While you read this blog, you might be wondering if you really need a blog for discussing the topic of expense. Is the topic so heavy that it requires a whole blog to discuss? Moreover, everyone knows about expenses, and we should control them, along with related ideas such as expense tracking. So, what is the intention behind this blog?

- Firstly, this blog is essential and serves as a pre-requisite for properly understanding my next blog on Personal Finance Ratios.

- Secondly, a vast majority of us, over the years, have been viewing expenses as one single element.

- Consequently, we perceive every expense as the same. However, the reality is different! We have not categorized expenses or given proper prioritization to the categories.

Therefore, the aim of this blog is to provide a complete overview of different expense categories and emphasize the importance of prioritizing these categories in our spending. (Feature image credits: Photo by Karolina Grabowska)

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index for all my blogs.

You might also be interested to read these related articles:

First things first

Let us grasp a few basics:

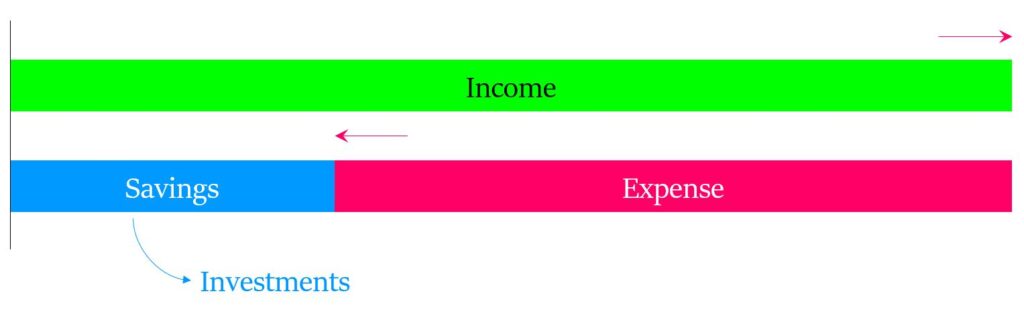

- Income/earnings: We earn money from our profession and business. Other sources, like rent, bank interest, dividends, etc., can also contribute to our income.

- Expenses: Our spending consumes the earned income. (and also the ‘Hero’ for this blog!)

- Savings: We have income left after all our expenses are accounted for.

- Investments: We channelize savings into assets with the intention of earning profits in the future, generating regular income, or a mix of both.

Our income is not entirely within our control as there is a limit to what we can earn. While we can improve our income through upskilling and job switching, there are limitations to this, and it may not be feasible for everyone or in every profession.

On the contrary, we have more control over our expenses. However, controlling expenses is easier said in a blog like this than in reality. Two main reasons contribute to this difficulty:

Every expense is not the same

- We make the mistake of seeing expenses as one category, treating every expense as the same.

- Consequently, this distorted view becomes the biggest mistake in personal finance.

- For instance, a medical expense is not the same as an expense on foreign travel.

- Therefore, we must see expenses in different and right categories.

Prioritization of Expense

This is related to the previous idea. So, what is this about?

Let us suppose you receive 50K in your account tomorrow. What would be your priority if you could spend this money on one of the items? An expensive mobile, paying your EMI, or spending on household essentials? Alternatively, saving the money is also a possibility.

A wrong priority often gets us into trouble.

Expense Classification

The expenses must be classified into three categories:

- Mandatory Expenses

- Living Expenses

- Discretionary Expenses

Total expenses = Mandatory expense + Living expense + Discretionary expense.

What are the main differentiating criteria for these three expenses?

- Characteristic: What is the essence of this expense and why is it important?

- Priority: What is the order of importance among these expenses, which takes the highest and least priority?

- Negotiable: To what extent can you control this expense, and how negotiable is it? Can this expense be postponed, reduced, or avoided?

- Implications: What are the consequences if the expense is delayed or not honored?

Let us examine these three expenses in detail against these criteria.

