In previous blogs, I discussed in depth about: (1) Framework for stock analysis, (2) Financial Statement Analysis, (3) Financial Ratio analysis, and (4) A practical case of Ratio analysis using debt-equity ratio. In this and the upcoming blog posts, we will delve into the topic of Dividends. This analysis holds a significant level of importance within the realm of fundamental analysis. (Featured image credits: Image by Gerd Altmann from Pixabay)

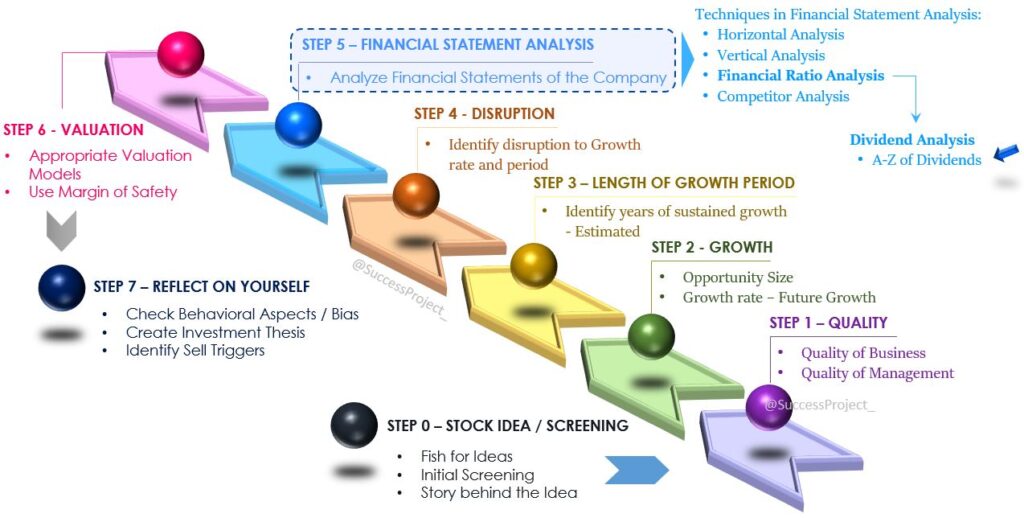

Where does dividends analysis fall in the bigger picture of Fundamental analysis? The below image gives the answer.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index page for all my blogs.

You might also be interested to read these related articles:

A-Z of Dividends

What are Dividends

- It can be seen as a reward paid to the shareholders for their investment in their company

- Dividends are the distribution of a company’s earnings/profits to the shareholders.

- Companies Act 2013, defines a Dividend as “The amount of profit that has not been retained in the business and has been distributed among the company’s shareholders in proportion to the number of shares held by them“

- It’s important to highlight that not the entire earnings or profits are allocated as dividends to shareholders.

- This is due to the company’s need to maintain sufficient cash reserves for fueling future growth initiatives and expansion endeavors.

The company’s board meticulously assesses both the current year’s earnings and the plans for future growth, taking into consideration the financial resources required to realize these expansion strategies.

In light of this comprehensive evaluation, the board then determines the proportion of the profits that can be disbursed to shareholders as dividends.

How does a company calculate dividends to pay its shareholders?

- There isn’t a formula or established method for calculating the dividend distribution amount.

- The decision to pay out dividends solely rests with the directors or management.

- The principal determinant in determining the dividend amount that can be distributed to shareholders is the company’s future growth needs, such as machinery replacement or new factory establishment.

Can a company not pay Dividends?

After evaluating the current year’s earnings and considering future growth aspirations, the company’s board could opt not to allocate dividends to shareholders.

- It’s worth emphasizing that dividend payouts are not obligatory for a company. Consequently, shareholders lack legal avenues to compel dividend disbursements, even in the presence of substantial profits.

- Companies might refrain from paying dividends for two primary reasons: firstly, an absence of ample profits to cover dividends, or secondly, the existence of significant growth prospects that demand substantial cash investments.

Can the dividends use to buy additional shares within the same company?

