In this blog, we will discuss the Porter’s 5 Forces Analysis of the Diagnostics Industry. (Featured Image Credits: Porter’s Five Forces, wallstreetmojo.com)

Brief Background of this Blog Series

Diagnostics Industry was of interest to me since 2017. However, I could spend dedicated time only during 2021 to study this industry. The contents that you see in the coming blogs were mined from Annual Reports, Concalls, RHP, Management interviews and a few Twitter spaces by Mr Aditya Khemka and Dr Velumani.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

Earlier Blogs in Diagnostics Industry

Overview of Porter's 5 Forces

The Porter’s 5 Forces in itself is a deep topic to understand the Industry structure and attractiveness for an investor. I have included a short write-up on the model to understand this blog better.

Porter’s Five Forces is a model that identifies and analyzes five competitive forces that shape every industry and helps determine an industry’s weaknesses and strengths. This model helps to analyze the attractiveness of a particular industry and evaluate investment options. The 5 forces are:

- Competition in the industry

- Potential of new entrants into the industry

- Power of suppliers

- Power of customers

- Threat of substitute products

More details can be had from: https://www.investopedia.com/terms/p/porter.asp

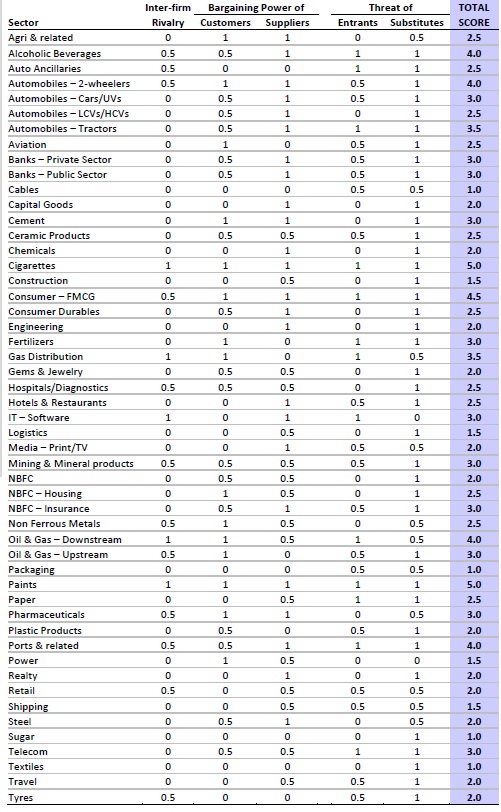

One can get some insight of this Model in the Indian context i.e For Industries in India from MOSL Wealth Creation Report. The have adopted a rating Methodology which helps to decide the attractiveness of a Industry. A snap of the view is below. Do read the report for indepth understanding.

Challenges to Use this Model in Diagnostics Industry

The diagnostic market is not homogenous. In our earlier blog we saw that the industry is not one, but two: Pathology and Radiology. Within these, there are many business segments and sub-segments. Each of these are unique in terms of market demand, competition, skill requirements, CAPEX etc. Trying to do this Porter’s 5 forces model in this industry is a challenge and also creates ambiguity. The reason being, what is ‘high’ for one part of the market is ‘low’ for another. Example Diagnostic chains have a high bargaining power with suppliers, whereas standalone centers are at the other extreme with low bargaining power. A few reasons for this heterogeneity:

- Skewed market share: One side we have some 50 odd organized players holding 16% of market share, while on the other side there is 1 Lakh odd labs in the unorganized segment holding the remaining 84% of market share.

- Different Volumes: The volumes handled by organized sector and unorganized sector is significantly different

- Different test menu: Standalone centres are more into routine test (covering 100 – 200 tests), while at the other extreme the diagnostic chains can handle the entire spectrum of routing, semi-specialized and specialized tests (Covering ~4000 to 5000 tests)

- Diverse business models: Huge difference between the way the organized and unorganized players work. Again the business dynamics of pathology is much different from image diagnostics.

Important: I have tried the best to accommodate these differences in the respective places in this analysis. The strength of the 5 forces has been rated on a three-point scale: Low, Medium and High. However, added the words ‘very’ to indicate the relative strength/weakness wherever needed.

Porter's 5 Forces - Diagnostics Industry

Competitive Rivalry

This force is HIGH. This means the industry has heavy competition. But the competition intensity and landscape are different from the traditional competition.

Industry Landscape

- Organised sector

- 4 listed Pan India diagnostics chains

- 1 listed regional diagnostics chain

- Many unlisted regional diagnostic chains

- Unorganized sector: Standalone centers + Hospital based chains. The total number of standalone labs in the country could be around 100,000

Competition Landscape

- The competition is more between the organized sector and unorganized sector rather than between the companies in the organised sector

- The Pan India and Regional diagnostics chains are not truly in competition. Each of them are into different market, or business segments.

