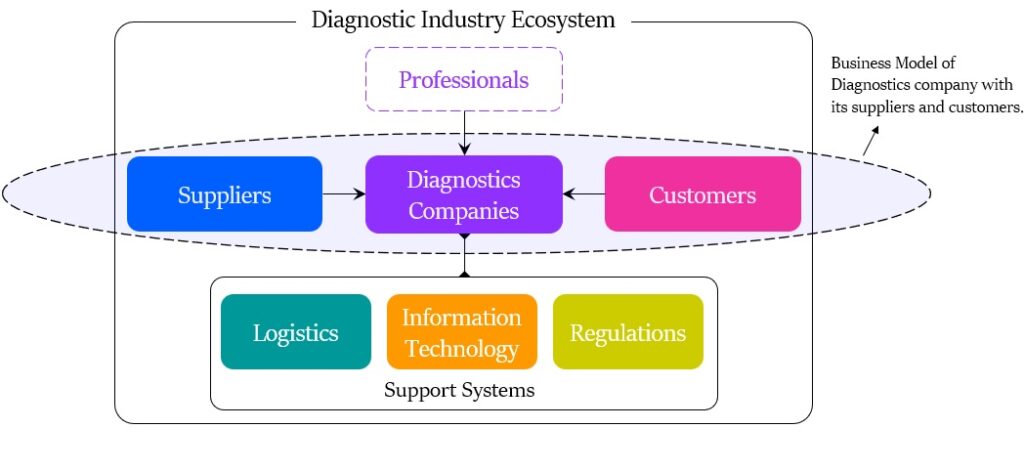

In the previous blogs on Diagnostics Industry Ecosystem, we saw suppliers and customers were part of the ecosystem. The inputs for Diagnostics companies come from supplier and customer are the end users of the service. This topic could have been better covered as part of the earlier blogs where we discussed suppliers and customers. However, the depth of content needed a focused discussion and hence this dedicated blog. In this blog, we cover the business models/dealings of Diagnostics companies with their suppliers and customers.

Brief Background of this Blog Series

Diagnostics Industry was of interest to me since 2017. However, I could spend dedicated time only during 2021 to study this industry. The contents that you see in the coming blogs were mined from Annual Reports, Concalls, RHP, Management interviews and a few Twitter spaces by Mr Aditya Khemka and Dr Velumani.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

You might also be interested to read these related articles:

Suppliers

Suppliers sell the Diagnostics company with equipment’s, accessories and services needed for their daily operations. The equipment used in Pathology and Radiology is vastly different. Most of the equipment used in Radiology are expensive than their Pathology counter parts.

The business dynamics of Pathology machines is very unique when compared to Radiology.

Business Dynamics of Pathology Machines

Analogy

To easily understand the business model, consider a Razor or Printer#. These are sold to the customer at a low price. The Razor or Printer needs blades or toner periodically, which is quite costly. Also the requirement for the blades and toner is recurring. So effectively the company sell printer once at a lower price and toners at a higher price which is recurring. A similar arrangement exists in the sale of Pathology machines.

# The analogy of Razor and Printer is taken from the video “Understanding the Diagnostics Lab Business” https://youtu.be/nzNHOP5GONU, By Mr. Onkar Raunak of PPFAS Mutual Fund.

How it works in Pathology Machines

- Suppliers sell the machines to diagnostic companies at low or no capital cost

- The Diagnostic company has a minimum purchase commitment of reagents, consumables, disposable and test kits for a specified period ranging from 2 to 6 years as agreed in a contract with the suppliers.

- The reagents are very important in Pathology testing:

- They are substances/chemicals used to produce a chemical reaction to detect, measure, or produce other substances.

- In a blood test, the reagents are used/mixed with the blood sample and the equipments does the analysis and gives report for the tests. (A similar approach for other samples & body fluids)

- The diagnostic company get the equipment at a low (or no) cost, installs the machine in their facility and operates it using the reagent and consumables provided by the supplier for the term covered in the

- Title to and ownership of such equipment and automation systems remain with the supplier and may only be passed to the Diagnostic company upon completion of the term of the contract at a mutually agreed pre-decided price.

- If the Diagnostic company does not purchase from the vendor the requisite volumes of reagents and consumables specified in the contract, the vendor may terminate the contract and retake possession of their equipment (Depending on the terms of the contract, suppliers may even have the right to levy a specified penalty to the diagnostic company.)

- So, this would mean that, even if market prices for comparable reagents, diagnostic materials and disposables decrease in future, (0r) available for a lesser price with another vendor, the diagnostic company has to still purchase these items i.e. regents, from the supplier at the prices agreed in the contract.

