Thyrocare Technologies Limited, is a disruptor in the Diagnostics Industry. In this blog, we will cover the key insights about the company.

(Featured Image Credits: Cover page of Thyrocare Technologies’ 2022 Annual Report.)

Brief Background of this Blog Series

Diagnostics Industry was of interest to me since 2017. However, I could spend dedicated time only during 2021 to study this industry. The contents that you see in the coming blogs were mined from Annual Reports, Concalls, RHP, Management interviews and a few Twitter spaces by Dr Velumani.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

Earlier Blogs in Diagnostics Industry

Business Segment

Pathology

Their focus is more into Biochemistry catering to:

B2C Segment

- This segment covers the Preventive and Wellness tests.

- There are around 34 profiles are administered under their “Aarogyam” brand.

- They cater to this segment through corporate tie ups and online players

B2B Segment

In this segment, the company gets samples from Franchises and Third Party.

Note: The B2B segment brings the needed volumes to achieve economies of scale.

Radiology

PET-CT Scanners with primary focus on early cancer screening. This radiology segment is through their wholly owned subsidiary Nueclear Healthcare Limited (NHL).

The company currently have 10 active operating PET-CT scanners in our 8 active imaging centres : two in Navi Mumbai, two in New Delhi, one each in Hyderabad, central Mumbai, western Mumbai, Baroda, Nashik and Bangalore.

Others

A portion of the revenue comes from the sale of Glucose Strips, Glucometer, vials & kits, and trading of point of care testing devices.

Source of Information: Annual Report 2022.

However, there is a change in management from September 2021. The new management has different growth ambitions, plan and strategy. Accordingly, there are some changes happening in the business segment. This is in terms of entering new segments. However this would need little more time for better clarity.

Their Journey

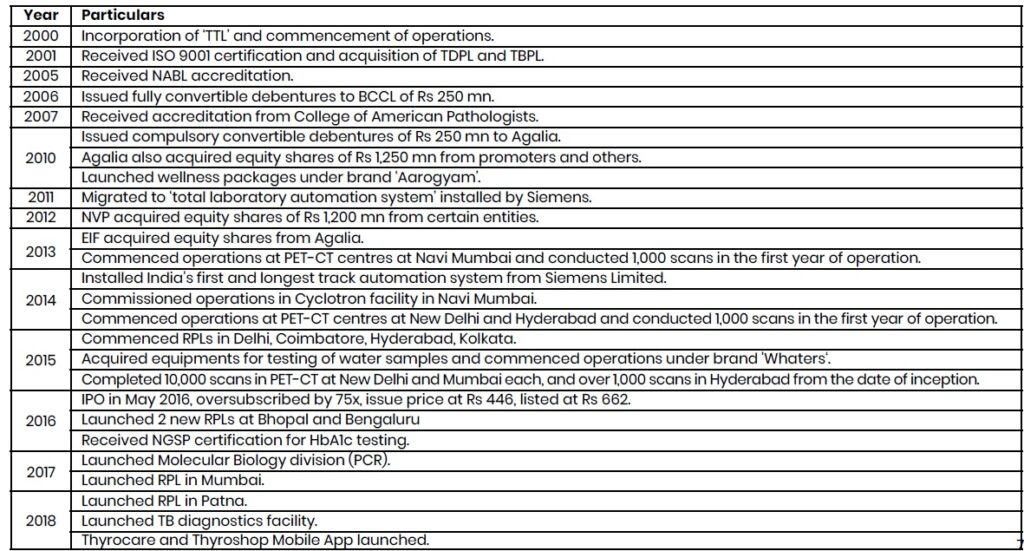

Thyrocare Technologies started its journey in 1996 with 3 tests – T3, T4 and TSP. Below is the key milestone in their journey. (Source of the image: Sector Update – BK Securities, December 2020)

The Year 2021 saw a major change. There was a change in ownership. The promoter group (Dr. Velumani with 9 other shareholders.) sold their stakes to Docon Technologies Private Limited. Thus Thyrocare Technologies become a subsidiary company of Docon Technologies Private Limited. As API Holdings Limited is the holding company of Docon Technologies Private Limited, it has become the Ultimate holding company. The new management is in the company from September 2, 2021.

Management

1996 - 2021

Dr. Velumani, started the company in 1996. He introduced a franchisee model in his diagnostic laboratory and offered affordable testing services. Thyrocare expanded from testing for thyroid disorders to preventive medical checkups and other diagnostic blood tests.

