below covers the analysis of the quality of business.

Quality of Management

Management analysis deals primarily with soft information. There is no index or ratio that ranks management capability, passion, and integrity. However, it is not entirely a grey area, as there are many pointers available in the Annual Report that can be considered as good as hard information. A few basic ones include:

- Integrity: Observations in the Auditor’s report, Related Party Transactions, Promoters’ salary, and corporate actions that primarily benefit promoters.

- Capability and Passion: Past performance data from financial statements and the execution capability demonstrated in handling new projects, expansions, and future plans shed light on their capability and passion.

I have created a three-part video series on Management quality. I encourage you to check it out.

Growth

- Opportunity size: Investors can determine the size of the opportunity in which the company operates. A comprehensive understanding of this concept can be gained from Mr. Bharat Shah’s interviews and book.

- Future growth rate: Investors should assess the potential growth rate required to scale to the opportunity size. Management capability plays a crucial role here, as only capable management can effectively exploit the opportunity.

- Longevity of growth: Investors must evaluate how long the estimated growth rate can be sustained. Whether it is 2 years, 5 years, or 10 years, longer sustainability is more favorable for a long-term investor.

- Disruption: Investors should consider potential disruptors that could impact the estimated growth rate and longevity of growth. Factors like technology advancements, regulatory changes, and the introduction of new products are essential considerations.

In my actual framework, these are covered in steps 2 to 4. I do this in three different steps to give a dedicated analysis to growth, its longevity and disruptive factors.

An important observation exists in this Step 1 to 4. Many investors fail to perform Steps 2 to 4 successfully. The reason is that it requires more gazing into the future and an in-depth understanding of the industry, opportunity size, and future prospects. All of this constitutes more of soft information and the art part of investing, which not many can handle.

The two videos below provide a comprehensive analysis of growth, delving into its details.

Financial Statement Analysis

This is the fifth step in the framework.

The company publishes financial statements as the primary information about itself. Financial statement analysis is performed based on these statements, forming the basis for the analysis. This analysis acts as a window through which we can see the financial performance of the company, and all the required data is available in the company’s Annual report.

Stephen Penman in his Book “Financial Statement Analysis & Security Valuation” beautifully ties the relationship between financial statements and financial statement analysis as below:

“Financial statements are a lens to business. Financial Statement Analysis calibrates the lens to bring the business into focus. Imperfect financial statements dirty the lens and distort the picture.”

But this is important to...

Investors need to do this analysis only after satisfying the previous steps. It is only after completing these previous steps that you have a company with good business fundamentals, ethical and capable management, and an attractive future growth rate for a long period.

This is hard information

- This step/analysis relies more on hard information as it is based on published financial statements.

- Additionally, the beauty of financial statement analysis is that the same set of data/information in the financial statements is available to everyone.

- However, despite this accessibility, different people can draw different inferences from the analysis.

- The numbers in the statement are not just static; instead, they convey a story and offer many insights into a company’s recent and past performance.

- Nonetheless, these insights are not readily known, and an investor must be skilled and experienced to understand and interpret the message from the numbers and uncover the insights.

Financial statement analysis holds a central position in fundamental analysis. It is the articulation of the financial statement analysis with findings from other steps that tells a story about the company and provides clear insights into the future.

You can read more about Financial Statement Analysis covered in my next blog.

The two-part video below, which I have created, delves into a detailed analysis of Financial Statement.

Valuation

The basic definition for valuation goes as follows: “Valuation is the fundamental assessment of the intrinsic value of a stock.”

Once an investor gets a stock idea, the first discussed topic is valuation. The thoughts revolve around questions like “Is the stock overvalued or undervalued or fairly valued?”, “What is the P/E?”, “Is the P/E high or low?”. This is a highly flawed approach. What is the use of valuing a company, with:

- Poor business dynamics,

- Fraud or incapable Management,

- Poor past performance, and/or

- Poor future growth prospects?

Valuing a stock without understanding the above dynamics is not possible.

Remember to take this up at the last...

Investors should take up valuation as the last step after completing the previous steps. This approach enables them to:

- Value a stock with good quality business and management, and

- A company that has good future growth prospects. Investors would be able to fairly estimate the growth rate, the number of years this growth can sustain, and also have a fair understanding of what can disrupt growth (This is a possible risk in investment).

