In the last blog, we saw a few basic details of MNC companies covering their unique traits, premium valuation, and diverse views on corporate governance. The term corporate governance is broad and encompasses multiple facets ranging from outright accounting fraud, concealing and misrepresentation of information, Related Party Transactions that are not in the best interest of minority shareholders (and/or) carried out with the sole purpose of benefitting the promoters. Royalty is one such area of debate when it comes to corporate governance. We will try to understand more about this royalty in the context of MNC stocks. (Image credit: Toyota Headquarters)

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

You might also be interested to read these related articles:

- Royalty is a legally binding payment made to an individual or company for the ongoing use of their assets, including copyrighted works, franchises, and natural resources. (Reference: https://www.investopedia.com/terms/r/royalty.asp)

- It is a fee that a company pays for using technology, patent, copyright, brand name or anything ‘owned’ by another company or entity.

- In the context of MNC companies the royalty payment is made by an Indian-listed entity to its overseas parent. Example: Maruti would pay a royalty to Suzuki for use of its technology.

However, a heads up here

- It may be wrong to think that Indian counterparts don’t have this!

- Indian companies promoted by family group pay a royalty to their Indian promoter group E.g. Tata, Godrej

- In 1996, Tata Sons became the first big Indian company to start charging royalties from subsidiaries for using the brand name.

This blog focuses on the discussion of royalty in the context of MNC companies with overseas parent and their subsidiary listed in India.

Why Investors are concerned about Royalty?

It is a perfect argument that when a company uses something owned by another, it is bound to pay for that. However, many questions and concerns arise when the two companies are related. That is exactly the situation when payment is made to the global parent by the Indian-listed entity. The key concerns are:

Who benefits from Royalty?

Royalty benefits only the foreign promoters and not other stakeholders.

- While there are counter-arguments that royalty gives access to new technology and use of parent brand that increase the revenue.

- This may be true, but how to value the benefit derived?

This leads to the next discussion on the value of the benefit.

What is the value of Royalty?

It is difficult to value the royalty paid and its outcome. The benefits which the MNC parent claim is “Perceived benefits” which are difficult to quantify. You would not be able to answer:

- How much revenue increased due to the usage of the overseas brand?

- What is the real value of the “Brand Name” that is being charged as royalty?

- Is the royalty paid commensurate with the benefit reaped by the company?

- Does the increased royalty bring in additional value? – in case of an increase in royalty.

How does royalty hurts?

Royalty payments are real cash outflow (Not an accounting one!). This reduces the money available to the company which otherwise could have been used for:

- Paying dividends, thereby benefitting all stakeholders i.e. Overseas promoters and minority shareholders

- Reinvesting for cash, the growth again benefits all stakeholders. In case the cash available for growth is less (Post royalty payments) the company is forced to take debt.

- Royalty payment as such is not bad however very high royalty or steep increase over the years hurts investor’s interests.

Royalty is a One-sided arrangement

- The usual arrangement is that the royalty is paid as % of revenue and not profits. So what this implies? Even if the company makes losses, the promoter parent gets royalty!

- During such bad business conditions dividends are cut (Which affects minority shareholders) but royalty to the parent company continues to be paid!

- Thus the royalty is a one-sided arrangement favouring the overseas parents.

Government is also concerned about Royalty

It is not only that the investors are concerned about royalty. Government also is… The government has in the past raised its concerns about high royalty payments.

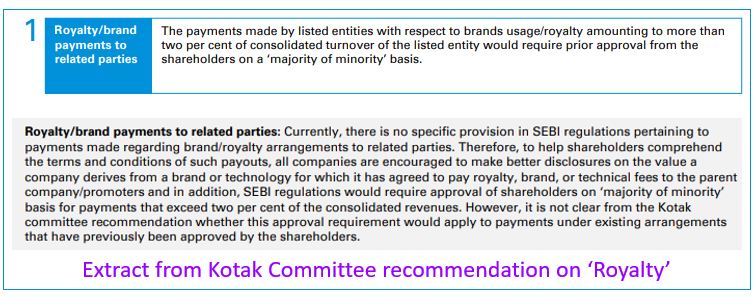

Not to stop voicing the concerns, it has also been taking measures to regularize this channel. The government had formed the Kotak Committee under the chairmanship of Shri Uday Kotak to improve the standards of corporate governance. One of the topics addressed by the committee was on royalty payments. Its outcome in 2019, was that SEBI brought the requirement of a “majority of the minority” vote shareholder approval for royalty payments over 5% of revenues.

However, there was some resistance to implementing the same and appears to be put on hold in 2019. I am unable to get sufficient literature on the progress of this plan. So I ASSUME, that currently, the recommendation is still to implemented.

