This blog will focus on a much lesser known and discussed topic – Royalty Analysis. This aims to analyse royalty and gathering interpretations. (Featured image: Oracle Headquarters)

You will see a few qualitative and quantitative tools with examples. I believe you will find it interesting. To better understand this blog, you need to read my two earlier blogs on MNC companies that cover:

- Overview of MNC Companies, their unique traits and premium valuation

- Royalty payments to overseas parents, investor concerns and views of the investment community

Before getting into the main idea of this blog, let me share my view of this idea of royalty in itself is bad.

Hi, This is Venkatesh. I write on Personal Finance, Stock Investing, Productivity and Time Management. You will be interested to read more about me and the purpose of my website.

If you are interested in these topics do subscribe to my blogs. You would maximum receive 4 to 5 emails a month.

You might also be interested to read these related articles:

Is Royalty Good or Bad?

To the pointed question, “If Royalty is Bad or Good?”, there could be valid pointers that it is good. Yes, there are positive views for royalty payment.

- The Indian entity without royalty payment may not have access to the parent technology to introduce innovative products. Such innovative products may even help to build a moat.

- The brand or use of logo improves the product reach and thus increases revenue.

But it is very difficult or rather impossible to quantify the quantum of benefits. You never know the value of the benefit accrued by the Indian entity in relation to the amount paid as royalty. Most often it is “perceived benefits”. Yes, a perception created to benefit the overseas promoters! There is no way to calculate the increase in revenue due to the use of the parent’s brand name/logo.

Is it possible to identify how many additional packets of biscuits or shampoo were sold due to the use of the parent’s brand name/logo? A big NO.

The royalty for a technologically superior product like a car or mobile phone can be justified. But how to justify the royalty for the products like biscuits, shampoo, soap, toothpaste etc.? This is a strong topic of debate.

While royalty is no doubt good, quite often the policy is very much skewed to the overseas parents. The abuse of this channel is what should be a real concern for the investors, rather than a debate of “Good” or “Bad”.

Tools for Royalty Analysis

There are six tools that help in royalty analysis. It includes both qualitative and quantitative tools. The six tools are:

- Royalty Details

- Royalty Amount

- Royalty Vs Expense

- Royalty Vs Revenue

- Royalty Vs Dividends

- Royalty Vs Debt

All the details needed for this analysis come from the Annual report.

Note: The first two tools, is discussed in this blog. The next blog covers the remaining four tools.

Royalty Details

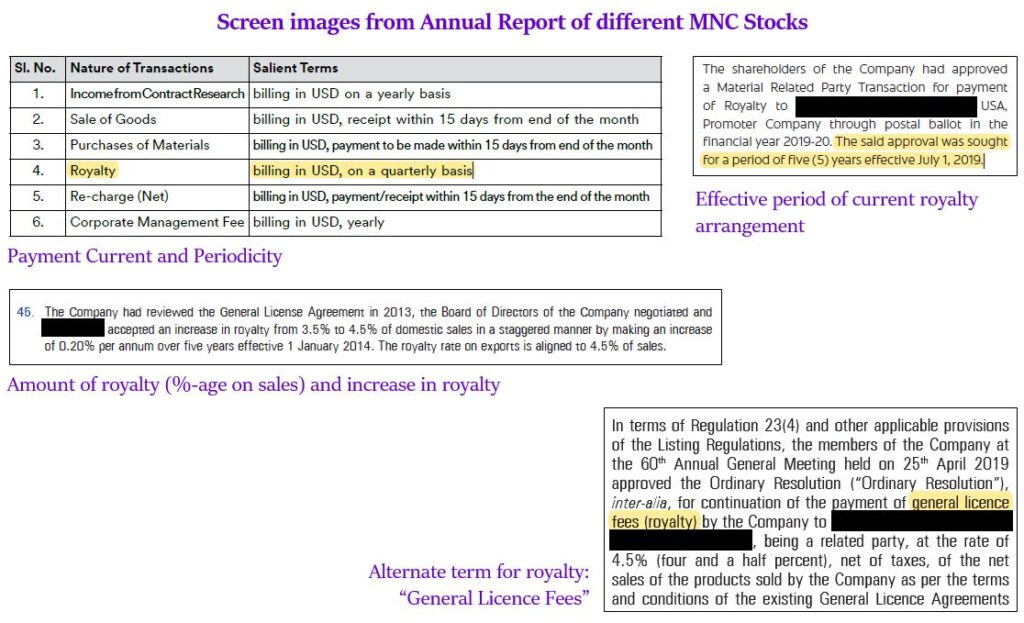

This analysis aims to get the royalty details. Common details include:

Purpose of Royalty

Why is royalty paid for? What benefit does the Indian entity get from royalty payments? It is mostly for use of the parent’s brand name, technology, logo etc. See if a finer footprint is available i.e. Is there a new product or technology for which this Royalty is charged?

Royalty Amount

The amount fixed for royalty payment. Usually, it is a certain percentage of sales.

