In this blog, we will see some insights for investors. The topics covered are pricing, accreditation, Preventive test and Hub & Spoke model.

Brief Background of this Blog Series

Diagnostics Industry was of interest to me since 2017. However, I could spend dedicated time only during 2021 to study this industry. The contents that you see in the coming blogs were mined from Annual Reports, Concalls, RHP, Management interviews and a few Twitter spaces by Mr Aditya Khemka and Dr Velumani.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

You might also be interested to read these related articles:

Pricing Dynamics

Pricing Pressure

In the last blog, we discussed the competition in the industry and changing landscape with new players coming in. We will now discuss the impact of competition on pricing.

- As we discussed, our previous blog the listed players have a benign competition.

- There is no price wars (Between Diagnostic chains) as evident from the healthy profit margins.

- Due to inherent cost efficiencies in their business model and the size of the opportunity the diagnostic chains are able to offer competitive prices as compared with players in the unorganized sector.

- Diagnostic chains have higher bargaining power that allows them to keep their input costs (bulk purchase of reagents) lower than standalone centers.

However, the story changes with the entre of new kind of players – Online/Platform companies

- The new players draw PE money and could launch disruptive prices to gain market share.

- This has already started with a few companies launching a few tests at disruptive prices.

- This could force the Diagnostics chains to lower the list price of tests and thereby affect future profitability.

Price Cap

Price cap is a major concern, where Government can set limits of price for a particular test/panel

- Such cap does impact profitability, but it is not always (or) for every test

- This has happened in the past at times of seasonal epidemic and pandemic, when such measures are taken:

- In October 2015, there was such a cap on Dengue test

- In 2020, first wave of COVID, there was limits on test

However, pricing cap for all tests always is a challenge due to factors such as:

- The cost structure varies between geographies.

- The costing is different varies based on the volume of operations i.e. The cost/unit in case of 10 tests is much higher than unit cost of 1000 tests.

- Even if price cap is there, it would be only for some period of time till the epidemic or pandemic end/reduces.

How Customers View Pricing

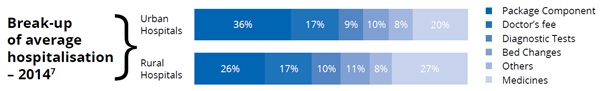

In case of hospitalisation, the total cost of diagnostics is not more than 10% of the overall hospitalization cost. The ticket size of a diagnostic spend is relatively low (When compared to the total cost of treatment) and less frequent.

Source of this data and image: Diagnostic report Nathealth India

Management View on Pricing

Let us see how the Management of the Diagnostics company views this topic.

“When someone is not well in a family, the family members are not shopping around who does the cheapest test, but they are shopping around who will give the correct report. People come to Pathology lab once or twice a year and the average spend is around 500 to 600 rupees. So, this will not be bankrupting them nor is a frequent spend. They spend lot of money in the hospitals. So, price for diagnostics is not a huge concern for patients.” – Ameera Shah, MD Metropolis

Accreditation

- There are currently 2,500 labs which have NABL Accreditation (Source: https://nabl-india.org/nabl/file_download.php?filename=202205110910-NABL-600-doc.pdf, This link also has the list of labs that have accreditation.) This is roughly 2.5% of 1 Lakhs labs in India.

- NABL certification is voluntary, which authorises the lab to do certain kind of tests. These are around specialized or semi-specialized tests and not on routine tests.

- Physicians trust is directed toward diagnostic labs with accreditations – This is advantageous for organized diagnostic chains.

- Labs with NABL certification has (1) Demand for such tests, (2) Pricing power in such tests, (3) Leading to higher margins for such tests.

This area diagnostic chain has a clear edge over their unorganized counterparts as they have the financial and operational capability to obtain various accreditations.

Preventive Test

- In an earlier blog we saw that based on the purpose of the test, the diagnostic market is segmented as Prescriptive and Preventive/Wellness Diagnostics.

- One key differentiator is that the prescriptive test is done when a person has acute disease, but not required once they get cured

- Such tests are not recurring, which is contrast to Preventive / Wellness testing, where it is done periodically for chronic diseases

- Preventive care is needed to control, avoid or detect future complications/diseases

- Who are the customers in this segment?

- People who are healthy today but have sedentary lifestyle and prone to diseases such as cardiovascular and diabetics.

- They are direct walk-in customers and advertising and marketing has some role in increasing the volumes in this segment.

- With more awareness of health this preventive healthcare segment will be very big opportunity in future

- The corporate sector is focusing more on the well-being of their employees, promoting them to undergo preventive and wellness tests – This is a big growth driver for Prescriptive Diagnostics

- Measures are taken by the Government to promote preventive testing via tax cuts – May become a tailwind for volume growth.

- In India, the spend for preventive care is from individual pockets, unlike in western countries where the health insurance takes care of this aspect. A change in this direction would lead to tremendous growth in this segment

- Within the listed players, Thyrocare is more focussed on Preventive / Wellness diagnostics

In the views of management…

“People buy car, house and then to enjoy these luxuries, people will start looking for good health/preventive maintenance” – Dr. Velumani, CEO, Thyrocare

Hub and Spokes Model

In our earlier blog, we discussed about the “Hub and Spoke” model in business and the importance of logistics. This model is a big game changer for Diagnostics Chains. It gives them an edge over Standalone labs and Hospital-based labs. This model helps them to scale.

- Diagnostic chains have to process large testing volumes in order to achieve economies of scale, as they result in optimum utilization of equipment and help spread the operating costs of consumables and staff over a larger number of centres.

- Hence, it is important to increase the network of satellite labs and collection centers aligned through the hub-and-spoke model.

The power of hub and spoke model can be well understood from the below example. Consider a diagnostic chain having operation in 10 cities.

- Without the Hub and Spokes model of operation it needs to buy 10 equipment in 10 different cities

- Each of this 10 equipment will need buy the minimum volume of reagents from the suppliers and need to generate certain minimum volumes to break even

- In the Hub and Spoke model, the company buys only 1 equipment and install in the regional or national reference lab (Instead of 10 equipment, without the Hub & Spoke model)

- The samples are collected from the 10 cities through collection centres and satellite labs and send to the centre where that one testing equipment is installed.

- Outcome: Less cost of equipment (1 instead of 10), minimum commitment of reagents less by 90% and the 10 times more volume to the 1 equipment, giving the volume benefit.

To Close…

All of the above show how Diagnostics chains have an edge over labs in the unorganized segment. In the next blog, we will cover a few more investor insights.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.