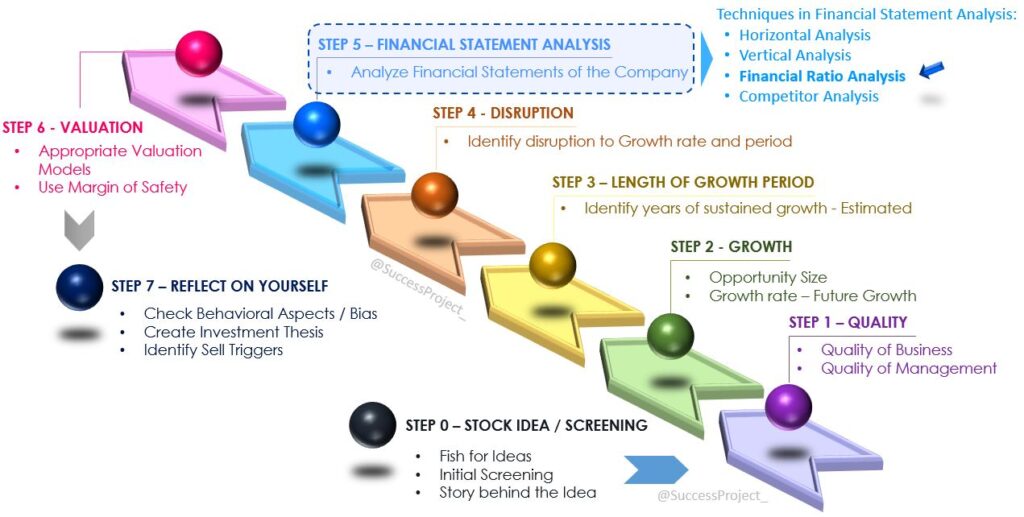

This blog delves into Financial Ratio analysis, a crucial technique in Financial Statement Analysis. In our previous blogs, we examined (1) The different steps in stock analysis, where Financial Statement Analysis was one of the steps, and (2) The different techniques in Financial Statement Analysis. (Featured image credits: Photo by Pixabay: https://www.pexels.com/photo/scientific-calculator-on-wooden-surface-220301/)

Now, let’s explore the comprehensive focus of this blog with the help of the image below. (Note the blue arrow)

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month. Do check my Blog Index for all my blogs.

You might also be interested to read these related articles:

DISCLAIMER

The contents of this blog aim to provide investors with an understanding of Financial Ratio Analysis. Please note that these contents are not intended for academic purposes.

Financial Ratio Analysis - A Overview

- Ratio analysis is a vital technique within Financial Statement Analysis.

- By examining a company’s published financial statements, investors can access the data necessary for this analysis.

- Through establishing mathematical relationships or comparisons between various items in the statements, financial ratios offer valuable insights.

However, their true significance emerges when considered in conjunction with each other. To draw meaningful conclusions, investors must carefully select a relevant set of ratios tailored to the specific company or sector under evaluation.

How many Ratios are there?

- Professor Anil K Sharma states in his lecture that the literature has 365 financial ratios.

- However, not all ratios are necessary for every circumstance, company, or industry.

- The selection of ratios depends on the analysis’s objective, which, in turn, relies on the stakeholder’s role, such as being a lender, investor, supplier, etc.

- The key lies in exercising judgment to choose the most relevant ratios based on the specific objectives of the analysis.

Who are the Stakeholders?

In a company, there are several stakeholders, as discussed in the earlier blog. Capital is brought in through equity and debt.

- Equity is provided by shareholders and investors.

- Debt is raised from lenders like banks and financial institutions.

- Debt can be both short-term, supporting working capital needs and daily operations, and

- long-term, aimed at financing future growth and capital expenditures (CAPEX).

Additionally, suppliers play a role as short-term lenders, providing raw materials or services and collecting payment after a few days. Besides capital, effective management is crucial in channeling resources and running the company. Hence, employees, management, shareholders/investors, lenders, and suppliers are a few of the stakeholders in a company.