Mutual funds investors might embrace this notion, given the opportunity to reinvest dividends for purchasing extra units of the fund. This practice is termed ‘Dividend Re-investment’. Conversely, such an avenue does not extend to dividends disbursed by a company.

Nevertheless, following the crediting of dividends to their accounts, investors possess the freedom to employ this sum to acquire added shares of the very same company. This concept is referred to as ‘Dividend Compounding’—the act of purchasing company shares utilizing dividends paid out by that very company.

Types of Dividends

Final Dividends

- The company declares this dividend during the Annual General Meeting (AGM) following the financial year.

- Consequently, this occurs subsequent to the publication of the company’s final version of financial statements.

- The proclamation of the ultimate dividend also transpires once within each financial year.

Interim Dividends

- This dividend is announced before a company’s annual general meeting (AGM) and the subsequent release of its final financial statements.

- Companies have the option to pay interim dividends and may forgo paying a final dividend.

- In such cases, the cumulative dividend for the year becomes the total of all interim dividends.

- When companies disburse both interim and final dividends, the combined dividend for the year comprises the aggregate of all interim dividends and the final dividend.

- Notably, Interim Dividends, unlike Final Dividends, can be paid multiple times within a financial year, possibly on a quarterly or semi-annual basis.

Interim Dividends provide valuable insights:

- They indicate that the earnings for the given period have met or exceeded expectations.

- Investors perceive interim dividends as a positive indicator.

However, a caveat exists:

- Frequent or high interim dividends might jeopardize future growth prospects. Hence, investors should assess whether the company has set aside adequate funds for its future growth before committing to substantial or recurring interim dividends. (This assessment can be conducted by evaluating the quality of Dividends, a technique to be discussed in forthcoming blogs.)

- Furthermore, it’s essential to note that the consistent quarterly payment of dividends in the future isn’t guaranteed:

- If a company that has been consistently paying quarterly dividends misses one quarter’s payment, it can negatively impact the share price.

- This inconsistency in dividend payments can lead to a loss of investor confidence due to the unpredictable and irregular dividend pattern.

Special Dividends

At times, a company might issue special dividends, which can stem from various reasons or special occasions, including:

- Successful attainment of significant milestones such as 25 Years (Silver Jubilee) or 50 Years (Golden Jubilee) since incorporation.

- Possessing substantial cash reserves with limited available investment opportunities.

- Dispensing the funds obtained from the sale of assets like land.

Investors should take note: These special dividends are both unpredictable and non-recurring.

Important Dates for Dividends

For a long-term investor, comprehending this concept is generally unnecessary. They retain the stock with the intention of benefiting from dividends and future growth. Such dates hold minimal significance for them. Nevertheless, the information below is provided for academic enrichment.

Certain “investors” opt to purchase or sell stocks contingent on these corporate actions to swiftly capitalize on gains. For these individuals, this comprehension proves valuable.

