In this blog, we will discuss the Trends in Diagnostics Industry. The trends can be broadly put in 3 categories:

- Growth Trends

- Technology Trends

- Business Model Trends

I have discussed the Technology Trend a bit more in detail. This is to give a fair overview of the Technology-led disruptions in future. However, it is to be noted that new technologies are emerging and growing rapidly. I have provided additional links for further reading. (Featured image credits: Trends in Diagnostics)

Note: Most of the Growth and Business Model related trends are from the below three sources:

- Lalpath DRHP, Trends in technology, Page 124 – 126

- Thyrocare DRHP, Developing Trends, Page 112 – 113

- Metropolis DRHP, Recent Trends, 130 – 131

Brief Background of this Blog Series

Diagnostics Industry was of interest to me since 2017. However, I could spend dedicated time only during 2021 to study this industry. The contents that you see in the coming blogs were mined from Annual Reports, Concalls, RHP, Management interviews and a few Twitter spaces by Mr Aditya Khemka and Dr Velumani.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

You might also be interested to read these related articles:

Growth Trends

Network Expansion

- Diagnostic chains operating on a hub-and-spoke business model benefit from economies of scale and higher bargaining power with suppliers when compared to standalone diagnostic centers

- To gain a competitive edge, diagnostic chains will rapidly expand their network by adding more satellite labs and/or collection centers.

- To support this expansion in the physical network, diagnostic chains will seek to improve their logistics networks to improve their turnaround time and ensure the quality and accuracy of test results by performing the testing prior to degrade of samples.

- A wider network resulting in a higher volume of samples will help diagnostic chains to achieve greater economies of scale and maintain lower operating costs

Emphasis on Doctor Referral Network

- The revenue of the diagnostic industry is contributed by doctor referrals (>50%), with the balance coming from patient walk-ins and corporate customers (<50%).

- For advanced diagnostic tests (More specific to radiology) such as sonographies, X-rays, MRI or CT Scans, doctor referrals contribute to an even greater share of customers.

- A strong doctor referral network is one of the keys to increasing revenue of diagnostic centers.

- To increase revenue, diagnostic centers are expected to continue building doctor referral networks, particularly for diagnostic chains expanding their network in new regions or areas.

Emphasis on Brand Building

- Other than referrals by doctors, diagnostic centers can increase revenue by increasing patient walk-ins.

- To achieve this, it is important that diagnostic chains have a recognized and quality brand name. – Reputation and customer perception of a brand are critical to diagnostic chains.

- This is achieved by diagnostic chains launching: (1) Advertising campaigns, (2) Healthcare camps and (3) Various wellness and preventive test packages under their own brand.

- Diagnostic chains, are expected to continue to promote their brand images and build on customer awareness through various marketing initiatives.

- Maintaining and enhancing reputation and brand recognition depends primarily:

- Quality, accuracy, timely delivery of reports and consistency of services

- Turnaround time and patient satisfaction

- Success of marketing and promotional efforts.

- The quality of lab equipment, testing reagents, and employ of qualified pathologists and radiologists at diagnostic centers contribute to the quality and accuracy of test results.

- Diagnostic centers will continue to improve the quality of equipment and enhance quality control procedures to ensure the quality and accuracy of their test results.

Expanding Test Menu and Sophisticated Tests

- With advancements and increasing focus on research and development, new tests are getting added frequently.

- Molecular pathology and DNA/RNA typing are the major areas where the diagnostic chains are adding more and more tests to gain a competitive advantage over other players.

- Emerging technologies in the diagnostic market, such as liquid biopsy, next-generation sequencing, microfluidics, and multiplex molecular diagnosis are also expanding the test menu.

Technology Trends

Point of Care Testing

Traditionally, laboratory testing requires patients to come in or specimens to be transported to the center for analysis. Point-of-care testing (“POCT”) refers to decentralized diagnostic tests that are conducted at or near the site of patient care through the use of portable, hand-held devices and test kits, which may be connected to small analyzers. Point-of-care testing is primarily performed by non-laboratory personnel in diverse locations: (1) Patient’s bedside, (2) Out-patient clinics, (3) Primary care clinics, (4) Retail pharmacies, (5) Ambulance and (6) Patients’ homes.

Digital Pathology

- Digital pathology is the acquisition, management, sharing and interpretation of pathology information — including slides and data — in a digital environment

- Digital slides are created when glass slides are captured with a scanning device, to provide a high-resolution digital image that can be viewed on a computer screen or mobile device with a viewing software either locally or remotely via the internet.

- Image analysis tools are used to derive objective quantification measures from digital slides.

- Pattern recognition and visual search tools are usually used to classify specimen imagery and identify medically significant regions of digital slides.