What is the Interest of the Stakeholders?

These stakeholders have different interests:

- Lenders of short-term debt and supplier: Profitability and short-term liquidity ratios

- Lenders of long-term debt: Profitability and solvency ratios of the company

- Investors: They are focussed on most of the ratios. They are interested in:

- Profitability, Return on Investment ratios and Dividend ratios to evaluate the investment attractiveness

- Solvency ratios to evaluate the ability of the company to raise capital for future growth

- Liquidity ratio to evaluate their comfort in handling daily operations

- Cash flow indicator ratios to evaluate the company’s strategy on external financing, returning money to shareholders (through buybacks or dividends), CAPEX etc.

Classification of Finance Ratios

We have observed that different stakeholders have access to numerous ratios for their specific use. These ratios are categorized under different headings based on their common intended use.

Liquidity Ratios

- Purpose: The purpose of these ratios is to identify the liquidity position of the company, which refers to the availability of liquid funds to meet short-term financial obligations.

- The ratios have cash or the most liquid assets in the numerator and short-term borrowings and current liabilities in the denominator.

- A higher ratio indicates better liquidity, and a value greater than 1 indicates that the company is in good shape to meet its short-term financial obligations.

- Data source: The current assets and liabilities from the Balance sheet.

- Interested stakeholders: Short-term lenders, suppliers, and investors.

Common ratios include the current ratio, acid test ratio, and cash ratio, among others.

Solvency Ratios

- Purpose: The purpose of these ratios is to measure the ability of a company to meet its long-term financial obligations, which include timely payment of interest and repayment of principal debt amount.

- Companies often resort to long-term debt for future growth through organic expansion or acquisitions.

- These ratios compare the long-term debt with the assets of the company and help determine the financial risk faced by the company.

- A higher ratio indicates better solvency.

- Data source: The non-current assets and liabilities from the Balance sheet.

- Interested stakeholders: Long-term lenders and investors.

Common ratios include the Debt-Equity ratio, Interest coverage ratio, Total assets to Debt ratio, among others.

Profitability Ratios

- Purpose: The purpose of these ratios is to measure a company’s ability to generate profit on revenue.

- For any company to sustain expansion and growth, it must earn sufficient profits.

- These ratios relate profits against revenue and indicate the efficiency of business activity.

- Data source: The profit and various line items from the Income statement.

- Interested stakeholders: Lenders, suppliers, company management, and investors.

Common ratios include Gross margin, Operating margin, Net margin, and others.

Return on Investment (RoI) Ratios

- Purpose: The purpose of these ratios is to measure a company’s ability to generate profit on investment.

- While profitability ratios focus on profit in a narrow context, return on investment (RoI) ratios consider profit in a wider context, comparing it with the overall investment made by the firm.

- Data source: Profit from the Income statement and various types of investment from the Balance sheet.

- Interested stakeholders: Company management and investors.

Common ratios under this category include Return on Capital Employed, Return on Invested Capital, Return on Equity, and others.

Turnover Ratios

- Purpose: The purpose of these ratios is to measure the operating performance and efficiency of the use of assets and various resources of the firm.

- They are also known as activity ratios or performance ratios.

- These ratios focus on assessing how quickly the raw material is converted into finished products and how fast the finished products are sold.

- Data sources: Data from the Balance sheet and Income statement.

- Interested stakeholders: Company management and investors.

Common ratios under this category include Asset Turnover Ratio, Inventory Turnover Ratio, Receivable Turnover ratio, Accounts payable Turnover ratio, and others.

Dividend Policy Ratios

- Purpose: The purpose of these ratios is to measure the attractiveness of dividend returns from the company.

- Returns from equity investment come through dividends and capital gains, and different investors have varying preferences for these returns.

- These ratios are specifically used by investors who focus on stock investment for dividend returns.

- Data source: There are multiple sources and including dividend declared, market price, earnings from the income statement, and values from the cash flow statement.

