There are different themes in investing i.e. Investing in PSU, Sector specific companies, Holding companies etc. One such theme is investing in MNC companies. In this and the next few blogs, we will understand more about MNC companies and what needs to be analyzed from an investment perspective. (Image credit: Toyota Headquarters)

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

You might also be interested to read these related articles:

What is a MNC?

- MNC stands for Multi National Company which has business that operates in many different countries at the same time.

- Shares of such multinational companies listed in India, are often referred to as MNC stocks.

- These stocks have a foreign entity as a promoter or major shareholder.

MNC landscape in India

- There are around 80+ MNCs listed in India

- Of this more than 80% of these companies have their parent companies in North America and Europe

MNCs are unique in many ways which we will discuss in this blog.

The History of MNCs in India

Many of these companies were established pre-independence. They continued to operate in India as 100% owned subsidiaries of the overseas parent. Three companies even have a legacy of 100+ years:

- ITC – 112 Years,

- Britannia Industries – 104 Years and

- Kansai Nerolac – 102 Years

However, two important events had a significant impact on MNCs. One led to the birth of MNCs getting listed in India, while the other led to its growth.

How it all started in the 1970s

- As a historic background it is to be noted that MNCs did not voluntarily list in India.

- They were compelled to do so in the late-1970s FERA regulations requiring them to dilute ownership.

- These companies had a choice to (1) Partner with Indian companies or (2) Get listed in India or (3) Close their operations.

- A few closed their operations while a few got listed.

- Thus for the parent company, India is one of the few (or the only) geographies with listed subsidiaries.

- Else the parent is listed in the home country while entities in other countries were unlisted.

Reference: MNCs and royalty: Me Before You?

MNC growth post-1990

- During the 90s India was in an economic crisis.

- To wade the crisis, the government implemented a new economic policy that enabled foreign investments in Indian markets with the concept of LPG (Liberalization, Privatization and Globalization).

- This led to a lot of MNCs coming to India.

- Between 1991 and 2012, the number of MNCs in India more than quadrupled. (Reference: Bain Analysis)

Sector Presence

- Till the 90s, MNCs were dominant in the FMCG space.

- Post 90s, in the era of liberalization MNCs entered into new and diverse sectors such as technology and consumer durables.

- Presently MNCs dominate the FMCG, Pharma and Auto Ancillaries.

- Some industries are entirely (or majorly) dominated by MNCs in the listed space

- Tobacco Industry: ITC, Godfrey Philips and VST Industries

- Credit Rating Agencies: CRISIL and ICRA

Importance of MNCs

To Consumers

Indian consumers, rely on many products of many of these companies right from the time they wake up to fulfil various requirements.

- Daily essentials: Toothpaste, soaps, shampoo etc.

- Food: Tea, coffee, biscuits, noodles, packed foods, snacks etc.

To Employment

- As employers, MNCs also provide employment opportunities.

- The increase of MNC presence in India, it supports the employment to the vast majority of the Indian population.

To Investors

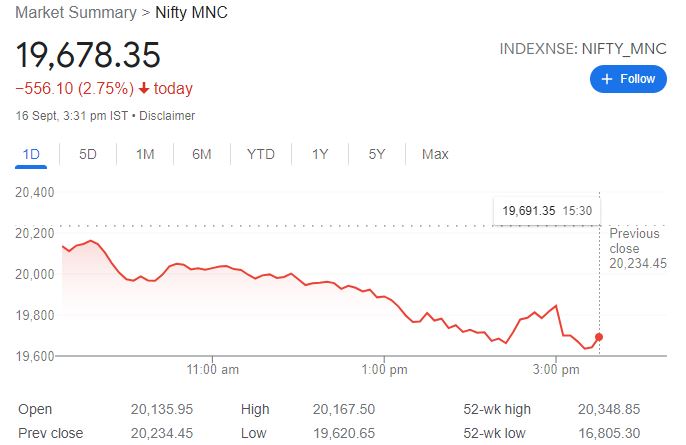

MNC has an index in the exchange. The NIFTY MNC Index comprises 30 listed companies on National Stock Exchange (NSE) in which the foreign promoter shareholding is over 50%.

The sector and individual company weightage are as below.

Traits of a MNC

MNCs are unique in several ways when compared to their Indian counterparts.

- Overseas parent company support for technology and finance

- Solid balance sheet / Low Debt

- Asset Light

- Good Corporate Governance

- Good Dividend Policies

- Premium Valuations (in comparison to similar Indian listed companies)

- Most cases these companies have some kind of moat

We will discuss the traits of premium valuations and corporate governance in this blog.