He had exited the business in the second half of 2021. You can read more about Thyrocare from his webpage, https://www.velumani.com/about-me/thyrocare/

September 2, 2021 Onwards

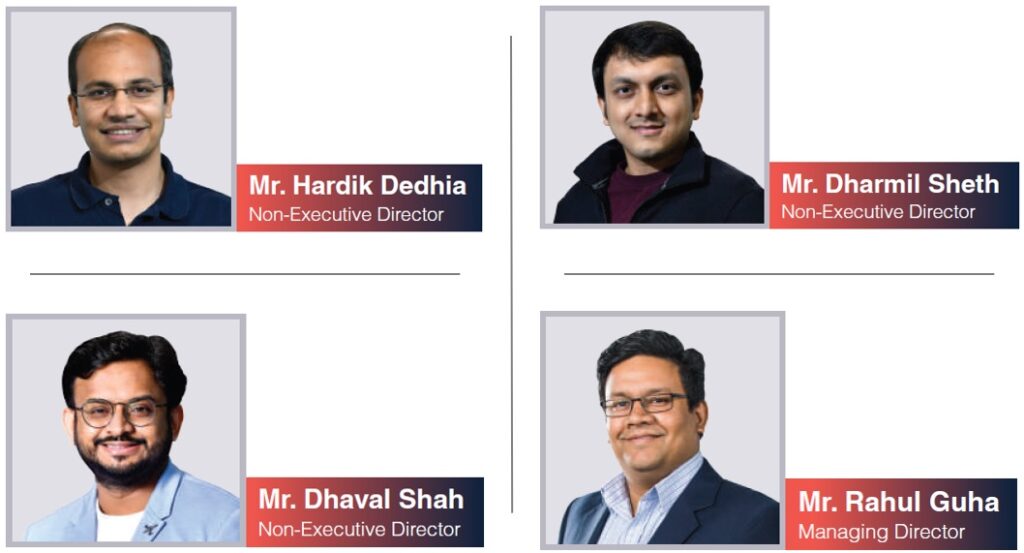

Subsequent to the stake sale by Dr. Velumani and their family members, Thyrocare became a subsidiary of Docon Technologies Private Limited. There is a new management with Mr. Rahul Guha being the Managing Director. The new management has different strategies and growth ambitions. They have been communicating it in their investor meet/concalls. I will cover a few aspects in this blog. But you could get a complete view from the slides and transcript from the company website at https://investor.thyrocare.com/announcements/