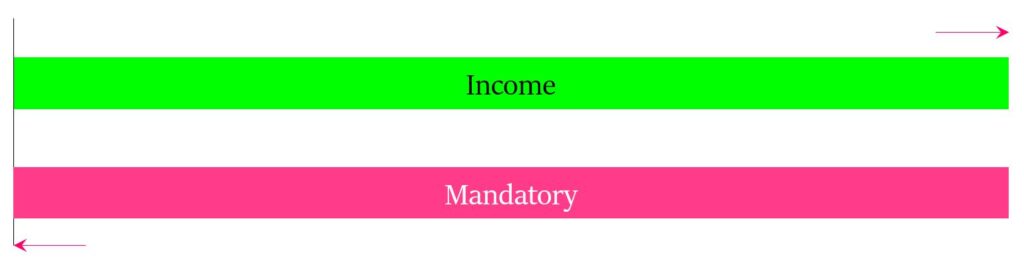

Mandatory Expense

- Characteristic of the expense: These expenses constitute mandatory obligations and are usually associated with a due date. They represent our commitments.

- Priority: These expenses hold the highest priority in your income. They must be taken care of before your living and discretionary expenses.

- Is the expense negotiable? No, it is very hard to negotiate these expenses. Neither the amount to be paid/spent nor the due date is negotiable.

- Implication of not honoring expenses: If these expenses are not paid before the due date, there are penalties, termination of services, legal implications, or health crises.

Examples of these expenses: Loan EMI, Utility bills (Water, Power, Gas, etc.), Taxes, House rent, School fees, Insurance Premium/renewal, Out of pocket medical expenses, etc.

Implications

Let us examine a few practical implications of not attending to these expenses before the due date. This will help to understand the importance of mandatory expenses.

- Utility bills: Delayed payment results in penalties or termination of services.

- Education fees: Late payment may lead to your children being denied admission to school.

- Insurance premium: Failure to pay/renew on time leads to policy lapses.

- Taxes: Failure to pay advance taxes within the specified window results in interest and penalties.

- House loan EMI: Non-payment of EMI has serious consequences.

- Out-of-pocket medical expenses: Delay in payment can lead to a health crisis, especially when insurance coverage is limited.

Note: There might be a grace period with an additional penalty, but it is not applicable every month. The underlying fact is that the amount and the due date are non-negotiable.

What is often overlooked is that such expenses must be honored even if you do not have any income. You cannot default on your house loan because you do not have a job. The Bank will not wait to continue the EMI after you get a job.

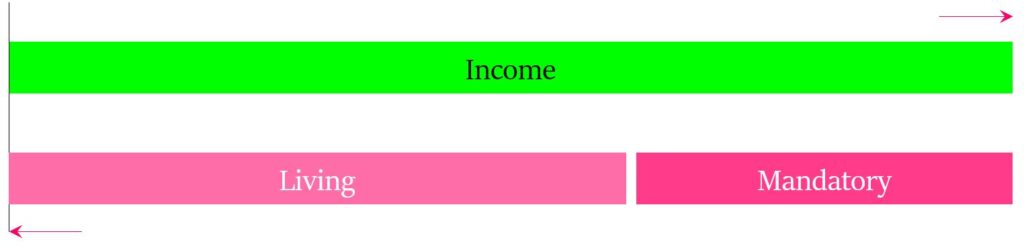

Living Expense

- Characteristic of the expense: These expenses cover living and daily livelihood expenses. They represent our needs.

- Priority: This takes the second priority in your income after mandatory expenses. The money left after mandatory expenses is the real disposable income.

- Is the expense negotiable? Yes, to some extent: (1) You can reduce the amount spent, (2) Postpone the expense, and/or (3) Replace the spend with substitutes. However, these expenses cannot be completely avoided.

- Implication of not honoring expenses: Not as significant as mandatory expenses, but there is a compromise on lifestyle and a need to move out of the comfort zone.

Examples of these expenses: These include basics and daily needs like food, clothing, travel to the office, etc.

Implications

A few practical examples of how it is negotiable to some extent:

- Reduce spending: You can reduce spending on expensive groceries.

- Postpone expenses: You have the flexibility to postpone the purchase of your dress and for your family.

- Substitutes: While you may be traveling to the office in your own car, during difficult times, you can do carpooling or use public transport to save on fuel costs.

Most of the time, you cannot completely avoid this expense.

