A few months back, I had written 2 blogs on Health Insurance covering,

- The jargons related to Health Insurance that you all must know.

- The importance of reading Policy Wording document when you buy (or) compare different policies.

Both these ideas were complimentary i.e. Knowing one was essential to understand the other. You can understand the policy wording only if you understand the jargons around Health Insurance.

This blog we will see, what all you need to check before buying a Health Insurance. These details are covered in the policy wording document. You must read my earlier blog A-Z of Health Insurance to better understand this blog.

Featured image credits: https://www.tomorrowmakers.com/health-insurance/insurers-are-now-rewarding-you-being-good-health-article

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

Do check the blog Index page for all my previous blogs.

- Does the policy covers treatment for AYUSH

- If covered, what is the nature of limit:

- Is it for the full SI or some %-age of SI?

- Amount upto some maximum limit

- Look for other conditions (Some companies insist that such a treatment must be taken in Government hospitals)

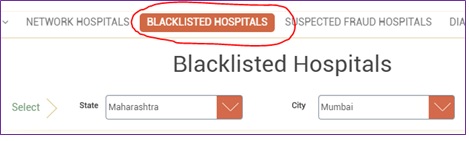

Black Listed Hospitals

These are hospitals that indulge in corrupt practices around Health Insurance.

- Health Insurance companies would not process the claims for treatment made at Black listed hospitals

- The list of such hospitals is available in their websites

- Make a note of that hospitals, to ensure that you don’t get admitted there.

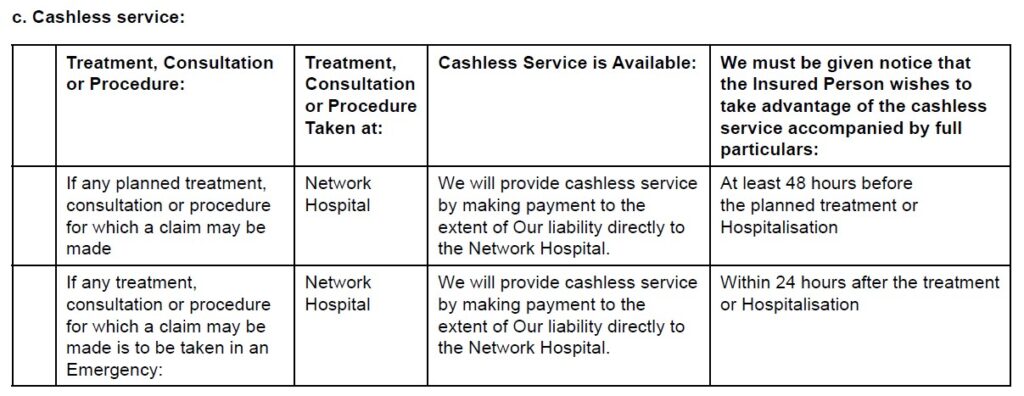

Cashless Facility

- This facility is available in the Network hospitals

- The time taken for authorization of cashless facility

- Get the details of the procedure for planned and emergency hospitalization (Look the sample below)

Note: Even with cashless facility, the role of an emergency fund cannot be ignored. Do not miss out the FAQ section on my earlier blog about Emergency Fund.

