This blog, will focus on the Indian Diagnostics Industry. In the last blog, we saw a high-level overview of the Healthcare Sector. (Featured image credits: https://www.who.int/news/item/29-01-2021-who-publishes-new-essential-diagnostics-list-and-urges-countries-to-prioritize-investments-in-testing)

Diagnostics is an important part of the healthcare sector. It helps in the diagnosis of the health condition of a patient. This is the first and most important step in disease management. Without this accurate identification, it is not possible to provide the correct treatment.

Brief Background of this Blog Series

Diagnostics Industry was of interest to me since 2017. However, I could spend dedicated time only during 2021 to study this industry. The contents that you see in the coming blogs were mined from Annual Reports, Concalls, RHP, Management interviews and a few Twitter spaces by Mr Aditya Khemka and Dr Velumani.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

You might also be interested to read these related articles:

Highlights of the Indian Diagnostics Industry

Diagnosis of diseases is key to detecting, diagnosing, and assessing any disease and plays a major role in the treatment, management, and prevention of diseases. Below is a high-level overview of the Indian Diagnostics Industry.

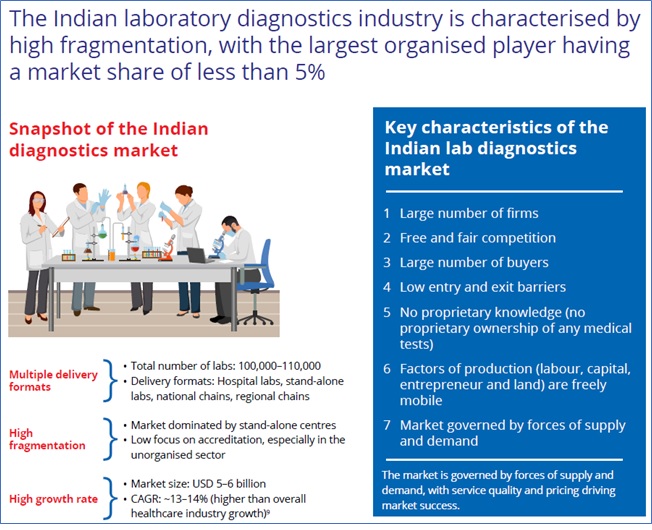

Source: Report titled, “An Assessment of India’s Laboratory Diagnostic Industry” www.nathealthindia.org

- The industry is valued at approximately US$ 9 billion (about 67,500 crores), Reference: Krsnaa Diagnostics 2022 Annual Report.

- The diagnostics industry is expected to grow at a CAGR of 13–14%, which is higher than the overall growth rate of the healthcare sector. The general expectation is that the organised chains of diagnostic laboratories would have an even growth higher rate.

- The market is segmented on basis of the nature of tests, kind of provider, end users, competitive landscape, and geographical distribution.

- Fragmented Industry

- The industry is highly fragmented with a large number of unorganized players. It can be seen in the above image that there are about 1 to 1.1 Lakhs standalone labs.

- There is no single market leader or monopoly. The largest of the organised players has a market share of less than 5%.

- In recent times patients are preferring organized chains over standalone centres due to the unavailability of complex tests and the lack of high-quality services at standalone centres. Consequently, the growth rate of organized players is expected to be higher in the near future.

- There are two major sub-industries:

- Pathology: This involves the analysis of body fluids or tissues used to diagnose diseases.

- Radiology: Uses imaging technologies such as CT scans, MRI scans, X-rays and others are used to diagnose diseases

Note: Pathology and Radiology each have further market segmentation based on additional test classifications.

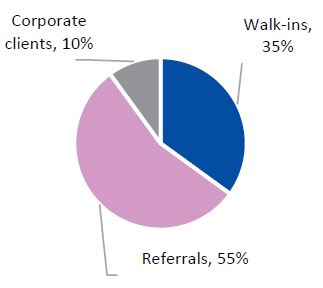

- End Users: Doctor Referrals, direct patient walk-ins, and corporate clients.

Note: More details of the different terms used above i.e. Pathology, Radiology, Organized chains, and Standalone labs will be discussed in future blogs.

Characteristics of the Diagnostics Industry

Importance of Diagnostics Industry

Diagnostics is the first step to treating diseases and is also an essential step. It starts right from the detection of the disease, determination of the effectiveness of treatment, and even post-treatment monitoring of the patients. Thus, within the healthcare Industry the Diagnostics industry has an important role in treatment of patients.