Glass slides continue to stay. Pathology starts with collected tissue. Glass slides are necessary, only to be later transferred to a digital scan. If your interested to understand more on this topic, you could check https://www.leicabiosystems.com/knowledge-pathway/what-is-digital-pathology/

Whole Slide Imaging

- This is also known as virtual microscopy, or whole slide scanning

- This refers to digital scanning a complete microscope glass slide and creating a single high-resolution digital file, allowing the digital file to be viewed on a computer monitor rather than through a microscope.

- This is commonly achieved by capturing many small high-resolution image tiles or strips and then montaging them to create a full image of a histological section.

- These whole slide images can then be stored for archiving and documentation, and it can also be shared for consultation and for teaching purposes.

Wearable Bio Sensors

They are a combination of wearables and biosensors (Wearables + Biosensors)

Biosensors

- Biosensors is a device made up of (1) Transducer, (2) Biosensor reader device and a (3) biological element.

- Depending on the applications, biosensors are also known popularly by the names like immunosensor, optrodes, biochips, glucometers and biocomputer.

- Bio-sensors can detect any alarming situations that could cause detrimental effects on health, including body weight, heartbeat rate, blood sugar level, blood pressure, hormone levels, and even psychological and emotional conditions.

- They can analyse data to give patients information on the above data.

Wearables

- Wearables are objects that can be worn on the body. For e.g. smart watches, clothes, bandages, tattoos, patches, spectacles, rings etc.

- These allow physicians to overcome the limitations of technology and provide a response to the need for monitoring individuals over weeks or months.

How a WBS is used in diagnosis?

- WBS are digital devices that can be worn on the body in the form of wearable systems or devices such as smart shirts, smart watches, thin bandages or tattoos —allowing blood glucose levels, blood pressure, heart beat rate and other biometric data to be measured continuously and constantly.

- WBS typically rely on wireless sensors enclosed in bandages or patches or in items that can be worn.

- WBS allow constant monitoring of physiological signals. The data sets recorded using these systems are then processed to detect events predictive of possible worsening of the patient’s clinical situations and are explored to access the impact of clinical interventions.

- This real-time information is then sent wirelessly to healthcare providers or monitors.

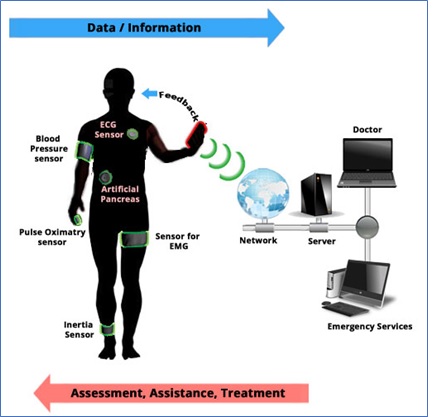

- Wearable Biosensors creates a two-way feedback between doctors and patients as shown in the image below.

Common Wearables

- Eyewear: Google’s smart lens is an example of eyewear that functions as a biosensor because the eye contains blood vessels that can be read to reveal, for example, blood sugar level. What categorized as biosensing eyewear generally includes only contact lenses, especially because smart eyeglasses generally fall into the headset category.

- Mouthpiece: With this sensor, everything that enters or is currently inside your mouth, including your saliva, can be read to provide useful biosensing data.

- Health Patch Biosensor: This sensor is placed on the chest. The sensor here has the ability to gather biometric datas like:

- Pulmonary (sleep duration, Respiratory rate, sleep quality, sleep actigraph/sub-posture),

- Neurologic (Gait analysis, fall detection/severity),

- Cardiovascular (heart rate variability, heart rate, Single-lead ECG, contextual heart rate), and

- Other (step count, posture, Temperature, summarized activity, energy expenditure, stress)

- Armband: A biosensor can also be worn around the upper arm, where it can sense blood pressure and sweat content.

- Wristband: Many biosensors use this design, such as the biosensing strip that attaches to your wrist like a tight bracelet.

- Smart Watch: Unlike a wristband that not necessarily comes with a display, a smartwatch has a built-in display that acts as a dial and a biosensing monitor.

- Ring: Gathers data on blood circulation, including blood pressure, heart rate, sugar level, and oxygen saturation. The ring sensor can be worn all the times. Due to this, continuous health monitoring is possible.

- Smart Shirts: This uses optical fibers to detect wounds and special sensors and interconnects to read/monitor vital parts of your body, including body temperature, heartbeat, blood vessels, and sweat content.

- Belt: Gathers data from sources that are physically apparent, such as waist size, and behavioral sources, such as eating, sitting, movement, etc.

- Smart Shoes: Read gait, your skeletal conditions, your speed, and your movement.