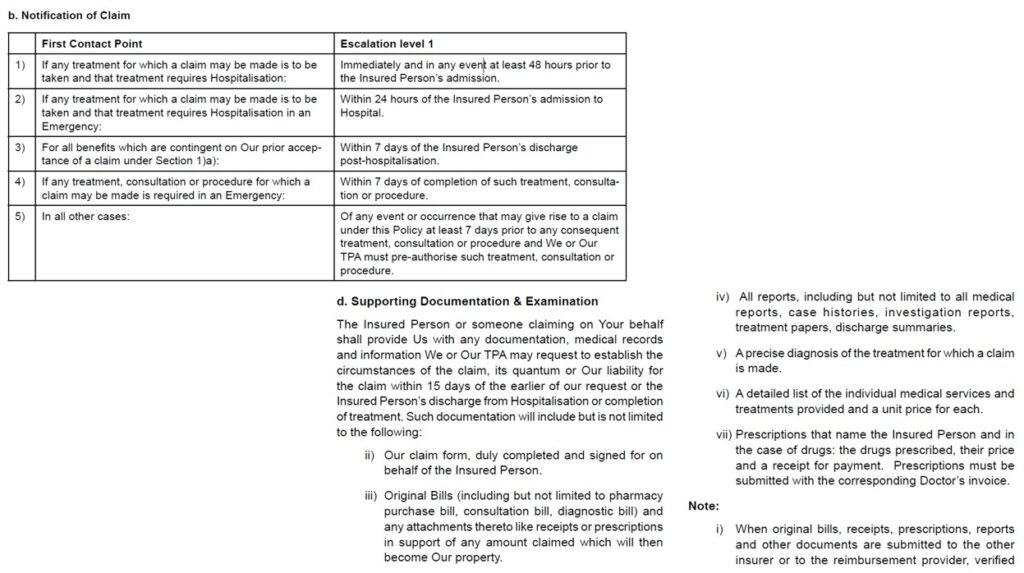

Claim Process

To fully appreciate the value of a policy, it is critical to pay close attention to this aspect. The real benefit from a policy is recognized during the claim phase, especially if you find yourself hospitalized and the process is being managed by your loved ones, friends, or colleagues. As a result, it’s important to both comprehend the process thoroughly and keep your family members informed. There are three key factors to consider during the claim process.

- Firstly, a simple claim process should be the top priority. Additionally, you should understand the claim process by referring to the policy wording document (a sample of which is provided below).

- Secondly, seeking a faster settlement of claims is highly advantageous for the insured.

- Finally, good customer support can be an additional advantage.

Co-Payment

- This feature is a clear disadvantage to the policy holders

- Having no co-payment is ideal, but if it does – it’s best that you have the least amount

- When you compare policies, select one with the least or no co-payment amount

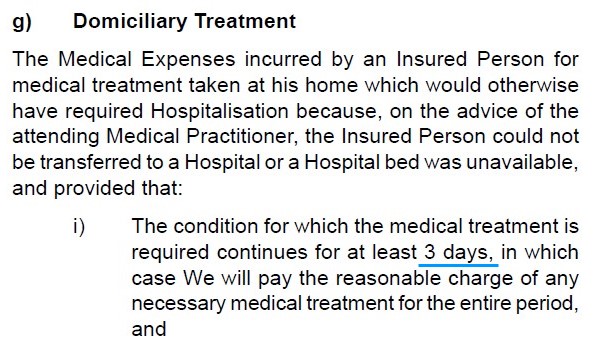

Domiciliary Treatment

- The minimum number of days for which the treatment must be done

- Does the policy cover Pre-Post Hospitalization expenses? (Some insurers may not cover either one of the expenses)

- The number of days Pre-and Post Hospitalization expenses are covered for such treatments

- Some insurers offer a restrictive coverage for Pre-& Post hospitalization in the form of less number of days coverage

- The limit expenses for such treatment

- What % of SI

- How many days treatment is paid?

- What is the minimum number of days the treatment must be done?

- Which are the diseases that are exempt from coverage.

Sample from a policy document given below.

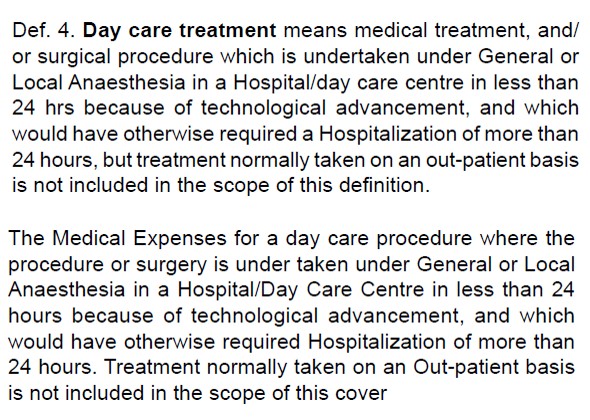

Day care procedures

- You need to clearly understand what the insurance company defines as “Day Care”

- Compare the number & list of day care procedures covered by different insurers

Network Hospital

- One should always check the number cashless network of hospitals with the insurance company.

