In the Diagnostics Industry, the unorganized segment has a lion share of 84%. The unorganized segment consists of hospital-based labs and standalone Diagnostics centres. (Refer to my earlier blog for details of the split between the Organized and Unorganized segments)

So, it looks like the Unorganized segment is dominating! But the other way to see is that the organized sector has a huge opportunity to take over.

Will this domination by the unorganized continue (or) will the organized segment continue capturing market share?

In this blog, we will discuss the different possibilities in detail.

Brief Background of this Blog Series

Diagnostics Industry was of interest to me since 2017. However, I could spend dedicated time only during 2021 to study this industry. The contents that you see in the coming blogs were mined from Annual Reports, Concalls, RHP, Management interviews and a few Twitter spaces by Mr Aditya Khemka and Dr Velumani.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

You might also be interested to read these related articles:

If you look back 15 to 20 years, there was not much organized presence in the Diagnostics industry. The unorganized segment was having nearly a 100% share in the business. In these 15 years, the organized segement took up 17% of the unorganized.

Will this trend continue? If yes, What are the drivers that will push this trend?

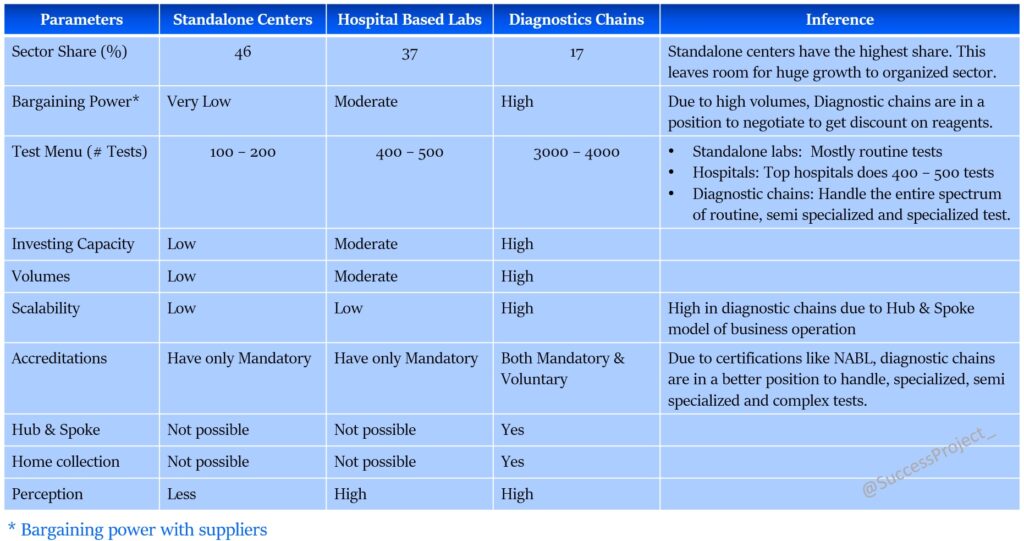

To seek an answer to this let us understand a few key business dynamics of the three players:

- Standalone Centres

- Hospital Based Labs and

- Diagnostics Chains

Business Dynamics of Different Players

Standalone Centres

Types of Test

- Mostly do the routine test, but no (or limited) semi-specialized and specialized tests.

- Inference: The players lose this part of the business to an organized segment.

Accreditation

- 97% of the labs do not have accreditations like NABL

- Inference: These labs cannot do certain tests. This favours the organized segment.

Cost Structure

- The volumes generated by these centres are low. So there are not much economies of scale. They need to buy the committed volumes of reagents from the equipment suppliers irrespective of volumes. Thus the unit cost/test is generally high. The reagent dynamics is very much applicable to the Pathology segment. It is in this segment that the standalone players have a larger presence compared to the Radiology segment. (To understand this line, you must read my earlier blog on the importance of Reagents on the cost.)

- Inference: These centres lack competitive pricing. This Diagnostics chains have high volumes and benefit from economies of scale.

Investments

- These centres find it difficult to invest in the latest technology or convenience like home collection, online test results, app based operations, branding etc.

- Inference: Limited growth, expansion and capacity to scale.

