In the last blog, we delved into Dividend fundamentals, dividend types, and associated dates. This time, we’ll explore integrating dividends into stock analysis and investment choices. (Featured image credits: https://www.romania-insider.com/romanian-companies-dividends-bucharest-stock-exchange-%20may-2020)

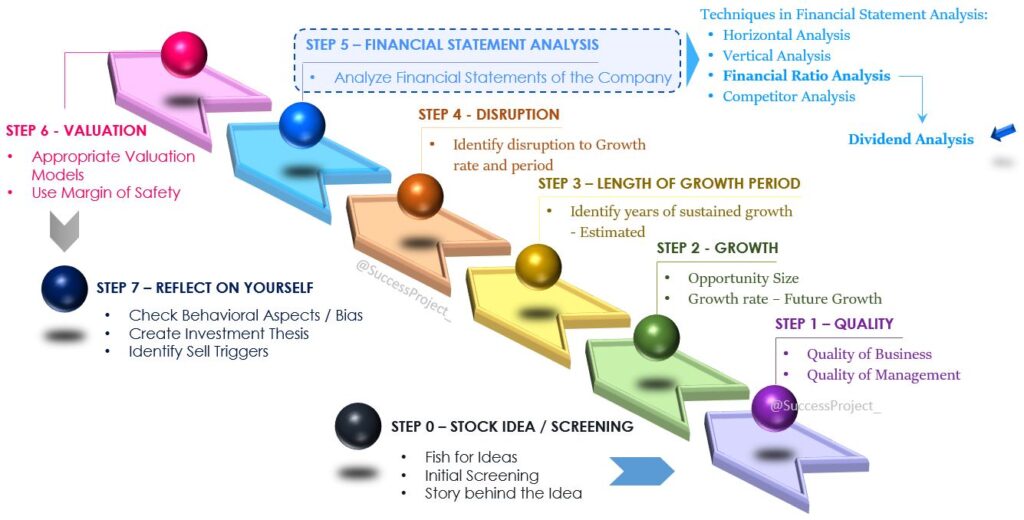

The below image gives a view of where dividend analysis stands in the fundamental analysis.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index page for all my blogs.

You might also be interested to read these related articles:

Should dividends be a factor in stock analysis?

- When selecting stocks, dividends play a crucial role.

- Examining different dividend metrics and ratios offers investors a deep understanding of management’s financial and business strategy, encompassing growth objectives and funding pathways.

- Dividends represent tangible cash outflows, thereby mirroring the earnings’ caliber.

- Additionally, it can serve as an indicator to assess the valuation spectrum—whether a stock is overvalued or undervalued—by employing the dividend yield metric.

However, it’s imperative for investors to acknowledge that dividends cannot singularly serve as the exclusive or primary criterion for stock selection or valuation.

How to factor dividends in stock analysis?

The solution lies in answering the question, “Who are you as an Investor?” When considering dividends, investors can be categorized into Income (or Dividend) investors and Growth Investors, each with distinct expectations from their investments. Consequently, their approaches to dividends would vary.

- An Income (or dividend) investor prioritizes periodic dividends over distant capital appreciation.

- In contrast, a Growth investor favors retaining dividends for growth, aiming for future capital gains rather than immediate dividends.

Regarding dividend yield: For a comprehensive understanding of this discourse, familiarity with Dividend Yield is essential. This financial ratio comprises total dividends paid in the financial year as the numerator and the stock’s market price as the denominator. (More on Dividend Yield and other metrics will be explored in the blog on Dividend Metrics.)

How do Income investors factor dividends in their investment decision?

Income investors opt for stocks with robust dividend yields. Their aim is to ensure that the post-tax dividend yield surpasses post-tax fixed deposit returns. For instance, if the current 1-year fixed deposit interest rate stands at 6%, income investors find stocks with dividend yields exceeding 6% appealing. Among this group are risk-averse individuals and retirees, who view dividends as a reliable income source.

When it comes to stock selection, the dividend amount can often serve as the primary criterion, sometimes accompanied by certain considerations such as:

- Consistency: A track record of consistent dividend payments over 5-10 years.

- Growth: Yearly increments in the dividend payout.

- Earnings: Substantial earnings growth to support the dividend growth.

- Management: The company being under sound management.

Moreover, valuation hinges on the dividend yield, shaping the pricing of the chosen stocks.

How do growth investor factor dividends in their investment decision?

Now, let’s shift our focus to Growth Investors and explore their distinctive approach to stock selection and valuation.

Growth investors lean towards companies that opt for limited or no dividend payouts. Their preference is for companies to reinvest profits into future growth. The rewards for growth investors come in the form of elevated stock prices, translating to substantial capital gains over time. However, this scenario relies on the successful growth of the company through reinvested profits, ultimately reflected in stock price appreciation.

- Stock selection: dividends hold minimal sway for growth investors. Instead, they seek out companies with bright future prospects, often characterized by low or absent dividend distributions.