Royalty Increase

Is there an increase in royalty? If yes, is the increase one time or year on year?

Related Party

To whom does the Indian listed entity pays the royalty? It is usually the parent company. But there are cases where the royalty is paid to another subsidiary of the parent.

Frequency of Payment

How frequently is the royalty amount paid? Quarterly, Yearly etc.

Payment Currency

Indian Rupees or Currency of the parent company.

Different Avatars

In the previous blog we saw that royalty can take different (or additional) forms. You need to note these details to make appropriate searches in the Annual report and estimate the amount that is paid as royalty. i.e. If the company terms “royalty” as “General Licence fee” or “Technology Transfer Fee”, then you need to look out for this term(s) in the Annual report.

These details can be found in the annual report. Search for the term “Royalty” in the annual report. Read each occurrence and extract the context of the references to royalty. A few samples below:

Note: Companies may not share all these details listed. You may get some of the details. The depth of information shared is a pointer to the quality of disclosures. The royalty amount is the only detail that you can surely find in the annual report.

Royalty Amount

This is the amount that the Indian listed entity pays to overseas parents as royalty. There are 3 ways to locate it in the annual report.

Notes to Financial Statements

Royalty payment is treated as an expense. The expenses are listed in the P&L statement. The royalty details can be found under the break up of expenses. This is shared in the notes to financial statements. Look for “Royalty” in the break up under expenses. Usually, royalty is placed under the head “Other Expenses”. Below is a sample.

Sometimes “Royalty” could be referred to in a different term like “General Licence Fee” etc. If there is a different term, you need to search that term in the expenses category. In the below example royalty is referred to as “General licence fee”:

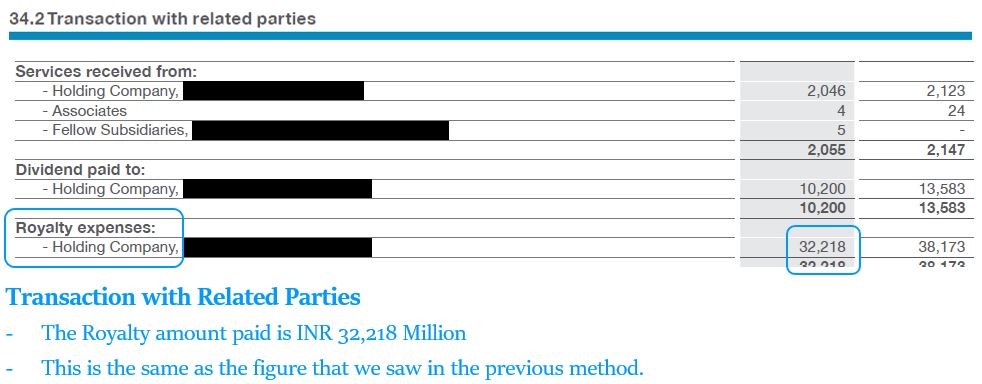

Related Party Transactions

The royalty details would be listed under the “Related Party Transactions” section. It could be found under the payments made to the “Holding Company” and listed as “Royalty expenses”. Below is a sample.

Note:

- Sometimes the royalty is not paid to the holding company. It could be to another subsidiary of the parent. In this case, the royalty payment may not be listed under the “Holding Company” but the respective subsidiary.

- Some companies do not list the related party transactions section if the value of the transactions with related parties is below a threshold level. In this case, you need to use the previous method.

Search for 'Royalty'

This is a simpler method. But you will still get the details under the headings discussed in Methods 1 and 2. Search the annual report for “Royalty”. Review each occurrence. You will find the amount paid as royalty in one of the places.

Note: Be careful, not to refer the term “Royalty Received”. This is the amount that an Indian entity receives from another subsidiary or joint venture. This is not our focus for this analysis.

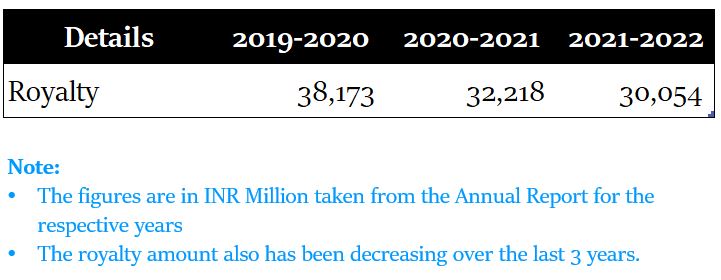

You now have a one-year royalty amount. This by itself does not give any insight. An extended analysis could involve checking the trend of royalty paid for the last 5 to 10 years. This provides insight into the increase or decrease in royalty over the chosen period.

What is next?

Royalty amount does not give much interpretation. Is it less or more? To gain meaningful inference the royalty should be compared with other figures in the financial statement. It can be compared with:

- Expenses

- Revenue

- Dividend

- Debt

In the next blog, we will discuss these four tools in detail.

Hope you found this blog useful. Do share my blogs with your friends, peers and fellow investors.