The Indian power sector has a lot of companies and may unlock many long-term investment opportunities. This blog will provide valuable insights and analysis specifically designed for stock investors looking to invest in this sector. We will explore the various facets of the Indian power sector, including power generation, transmission, distribution, and ancillary industries. The exploration will encompass the key players, market dynamics, ongoing reforms, regulatory landscape, and other factors that shape this sector. (Featured image credits: The image is from a blog on the Power sector. I would suggest readers to read it at https://www.moneyworks4me.com/investmentshastra/indian-power-sector-analysis-industry-overview-and-research-2011/)

To gain a comprehensive understanding of the context of sectors and industries, it is essential to read my earlier blog Is Sector and Industry Analysis Important.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

Background

Every year, I actively delve into studying different industries or sectors to expand my knowledge and broaden my circle of competence. I approach this process without any predetermined preferences, allowing external triggers to spark my interest in a particular industry. Following the ILFS controversy and the news surrounding CARE Rating, I became intrigued by the Rating Industry.

Similarly, while screening for high dividend yield stocks, I came across several companies within one industry of the power sector. Around the same time, there was news around the sector with views from Rakesh Jhunjhunwala.

These two triggers compelled me to thoroughly understand the power sector and its various industries. Over the course of a year, I studied this sector comprehensively. In my upcoming blogs, I will share the insights and findings from my in-depth exploration.

Power Sector Overview

Electricity plays a vital role in driving the socio-economic development of any nation. Insufficient power supply, in turn, hampers economic productivity and growth. Furthermore, industries heavily rely on electricity for their operations, making it crucial for sustained economic progress. Additionally, power is indispensable not only for productive activities but also for leisure pursuits. Consequently, the development of robust power infrastructure becomes imperative for supporting economic growth and enhancing the overall quality of life.

Indian Power Sector Overview

The Indian power sector boasts a massive ecosystem with numerous significant aspects. To delve deeper into its intricacies, let’s explore its diversification, ranking in electricity production and consumption, installed renewable energy and hydro capacity, and the constitutional framework:

Diversification and Size

- The Indian power sector exhibits a high degree of diversification, incorporating various sources of energy generation, such as thermal (coal, gas, and oil), hydroelectric, nuclear, and renewable energy (solar, wind, and biomass).

- It comprises a mix of state-owned and private companies actively involved in the generation, transmission, and distribution segments.

- Furthermore, the sector witnesses the presence of regional and state-level electricity boards, regulatory authorities, and agencies responsible for policy formulation and implementation.

Electricity Production and Consumption

- In terms of electricity production, India holds the third position globally, following China and the United States.

- Transitioning to consumption, it stands as the second-largest consumer of electricity worldwide, with the demand fuelled by economic growth, urbanization, and rising living standards.

Renewable Energy Capacity

- Globally, India secures the fourth rank concerning installed renewable energy capacity.

- The country’s renewable energy sector has experienced substantial growth, primarily propelled by solar and wind energy.

- To further emphasize its commitment to sustainable energy sources, India has set ambitious targets, aiming to fulfil 50% of its energy requirement through renewables by 2030.

Hydroelectric Capacity

- India holds the sixth position globally when it comes to installed hydroelectric capacity.

- The Hydroelectric power plays a role in meeting peak power demand and grid stability.

Constitutional Framework

- Under the Indian Constitution, electricity is a concurrent subject, meaning that both the Parliament (Central Government) and state legislatures have the authority to make laws on electricity.

- In case of any conflict between central and state legislation on electricity, the law passed by Parliament takes precedence, and state legislation will be void to the extent it contradicts the central law.

- Consequently, each state in India has its own legislation and regulatory framework to govern the power sector, including regulations related to generation, transmission, distribution, and consumer tariffs.

The Indian power sector’s diverse nature, ranking in electricity production and consumption, emphasis on renewable energy, and the constitutional framework highlight its complex and dynamic nature.

Milestones in Indian Power Sector

The story of the Indian power sector starts in 1879. Below are the key milestones:

1879

The Indian power sector had its beginnings with the demonstration of electric light by a company named P W Fleury and Co. in Calcutta (now Kolkata). This event marks the initial introduction of electric lighting in India.

1897

The first hydroelectric plant in India was established in Darjeeling with a capacity of 130 kW.

1899

The Calcutta Electric Supply Corporation Limited installed the first thermal power plant in Calcutta. This marked the entry of thermal power generation into the Indian power sector.