Premium Valuations

This topic has two dimensions.

- Premium to Indian counterparts

- Premium to overseas parents

Premium to Indian counterparts

MNC companies command premiums relative to Indian companies in the same industries.

Reason: This difference in valuation is due to the traits that we saw in MNC companies. The prominent ones being:

- Parentage support with the latest technology, globally recognized brand, intellectual property, marketing etc.

- Professional Management (executive control in the hands of independent boards.)

- Better corporate governance and financial reporting standards

- History of good returns to shareholders both in the form of dividends and capital gains.

Note: Leveraging parents/global technology is not easy nor straightforward. The technology must be adopted for use of Indian consumers. A simple example could be from the Auto industry. India has right-side driving when compared to left-side driving in many countries. While a European Automaker may bring their technology to India, the design has to be changed significantly to adopt to India requirements. A proper understanding of the Indian market is very crucial for both the success of the product development and marketing it.

Premium to Parent Company

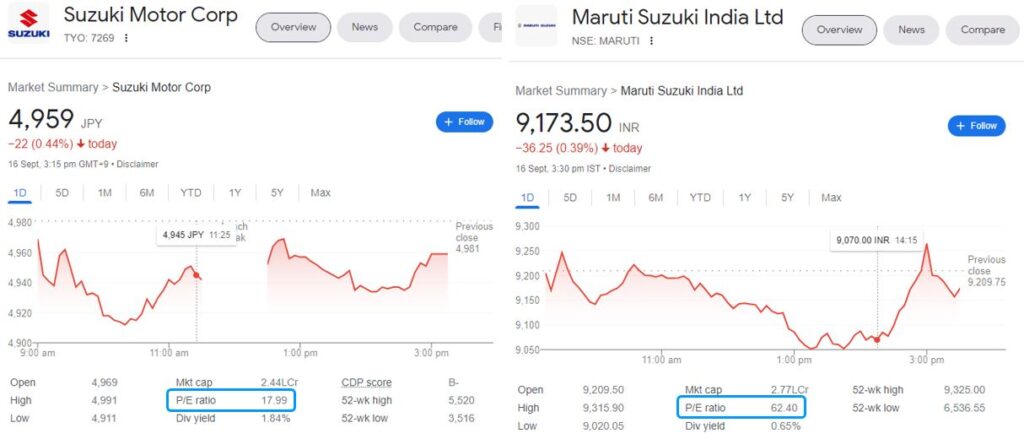

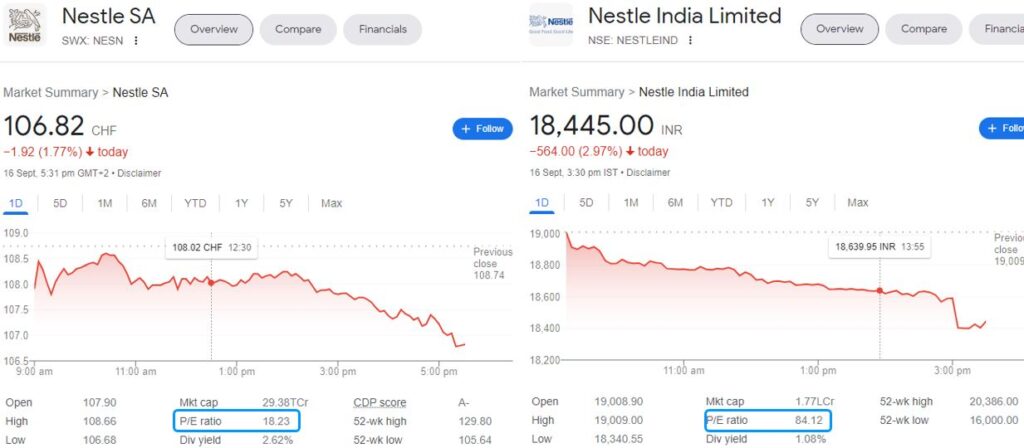

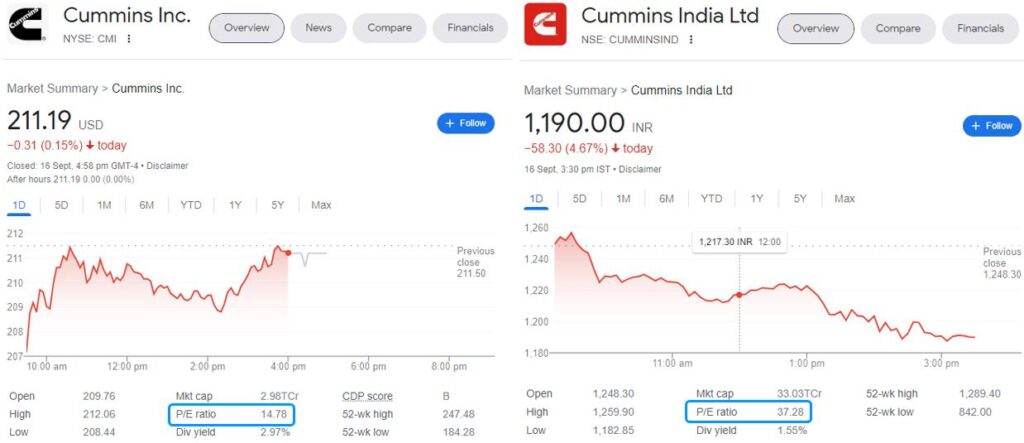

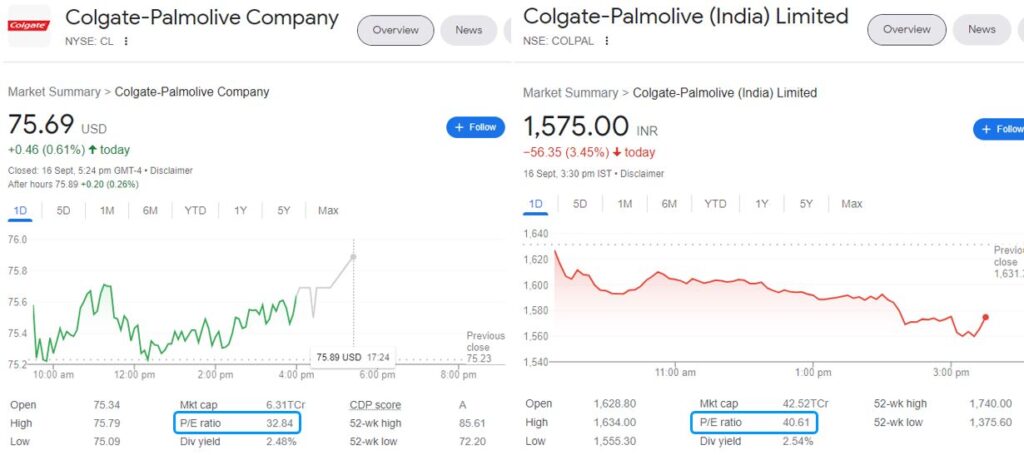

MNC stocks don’t just trade at a premium to the general market, they mostly trade at higher multiples than their own parent companies – Navin Vohra and Garima Arora

Reason: MNC parents are in mature, saturated, and fiercely competitive home markets. However, their subsidiaries (listed entities in India) are in a new and growth environment. (Reference: Premium Valuations of MNC Companies in India: A Historical Analysis)

Below are a few random samples with the price multiples of parent and Indian listed entity. In a case, the different was as high as 4 times.