Business Insights

Key Numbers

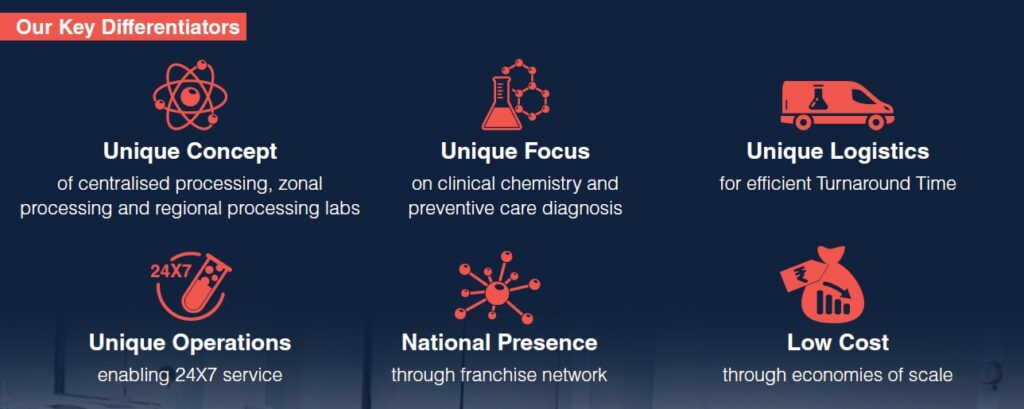

Key Differentiators

New Business Verticals

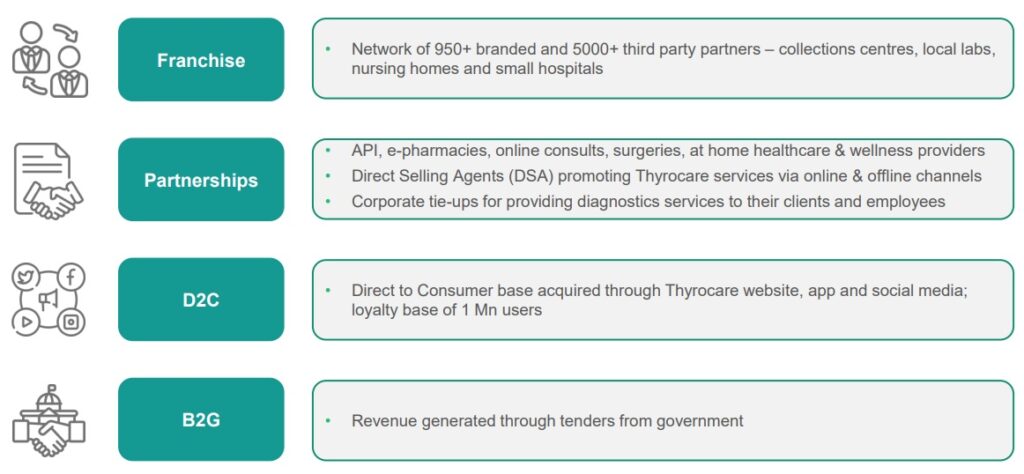

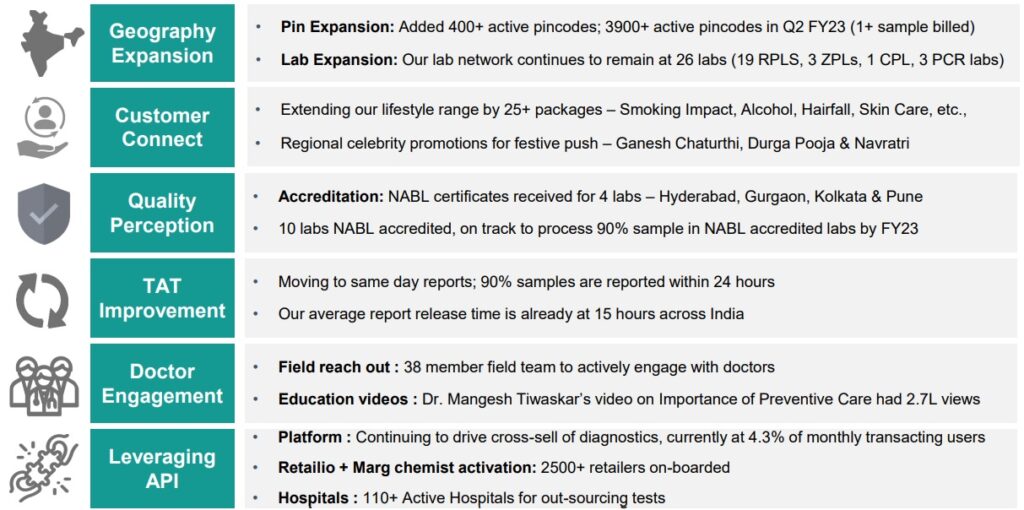

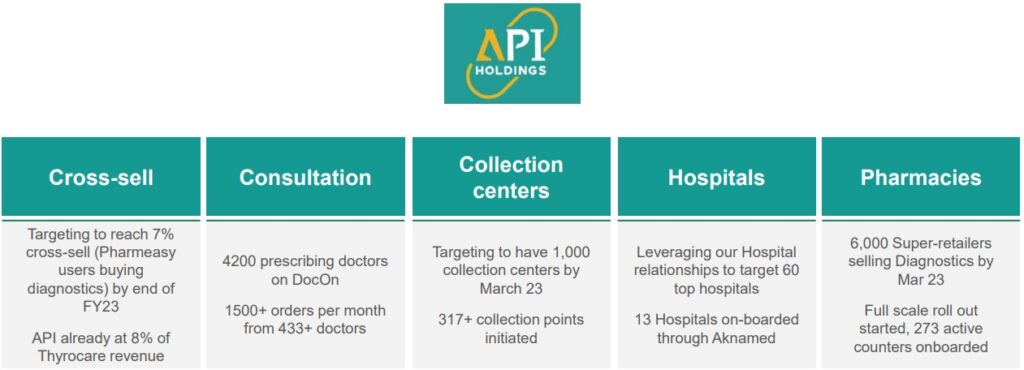

The new management has made some changes in the business vertical aligning to their new business and growth strategy. (Reference to below image: November 2022 Concall Presentation)