References / Additional Readings for this topic

- https://wearableworldlabs.com/types-of-wearable-biosensors/

- https://www.mepits.com/tutorial/180/biomedical/wearable-biosensors

- https://www.digiswitch.org/wearable-technology-trends/

- https://www.businessinsider.in/latest-trends-in-medical-monitoring-devices-and-wearable-health-technology/articleshow/70295772.cms

mHealth

- mHealth (also written as m-health) is an abbreviation for mobile health, a term used for the practice of medicine and public health supported by mobile devices.

- The term is typically used in reference to using mobile communication devices, such as mobile phones, tablet computers and PDAs, for health services and information, but also using their devices to affect emotional states.

- The mHealth field has emerged as a sub-segment of eHealth, which can be defined as the use of Information and Communication Technology (“ICT”), such as computers, mobile phones, communications satellites and patient monitors for health services and information.

Business Model

Industry Consolidation

India’s diagnostics industry is highly fragmented. With emergence of pan-India diagnostic chains, the sector will find more consolidation via mergers and acquisitions and increased market share of organized chains. Such acquisitions tilt the plain of competitive landscape to their favor (acquiring companies) and eventually leads to consolidation in the industry.

Focus on Preventive and Wellness Diagnostics

- Among the organized players, there has been an increasing trend toward targeting healthy individuals who have sedentary lifestyles and are more prone to lifestyle diseases such as cardiovascular and diabetes ailments.

- Bulk business from employer schemes is a key driver of this market.

- Emerging trend of precision medicine and focus on preventive care, walk-in/direct-to-customer diagnostic services are expected to drive growth in the diagnostics arena.

Growing trend of Evidence-Based Medicine

- Physicians are transitioning to evidence based medicine where the treatment is rendered to patient based on pathology and diagnostic reports to enable correct therapy and faster patient recoveries.

- Hence doctors increasingly prescribe diagnostic tests to aid the proper diagnosis and treatment of diseases, which drives the volume of patient samples at diagnostic centers.

- Physicians trust is directed toward diagnostic labs with credible accreditations.

- This trend is advantageous for organized diagnostic chains as they have the financial and operational capability to obtain various accreditations.

Emergence of Online Aggregators

- Aggregators have been active in the healthcare space for few years and within the diagnostic sector, they seek to enhance patient convenience by offering better servicing compared to the unorganized players.

- Online aggregators provide a robust website platform where customers can choose most suited diagnostic packages.

- They also provide the facility of choosing the service provider and the price it offers.

- Individual health check-up providers suggest various health check-up packages to customers based on their requirements and handle the booking of packages at designated service providers.

- These facilities are bringing diagnostic and health checkup services to the fingertips of customers by allowing them to choose from a number of available options almost instantly.

- The established national diagnostic chains have built a solid online presence themselves and offer an effective counter.

- However online aggregators resort to discounts on test to increase the number of users of their platform

Asset Light Mode of Growth

Hub and Spoke Model

Most organized diagnostic chains operate on a hub and spoke business model which benefits from economies of scale. To gain a competitive advantage these diagnostic chains are increasing their network rapidly to reap the benefits of economies of scale and lower operating costs. Hence, organized diagnostic chains are expanding their network rapidly through the addition of satellite laboratories and collection centers. (You may need to read my earlier blog for the full understanding of Hub and Spoke Model(

Shop-in Shop Model

Diagnostic players are entering into outsourcing contracts with hospitals where the diagnostic chain handles the complete operations of the diagnostic department of the hospital. Such new models of outsourcing clinical tests to private laboratories is expected to rise to streamline and increase efficiency.

Home Collection

Home sample collection and testing has been on the rise, provided by almost all organized players and unorganized players as well. Phlebotomist collects the sample and transports it in a specially designed transportation box (cold box) to the designated processing center. Home sample collection is one of the key success factors for diagnostic chains which have helped them rapidly penetrate the urban market.

Diagnostic chains acquire Market Share of Standalone Centers

- Diagnostic chains have grown rapidly with the emergence of pan-India players. Diagnostic chains have been able to maintain rapid growth by opening more collection centers, which has helped them improve their asset utilization.

- Moreover, large chains have higher bargaining power that allows them to keep their input costs (bulk purchase of reagents) lower than standalone centers.

- Standalone centers also tend to lose out on some business on account of the unavailability of complex tests and the perception that the quality of services may not match that provided by branded chains.

- In last few years there have been quite a few acquisitions in this space with larger players buying smaller players in order to gain market share.

- All these will lead to diagnostic chains continuing to acquire market share of standalone centers.

In the next blog, we will discuss the Market Drivers and Porter’s 5 forces analysis.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.