Watch out the different Avatars

Royalty comes in different forms, with different terms. Below are other forms of charges paid to the global parent company.

Reference: MNCs and royalty: Me Before You? by Institutional Investor Advisor Services

One sample where royalty is termed as “General License Fees”

One reason to have this alternative nomenclature is to avoid regulatory scrutiny as these do not fall in the ambit of royalty. While these are referred to in different terms, these are all forms of royalty. An investor should factor these in the assessment of royalty payouts.

Voice of the Investment Community

In numerous occasions, many market veterans, investors and fund managers have voiced their views against royalty. A few of which are presented below:

Bharat Shah

(Executive Director, ASK Group)

A parent firm of an MNC seeks to charge a royalty, as high as 5% of sales (Read it right, on sales and not on profits) for selling soap, oil, cement in perpetuity, on entire current (not just incremental) sales, one does not need a consultant to figure out this mis-governance.

Business is being built in Indian territory by selling to by selling to Indian customer and brand building expenses which is again charged in the local balance sheet and yet, such high and unconscionable royalty is being charged, it is being permitted and it does not even require approval of minority shareholders.

Reference: Extracts from his book, “Of Long Term Value and Wealth Creation“

Chetan Parikh

(Director of Jeetay Investments)

“Royalty is justifiable when resources outside the company have gone into creating the brand name, which gives pricing power and increases entry barriers for other possible competitors. It is also justifiable when technology and process improvement have been developed outside the company“

“It is not justifiable as a form of ‘economic rent’ that the promoter group uses as a separate income stream along with dividends. There cannot be a formula to determine royalty” – Royalty is also paid for use of brand and family names. This gets shareholders the most agitated as it is difficult to put value to a name.

“As an issue, royalty may not be significant for investment. But if a company imposes an unjustifiable royalty, it’s a matter of concern,”

Reference: Tips to invest in companies embroiled in royalty payment problems

Sandeep J Shah

(CEO, Sampriti Capital.)

“There is a one-step correction in stock price when the news of royalty increase comes out. It might depress the return of existing shareholders but is forgotten after one year,“

“Royalty is a small component of the profit and loss account and a small expenditure. However, what one should look at is to what extent will it affect profitability, whether parents’ commitment will increase after the payment and whether it will keep increasing the fee in the future,“

Reference: Tips to invest in companies embroiled in royalty payment problems

Sandip Sabharwal

(Chief Executive, portfolio management services, Prabhudas Lilladher)

“I think if a company is paying for a new product or technology, royalty is justified. But charging for the entire business is not justified,”

Reference: Tips to invest in companies embroiled in royalty payment problems.

G Chokkalingam

(Founder of Equinomics Research & Advisory)

“Royalty payments are calculated on revenues, while dividend income depends on the profitability of local subsidiaries that can vary a lot during a business cycle,”

Reference: Royalty bigger than dividends for MNCs

Avinash Gupta

Senior Director at Deloitte India.

“MNCs all over the globe, including Indian companies, charge royalty from their foreign subsidiaries for using parent services. Access to parents’ brands, technology and processes helps subsidiaries scale up faster and they are well within their rights to ask for a share of the revenue. The rate of royalty payment is, however, debatable and varies from company to company,”

Reference: Royalty bigger than dividends for MNCs

How should investors analyse royalty?

Analysis of royalty is very important when it comes to investing in Indian-listed entities owned by overseas parents. Royalty gives insight into management intentions and quality. The idea of royalty as such is not wrong. But only when it is abused and is against the interest of the shareholders it comes under scrutiny.

Analysis of royalty forms the qualitative aspect of investing in dealing with soft information (Refer to my earlier blog Framework for Stock Analysis).

- There is no right or wrong answer. While the investors feel that the royalty is very high and not in their best interest, companies come with a direct contra argument defending their royalty payment.

- There is no formula to determine how much royalty is high or low

Thus the subject of royalty is a qualitative aspect with no boundary for subjectivity. A few questions that naturally come up are:

- Is it possible to gauge this royalty?

- What are the metrics available?

- How much of royalty is low, high or acceptable?

- How much growth of royalty is acceptable?

- To what extent does the royalty affect profitability?

The approach to answering all these questions can be found in my next blog. In that blog, I discuss a “Tool Kit for Royalty Analysis”. There you will get a set of qualitative and quantitative approaches that helps to analyse royalty payments.

If you are investing in MNC companies, then royalty analysis should be part of your fundamental analysis kit.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.

Nice step by step explanation in series of articles. Thank you.