- At the time of a medical emergency or hospitalization, the hospitals in the network offer cashless option, where by the insurer settles the medical bills directly with the hospital

- Insurers with high number of network hospitals in your city should get a higher weightage

- More importantly focus more on the number of network hospitals that are there in the city you reside (and also the ones you frequently travel to)

- You may also check, if your preferred hospital (or nearby hospital) is in the company’s list of network hospital – But remember! The list of network hospital is ever changing.

- The hospital that you see as a Network hospital today may not continue to be a network hospital after a few years.

Sub Limits

- Ensure that you know the different Sub-Limits applicable for your policy and understand them well with various numerical illustration and cases provided in the policy wording document

- The higher the limit, the better for the policy holder

- Of all the limits, the room rent limit is very crucial as the type of room you choose has a cascading effect on the overall hospital bill

- If you choose a room category that is not within the limits prescribed in the policy, you would need to pay 30-40% of the total hospitalization charges and the room rent difference alone.

This article brings out clearly how the overall hospitalization bill and room rent charges are related https://www.coverfox.com/health-insurance/articles/room-rent-limit-in-health-insurance/

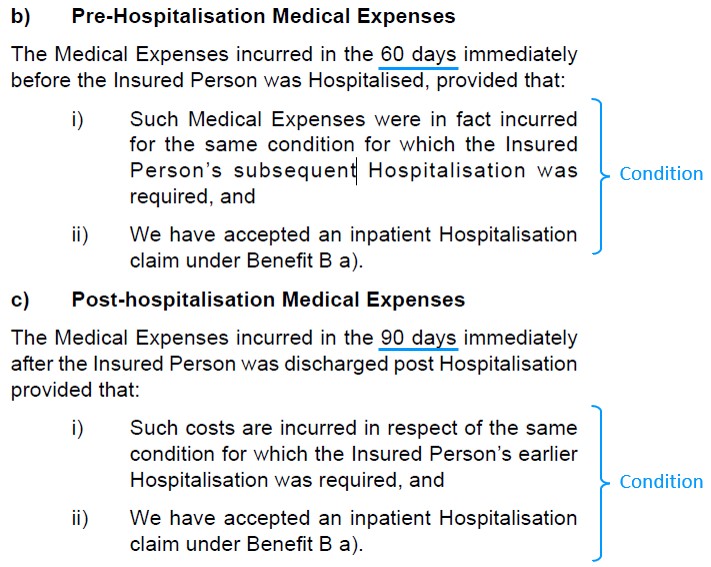

Pre-& Post Hospitalization expenses

- Different companies offer different period (i.e. # of days) for the Pre-and Post-Hospitalization expenses.

- You need to compare this period offered by different policies

- How many days would be better? Answer: More the better

- You also need to give importance to the associated conditions (Clauses/Sub clauses) for claiming his expenses.

Sample from a policy wording document.

Premium Amount

- Many health insurance companies publish the rate card of their policies with a table having premium details for different ages and SI

- In recent years, once can find ‘Premium Calculators’ in their websites where you can enter a few variables i.e. age, SI etc, and you get your annual premium in a few seconds

- Please do not do these both – The annual premium amount SHOULD NOT be a weighing factor in choosing a Health Insurance product

- Health Insurance is long term product and so do not look for a cheap one (less premium), but look for a good one that suits your need, irrespective of low or high premium