- Valuation takes a different trajectory for growth investors, as they find no utility in incorporating Dividend Yield into their valuation metrics.

Remember these when it comes to Dividends

When employing dividends in stock analysis, investors need to exercise caution with the following considerations:

Dividends may not be sustainable

- Importantly, investors must bear in mind that future dividend payments come with no assurance.

- In the event of an unfavorable business cycle or the requirement for funds to fuel growth, a company might reduce or even withhold dividends altogether.

- This risk is one that Income investors should carefully incorporate into their investment deliberations, given that dividends constitute the principal objective of their investments.

Eliminate Special Dividends

During the process of calculating Dividend Yield, certain steps are imperative to ensure accuracy and informed decision-making.

- While computing the Dividend Yield, an investor should diligently account for and exclude any special dividends from both the past and current year.

- Special dividends can significantly inflate the dividend yield for that specific year.

- Relying on this inflated dividend yield for decision-making can lead to disappointment in the subsequent year, especially if no special dividend is declared, resulting in a substantial drop in the dividend yield.

- Moreover, eliminating special dividend is essential due to their unpredictable and random nature, rendering them unfeasible as a consistent factor for analysis and decision-making.

Consider the Average Dividends

To ensure a comprehensive assessment and well-informed decisions, it’s crucial to adopt a broader perspective in dividend analysis.

- Avoid focusing solely on the dividend of the most recent year when making decisions.

- Instead, calculate the dividend yield by averaging the dividends over a span of 3-5 years.

- This approach effectively incorporates the impacts of business cycle fluctuations while also mitigating the influence of sudden spikes or declines in the current year’s dividend.

Dividend History

Investors should thoroughly examine the dividend history spanning the past 10 years. Keep an eye out for discernible patterns such as:

- Consistent dividend amount each year.

- Year-on-year dividend increments.

- Erratic fluctuations, like Year 1 – Rs.5, Year 2 – Rs.10, Year 3 – Rs.2, Year 4 – Rs.7.

- Steady dividend payout ratio.

- Fluctuations in dividend payout ratio, either increasing or decreasing.

In instances where dividends were omitted for a specific year, consult the Annual report to ascertain the underlying reasons.

Holistic approach to Dividend analysis

Broadening the scope of analysis beyond dividends is crucial for a comprehensive assessment.

- The analysis should encompass more than just dividends.

- Consider other essential aspects, such as earnings cover, free cash flow cover, operating margin, Return on Equity, and the quality of management.

- This approach is warranted because dividends aren’t isolated entities; they stem from earnings, which in turn hinge on revenue generation and financial or operational efficiency.

- While the analysis emphasizes dividends, it’s essential to concurrently evaluate other qualitative factors like management quality and future growth prospects, alongside quantitative metrics.

This well-rounded evaluation ensures a holistic understanding of the investment’s potential.

What insights can an Investor gather from Dividend Analysis?

Building upon our earlier discussions, let’s delve into deeper insights gleaned from a 5 to 10-year dividend history. Examining an extended dividend history unveils valuable insights, including:

- Erratic Dividends: These introduce additional volatility in stock valuation, rendering the dividend yield less informative.

- Consistently Stable Dividends: This may imply limited company growth, although this observation should be cross-referenced with earnings trends.

- Stable Dividends with Declining Earnings raises a red flag

- Ideally dividends should fall when earnings are less.

- This poses a question about the source of funding for the company’s growth.

- If the answer is debt, future interest liabilities could arise.

- Growing Dividends: A promising scenario, elevating the dividend yield for the invested price. This insight, however, must be cross-referenced with earnings data to ascertain the origin of growing dividends.

- Decreasing Dividends: A warning signal for investors to investigate the year-on-year decline in earnings.

- Increasing Dividend Payout Ratios: A lower portion of funds retained for future growth. Does this signal a dearth of growth opportunities?

These insights underscore the intricate relationship between dividend and a company’s financial health, offering a more nuanced perspective for investment evaluation.

General Inferences

- Interim Dividends: Reflect earnings up to the latest time period, like the 1st, 2nd, or 3rd quarter, being in line with or surpassing projections.

- No Dividends: This can stem from several factors, including:

- Company operating at a loss (not generating profits).

- Inadequate profit available for distribution after accounting for future growth.

- Management identifying significant growth prospects requiring substantial investments.

This is a concise overview. Further in-depth insights can be derived from diverse metrics and ratios, which we’ll explore in upcoming blogs.

Conclusion

In investing, the significance of dividend analysis cannot be overstated. Delving into a company’s dividend history, patterns, and financial health offers a window into its stability, growth potential, and commitment to shareholders. Dividend analysis complements the broader spectrum of stock evaluation, providing a comprehensive understanding of a company’s trajectory.

In the next blog, we discuss the views on Dividends by different investment gurus. dividend analysis.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.