- Interested stakeholders: Mostly investors.

Common ratios under this category include Dividend pay-out ratio, Dividend yield, Dividend coverage ratio, and others. You can find detailed explanations of all these ratios in my blog “Powerful Dividend Metrics Part 1 and Part 2.“

Cash Flow Indicator Ratios

- Purpose: Measure the amount of cash generated and the coverage it provides for various obligations like dividend payment, interest payment, and debt repayment.

- These ratios offer insights into management’s strategy regarding the source and use of cash, including equity or external financing and CAPEX or rewarding shareholders.

- They are crucial for all stakeholders, as ultimately, cash is what matters most.

- Data Source: Numbers from the cash flow statement and other values from any of the three financial statements.

- Interested stakeholders: Almost everyone.

Common ratios: Cash flow coverage ratio, Cash Return on Capital Invested, Cash flow return on Investment, Free Cash Flow / Operating Cash Flow ratio, cash-generating power ratio, and more.

Capital Market Ratios

- Purpose: Measure the investment worthiness of a company.

- Market price of the share is utilized in these ratios.

- They reveal how cheap or expensive a company is in relation to its sales, earnings, assets, and future growth prospects.

- Data source: Market price and values from any of the three financial statements.

- Interested stakeholders:

- Investors use these ratios to evaluate the attractiveness of an investment option.

Common ratios: Price/Earnings Ratio, PEG Ratio, Price/Sales Ratio, Price/Book Ratio, Dividend Yield, etc.

Note: Another classification method is based on the financial statement used for deriving the ratios. The ratios can be categorized as (1) Balance sheet ratios, (2) Income statement ratios, (3) Cash flow ratios, and (4) Cross-statement ratios. In cross-statement ratios, the values for calculation come from multiple financial statements.

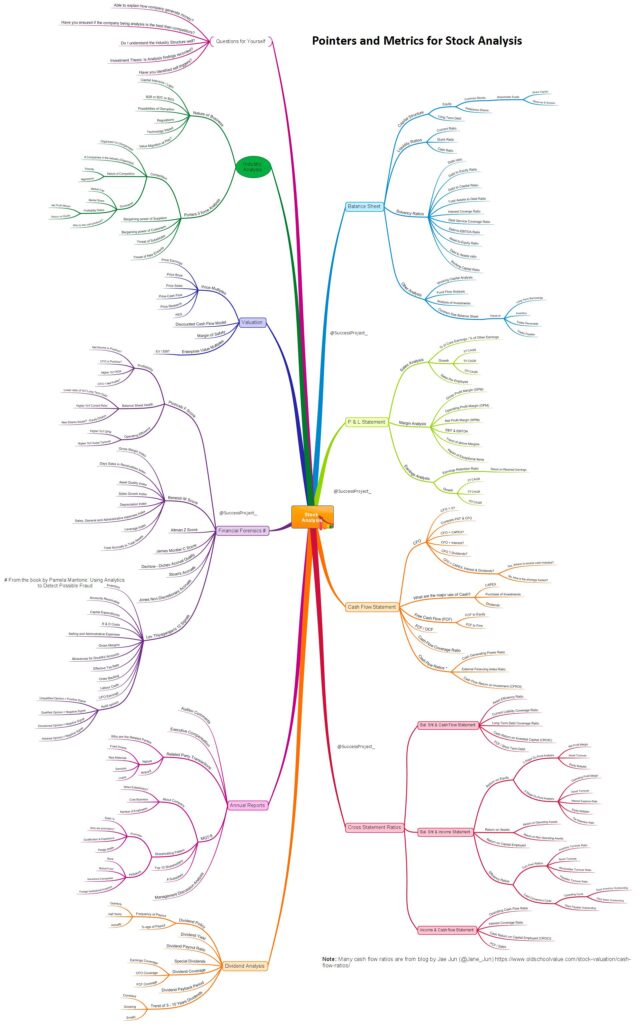

The mind map below encompasses the majority of the ratios required for an investor. It offers a comprehensive view, covering the entire stock analysis framework.