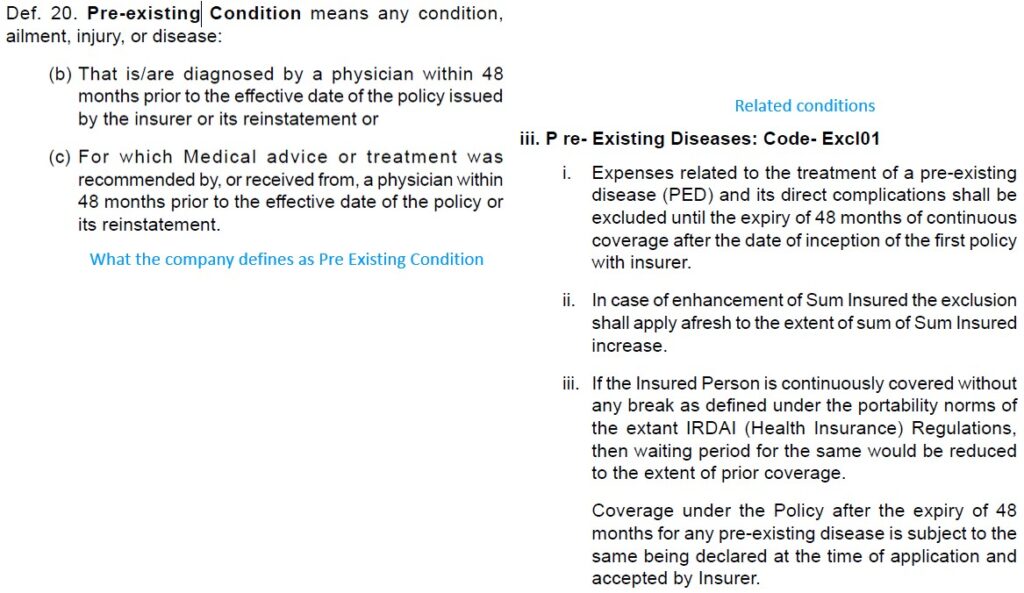

Pre-Existing Condition

- The approach followed in these cases different from different insurance companies

- Insurance companies do cover pre-existing condition with some conditions or waiting period

- Do not hide any pre-existing condition at the time of buying an insurance, as it could lead to rejection of claims in future

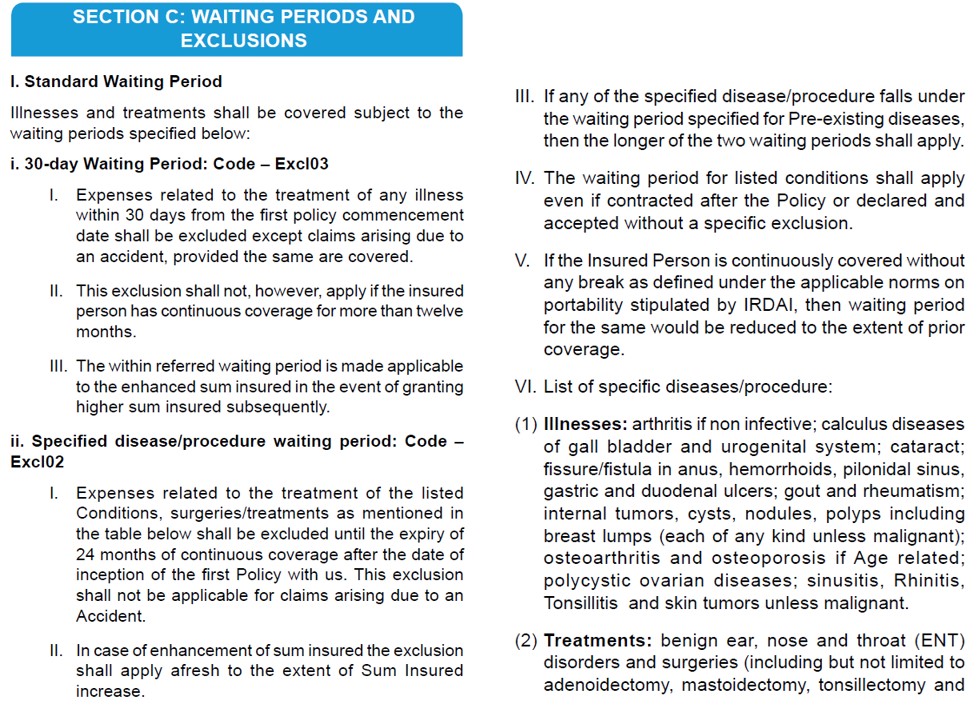

Waiting Period

- It is best for policy holders, if there is no waiting period clause in their plan

- But is does happen that way. Lesser the waiting period, good is for the policy holder.

- When you compare policies, look for different pre-existing waiting periods.

- If you do not have any ailments or conditions, you have no pre-existing waiting period.

Sample from a policy document.

Hope you found this blog useful. Do share any additional resources you have in the comments section. Kindly share my blogs with your friends, peers and fellow investors.