Different valuation models are suitable for different situations and industries, providing investors with the flexibility to choose a suitable valuation model. Your judgment is needed to decide on the right valuation model, and this judgment can come only after properly handling the previous steps. The inputs (growth rate, number of years of forecasting, discount rate, etc.) from the previous steps are then fed into the model to arrive at the fair value of this stock.

Margin of Safety

The margin of safety is an important related idea in valuation. It helps protect from different missing information, wrong assumptions, and unforeseen future events not factored in the analysis.

What's next?

The valuation is then compared to CMP, and accordingly, investors treat the stock as:

- Undervalued and can be taken up for investment if CMP < Your valuation

- Overvalued (The stock is a worthy investment but not at current levels) if CMP > Your valuation.

The two-part video below, which I have created, delves into details of valuation.

Reflect on Yourself

Once you cross the valuation stage of this framework, two things happen:

Bias towards the stock

- As you do the stock analysis, you unknowingly develop a bias towards the stock.

- This happens as you read the positives/negatives about the industry and the company’s future plans.

- This bias leads you to unconsciously overestimate growth, underestimate risks, and make aggressive/conservative estimates of various soft information.

Sunk cost fallacy

- In this exhaustive analysis, you would have spent a good amount of time.

- At a stage, even if the stock is not good for investment, you suffer from a sunk cost fallacy of spending a huge amount of time.

- As a result, you are inclined to invest despite the stock not being a worthy one.

How to overcome this?

- Take a cooling time: Once you have done the analysis and finished the valuation, do not make a buy/not buy decision immediately. Give a cooling period of 1 week to 10 days to allow for a clearer perspective.

- Reflect on yourself: After the cooling period, reflect on yourself. Revisit the analysis and see if you have missed any details, ignored any risks, or considered conservative/aggressive estimates. Ask yourself if you are biased toward the company or if the sunk cost fallacy is influencing your decision. You need to be honest with yourself during this introspection.

- Create the investment thesis: Spend a few hours on this, as it provides a great amount of clarity and solidifies your reasoning for the investment decision.

Investment Thesis

Capture all the data and your findings of the analysis in a file or document – This is called the Investment Thesis.

- Differentiate the items based on soft information (assumptions, estimations) and hard information.

- Next, outline the buy rationale. Answer the question “Why is this stock a buy?” The summary of an investment thesis should clearly outline 5 – 10 points explaining why the stock is a “Buy” or why it should be rejected.

- Additionally, identify sell triggers. These are the conditions in which the stock needs to be sold. Identifying such triggers helps make a timely exit without emotions attached to the decision. If that trigger happens, evaluate the situation and make a sell decision.

Lastly, remember that an investment thesis is not an analyst report with a focus only on target prices. This document is a dynamic/running document and should be updated on an ongoing basis as new information becomes available during this 6-step analysis.

The two videos below provide an in-depth discussion on investment thesis and human behaviors.

Conclusion

Developing and following a comprehensive investment framework is crucial for successful investing. By combining various steps, such as identifying stock ideas, conducting thorough analyses, and valuing companies, investors can make informed decisions.

Remember, the framework should integrate both hard and soft information. Additionally, exercising patience and objectivity during the process, along with incorporating a margin of safety, can help safeguard investments.

Ultimately, an investment thesis serves as a guiding document, evolving with new information and Insights. This is not a one-time exercise that you do only at the time of investment. All the above steps must be periodically repeated throughout the lifecycle of your holding. Then only you will be able to decide on more buy, hold, watch closely or sell, as and when the new reality kicks in.

If you have 4 hours do refer to my 15-part video on this topic of How to analyse a stock. I have these steps in detail with ample examples.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.

Thank you! what an outstanding article!

You are welcome. Thanks for your comments.

Pingback: Financial Statement Analysis, All you need to know - Venkatesh

Pingback: Financial Ratio Analysis, All you need to know - Venkatesh

Pingback: Did you see Debt-to-equity Ratio This Way? - Success Project

Pingback: Dividends analysis is important for investment - Venkatesh

Ek Number 👌👌