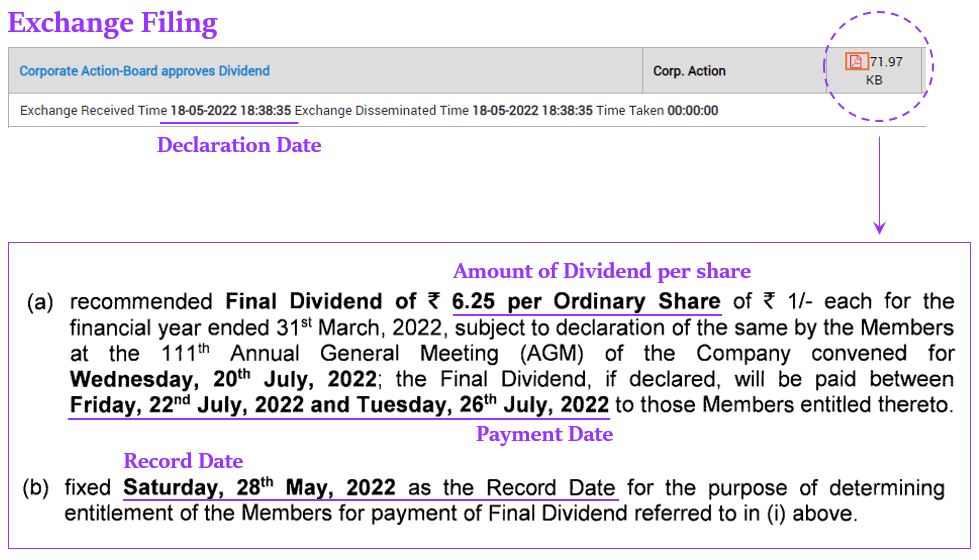

Date of Declaration

The directors or board announce this as the dividend announcement date. The announcement could take the form of a stock exchange filing or may also be conveyed through media channels. The declaration statement includes specific details such as:

- The amount of dividend declared per share.

- It might also encompass the date of record and the payment date. (On occasion, these specifics could be published a few days later in a separate filing.)

Whether an investor holds stock on this date or not holds no bearing on their eligibility to receive the dividend.

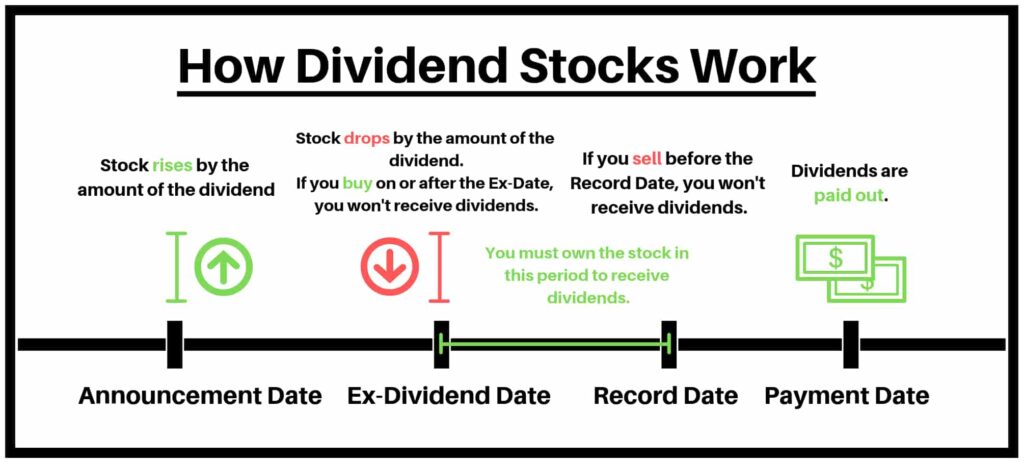

Ex-Dividend Date

- It is the day the stock starts trading without the value of its next dividend payment. (Reference: https://www.investopedia.com/terms/e/ex-dividend.asp)

- This date serves the purpose of identifying the stockholders eligible to receive the declared dividend.

- If an investor acquires a stock on or after the ex-dividend date, they won’t be entitled to the declared cash dividend; instead, the dividend will be attributed to the stock’s seller.

- Investors who purchase the stock before the ex-dividend date, however, will be entitled to receive the dividend.

Record Date

- On this date, the company establishes the eligible shareholders who will be entitled to receive the dividend.

- The record date occurs one business day following the ex-dividend date.

- However, this isn’t a significant determinant in an investor’s decision-making process.

Payment Date

- On this date, the dividend is deposited into the shareholder’s account.

- Additionally, the payment amount is calculated according to the shareholder’s share count, which involves multiplying the number of shares held on the record date by the dividend amount per share.

- Because both the number of eligible shares and the dividend per share are predetermined ahead of the payment date, this occurrence does not exert any influence on the stock’s price or prompt any investment choices.

The below image gives a better understanding of this discussion. (Image Reference: https://tradeoptionswithme.com/how-dividend-stocks-work/)

Conclusion

Dividends provide insights into a company’s financial health, growth strategies, and commitment to rewarding its shareholders. This blog would have helped you understand the declaration of dividends, ex-dividend dates, and payment processes, to the considerations of special dividends and their impact on investment decisions.

In the next blog, we discuss factoring dividend analysis in our investment decision.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.