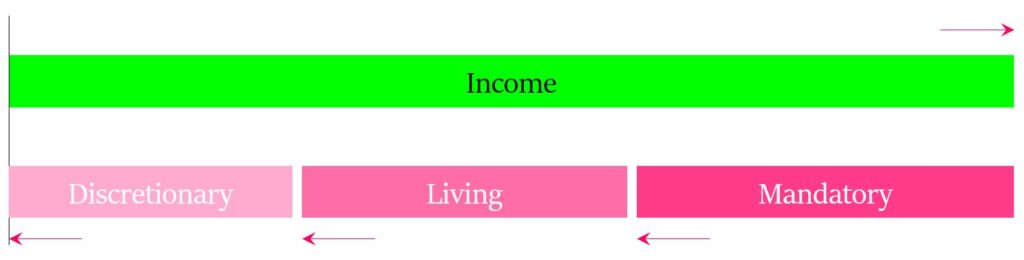

Discretionary Expense

- Characteristic of the expense: It represents luxury expenses in our life. These are our wants and desires.

- Priority: This should have the lowest priority in your income.

- Is the expense negotiable? This expense is fully negotiable. You can avoid or postpone these items during difficult times.

- Implication of not honoring expenses: Almost nothing. Life will continue comfortably without any of these items.

Examples of these expenses: This category comprises a vast array of items, and it varies among individuals. A few examples could be:

- Luxury car

- High-end devices like laptops, mobile etc

- Foreign vacation

- Jewellery

- Hobbies

- Home decoration

- Entertainment: Resort, Theatres, Cable / OTT

- Party & get-togethers

- Club membership, Gym, Spa etc.

If you see any of the items in the list, your life will still run even without it. Discretionary expense is the only place where you have the maximum lever to control.

Different Possibilities

Mandatory expense = Income

Can mandatory expenses fully consume your income? I don’t think it is possible and it could be a hypothetical case; otherwise, there will be nothing left for living. Living expenses can only be covered by borrowing. That is not sustainable month on month and is a disastrous scenario.

Mandatory expense + Living expense = Income

You can sustain your living. This is ‘Ok Scenario’, but you don’t spend for discretionary items nor have any savings.

Mandatory expense + Living expense + Discretionary expense = Income

You take care of all your expenses from your income. While this may look ideal, it is not a satisfactory scenario. However, you need to think about savings beyond expenses. This is a Reasonable Scenario, but it still falls short as it does not cover savings.

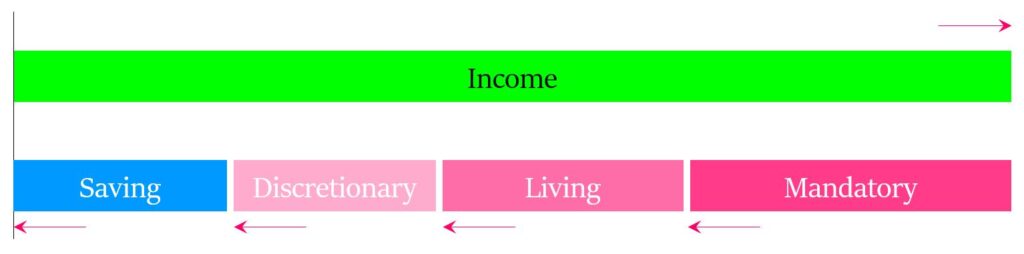

(Mandatory expense + Living expense + Discretionary expense) + Saving =Income

Here you cover the savings beyond your needs and wants. In case you need to increase your savings, you need to closely watch your desires/wants. These are the discretionary expenses which is a lever in your hand to increase your savings. This is the most ideal scenario.

Common Pitfalls

Not tracking expenses

There are two kinds of pitfalls:

- Many people do not track their expenses. Due to this, they have no clue about their spending and thus cannot make any financial plans.

- Quite a few people track their expenses but do not categorize them as discussed. As a result, all expenses are treated as the same.