Customer Perception

- On a comparative basis, customers perceive the quality and hygiene of a Diagnostics chain as higher than standalone centres. Even the Medical community has higher trust in organized players.

- Inference: Patients have a lesser preference for these centres. The only area they score is “a kind of nearness” to the locality and low cost in certain routine tests.

Hospital Based Labs

- These centres enjoy the advantage of a captive patient base, both In-Patient and Out Patient.

- Doctors in the hospital recommend tests and patients also may have to compulsory do the tests in the hospital

- Pricing power – Hospitals charge a premium for their tests, and people must go there for a cure.

- Tertiary hospitals may not have all the needed advanced equipment to conduct tests may send samples to other labs/diagnostic chains – Due to lack of volumes, diagnostics as a business is not economically viable in Tertiary hospitals.

- The Pathology segment is lucrative and they prefer to have it with them. When it comes to capital intensive Radiology business, hospitals prefer “Managed services” model with Diagnostics Chains.

Diagnostics Chains

- Diagnostic chains use Hub and spoke model to increase the volumes to achieve economies of scale (More details about this model was discussed under the heading Hub and Spoke model in the previous sections)

- To adopt this model and to operate the network, diagnostic chains use modern logistics and information management systems (More details on logistics and Information Technology was covered in the previous sections)

- Hospital association is needed to bring volumes in special and semi-special tests. As we saw Tertiary hospitals do not have all the advanced equipment and send the samples to diagnostic chains.

- They can invest in Technology, Logistics, expansion, branding, customer conveniences etc.

- Diagnostics chains enjoy the advantage of diversified business models i.e. B2C, B2G etc. This reduces the risk of customer concentration.

- Diagnostic chains have no expense related marketing or promotions in B2B. Hospitals or clinics collect the sample and send it to diagnostic chains. A patient might not even get to know (or be bothered) where his sample is being sent.

Investor Insights

The dynamics of the different players point to one major theme for the future. Movement of business from Unorganized to Organized segment. This can be related to “Value Migration” which Shri. Raamdeo Agrawal talks about it frequently.

However, it is not going to become like unorganized is 0% and organized takes the 100% share. Based on the key business dynamics of standalone centres, hospital labs and diagnostic chains that we saw just now, let us understand how the consolidation/migration is likely to happen.

Standalone Centres to Diagnostics Chains

This migration to an organized segment would happen due to cost structure, accreditation, difficulty in adding convenience like home collection, inability to invest in technology and non-availability of specialized and semi-specialized tests. However, newer working models and partnerships between standalone centres and diagnostic chains would emerge in the coming years.

In the views of management…

“I don’t believe that organized will completely wipe out unorganized. We will just co-exist.” – Mr Om Manchanda, MD, Dr Lal Pathlabs (Source: https://www.youtube.com/watch?v=5YkgDi–VE8)

Hospital based Labs to Diagnostics Chains

This is not going to be easy, as hospital leverage their captive base of In-patients and out patients. The doctors in the hospitals refer the tests and patients’ compulsory need to do the testing in these labs. Even if the cost structure is high, hospitals can charge a premium from their patients and have good margins.

Regional to Pan Indian chains

This migration can be expected within the organised sector. There is some trust factor and relationship built between doctors and the regional diagnostic chain. This has happened over the years and not overnight. Now for a pan India chain to enter a city dominated by a Regional chain is going to be a challenge to get the trust and penetrate the market. While it is difficult, it is not impossible. It would take a longer time (May not be months but years) to capture market share. Investors would need patience for this story to play.

The opposite of this also can happen…

Regional chains can enter into multiple geographies in India to become Pan India chains.

The success of many large chains has spurred smaller regional players also to adopt the hub-and-spoke model. Regional chains are also now using collection centres to expand their reach in their local markets, and are investing in logistics and IT systems to compete with the larger chains. These smaller regional chains focus on customer service to differentiate themselves and compete with the large, established brands. Regional players are not going to let their market share easily to Pan India players. This movement from regional players to pan India players is going to be an interesting place to watch.

With the above reasons, one could see a significant shift in the market share of unorganized players to organized players. Below is the tabulation of the different players on various business parameters.

To Close…

In the next blog, we will understand more investor insights around pricing, competition etc.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.