- Krsnaa Diagnostics is more into B2G model while others are into a mix of B2B and B2C,

- One Chain is predominant in Delhi and few parts of Northern India, while another is focus only in Andhra Pradesh, Telangana and Kolkota,

- One Chain is more focussed on Biochemistry/Wellness test segment while others have a mix in their test menu

- So, the actual intense competition is between the 83% Unorganized Segment and 17% Organized Segment (Refer earlier blog, “Diagnostics Market Segment“, for details of this breakup.)

- New type of competition is also setting in with entry of Online players and Pharma companies into this segment. My earlier blog, “Competition in Diagnostics Industry” covers this dimension in detail.

More details about the impact on pricing due to competition is discussed in “Investor Insights“

Advantages of Organized Segment

- Economies of scale due to higher volume leading to lower cost structure

- Strong brand advantage

Opportunity SIze

Very big, with 1.4 Billion Indian population needing health care.

In the views of management…

“I believe that there is no competition in the Indian health care industry, it is only miniscule, that too presumed, assumed. The market is so big with a billion population and 10+ Thyrocare can comfortably smile and do business. The competition is not between 4 or 5 organized players – The competition is between the organized (15%) and the unorganized (85%). No worry about competition atleast till 2025.” – Dr. Velumani, CEO, Thyrocare.

Threat of New Entrants

This force is HIGH. This would mean that anyone can open a lab and thus increasing the competition intensity.

Entry Barrier

Very Low

- The diagnostic healthcare services industry in India is highly competitive and fragmented.

- This low entry barriers have encouraged entrepreneurship, with small players setting up labs with minimal capital investment.

Reasons for Low Entry Barrier

- Absence of stringent regulations,

- Low capital requirements: Less investment on infrastructure like physical space and equipment for Pathology based services will see an increase in large number of standalone centres usually carry out basic tests. Equipment are provided free or at low cost by suppliers.

Future

- Due to law barriers to entry the number of standalone diagnostic centers operating in India is expected to increase.

- However as discussed in Growth Opportunities, the Unorganized segment will consolidate with the organized segment.

- This again is a opportunity for the organized segment.

Advantages of Organised Segment

- Absolute cost advantages / Economies of scale & brand identity

- Diagnostic chains handling high volumes have cost advantage, economies of scale and enjoy brand identity

Threat of Substitute Products

This force is VERY LOW. This means that there is less alternative available for Diagnostics.

Presently, there is no technology that can replace the diagnosis being done. Though there are quite a lot of technology related innovations happening as we discussed in Technology Trends, it is going to be many years in future, before it can be approved and commercially viable to disrupt this industry. Again, such products would be restricted to few testing segments/test i.e. Kits for blood sugar test.

Bargaining Power of Suppliers

This force is Very High for Diagnostic Chains & Very Low for Standalone Centres

- Majority of our equipment and reagents needed for testing are imported.

- These are manufactured by very few companies globally – The number of suppliers is very less.

- The business model between the equipment supplier (Need to read this blog for better understanding of this statement) and the diagnostic company have a contract in a manner that the diagnostic companies have to buy a minimum volume of reagents from these suppliers at pre-determined price, even if the reagents are available at lesser prices in future or from a different supplier.

- In this scenario, the organised and unorganised have different bargaining power:

- Diagnostic chains: Very High bargaining power on the price of reagents due to high volumes

- Standalone and hospital based labs: Very low bargaining power on the price of reagents due to low volumes

Bargaining Power of Buyers

This force is VERY LOW. This is good for the Industry as Customers lack the ability to bargain the prices.

- The price of the test is as list/catalog price, which increases marginally to the extent of 2 – 5% (Sometimes this does not even beat the inflation!) in the case of Diagnostic chains

- Typically, a patient visits a diagnostic centre once or twice a year

- The spend on tests is very less (~10% of the total cost of treatment) when compared to spending on treatment and medicines

- They do not bargain with the lab for lesser prices, however one possible consumer behaviour is to choose a low-price provider between two labs which they have access

- While there are so many standalone labs, only 2.5% of them are NABL certified which is capable of conducting specialized and semi specialized tests – Where the buyers have no option other than going to that NABL certified lab

- Buyers are more concerned about the quality and accuracy of the test rather than a 5 to 10% savings.

This dynamics is not partly true when it comes to tests in the Wellness segment. There the customers does not depend on Doctor’s referral. The customers could choose the lab. They then choose the one which offers discounts.

In the views of Management…

“When someone is not well in a family, the family members are not shopping around who does the cheapest test, but they are shopping around who will give the correct report. People come to Pathology lab once or twice a year and the average spend is around 500 to 600 rupees. So, this will not be bankrupting them nor is a frequent spend. They spend lot of money in the hospitals. So, price for diagnostics is not a huge concern for patients.” – Ameera Shah, MD Metropolis

In the next blog, we will the Market drivers for the Diagnostics Industry.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.