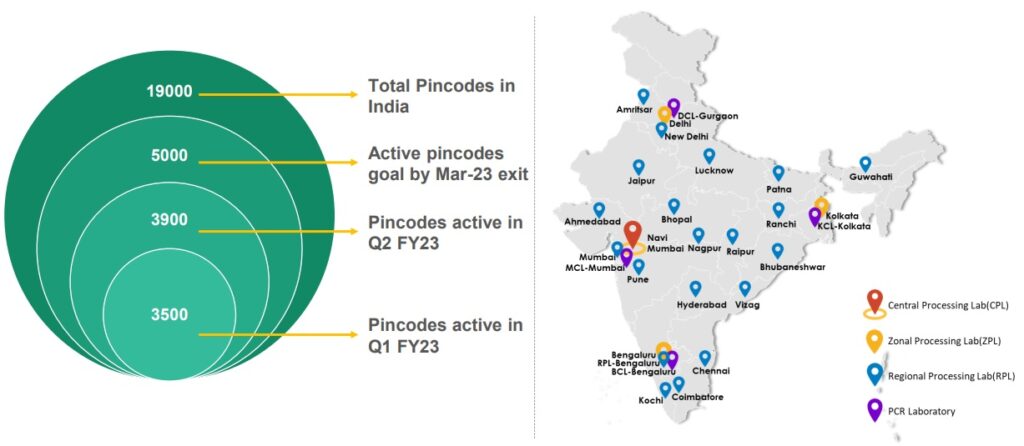

Lab Network and Geographic Expansion

Growth Strategy

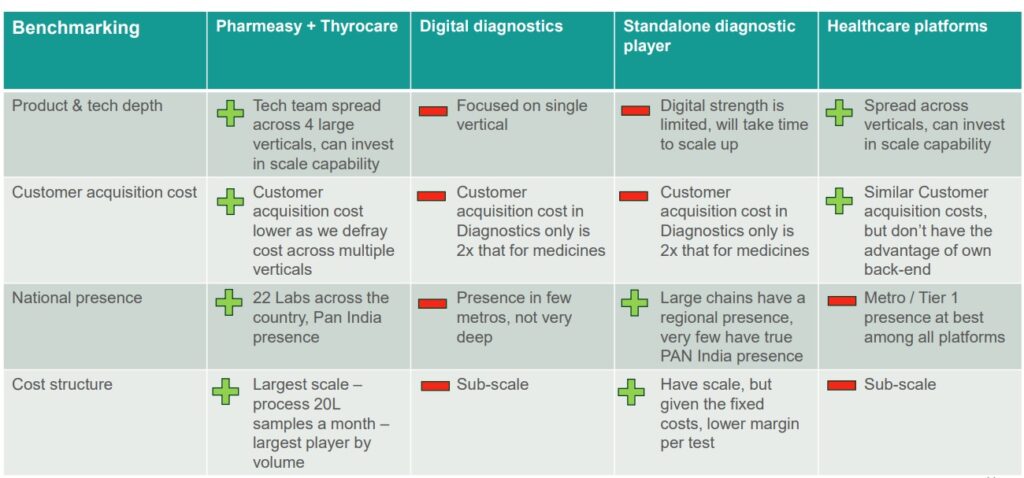

Industry Positioning

In my earlier blog, I had a discussed about the competition in the Diagnostics Industry. There I had discussed the competition landscape with three types of competition, (1) Online Players, (2) Standalone Diagnostics/Unorganized segment and (3) Pharma companies. Similarly below image is the comparison of the industry positioning of Thyrocare Technologies against different competition. In all the four benchmarks they have a edge over competition.

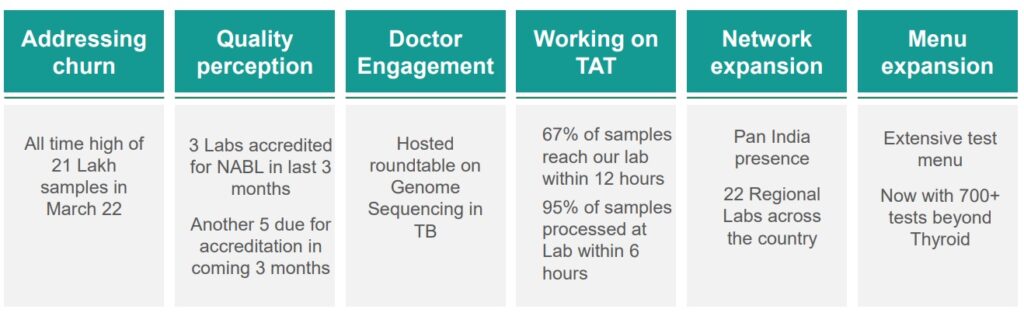

Focus on B2B

With the focus on B2B business, the company continues to expand its network of of collection points, comprising of TSPs, TAGs, OLCs, local hospitals, laboratories, diagnostic centres, nursing homes, clinics and doctors, currently spread across more than 500 districts by effectively addressing the turnaround time difficulties faced by the network. The company also has initiated engagement with doctors through its field force. Below are the strategies to maximise Thyrocare as a Brand in B2B segment (Source: April 2022, Concall Presentation).

Leverage Parent Company Network

The Ultimate Holding Company of Thyrocare Technologies is API Holdings. The company leverages the network and business verticals of API to drive growth.

To Close…

Did you find this kind of analysis of the company useful? If Yes, do give me a thumbs up, I will post similar insights for remaining 4 diagnostics chains.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.