This is the resource page of Peter Lynch where you will find his interviews, media appearance, articles and videos. Though it is not exhaustive at present, ultimately it would become one with all your support. Do share any other resources that you know in the comments section.

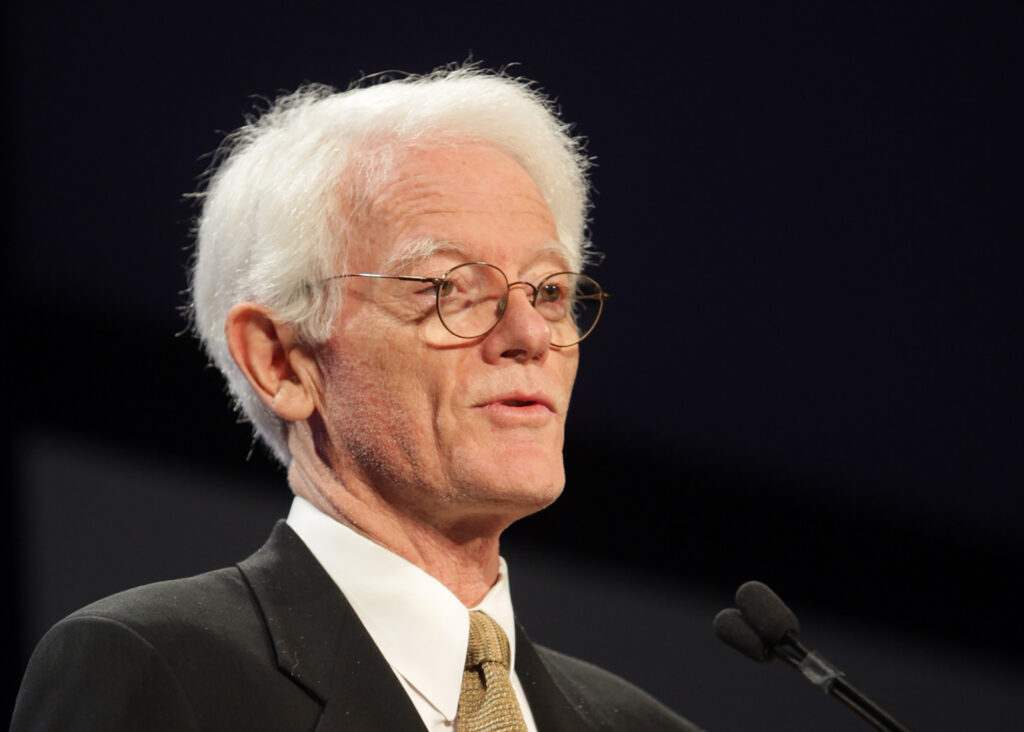

Featured image credits: https://www.bloomberg.com/news/articles/2022-05-18/fidelity-legend-peter-lynch-acquires-5-2-stake-in-penny-stock

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

You might also be interested to read these related articles:

Peter Lynch is an American investor and fund manager. He was the manager of the Magellan Fund at Fidelity Investments.

He has authored three books on Investing.

One Up On Wall Street

Beating the Street

Learn to Earn

I could see a sense of humor in his writing in these books. But it was very subtle to recognize it.

Not many know that Peter Lynch also wrote a series of investment articles for Worth magazine that expand on many of the concepts mentioned in the books. You can download the articles in a PDF format by clicking on this link here. READERS NOT TO MISS THIS WRITINGS.

I found this gem from https://www.dividendgrowthinvestor.com/2020/05/peter-lynch-articles-for-worth-magazine.html

My Key Learnings

The books of Peter Lynch are Pearls of wisdom that no Long Term Investor can afford to miss. However the below two important ideas, had a big impact in my investment framework.

Never Invest In an idea you can't illustrate with a Crayon

This is from his book BEATING THE STREET.

This should be a very important idea for any retail, DIY or Individual investors. The investor should well understand the company, its business and how it makes money. On this scale, some companies are easy to understand while many others are not so. On a extended note, even Warren Buffett and Charlie Munger had discussed this idea. They study a company and if they find it difficult to understand, label it as “TOO HARD TO UNDERSTAND”. One of the hot stocks in the market last year was IRCTC. Many who invested money in the company would not know the full form of IRCTC! This is not the way that one should take up long term investing.