Corporate Governance

Corporate India had witnessed a series of corporate governance crises in the past. When the news is open, the stock prices of these companies crash. MNC has been one theme which has been resilient to this issue. They have the highest level of corporate governance. However, this could ONLY be a relative view when compared to its Indian counterparts.

MNCs do have their share of corporate governance issues. Several foreign MNCs operating in India have indulged in practices, not in the interests of minority shareholders. Some of the methods include:

- Paying a higher royalty to the foreign parent company, even in the face of falling volume growth or

- Merging of an unlisted subsidiary at high valuations (Akzo Nobel) or

- Transfer of profitable division to the parent company at lower valuations (Siemens) or

- Transfer of core business to an unlisted subsidiary of the parent (Maruti).

Reference: The above 4 methods are from an article published by Wealth Insight in their July 2015 issue.

Onkar Raunak, Fund Manager shared a similar view: “MNCs have lesser corporate governance issues, but they are not as transparent as perceived. Most MNCs do not hold conference calls or analyst meetings, and it is not easy for analysts to access management. Very few offer public disclosures with quality that matches those of their domestic counterparts. “

Corporate governance is closely related to the previously discussed idea of premium valuation. MNCs, which typically have good governance standards, will command a premium over others.

The first big concern raised in corporate governance is the subject of Royalty payment. This shall be discussed in the next blog.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.

Many thanks for doing a nice job of educating from scratch. Wondering why do you do this.

You will have the answer to your curiosity “Wondering why do you do this” in my blog itself. Do read my first blog and “About me” section. Thanks.