Below the image is the link to download a high-resolution pdf of the mind map.

One page Mind Map with metrics for Stock Analysis covering both Qualitative and Quantitative aspects ranging from financial ratios to management quality analysis.

How should an Investor approach Financial Ratio Analysis?

As an investor, you must understand the following for each ratio:

- Type of ratio: Determine which classification the ratio belongs to, such as liquidity ratio or solvency ratio, etc.

- Other names: Familiarize yourself with any alternative terminologies for the same ratio.

- Description: Grasp the purpose, use, limitations, and available literature about the ratio.

- Understand the minimum and maximum recommended benchmark values.

- Formula: Learn the formula to calculate the ratio and recognize the source of the numbers used in the calculation.

- Gain a deep understanding of the items in the numerator and denominator of the formula.

- For example, if the numerator includes current liabilities, you should know that they refer to obligations that need to be settled within one year.

- Be aware of the various components of current liabilities, such as payments to vendors, repayment of short-term debt, and payment of interest.

- Interpretation: This is the most critical aspect. Learn how to interpret the ratios to derive meaningful insights and make informed decisions. Interpreting ratios requires practice and analysis of different companies.

In the next blog, I will illustrate all the above aspects using one of the ratios specifically the Debt-Equity ratio, as an example. The focus will be on how ratios can be interpreted, which is a crucial skill to master for successful financial statement analysis.

Interpretation is the Key to Financial Ratio Analysis

The calculation of ratios is not a big deal. An excel with the needed formulas gives the ratios. Many websites and databases like moneycontrol and screener.in offer free ratio calculators and data for various companies. The challenge lies in interpreting the ratios and grasping their implications.

Thus, these ratios are available to anyone in a few clicks. The key aspect is interpreting the ratios. The ratio conveys something that the investor must be able to identify. The investor needs to answer:

- What is the meaning of this figure?

- What does this figure say about the past, present, and management strategy?

- Is it high or low? (Based on the unfavourable extreme of either high or low, you need to dig more to figure out the reason)

This requires delving deeper to understand the underlying reasons. An informed interpretation is crucial for making sound investment decisions. There should be some basis for interpreting these figures.

Basis for Interpretation

- Benchmarks/Rules of thumb: Standard rules in literature establish the minimum and/or maximum acceptable range of ratios.

- Competitor Analysis: By comparing these ratios with other companies in the industry, investors gain insights into how much the company lags behind the leader and surpasses the laggard.

- Industry Analysis: Comparing the company’s ratios with industry averages determines whether it leads or lags within the industry.

- Time Series Analysis: Calculating ratios over 5-10 years and analyzing trends reveals the company’s performance over time—whether it is stable, declining, or improving. Past trends offer insights into future expectations.

Conclusion

Financial ratio analysis is a powerful tool that allows investors and stakeholders to gain deep insights into a company’s financial performance and health.

- By examining various ratios, such as liquidity, solvency, profitability, and efficiency ratios, investors can assess the company’s ability to meet its short-term and long-term obligations, generate profits on investments, and efficiently utilize its resources.

- It helps in making informed investment decisions and understanding the company’s position relative to competitors and industry averages.

- While calculating ratios may be straightforward with readily available tools and data, the true value lies in interpreting these figures.

- Through benchmarks, competitor and industry analysis, and time series analysis, investors can decipher the meaning behind the numbers and make informed decisions.

Financial ratio analysis empowers investors to gauge the investment worthiness of a company, identify potential risks and opportunities, and ultimately align their investment strategies with their financial goals. As an essential component of the stock analysis framework, mastering financial ratio analysis is an essential skill for any long term investor.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.

Hi Venkant ,

Good Day,

Request you take one sample balance sheet or screen shot from screener .in and explain with example which would be more useful.

So that we can cross check while we do it on our own.

thank you,

regards

Abhilash.

Pingback: Dividends analysis is important for investment - Venkatesh