Cyclicity of Diagnostics Industry

We just saw that this industry is very much essential and plays a key role in the healthcare sector. The doctors need to decide on the medical condition and the nature of the treatment. The demand for tests does not depend on general economic cycles. If someone is sick, they approach a doctor, who in turn refers them to a diagnostic lab for testing. This happens irrespective of the phase of the economic cycle. Diagnostic tests form an integral part of the identification and treatment of the disease. Thus, this industry has a low cyclicity of demand. (Reference: https://www.drvijaymalik.com/diagnostic-labs/, Do read this blog on the Diagnostics industry by Dr Vijay Malik.)

Heterogenous Industry

Aditya Khemka says in one of the Twitter spaces, “Everybody treats diagnostic has 1 industry but it is two, one is Pathology and other is Radiology”. In fact, the kind of division is more than two as you can see below.

- Pathology has segments like Biochemistry, Immunology, Microbiology and so on.

- Radiology also has segments like Low-end Radiology and High-end Radiology. X-Rays come in Low-end Radiology while MRI Scans or PET come in High-end Radiology.

Note: The X-Ray can be seen as a sub-segment within the low-end Radiology segment. Similarly, MRI is a sub-segment within the high-end Radiology segment.

The industry at the top level has two divisions. These divisions in turn have many segments and sub-segments. Each of these segments and subsegments has different business dynamics, market demand, competition, CAPEX, skill requirements (i.e. Pathologist for Pathology and Radiologist for Radiology), pricing structure, scalability etc. Thus, diagnostics is a heterogeneous and complicated industry. This awareness is important for an investor when analysing Diagnostic chains.

Doctor Referrals

The industry heavily depends on Doctor referrals. More than 50% of the tests are referred by doctors. Doctors refer to labs where they have trust. The reason is that the treatment is based on the test results. The stakes are very high here, which is the life of a patient. If treatment is made to a patient based on the unreliable results from an unreliable lab and, if something happens to the patient, then it is Doctor’s liability. Even their license can be cancelled. No doctor will take a risk when it comes to diagnostics tests. Hence even if a patient does a test in a different lab due to low cost, the doctor will still ask the test to be repeated with a lab they trust. Doctors trust multiple labs, which are mostly diagnostic chains like Dr Lals, Thyrocare, Metropolis etc. A doctor is an important person in the ecosystem. Hence Diagnostic companies establish and maintain a relationship with doctors.

Source: Edelweiss Diagnostic Sector Report of August 2020

Advertisement Expenses

This aligns with the previous topic on the heavy dependence on doctor referrals. The doctor directs the patients as to which lab the test has to be done in. More than 50% of the test are referred by a doctor. Only around 35% would come directly from end consumers. These are focussed on Preventive Diagnosis, where the patient is just interested to know if the medical parameters are within limits. Thus, diagnostic companies do not invest much in advertising.

Trust

The business in this industry depends heavily on trust. Patients and doctors need to have test in the lab and their reports. This is more a “word of mouth” business. No one will take the risk of going to a lab whose report is not trustworthy.

Dynamics of Customer Spend

Ticket Size

The overall ticket size of the spend on diagnostics is very much negligible when compared to the overall money spent on treatment, hospitalisation and medicines. Some estimates put that diagnostics form 4–5% of the total healthcare expenditure, which influences the remaining 95% of the cost. While Diagnostics services have a lower share in overall healthcare spending (From the consumer – Patients end), yet it is crucial to identify problem areas and major illnesses.

Frequency

The frequency of spend is very less. A person may step into a diagnostics centre for once or twice a year. Also, this frequency is unpredictable. They may come to a lab only when they fall sick, and the doctor refers them to a lab. There is no way to predict as to when a person would need to visit a lab. Since the spending does not happen month on month, from the business standpoint, the diagnostics companies need to have new customers to sustain their growth.

To quote from one of the interviews of Ameera Shah, MD Metropolis,

“People come to Pathology lab once or twice a year and the average spend is around 500 to 600 rupees. So, this will not be bankrupting them nor is a frequent spend. They spend lot of money in the hospitals. So, price for diagnostics is not a huge concern for patients.”

To close…

This blog covered all insights about the Indian Diagnostics Industry. The next blog would be on Diagnostics market segmentation.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.