The idea that Peter Lynch drives is that before an investor commits money to a stock, he/she must be able to clearly explain what the company does, how it makes make and why the investor believes that the investment in the company will be profitable in future.

6 Category of Companies

This is from his book ONE UP ON THE WALL STREET.

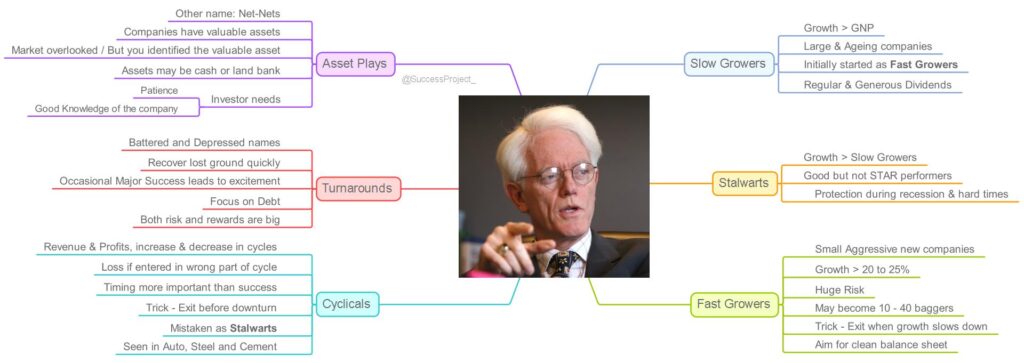

Peter Lynch classifies companies into 6 categories. Any investment idea or stock you hold would fall into one of the categories. He also has suggests different strategies to invest for each of these categories. The below mind map gives some details about each of the categories.

However it is very important to note that companies do not stay in one category for every. In their life cycle they move from one to another. A company may start as Fast grower, then move to Stalwarts before finally become Slow Growers also. When you investing for a long term, you must periodically study the “current category” and make a proper decision to hold or exit the investment.

Articles and Interviews

These cover the interviews by Peter Lynch and also articles written on Peter Lynch.

- Betting on the market

- A good place to be – Roee Bergman

- 9 Best Quotes of Peter Lynch

- Peter Lynch Interview

- The Peter Lynch Approach to Investing in “Understandable” Stocks By Maria Crawford Scott

- Acquirer Multiple, This has a bunch of small blogs and articles around Peter Lynch

- Peter Lynch’s six stock categories

- 4 great investing lessons from Peter Lynch

- Top 5 Investment Lessons From Peter Lynch

- Peter Lynch: 9 Investing Gems to Help You Beat the Market

- 4 Critical Investing Lessons Learned From Peter Lynch, by Nicholas McCullum

- The Peter Lynch Approach to Investing in “Understandable” Stocks By Maria Crawford Scott

Not to Miss this one…

The Peter Lynch Playbook by Mayur Jain (@MJBaldBard). This is a 20 page pdf

YouTube Videos

Videos by Peter Lynch

- How to Invest for Beginners, Duration: 48 minutes

- Lecture On The Stock Market, Duration 46 minutes (Made in 1997 this video is made 25+ years old.)

- 1994 Lecture, Duration 49 minutes

Videos on Peter Lynch

- Biography of Peter Lynch – A 30 minute documentary on America’s #1 Money Manager.

- Summary of the book One Up on Wall Street, created by Swedish Investor – Duration 14 minutes

- Summary of the book Beating the Street, created by Swedish Investor – Duration 14 minutes

Hope you found this blog useful. Do share any additional resources you have in the comments section. Kindly share my blogs with your friends, peers and fellow investors.

Hi Venkatesh! Thanks for all the valuable content. I’ve long admired Peter Lynch and I run a personal finance website. I did a summary of One Up On Wall Street, follow the link below to check it out:

https://finedtoday.com/PeterLynch.html

Thanks!