Cost of Reagents

The reagents are very costly and the pricing is covered in the contract between the supplier and Diagnostics company. The reagents are like consumables and need to be purchased periodically. We will see why reagents are costly.

- The cost of reagents covers the cost of machines that were supplied at low (or no) cost.

- Hence the reagents have the cost of the machines built into them.

- Over the contract period (or the useful life of the machine) say 5 years, the supplier needs to recover: (1) Cost of the machine, that was supplied at low (or now cost) + Cost of regents + Their profit margin

- In the above equation, the only variable the supplier has control over is the cost of reagents

- As in the contract, the Diagnostic company has to purchase the minimum volume of reagents and other consumables periodically at a predetermined price during the contract period (or the useful life of the machine).

- If the diagnostic company surpasses the volumes, they may get a discount on the reagents from the suppliers.

Key takeaway for investors

In the case of Pathology…

- Asset light business model: as equipment cost is low.

- Less CAPEX for growth: Diagnostic companies may not need high CAPEX to invest in machines for growth.

- Higher profits with higher volumes: Beyond contract volumes, the profit for diagnostic companies is high. This is because the reagents are sold at discounts beyond contract volumes. This is where Diagnostic chains (Pan India or Regional) score over the Hospital based centres and standalone centres. Diagnostic chains can manage to get and process huge volumes. Thus earning higher profits.

Customers

There are different types of Business segments based on who is the end customer. Broadly there are three segments:

- B2C Business Segment

- B2B Business Segment

- B2G Business Segment

Each of these segments has unique dynamics with different opportunities and challenges. Understanding these dynamics is essential to get insights about the company. In this blog, we will understand each of these three in detail. Most Diagnostics chains have a mix of these three segments. However, a few Diagnostics chains are very much focussed on a particular segment.

B2C Business Segment

This segment has individual/retail customers. The customers could be:

- Patients suffering from acute illness approach the diagnostics centres with a prescribed test request from a physician, other qualified healthcare professional, hospital, clinic or nursing home. (or)

- Patients suffering with chronic illness approaching the diagnostics centres without a prescription. By virtue of previous tests or any recommendation from a doctor, they are aware of the tests/packages they need. (or)

- Direct ‘Walk-in’ customers, with more focus on Preventive diagnosis. They are not driven by any request from the medical community.

Unique features of this Segment

- This segment requires investment in building a brand

- In the case of acute and chronic patients, doctor’s referrals drive the business. A doctor refers to a lab only when they trust the results from the lab. A Diagnostics chain needs connect with medical community to develop the reputation and brand for the lab. This leads to referrals from the medical community.

- However in case of wellness customer advertisement are key to build the brand

- The customer pay the price of the test upfront and also does not bargain on the price

- This segment is preferred and attractive for the Diagnostics chains due to better collection and profit margin

- The diagnostic chains that derive a higher share of revenues from the B2C segment have a low customer concentration risk and generally high profit margins. (ICRA Rating Methodology document)

- One pain area is to satisfy and meet the needs of individual customers

B2B Business Segment

This includes institutional customers like private laboratories, hospital laboratories, clinics, nursing homes, physicians and polyclinics. This segment brings in higher volumes, growth and stability. Hence Diagnostics chains tie up with hospitals, laboratories and corporate clients.

Unique features of this Segment

- These healthcare providers have their own testing needs, and while some have onsite testing facilities to serve their patients, they often lack the resources, expertise or scale to conduct certain tests, and must consequently send the samples to diagnostic chains

- The payment charged by diagnostic chains to such customers is a fee schedule contractually agreed with each of them or at the otherwise standard rates applicable to the client.

- The focus is more on Prescriptive diagnosis, Semi specialised and Special tests

- The payments are made after a period of time and at highly negotiated prices.

- This is in contrast to B2C where the payment is upfront and profit margins are higher

- Despite this Diagnostics companies do focus on the B2B segment as it helps higher volumes

- This higher volume leads benefits of economies of scale.

B2G Business Segment

This segment operates on the Private Public Partnership (PPP) model. Here Government has the responsibility to bring the patients to the Diagnostics company.

- Volumes are higher, due to which machines run longer and the revenues are higher.

- The rates are highly competitive which is decided during tender process.

- The contract could have provisions for rate escalations.

- B2G business is not less profitable, however getting the volumes is the key.

There are not many players operating in this segment. To my knowledge, only Krsnaa Diagnostics has a big presence in this segment.

To close…

Diagnostics companies have a healthy mix of retail and corporate customers. Good profit margins come from retail customers, while institutional customers bring high volumes leading to higher utilization of their reference lab. This also brings in a kind of customer diversification.

To understand the B2G Segment it is imperative to understand how a model works in the Diagnostics industry. This demands one full blog and hence the discussion is reserved for the next blog.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.