1910

The Electricity Act of 1910 aimed to regulate the generation, transmission, and distribution of electricity in India. It provided a legal framework for electricity operations and addressed issues related to licensing, tariffs, and supply.

1948

The Electricity Supply Act of 1948 provided for the establishment of the Central Electricity Authority (CEA) and the State Electricity Boards (SEBs). These bodies were responsible for the planning, development, and operation of the power sector.

1969

The National Thermal Power Corporation (NTPC) was established as a public sector undertaking. The objective of NTPC is to develop and operate thermal power projects, contributing to the growth of thermal power generation in India.

1975

The power sector is highly capital-intensive. The Power Finance Corporation (PFC) was established to provide financial assistance and support the development of power projects in India.

2003

The Electricity Act of 2003 was a comprehensive reform legislation that addressed the shortcomings of previous acts. It introduced significant reforms, including the opening up of the power sector to competition, privatization, and the creation of regulatory bodies at the central and state levels. The act aimed to promote efficiency, transparency, and consumer choice in the power sector.

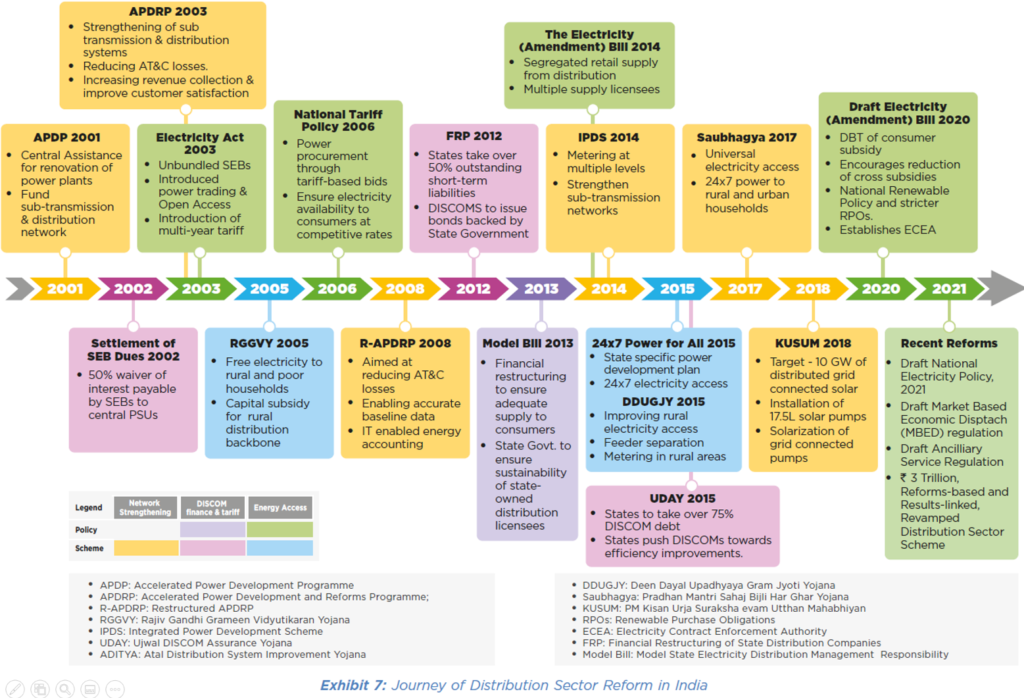

Over the last two decades, there had been lot of reforms in the sector. The below image gives a snap view of these reforms.

Reference: Turning Around the Power Sector

Industries in Indian Power Sector

Traditional View

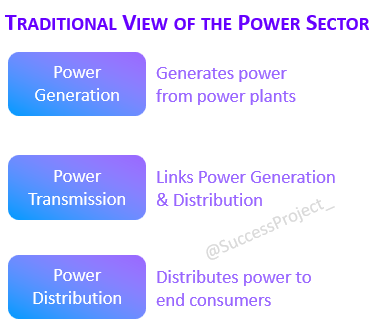

The Power Sector has the following sub sectors/industries:

These three industries are widely discussed, but there are other crucial aspects that often go unnoticed.