Discretionary expense trap

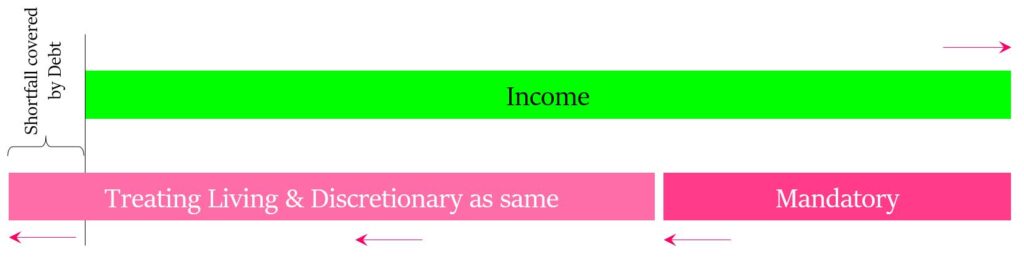

Possibility 1: People fail to see the difference between wants and needs. They wrongly believe that discretionary and living expenses are the same. As a result, they spend a lot on discretionary items, believing them to be living expenses. Consequently, the total expenses become greater than the income, leading people to borrow to cover the shortfall.

Possibility 2: People know the difference between wants and needs. However, they spend more on discretionary items. In doing so, the total expenses become greater than the income, and the shortfall is covered by debt.

Wrong prioritization of Expenses

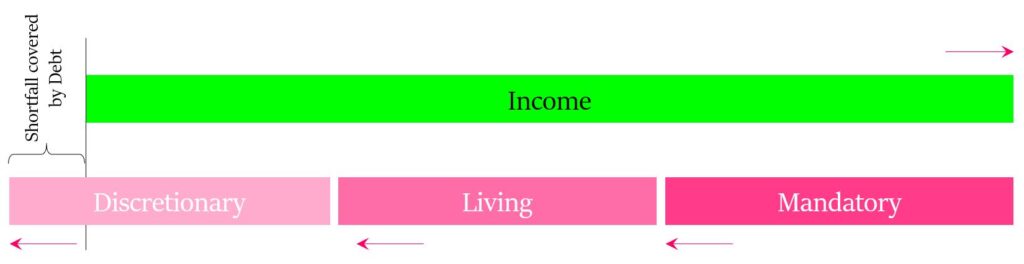

This is another common trap. People prioritize the expense in the wrong manner.

- They spend big on discretionary items first i.e. an expensive mobile, followed by mandatory and living expenses.

- There is no way to escape from mandatory expenses or reduce living expenses (Beyond a limit).

- Since discretionary spending took a huge chunk of income, people fall short in mandatory and living expenses.

- As a result, people resort to short-term borrowing to cover the shortfall.

- When this wrong prioritization repeats for years, i.e. Spending first on discretionary items, you end with sizeable debt.

How to overcome these pitfalls?

Track your expenses

This should be a must for everyone. Quite a few of them track expenses, but mostly, they do not categorize them as mandatory, living, or discretionary items. You should categorize and track your expenses for one year. This will provide many insights into your spending behavior. You might even find surprises where discretionary items form a major part of your expenses. With this visibility, you can have proper control over your expenses.

Avoid "Discretionary expense trap"

The discretionary expense could be the only aspect that differentiates between a debt-free and debt-laden life. This is a huge differentiator in your life. Tracking expenses with the right categories help you to identify discretionary expenses. Once identified you can make the right decision (to avoid, reduce or postpone) on the discretionary expense based on your then circumstance. You may even let go of discretionary expenses if nothing is left after mandatory and living expenses.

Right Prioritization

The right priority of spending is very important and essential. You should spend on mandatory expenses first, then on your living expenses, and lastly on discretionary expenses. This approach would solve most of your problems around finances.

Where is savings in this picture?

We saw that savings are anything that is left after covering all expenses. Your expenses must be within a limit so that you are left with some savings for investing. Saving is very essential in everyone’s life. While there is no benchmark as to how much one should save, the higher the better.

Savings = Income – Expenses

Savings = Income – Mandatory expense – Living expense – Discretionary expense (In the same sequence)

Conclusion

Categorizing and prioritizing expenses are fundamental pillars of sound financial management.

- By understanding the distinction between mandatory, living, and discretionary expenses, individuals gain valuable insights into their spending behavior.

- Tracking expenses with these categories empowers better financial decision-making, allowing for proper control over expenditures.

- Prioritizing mandatory expenses ensures essential obligations are met, while managing living expenses with prudence leads to a stable lifestyle.

- Finally, by wisely controlling discretionary expenses, individuals can strike a balance between their needs and wants, avoiding excessive debt and fostering a path towards financial freedom and security.

Embracing these practices will pave the way for a healthier financial outlook and enable individuals to achieve their long-term financial goals.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.

This was very nice read