Realistic View

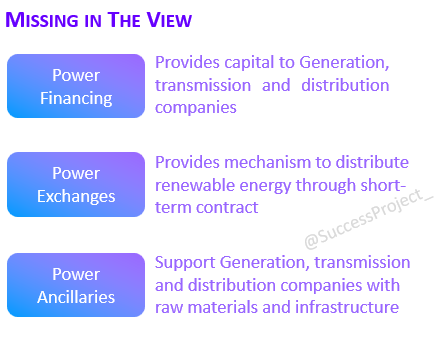

Power Finance Industry

All three industries within the power sector exhibit a capital-intensive nature, necessitating substantial financial investment. The sector’s overall capital requirements are primarily fulfilled through support from lenders known as Power Finance Companies, thus constituting the Power Finance Industry.

Power Trading

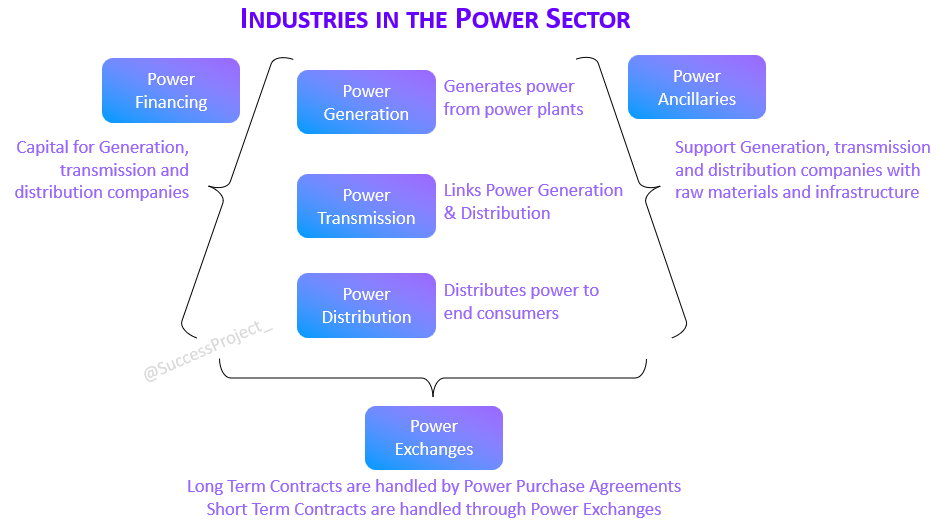

The Power Trading industry acts as a vital intermediary between Power Generators and Power Distribution companies or end users. In India, the power sales business can be classified into two segments:

- Long-Term Purchase: These transactions are facilitated through Power Purchase Agreements, which establish long-term contracts between power generators and buyers.

- Short-Term Purchase: These transactions are conducted through Power Exchanges, providing a platform for short-term power trading among various market participants.

Countries worldwide are actively transitioning to renewable energy sources. India is no exception, with ambitious plans in this domain. However, a significant challenge in renewable energy lies in its unpredictable and intermittent availability. For instance, solar power generation is restricted to daylight hours and can be affected by cloudy weather conditions. To address these uncertainties, short-term power contracts have emerged, and this is where Power Exchanges play a crucial role.

Power Ancillary Industry

The above three industries (Generation, Transmission and Distribution) need support from other industries. To explain this more clearly, consider a few examples:

- Coal based Thermal power plants need coal as raw material for their daily operations

- Solar power plants need solar panels

- Wind-based power plants rely on wind turbines and blades

- All the three industries need huge infrastructure development such as building power plants for thermal, hydel, or nuclear stations, as well as erecting towers for transmission companies and windmills.

Different manufacturing and infrastructure companies actively handle all the aforementioned support and activities. These companies constitute the Power Ancillary industry, which serves as the equivalent of the Auto Ancillary industry in the Auto sector.

Thus, considering only the traditional view of three industries in the power sector would not provide an accurate representation of the sector. These three industries also maintain close associations with the power sector.

The Indian Power Sector comprises six industries, each with its own distinct dynamics. In future blog posts, we will delve into these industries in detail, exploring the companies that operate within them.

Conclusion

There are possibilities of hidden investment opportunities in the Indian power sector, waiting to be discovered by stock investors. With its diverse industries encompassing power generation, transmission, distribution, power finance, power exchange, and ancillary sectors, this sector offers a wide range of investment possibilities. In the upcoming blogs, we will delve into the details of each of these six industries, exploring the key players, market dynamics, opportunities, and challenges they present. These valuable insights will help you to navigate this sector with confidence. However, before making any investment in Indian power companies, it is essential to conduct thorough research and assess the financial health and growth potential of individual companies. This diligent approach is essential to make informed investment decisions and avoid any land mines in your portfolio.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.